Deciphering Big Tech Giants’ Quarterly Results: Here’s What They Say!

The Big Techs recently disclosed their fourth-quarter results. For those who are interested in the industry, these are a few key findings and insights from the quarterly reports.

![]()

ALPHABET

Alphabet Inc., the parent company of Google, exceeded Wall Street forecasts with its fourth-quarterly earnings report. Ad sales, however, failed to expand quickly enough to keep up with experts’ predictions. YouTube, which has been contributing to increased growth, came up barely short of projections. With over 2 billion monthly users and an average of 70 billion views per day, YouTube Shorts continues to be a top priority for Google.

The cloud division, which was losing money for years while it attempted to compete with Microsoft Azure and Amazon Web Services, is where the company makes its money. Google Cloud continued to be a growth engine in the fourth quarter, expanding by 26%. The primary driver of revenue growth continues to be search. While brand and direct response advertising drove YouTube advertising, growth in retail was the main driver of Google Search and other forms of advertising revenue.

By the numbers

- Revenue reported was $86.31 billion, up 13.5%.

- Google Search and other advertising revenues rose to $48 billion, up 13% Yo-Y.

- Google cloud computing revenue was $9.19 billion up 26% Yo-Y.

- Advertising revenues reported were $65.52.

- YouTube advertising reported $9.2 billion, up 16% Yo-Y.

- Network advertising revenue was $8.3 billion, down 2%.

- Traffic acquisition costs were $13.9 billion.

Google is beginning to provide generative AI to an increasing number of companies to assist them in creating more effective campaigns and advertisements. Google unveiled Gemini, a large language model that it claims to be its most powerful AI model, in December. The business intends to license Gemini to users via Google Cloud so they can utilize it in their apps. Additionally, Google plans to test the usage of Gemini in Search, where it will speed up consumers’ Search Generative Experience (SGE).

Sundar Pichai, CEO, said in the conference call,

We are pleased with the ongoing strength in Search and the growing contribution from YouTube and Cloud. Each of these is already benefiting from our AI investments and innovation. As we enter the Gemini era, the best is yet to come.

Ruth Porat, President and Chief Investment Officer, CFO said,

We ended 2023 with very strong fourth quarter financial results, with Q4 consolidated revenues of $86 billion, up 13% year over year. We remain committed to our work to durably re-engineer our cost base as we invest to support our growth opportunities.

Read More: Google Integrates Gemini AI Into Search Ads Platform

META

Meta exceeded Wall Street expectations and had a positive fourth quarter. The positive outcomes show that digital advertising has recovered well from its 2022 decline. It was a significant year for both the business and the community. According to Meta’s estimation, over 3.1 billion individuals use at least one of the Meta applications daily. The already enormous social media company keeps on adding new users across all platforms.

Overall, Meta’s Q4 revenue increased by 25% over the previous year. Threads, the business’s Twitter-like social app that launched in July 2023, now has over 130 million monthly active users, according to the company. As is usual, almost all of Meta’s revenue came from sales of digital advertising. Chinese retailers have increased their spending to reach customers worldwide, which has contributed to Meta’s financial turnaround during the past year. They have been heavily investing in Facebook and Instagram ads.

By the numbers

- Revenue was $40.11 billion, an increase of 25% Yo-Y, and $134.90 billion, an increase of 16% Yo-Y for the full year.

- Facebook DAUs were 2.11 billion on average, an increase of 6% Yo-Y.

- Facebook MAUs were 3.07 billion, an increase of 3% Yo-Y.

- Family DAPs were 3.19 billion on average, an increase of 8% Yo-Y.

- Family MAPs were 3.98 billion, an increase of 6% Yo-Y.

- Ad Impressions delivered across all Meta apps increased by 21% Y-o-Y and the average price per ad increased by 2% Yo-Y.

Strong sales of the company’s Quest device during the holiday season drove record sales of $1.1 billion for the metaverse-focused Reality Labs division. Additionally, Zuckerberg stated that the ad business, which is expanding more quickly than Google, has benefited from advancements in artificial intelligence. By the end of the year, Meta plans to completely launch Meta AI assistant and further AI chat experiences in the United States using generative AI.

Meta Chief Executive Mark Zuckerberg said in a news release,

We had a good quarter as our community and business continue to grow. We’ve made a lot of progress on our vision for advancing AI and the metaverse.

Susan Li, CFO, stated that Meta’s big areas of focus in 2024 will be working towards the launch of Llama 3, expanding the usefulness of Meta AI assistant, and progressing on our AI studio roadmap to make it easier for anyone to create an AI.

AMAZON

For the fourth quarter of 2023, Amazon reported better-than-expected revenues, exceeding sales forecasts thanks to new generative AI capabilities in its cloud and e-commerce businesses, which drove strong growth throughout the Christmas season. The e-commerce behemoth had a great holiday season. Over 1 billion items were bought on the site in the course of the company’s 11-day Black Friday and Cyber Monday sales. Additionally, the events helped bring in new Prime members and save consumers billions of dollars.

With 26% Yo-Y growth in worldwide advertising, Amazon had a great result. Because machine learning has improved ad relevancy, sponsored products have been the main driver of advertising strength. The shift in customer attention towards encouraging innovation and introducing new workloads to the cloud was attributed to the increase in AWS revenues.

By the numbers

- Revenue was reported at $169.9 billion versus expectations of $166.2 billion, up 13.9% Yo-Y.

- AWS Revenue 13% increase in sales over the prior year to a total of $24.4 billion.

- Advertising sales of $14.7 billion.

- Subscription services were up 13%, reporting $10.4 billion in revenue.

Amazon has launched Rufus, a new AI shopping assistant trained in Amazon’s product catalog and other web-based information. The tool, driven by generative AI, may provide product recommendations and respond to queries from users of the Amazon mobile app. The corporation believes that advancements in AI might bring in tens of billions of dollars for its cloud computing division.

Chief Executive Andy Jassy said in Amazon’s press release

This Q4 was a record-breaking holiday shopping season and closed out a robust 2023 for Amazon. While we made meaningful revenue, operating income, and free cash flow progress, what we’re most pleased with is the continued invention and customer experience improvements across our businesses.

Amazon’s Chief Financial Officer Brian Olsavsky added,

We’re coming off a period where we’ve done a lot of hiring. There’s a general feeling in most teams that we’re trying to hold the line on headcount.

Read More: Amazon and Reach Partner for Targeted Ads Ahead of Third-Party Cookie Phase-Out

MICROSOFT

Microsoft had a record-breaking quarter, mostly due to Microsoft Cloud’s ongoing growth. Strong executions in the commercial areas and device advancements were credited for the anticipated growth in its quarterly results. The robust demand for Microsoft Cloud offerings, particularly AI services, led to enhancements in Azure, which in turn drove revenue growth.

On October 13, 2023, Microsoft completed the acquisition of Activision Blizzard. With the acquisition, the business expanded its player base by hundreds of millions. It broke previous records for MAUs on Xbox, PC, and mobile devices with over 200 million MAUs in a single month. The business has been integrating AI into every aspect of the IT stack, bringing in new clients and fostering increased efficiency. Additionally, the business reported increased revenue from Windows OEM sales and improved performance in consumer markets.

By the numbers

- Revenue recorded was $62.0 billion, an increase of 18%.

- Intelligent Cloud unit $25.9 billion, increasing 20% ahead of expectations.

- Azure revenues increased by 30%.

- LinkedIn’s revenues increased by 9%.

- Microsoft Cloud Revenue was $33 billion, up 24%.

- Search and news advertising revenue excluding traffic acquisition costs increased by 7%

AI is helping to drive revenue in the Azure consumption business. Over the past year, Microsoft, Amazon, and Google have all invested billions of dollars in artificial intelligence (AI) in an attempt to overtake one another as the leading providers of AI software.

Satya Nadella, chairman and chief executive officer of Microsoft said,

We’ve moved from talking about AI to applying AI at scale. By infusing AI across every layer of our tech stack, we’re winning new customers and helping drive new benefits and productivity gains across every sector.

Amy Hood, Chief Financial Officer added,

While it’s early days for Microsoft 365 Copilot, we’re excited about the adoption to date and continue to expect revenue to grow over time.

Read More: Vodafone and Microsoft Sign 10-year Strategic Partnership for IoT, Cloud, AI and More

APPLE

In its first-quarterly report, Apple exceeded analysts’ projections for both revenue and profits, but it revealed a 13% drop in sales in China, one of its most significant regions. The tech giant surpassed 2.2 billion active devices, setting a new milestone for its installed base. Apple attributes this to extremely high levels of customer satisfaction and unmatched customer loyalty.

According to projections, Mac sales increased by less than 1% throughout the quarter. Nonetheless, this is a noteworthy comeback for the product line, which had an annual decline of about 34% in the September quarter. iPad sales are still declining. For the first time in iPad history, Apple did not introduce a new model in 2023.

By the numbers

- Revenue was $119.6 billion, up 2% Yo-Y.

- iPhone Revenue was $69.70 billion 6% up.

- Mac $7.78 billion 1% up Yo-Y.

- iPad $7.02 billion down 25% Yo-Y.

- Wearables, home, and accessories revenue was $11.95 billion, down 11%.

- Service Revenues $23.13 billion up 11% Yo-Y

Additionally, Apple unveiled the Apple Vision Pro, their most sophisticated personal electronics gadget to date. Customers in the United States will be able to purchase it via Apple stores; later in the year, it will also be available in other countries. It is considered a groundbreaking gadget that is years ahead of anything else and is based on decades of Apple ingenuity. Additionally, the company announced that customers may select any Apple Watch model that is carbon neutral for the first time.

Tim Cook, Apple’s CEO said in the conference call,

Today Apple is reporting revenue growth for the December quarter fueled by iPhone sales, and an all-time revenue record in Services. We are pleased to announce that our installed base of active devices has now surpassed 2.2 billion, reaching an all-time high across all products and geographic segments. And as customers begin to experience the incredible Apple Vision Pro tomorrow, we are committed as ever to the pursuit of groundbreaking innovation — in line with our values and on behalf of our customers.

SNAP INC

Snap Inc. released a forecast that was slightly below Wall Street expectations. The company has now recorded six consecutive quarters of single-digit growth or revenue contraction. Snap Inc. struggled to recover from the downturn in the digital ad sector.

Snap Inc. has announced a new publisher partnership with Spotify in the United States, which will bring short-form highlights from Spotify’s podcasts to Spotlight and Stories. Additionally, the social media giant revealed new AI-powered tools for Snapchat+ users, enabling them to edit and share Snaps as well as create and send AI-generated images in response to text prompts.

By the numbers

- Revenue was $1,361 million, an increase of 5% Yo-Y.

- DAUs were 414 million, an increase of 39 million or 10% Yo-Y.

- MAUs increased 8% Yo-Y and surpassed 800 million in Q4.

- Subscriptions for Snapchat+ have reached over 7 million

Snapchat made a large investment in its augmented reality system. On average, almost 300 million Snapchat users use its augmented reality feature every day. Additionally, it has invested in automation and technology, used generative models, and optimized the ML Lens generation workflow.

Evan Spiegel, CEO said in the announcement,

2023 was a pivotal year for Snap, as we transformed our advertising business and continued to expand our global community, reaching 414 million daily active users. Snapchat enhances relationships with friends, family, and the world, and this unique value proposition has provided a strong foundation to build our business for long-term growth.

OMNICOM MEDIA GROUP

Omnicom exceeded analyst forecasts with impressive Q4 and full-year 2023 results. The growth in advertising and media during the quarter was driven once again by the performance of global media, with softer results from Omnicom’s advertising agencies serving as a partial offset.

Additionally, Omnicom completed the acquisition of Flywheel Digital, which will contribute to the introduction of scaled capabilities in the retail, media, and digital commerce sectors—the fastest-growing areas of the business. Furthermore, Omnicom disclosed that it has partnered with Getty Images as a first mover, giving them early access to a new generative artificial intelligence tool.

By the numbers

- Revenue reported increased $192.7 million or 5% organically, to $4,060.9 million.

- Advertising and media were up 9.3%.

- Public Relations was 2.9% down.

- Third-party service costs increased by $97.5 million or 12.4% to $884 million

Omnicom has reportedly spent tens of millions of dollars developing artificial intelligence over the past ten years, according to CEO John Wren. With the recent June 2023 launch of Omni Assist, a generative AI-powered virtual assistant that organizes, carries out, and produces advertising campaigns through cooperation with Microsoft, Omnicom became the first agency holding company to get access to the most recent Open AI GPT models.

John Wren, Chairman and Chief Executive Officer of Omnicom commented,

Omnicom finished 2023 with 4.4% organic revenue growth in the fourth quarter and 4.1% for the year. Looking out to full year 2024, we are set up well with solid fundamentals, tremendous opportunities in digital commerce and retail media from our Flywheel acquisition, and momentum in new business wins. Our accelerated investments in analytics and AI will enhance our ability to drive the best outcomes for our clients, while shareholders remain supported by our profitable operations and balanced deployment of capital through dividends, acquisitions, and share repurchases.

Read More: Decoding Big Tech Giants Quarterly Results: Insights Await!

Vodafone and Microsoft Sign 10-year Strategic Partnership for IoT, Cloud, AI and More

Vodafone, a mobile telecom provider, has signed a 10-year strategic partnership with Microsoft to provide generative AI, digital, enterprise, and cloud services to over 300 million businesses across Europe and Africa. Over the next ten years, Vodafone plans to invest $1.5 billion in cloud and customer-focused AI services created in partnership with Microsoft. Microsoft will also make use of Vodafone’s mobile and fixed connectivity services.

Strategic partnership covering IoT, cloud, generative AI

The partnership aims to transform Vodafone’s customer experience with Microsoft’s generative AI, hyperscale Vodafone’s leading managed IoT connectivity platform, develop new digital and financial services for businesses, particularly SMEs in Europe and Africa, and overhaul its global data center cloud strategy. Moreover, by April 2024, this will operate independently as a separate business. In addition to spurring growth in applications and broadening the platform to connect more machines, cars, and devices, the new business will draw in new partners and clients.

Introducing personalized digital services

Through the use of Microsoft Azure OpenAI capabilities, the partnership will use Generative AI to boost customer satisfaction and provide real-time, proactive, seamless, and hyper-personalized experiences across touchpoints. Additionally, it will make use of its distinctive benefits to reach over 300 million customers, public sector organizations, and businesses throughout Europe and Africa. TOBi, Vodafone’s digital assistant, will be included. Additionally, Microsoft Copilot will enable Vodafone staff members to change work procedures, increase output, and enhance digital efficiency.

With the use of cutting-edge generative AI technology, the new partnership will produce digital services that offer a highly customized and unique customer experience across a variety of channels. They will be based on Vodafone’s well-established framework for responsible AI, which includes impartial and moral privacy and security policies.

Read More: Microsoft Advertising Enhances Search and Ads with Generative AI

Significant Collaboration Areas

The companies have identified five key areas of collaboration:

Generative AI

The companies aim to enhance customer satisfaction by utilizing Microsoft Azure OpenAI’s capabilities to provide frictionless, proactive, real-time, and highly personalized experiences across all Vodafone customer touchpoints. This includes the digital assistant TOBi, which is accessible in 13 countries. Employees of Vodafone will also be able to use Microsoft Copilot’s AI capabilities to change working procedures, increase output, and enhance digital efficiency.

Scaling IoT

Vodafone has launched a new standalone global Internet of Things (IoT) managed connectivity platform that connects 175 million devices and platforms globally. Microsoft plans to invest in this platform. Vodafone also intends to join the Azure ecosystem, opening the IoT platform through Open APIs to a large developer and third-party community.

Africa’s digital acceleration

Microsoft intends to help scale M-Pesa, Africa’s largest financial technology platform, by hosting it on Azure and enabling the launch of new cloud-native applications. A purpose-driven initiative being introduced by the companies aims to improve the lives of one million SMEs and 100 million consumers on the African continent. The objective is to provide digital services to the underserved SME market and improve youth outreach, skill development, and digital literacy initiatives. Through the creation of a community of certified developers, the partnership seeks to promote innovation in financial services.

Read More: Microsoft Unveils pubCenter for Small, Mid-Sized Publishers to Monetize Websites

Enterprise growth

As part of its plan to become Europe’s top business platform, Vodafone will continue to commit to distributing Microsoft services, such as Microsoft Teams Phone Mobile, security solutions, and Microsoft Azure. In addition to supporting the estimated 24 million SMEs in Europe with a managed platform that expands with their company, this allows business customers to quickly adopt and operate Microsoft’s cloud-based services.

Cloud transformation

By updating its data centers to Microsoft Azure, Vodafone plans to expedite its cloud transformation. This will simplify and lower the operational costs of its IT estate while enhancing its responsiveness to customers. Vodafone will be able to replace numerous physical data centers with virtual ones throughout Europe as a result, streamlining and cutting the costs associated with running its IT estate. It will also be able to meet its energy requirements and advance its sustainable business plan.

Here’s what they said

Margherita Della Valle, Vodafone Group chief executive, said,

Today, Vodafone has made a bold commitment to the digital future of Europe and Africa. This unique strategic partnership with Microsoft will accelerate the digital transformation of our business customers and step up the quality of customer experience for consumers.

Satya Nadella, chairman and CEO, of Microsoft, commented,

This new generation of AI will unlock massive new opportunities for every organisation and every industry around the world. We are delighted that together with Vodafone we will apply the latest cloud and AI technology to enhance the customer experience of hundreds of millions of people and businesses, build new products and services, and accelerate the company’s transition to the cloud.

Read More: AudienceProject Partners with Microsoft Advertising; YouTube Delays Co-Viewing Measurement Plan

Decoding Big Tech Giants Quarterly Results: Insights Await!

Big tech companies recently released their quarterly results for Q3 2023. Here are some key insights for industry enthusiasts.

ALPHABET

Alphabet, the parent company of Google, released third-quarter earnings that were above analyst projections. The business was satisfied with the quarterly results. The tech giant credited Cloud, YouTube, and Search for the overall boost. Out of all three, Search continued to be the key driver of their revenue expansion. However, Google’s Cloud business division failed to meet its revenue projections. Since Q1 of 2021, this has been the slowest documented growth in the Cloud business.

Because of this, Alphabet keeps investing in the cloud industry, which is growing in significance as generative AI emerges. YouTube’s advertising income exceeded experts’ forecasts thanks to increases in direct response and brand awareness. This is attributed to Shorts, the TikTok competitor of YouTube with 70 billion views every day.

By the numbers

- Revenue reported was $79.69B, up 11%.

- Google Search and other advertising revenues were $44B, a rise of 11% Y-O-Y.

- Google Cloud computing revenue rose 22% to $8.41B against estimates of $8.64B.

- Advertising revenue was up 9% to $59.6B as against an estimated $59.1B.

- YouTube advertising revenue reported $8B, up 12% Y-O-Y.

- Network advertising revenue was down 3% to $7.7B.

- Traffic acquisition costs were up $12.64B vs estimates of $12.63B.

- Search ad revenue was up 18%.

Google disclosed its quarterly results in the middle of its antitrust lawsuit. Government authorities claim Alphabet uses unlawful monopolistic methods to maintain control over its search engine. Additionally, it’s predicted that more advertisers will spend money on Google advertisements, which could lead to increased rivalry among them. In addition, Google keeps funding its attempts to develop Generative AI in an attempt to overtake its rivals.

Sundar Pichai, CEO of Alphabet, said in the earnings call,

I’m pleased with our financial results and our product momentum this quarter, with AI-driven innovations across Search, YouTube, Cloud, our Pixel devices, and more. We’re continuing to focus on making AI more helpful for everyone; there’s exciting progress and lots more to come.

Ruth Porat, President and Chief Investment Officer; CFO said,

The fundamental strength of our business was apparent again in Q3, with $77 billion in revenue, up 11% year over year, driven by meaningful growth in Search and YouTube, and momentum in Cloud. We continue to focus on judicious capital allocation to deliver sustainable financial value.

META

In terms of earnings and revenue, Meta exceeded the third-quarterly results. This was attributed to the increase in digital advertising spending. Exceeding expectations, the results showed the fastest growth rate, with revenues rising by 23%. Additionally, the company’s user base has grown in the face of fierce competition from rivals such as TikTok.

As its clients recover from a challenging 2022, Meta is witnessing faster growth in its core digital ads businesses. Right now, Meta’s business is doing better than its rivals. Its recovery can be largely traced to increasing the impact of its online ads. Additionally, Meta has cited its significant investments in AI as a crucial technological advancement that has enabled it to attract businesses seeking to serve clients with tailored incentives.

By the numbers

- Revenue rose 23% to $34.15B.

- Facebook DAUs were 2.09 billion on average, a 5% increase Y-O-Y.

- Facebook MAUs were 3.05 billion, an increase of 3% Y-O-Y.

- Family Daily Active People (DAP) was 3.14 billion on average, up 7% Y-O-Y.

- Family Monthly Active People (MAP) was 3.96 billion, higher by 7% Y-O-Y.

- Ad impressions across all Meta apps increased 31% Yo-Y and the average price per ad was down 6%.

Meta anticipates its spending in 2024 will exceed that as it continues to invest in AI infrastructure. Meta expressed a distaste for falling behind in the race towards generative artificial intelligence. To boost engagement, the internet giant intends to roll out AI-powered avatars on Facebook and Instagram. Users may be able to engage with the platform in new ways, receive recommendations, and do more with these identities.

Susan Li, Meta’s Chief Financial Officer stated that for Reality Labs, Meta’s augmented reality and virtual reality division, the company expects operating losses to increase meaningfully Yo-Y due to its ongoing product development efforts and investments to further scale the ecosystem.

Mark Zuckerberg, Meta founder and CEO said in the announcement,

We had a good quarter for our community and business. I’m proud of the work our teams have done to advance AI and mixed reality with the launch of Quest 3, Ray-Ban Meta smart glasses, and our AI studio.

MICROSOFT

Microsoft released the first quarterly results of its 2024 financial reports, and the company was off to a great start to the fiscal year. The favorable outcomes were ascribed to Microsoft Cloud’s strength, which outperformed analyst predictions. Microsoft completed its $68.7 billion acquisition of Activision Blizzard, a publisher of video games, earlier this month.

Microsoft claims to have the greatest AI infrastructure and the widest cloud footprint. Furthermore, compared to other cloud providers, it has more regions where AI services are installed. Furthermore, while search income growth was still influenced by third-party agreements, the rise in search and news advertising revenue was linked to higher interaction on Bing and Edge.

By the numbers

- Revenue recorded $56.5, higher by 13%.

- Microsoft’s Intelligent Cloud Unit revenues were $24.3, up 19% beating estimates of $23.4B.

- Azure revenues rose 29% against an estimated 26.2%.

- LinkedIn’s revenue increased by 8%.

- Microsoft Cloud Revenue was $31.8B, up 24%.

Microsoft is still dedicated to making investments in the cloud and AI potential. In order to increase consumer productivity, it is concentrating on quickly integrating AI into all facets of its technological and business processes. In addition, it will maintain strong growth in the upcoming year thanks to its leadership in the commercial cloud and AI platform wave.

Satya Nadella, CEO of Microsoft said,

With copilots, we are making the age of AI real for people and businesses everywhere, we are rapidly infusing AI across every layer of the tech stack and for every role and business process to drive productivity gains for our customers.

Amy Hood, Chief Financial Officer, Microsoft, commented,

We saw healthy renewals, particularly in Microsoft 365 E5, and the growth of new business continued to be moderate for standalone products sold outside the Microsoft 365 suite. In Azure, as expected, the optimization trends were similar to Q4. Higher-than-expected AI consumption contributed to revenue growth in Azure.

Read More: Delve Into What the Quarterly Results For Big Tech Titans Are Saying

AMAZON

Amazon outperformed analysts’ expectations and exceeded its own projections for the third quarter. Growing online sales in its retail section and significant cost reductions drove growth. Additionally, a notable increase in advertising revenue and growth in its cloud business, which kept stabilizing, were its main drivers. According to Amazon, the increase in AWS revenues of over $900M was offset by customers’ shifting focus towards fostering innovation and delivering new workloads to the cloud.

Amazon is still concentrating on buyer behavior and customer happiness. Thanks to the Prime Day event, when over 375 million goods were purchased globally by Prime members, Q3 revenues increased 11% YoY. The company’s introduction of generative AI capabilities into its products and services compensated for the decline in advertising revenue. Demand for daily necessities in areas like health, beauty, and personal care has remained high on Amazon.

By the number

- Revenue posted $143.1B, up 11% Yo-Y vs analysts’ expectations of $141.41B.

- AWS revenue was $23.1B, higher by 12% Yo-Y.

- Advertising sales jumped to $12B, rising 26%.

In addition to warehouse robots, which were already a prominent business for the corporation, Amazon continues to make large investments in generative AI. Further, AWS and Anthropic, Amazon’s generative AI, will work together on future advancements in AWS Trainium and AWS Inferentia chip technology, according to CEO Andy Jassy of Amazon. He thinks that the partnership will support the ongoing acceleration of the benefits to customers in terms of pricing and performance.

Amazon chief executive Andy Jassy said,

We had a strong third quarter as our cost to serve and speed of delivery in our Stores business took another step forward.

Brian Olsavsky, Amazon’s Chief Financial Officer added,

We’re ready to make this a great holiday season for customers. Overall, consumers have shown resilience in their spending despite rising interest rates and stubbornly high inflation that has steadily eased since last year. Amazon said Thursday its retail business grew by 6% during the third quarter. It was boosted by the company’s popular Prime Day sales event held in July. It’s also seeing strong customer demand across categories like beauty, health, and personal care items. But we still see customers being cautious about price, trading down where they can and seeking out deals.

He further added that as Amazon enters the holiday season, its operations network and inventory are in the optimal position like never before.

SNAP INC.

Snap INC. reported the third-quarterly results of 2023 and numbers that were better than anticipated by Wall Street. Its ad platform enhancements were the cause of the improvement in outcomes. For quite some time, Snap’s company has been in turmoil. This is because of TikTok’s rivalry, Apple’s modifications to iOS’s ad tracking, and a number of other issues. It was encouraging to see sales rise again. Moreover, Snap improved the ML ranking and optimization for the web, app, and Dynamic Product Ad (DPA) platform by implementing over 17 significant changes.

By the numbers

- Revenue posted $1,19B, up 5% from estimates of $1.11 B.

- DAUs 406 million, high 12% (43 million) Yo-Y.

- Snapchat+ reached more than 5 million subscribers.

By concentrating on investing in ML models to enhance content ranking and personalization across all content offerings, Snapchat is aiming to increase the depth of engagement with its content. Additionally, it will keep utilizing AI technology to provide the community with new services and goods. In addition, the business declared that over 200 million users have sent over 20 billion messages on My AI since its debut.

Evan Spiegel, CEO of Snap INC. said in the earnings call,

Our revenue returned to positive growth in Q3, increasing 5% year-over-year and flowing through to positive adjusted EBITDA as our reprioritized cost structure demonstrated the leverage in our business model. We are focused on improving our advertising platform to drive higher return on investment for our advertising partners, and we have evolved our go-to-market efforts to better serve our partners and drive customer success.

OMNICOM MEDIA GROUP

Beyond estimates, Omnicom revealed remarkable revenue growth in the 2023 third quarterly results. With consistent growth in media, advertising, and precision marketing, the business is still on track for the entire year. The outcomes follow significant recent victories, like the $600 million Uber media contract, which was transferred from competitor WPP to Omnicom Media Group in September.

With the release of Omni Assist, Omnicom’s customized version of ChatGPT that improves every task with Omni, it continues to develop its Generative AI capabilities. In addition, it keeps evaluating how Generative AI will impact Omnicom’s operations throughout the entire company and plans ahead.

By the numbers

- Global revenue reported $3.58B, a high of 3.3% or $113.1M organically.

- Advertising and media posted a 6.1% growth to $1.9B.

- Public Relations was down 5.5% against 12.6% delivered in Q3 2022.

- Third-party service costs increased $90.6M or 15.4% to $678.6M organic growth.

Omnicom is confident that its clients will receive the greatest creative skills and capabilities from the newly established Omnicom Advertising Services.

John Wren, Chairman and Chief Executive Officer of Omnicom stated,

We are pleased with our strong organic revenue growth of 3.3%, with notable performances in our Advertising and media, Precision Marketing, and Healthcare disciplines. Our year-to-date organic growth of 4.0% remains in line with our full-year expectations, which reflects the resiliency of our business even in periods of economic uncertainty. Omnicom continued to post strong profitability and earnings growth in the quarter, and our recent business wins validate the benefits of our client strategy in this rapidly evolving marketplace. We are very well positioned for a recovery in business conditions, with a strong balance sheet and leading creativity in all of our service disciplines.

Read More: OMG’s Rudra Khanna on Navigating Marketing’s Dynamic Landscape

Microsoft Empowers Publishers with Content Control for Bing Chatbot

Microsoft recently provided publishers with new tools to control how their material is used in the brand-new Bing AI-powered chatbot component. New meta tags like NOCACHE and NOARCHIVE are part of these solutions. These restrict or block material in Bing Chat. Normal Bing search results will still include blocked content. The internet giant also hopes to allay publishers’ worries while enabling website discovery through standard search results.

Taking Care of Publisher Issues

Publishers have expressed concerns about the unauthorized use of their content ever since Microsoft announced its updated Bing search engine with chatbot features. Artificial intelligence (AI)-based chat features make publishers uneasy when they can’t regulate how the site’s material is used. Microsoft has recognized the need for greater control over how their content is used in Bing Chat following discussions with web administrators and the creators. Microsoft has provided a setting that enables users to control the content of chat responses. Additionally, it responds to publishers’ needs while enabling website discovery through regular search results. Microsoft chose to respond right away to publishers’ worries.

Read More: Microsoft Advertising Enters the Video and CTV Advertising Realm

Enhanced Content Controls for Publishers

Website admins can use the regular controls Microsoft has created to figure out the index and snippet length on Bing. The update gives publishers more control over how their content is used. This concerns both Bing Chat and the development of Microsoft’s GAI foundation model. Microsoft is introducing existing meta tags to restrict usage in Bing Chat answers in response to publishers’ worries. Publishers now have a variety of options for managing their material, and each one affects how Bing Chat and AI models use it. The following choices are available to publishers so they can manage how Bing Chat uses their material.

- Taking no steps could imply that content can be utilized to instruct Microsoft’s AI models and Bing Chat features.

- Only titles, snippets, and URLs can be used to train AI models or shown in Bing Chat when a NOCACHE tag is added. Publishers can consent to Bing Chat mentioning their websites.

- Added a NOARCHIVE tag to stop it from being used for AI training or Bing Chat.

Moreover, Microsoft also suggests combining the NOCACHE value with the NOARCHIVE value. This is because many paywall websites only employ the NOARCHIVE tag. Bing Chat users will locate paywall content more accessible thanks to this.

Moving forward

Microsoft and Google unveiled their views on the next search stage earlier this year, in different announcements. This will be enabled by generative AI (GAI). Microsoft is dedicated to maintaining open communication with publishers and the online ecosystem as it collaborates with the industry on upcoming AI standards. The tech behemoth guarantees web administrators enough time to prepare for and move to emerging AI standards. Publishers are urged to read Microsoft’s documentation on meta tags for more information.

Read More: Microsoft Advertising Enhances Search and Ads with Generative AI

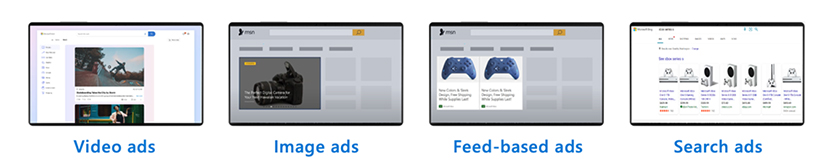

Microsoft Advertising Enters the Video and CTV Advertising Realm

At the DMEXCO conference, Microsoft Advertising unveiled a brand-new video ad product called Video and Connected TV (CTV) ads. Advertisers can now create online video and CTV ad campaigns on the Microsoft Advertising platform, thanks to the company’s video ad offering. The novel solution offers specific reach across large-scale properties to guarantee that the ad is presented to the appropriate target audience. The offering engine accepts search data. The internet juggernaut wants to profit from the burgeoning digital video landscape. By 2024, it is anticipated that people will spend 3.5 hours daily on average.

How does it work?

The new platform does not require advertisers to learn how to use the new platform. No set-up fees or lengthy onboarding procedures are needed, and campaigns are straightforward to optimize. The same platform offers the possibility to target ads on CTV. Because of this, creating campaigns only requires a few clicks. The only thing advertisers need to do is upload video assets that best represent their brands. Additionally, they must determine who they want to expose their ads to as well as how frequently they should do so across multiple devices. Setting frequency caps, reporting on domains where ads are served, and excluding any domains where ads should not be served are all features available.

Why should advertisers care?

Video and connected TV (CTV) capability increases conversion possibilities. It expands the options for ad-serving and using audience analytics to target high-value consumers. The choice to run commercials online or on CTV is also available. Advertisers can purchase CTV ads through a cost-per-completed view mechanism to target audiences on smart TVs and connected devices.

Moreover, according to Microsoft, search data is one of the most important components to enable this CTV and video service. Even when watching television, online searches have developed into one of the most potent intent signals. It is now a clear indicator of consumer intent. It reveals what the current needs of consumers are. Search offers information that can later be converted into marketing.

The rise of multi-screen viewing

As multi-screening is becoming popular, Microsoft’s new offering comes at a crucial time. According to recent studies, 4 out of 5 consumers read online news while watching TV, highlighting the opportunity for advertisers to target audiences who engage in multi-screen behaviors. Furthermore, 90% of Gen Z viewers in the U.S. utilize a second screen in addition to TV. This behavior creates attractive opportunities for marketers to better engage viewers. Even though the data just pertains to the U.S. market, the product is currently conducting pilots in 34 markets, with more than 405 billion monthly CTV impressions and 1.6+ trillion video impressions.

Image credit- Microsoft Advertising Blog

Video and CTV ads highlights

Microsoft’s access to billions of first-party data points is what distinguishes this platform. It makes it possible for advertisers to precisely identify their target market. Advertisers can target viewers on desktop, smartphone, and tablet devices with online video advertising purchased using a viewable CPM model for both in-stream and out-stream placements. User behavior from Bing, Microsoft Edge, Microsoft Start, and other properties is included in this treasure trove of data.

Max, Hulu, and Bloomberg are just a few of the venues where you can see video and CTV advertisements. Additionally, it has been reported in media sources like the Wall Street Journal, MSN, and the Huffington Post. A hyper-targeted audience is created by the platform using machine learning algorithms based on a variety of variables, including product preferences, demographic data, and browsing patterns. The goal of this strategy is to make targeted ads better so that marketers can reach the most relevant audiences.

Read More: Loop Media-Microsoft Advertising Forge New CTV OOH Inventory Category

Search data insights

One type of data used to create intelligence signals is search. However, Microsoft permits the use of billions of legal first-party data sets across numerous properties in advertising. They range from preferences for content and brands to LinkedIn profiles and much more. All of these signals are applicable to the video targeting feature. Based on viewing and browsing information, Microsoft Advertising Video and CTV advertising enable advertisers to use these signals to place brands in front of viewers with the appropriate messages.

Forecasts suggest a significant increase in ad expenditure

Forecasts indicate that between 2023 and 2025, U.S. programmatic video ad expenditures will increase by $22.51 billion (30.2%). The latest feature from Microsoft is made to effectively develop this growing pattern. Another appealing factor is the ease of application. The announcement is noteworthy because it signals a significant effort in an industry that is constantly developing. Additionally, it provides marketers with a more comprehensive, data-driven tool for audience interaction. Microsoft’s CTV and Advertising Video advertisements provide targeted audience capabilities. The growing rivalry and possible ad saturation have led to continuous innovation for success.

Here’s what they said

Product Marketing Manager at Microsoft Advertising, Liam Mackessy, told Search Engine Land:

This product has been designed for ease of use. You can get started in just a few clicks, there are no long onboarding processes, no set-up fees, and it’s simple to optimise. We’re making CTV advertising, which typically can be a little bit more complex to buy, more accessible to a lot more advertisers on the Microsoft Advertising platform. However, we still provide control and flexibility to advertisers – they can set their own frequency caps so that they can accurately plan budgets and campaigns accordingly. We also have the usual domain reporting and domain exclusions to help advertisers keep track of where their ads are serving so that they can decide which sites they may not want their ads to be served on.

Read More: Microsoft Submits Revised Activision Blizzard Proposal to UK’s CMA

Microsoft Submits Revised Activision Blizzard Proposal to UK’s CMA

Microsoft has proposed a fresh revised deal for the Activision Blizzard acquisition, giving a number of concessions. The resubmission comes after the initial deal was rejected. Early last year, Microsoft, the company that owns Xbox, made a pitch for Activision Blizzard. After China’s Tencent and Sony of Japan, it sought to become the third-largest gaming company in the world by revenue. The US tech titan first proposed a $69 billion acquisition. However, it faced extensive legislative scrutiny in the US, Europe, and the UK. The original contract was halted, the UK’s Competition and Markets Authority stated. It further claimed that a new, restructured arrangement had been reached between Microsoft and Activision. The CMA will analyze the acquisition agreement and will come to a conclusion by October 18.

Microsoft’s Revised Agreement to the UK

Microsoft is seeking to alter its arrangement to acquire a more limited set of rights in order to allay concerns voiced by the UK CMA regarding the proposed acquisition’s potential impact on cloud game streaming. Microsoft will not be able to exclusively release Activision Blizzard titles on its proprietary cloud streaming service, Xbox Cloud Gaming, under the terms of the revised agreement. Additionally, it will have to give up exclusive control over Activision Blizzard game license agreements to competing providers. Additionally, it will not purchase cloud rights for current Activision PC and console games for new Activision games developed over the course of the following 15 years.

Instead, French video game producer Ubisoft Entertainment will receive permanent rights. A distinct third-party content provider is anticipated to be made available through the new agreement and cloud rights divestiture to Ubisoft. Microsoft will then be allowed to provide Activision’s game content to all other online gaming service providers as well as to itself. Activision content will be available for licensing through a variety of revenue models, including subscription services, for Ubisoft. As part of the agreement, Microsoft would also have to offer game versions for other operating systems besides its own Windows.

Read More: Loop Media-Microsoft Advertising Forge New CTV OOH Inventory Category

Ubisoft Benefits Amidst the Scrutiny

The arrangement gives Ubisoft an unparalleled chance to make money off cloud streaming of video games. It will provide Ubisoft with the opportunity to develop and support various business models. These cover the licensing and cost of the games available on international cloud streaming systems. Microsoft will get a one-time payment from Ubisoft in exchange for cloud streaming rights to Activision Blizzard’s titles. It will additionally depend on the wholesale pricing structure of the market, with the ability to accommodate usage-based pricing. Additionally, Ubisoft will have the chance to make Activision Blizzard games available through cloud gaming services that use non-Windows operating systems.

Sarah Cardell, CEO of the CMA said in the announcement,

As part of this new deal, Activision’s cloud streaming rights outside of the EEA (European Economic Area) will be sold to a rival, Ubisoft, who will be able to license Activision’s content to any cloud gaming provider. This will allow gamers to access Activision’s games in different ways, including through cloud-based multigame subscription services. This is not a green light. We will carefully and objectively assess the details of the restructured deal and its impact on competition, including in light of third-party comments.

Read More: Microsoft and Meta Deepen Partnership to Boost AI Capabilities with New Gen Llama

Microsoft and Regulatory Backlash

The U.K.’s Commission and Market Authority have been the takeover’s harshest skeptics. It has brought up worries that the agreement might reduce competition in the just-starting cloud gaming business. Cloud gaming is believed to be the future of business. People will be free to stream games using subscription services just like they can with movies and television shows. Additionally, since cloud games are compatible with PCs, smartphones, and TVs, it would be unnecessary to purchase pricey consoles. Although the market for cloud streaming games is tiny, the CMA contends that the acquisition of a major developer of mega games by a top cloud gaming service provider would impede the emergence of healthy competition.

The CMA first announced its block to the acquisition in April. It stated that it could lead to reduced innovation and fewer choices for UK gamers in the years to come. Regulators previously also argued that Microsoft could take key Activision games like Call of Duty, World of Warcraft, etc, and make them Xbox and other Microsoft platforms exclusive.

Microsoft – Activision Blizzard Whirlwind

EU regulators were the first authority that originally approved the agreement in May. To cross that boundary, Microsoft made major concessions. They included royalty-free licensing to cloud gaming platforms for the streaming of Activision titles. However, the CMA rejected such proposals at the time. It believed they would give Microsoft the power to dictate the rules and regulations in this field for the following ten years. Although the EU has given the merger the go-ahead, British and American regulators have been more cautious out of worry that doing so might give Microsoft an excessive amount of control over cloud gaming.

In an effort to stop Microsoft from acquiring Activision, the Federal Trade Commission in the US engaged in an arbitration dispute with the software giant. A judge halted the FTC’s attempts to do so in July. This made it possible for Microsoft to proceed with the deal in the US. As soon as US regulators learned that the EU had authorized the idea, they quickly did the same. Later, the CMA stated that it was also prepared to take into account any suggestions from Microsoft for reorganizing the agreement and easing regulators’ worries.

Read More: Dentsu-Microsoft Forge AI Powered Alliance for Agency Brands

Microsoft’s commitment to regulation compliance

With complete adherence to and dedication to the EU, Microsoft commits to approve cloud streaming rights in the EEA. With the Ubisoft agreement, Microsoft will continue to obtain the rights necessary to fulfill its commitments to the EC. It will also extend the current legal obligations to other cloud gaming streaming services, like NVIDIA, Boosteroid, Ubitus, and Nware. Microsoft and the European Commission are working closely to assist each other’s assessments of the agreement. Further, it ensures to make sure that the obligations are upheld. It is presently attempting to enter into legally binding agreements to launch Call of Duty on competing consoles. Additionally, it will be accessible through cloud streaming platforms for Activision Blizzard titles. Thus, the transaction is now in a position to move forward in 40+ countries.

Brad Smith, Vice President of Microsoft stated in the blog post

We believe that this development is positive for players, the progression of the cloud game streaming market, and the growth of our industry. And, as we continue to navigate the review process with the CMA, we remain as committed as ever to bringing the incredible benefits of the acquisition to players, developers, and the industry

Read More: Microsoft’s Activision Blizzard Acquisition Approved by China

Loop Media-Microsoft Advertising Forge New CTV OOH Inventory Category

Microsoft Advertising and Loop Media, a provider of free ad-supported TV content, have teamed together to develop a new advertising inventory for SSP collaboration. Loop Media is a provider of digital video content with over 2 billion video views every month via eateries, shops, workplaces, medical facilities, airports, clubs, and colleges. In a pioneering arrangement in the SSP format, Loop Media and Microsoft Advertising will give marketers and demand-side platforms (DSPs) fresh distribution segments from which they may access and obtain Loop Media’s promotional engagements. Digital Out of Home (DOOH) and CTV (Connected TV) are the company’s key offerings on DSPs and SSPs (supply-side platforms). All prospective buyers of DOOH marketing will have access to Loop Media through the new category CTV Out of Home that was created as a result of this agreement. Buyers wanting to investigate ads on CTV OOH service networks will be among them.

Advertisers Rejoice

Through this strategic partnership with Loop Media, Microsoft Advertising seeks to grow its advertising business. It aims to give its advertisers access to the exposure and reach of Loop Media. This cooperation will also open up fresh options for marketers to efficiently and effectively interact with their target audiences.

Advertisers will have access to cutting-edge tools with the development of this brand-new sort of advertising inventory, the CTV OOH. They will be able to effectively connect with and interact with the demographics they want. The collaboration benefits both businesses and will increase Loop Media’s visibility in the constantly changing market.

Loop Media and Microsoft Advertising have paved a revolutionary ad landscape. The launch of CTV OOH under the aegis of the SSP partnership helps advertisers to precisely accomplish their marketing objectives. It has paved the way for a promising future by increasing market potential and improving client outreach with this agreement. Loop Media and Microsoft Advertising have created a game-changing advertising landscape by working together. The roll-out of CTV OOH under the SSP partnership framework gives marketers more freedom to precisely accomplish their marketing goals.

Read More: Connected TV Explained: The Essential Glossary Of CTV

And what they said

Bob Gruters, Chief Revenue Officer for Loop Media stated,

With this new category, Loop Media may be seen and purchased by an expanded group of advertisers in the marketplace. My team and I have been working diligently to get Loop Media positioned well across all revenue advertising categories including Microsoft Advertising’s CTV Out of Home category.

Erik Zamkoff, Microsoft Advertising associate director of Marketplace Development said,

We are pleased to launch our new CTV-OOH library on the Microsoft Advertising platform which provides a path for clients to buy CTV-OOH supply in the proper context with clear labeling in our new venue category packages. We are thrilled to feature Loop CTV-OOH supply in our new venue category packages.

About Loop Media

Loop Media, INC. is a market leader in digital out-of-home (DOOH), television, and digital signage. Through its Loop TV Service, it assists businesses in optimizing campaigns on various platforms by offering free music videos, news, sports, and entertainment channels. Loop Media has a license to stream music videos to companies in the United States using its patented Loop Player. Millions of users access its digital content at DOOH locations every day across the U.S. They include office buildings, retail enterprises, bars/restaurants, university campuses, TV platforms, airports, and local gas stations. It is the most comprehensive and important inventory of short-form entertainment.

Read More: Disney+ Hotstar Amp Brand Outreach With CTV Targeting

Delve In What the Quarterly Results For Big Tech Titans Are Saying

The quarterly results for big tech companies are out. Here are some key takeaways for advertisers and marketers.

Microsoft

Microsoft’s fiscal year has been challenging on many fronts. The acquisition of Xandr, the ad-buying platform, and the increase in search volume revenues failed to produce satisfactory results, making Microsoft miss the mark in Q4. With continuous commitments to investing in artificial intelligence technologies, analysts predicted the quarter to be successful for Microsoft. The company attributed stagnant growth to a decline in advertising spending, which was lower than a quarter on quarter.

Its Talent Solutions contributed to the company’s revenue growth exceeding expectations. Despite the increased revenue, Microsoft reported a reduction in numbers due to low ad spending. The tech giant concluded it was due to marketing solutions decline. LinkedIn’s revenue increased due to growth in Talent solutions. Microsoft Cloud showed promising growth in all of its businesses with improvements in its verticals. Search and news advertising went up with the Xandr acquisition.

By the numbers:

- Revenue was up by 8% increasing to $56.2 billion.

- Advertising and news search revenues up to $86 million, a 3% increase including traffic acquisition cost, 8% increase excluding traffic acquisition cost.

- Azure Cloud revenue growth slowed from 27% to 26%.

- LinkedIn revenue increased by 5%.

- Microsoft Cloud’s quarterly revenue was 21% or $30.3 billion YoY.

Currently, the company is prioritizing developing and spearheading safe generative AI models and practices. Their aim is to help customers use Microsoft Cloud to make the most of their digital resources and drive operations control.

Satya Nadella, Chairman and Chief Executive Officer, Microsoft stated in the Q4 results announcement,

We remain focused on leading the new AI platform shift, helping customers use the Microsoft Cloud to get the most value out of their digital spend, and driving operating leverage.

Amy Hood, Executive Vice President and Chief Financial Officer at Microsoft cited,

Advertising spend was slightly lower than anticipated which impacted Search and News advertising and LinkedIn Marketing Solutions. For LinkedIn, we expect revenue growth in the low to mid-single digits.

She further added,

Even with share gains in our hiring business, growth will continue to be impacted by the overall markets for recruiting and advertising, especially in the technology industry where we have significant exposure.

Meta

Meta produced results in Q2 that exceeded analysts’ expectations. Revenues from advertising rose robustly. The revenue uptick signaled the social giant’s ad business recovery after previous years of gloom and cross-border concerns. Meta cited the increase in DAUs for Reels, the company’s short-form video content app. This attracts 200 billion people to Facebook and Instagram. The app also generated $10 billion annually, which is a $3 billion increase Q/Q.

The company credits the increase in ad revenues to Threads, the text-based app, and continued investment in artificial intelligence. The company ascribed the increase in ad impressions to a heightened focus on TikTok’s rival Reels and AI-driven products as the key factors in the positive outcome. Meta commits to AI advancements and data centers. The CEO has also highlighted AI as the focal point of Meta’s growth strategy. He predicts revenue from AI-powered structures for marketers, AI chat agents, and productivity tools for employees.

By the numbers:

- Revenue up to $32 billion, up 11%.

- Facebook DAUs are 2.06 billion on average, an increase of 5% year over year.

- Facebook’s MAUs of 3.03 billion increased by 3% year-over-year.

- Family daily active people (DAP) 3.07 billion on average, 7% up Yo-Y.

- Family monthly active people (MAP) 3.88 billion and 6% higher Yo-Y.

- Ad impressions in Q2 2023 increased 34% year-over-year and the average price per ad decreased 16% Yo-Y.

Susan Li, Meta’s Chief Financial Officer however stated that their ongoing commitment to invest in Reality Labs, Meta’s unit for metaverse-related initiatives negatively impacted their results. However, it will not hamper their ambition to spearhead metaverse developments.

Mark Zuckerberg, CEO of Meta added,

We had a good quarter. We continue to see strong engagement across our apps and we have the most exciting roadmap I’ve seen in a while with Llama 2, Threads, Reels, new AI products in pipeline, and the launch of Quest 3 this fall.

Alphabet

Alphabet, Google’s parent company overcame its advertising slump in the Q/Q, signaling a return to momentum with favorable results. The revival of their revenue graph was needed to reshape the competitive AI technology landscape. The Q2 results erased concerns about Google losing digital ad prowess to AI advancements on the financial forefront.

The company attributed the overall growth to increasing Google Cloud Services demand, which is anticipated to adopt AI as it advances. The rise in revenues can be traced to costs from YouTube subscriptions and the Pixel family’s content acquisition. YouTube witnessed a surge in stabilized ad spending despite competition from TikTok. Google Cloud revenues were up due to its AI-optimized structure which piqued consumer interest.

By the numbers:

- Revenue was $74.6 billion, up 7%.

- Ad sales rose 3% to $58.1 billion.

- YouTube revenues increased by 4% to $77 billion driven by brand advertising.

- Network advertising revenues were down 5% at $7.9 billion.

- Google Search and other advertising revenues were up 5%, to $42.6 billion.

- Google Cloud revenues are up 28%, at $23.5 billion.

Alphabet is certain that the money needed to finance AI advancements will come from Google’s advertising engine. As such, Google has predicted that it will face more difficulties not only from rivals like ChatGPT, Microsoft, and Bing but also from Amazon’s shopping unit and TikTok and Reddit in trending topics. As part of its efforts to strengthen cybersecurity capabilities, search, and advertising capabilities, the CEO mentioned that AI would be integrated across its product groups.

Sundar Pichai, CEO, said in the announcement,

There’s exciting momentum across our products and the company, which drove strong results this quarter. Our continued leadership in AI and our excellence in engineering and innovation are driving the next evolution of Search and improving all our services.

CFO Ruth Porat commented,

We expect elevated levels of investment in our technical infrastructure, increasing through 2023 and continuing in 2024. The primary driver is to support AI opportunities across Alphabet, including investments in GPUs and proprietary TPUs, as well as data center capacity. With all that said, we remain committed to durably re-engineering our cost base to help create capacity for these investments in support of long-term, sustainable financial value.

Amazon

Amazon released its second-quarter earnings, and the numbers were impressive. According to CEO Andy Jassy, Amazon saw developments in areas they had been steadily advancing in for the past quarters. The e-commerce giant attributes its revenue growth to the rise in price points, selections, and convenience available to its consumers. Amazon continues to see strong demand for everyday essentials, positive feedback from customers, and updates to its website, mobile apps, and customizations.

AWS growth stabilized in Q2. Moreover, it continues to grow with customers, partner networks, functionality, and operational presentation. AWS revenues were twice as high as any other provider. Amazon is constantly working to further AWS technologies and features to aid customers in leveraging generative AI, productivity, and security. Ad revenue increased due to performance-based advertising efforts, improved customer relevance of ads, and ML benefits to understand ROI and ad spending for brands.

By the numbers:

- $134.4 billion revenue, an increase of 11% Y-o-Y vs estimates of $131.5 billion by Refinitiv analysts.

- Advertising revenue is up 22% Yo-o-Y, to $10.68 billion.

- AWS sales revenue growth of 12% Yo-Y to $22.1 billion.

- Subscription service revenues including Prime memberships were up 14%, at $9.8 billion.

Amazon is currently working on enhancing Machine Learning models to help marketers access audiences that were difficult to reach with Amazon ads. During an AWS event in New York, Amazon also committed to enhancing generative AI-powered applications with the latest and improved pre-trained large language models (LLMs).

CEO Andy Jassy mentioned in the earnings call,

As the economy has been uncertain over the last year, AWS customers have needed assistance cost optimizing to withstand this challenging time. They have also needed assistance reallocating spending to new initiatives that better drive growth. We’ve proactively helped customers do this.

Apple

Apple reported their results for the third quarter that were better than their expectations, however, revenue was down Yo-Y. The company attributed the growth in its revenue to healthy iPhone sales across the world. Apple set an all-time high record for services revenues, including advertising, the app store, and music, exceeding its predictions. The slump in iPad sales revenue was accredited to the iPad Air launch in the prior year. They continue to invest in product enhancements to encourage customer satisfaction which was reported to be 98% across the U.S.

By the numbers:

- Revenue was $81.8 billion, down 1% Yo-Y.

- iPhone revenues are $39.7 down 2% Y-o-Y.

- $6.8 billion, down 7%, for Mac.

- iPad $5.6 billion, down 20%.

- Wearables home, and accessories revenues were $8.3 billion up 2% with expectations.

- Services revenue $21.2 acceleration of 8%.

Apple is releasing its most ambitious and advanced personal electronic device, the Apple Vision Pro early next year for ordinary consumers. It is currently only available to advertisers, content creators, etc for demo purposes and has received stellar reviews.

AI and machine learning will continue to be an integral part of product design. Apple is planning to introduce AI and ML-powered live voicemail in iOS 17. They have also invested in research into generative AI and continue to responsibly enhance their products with these technologies. This is with the goal of enriching people’s lives.

Tim Cook, Apple’s CEO said,

We are happy to report that we had an all-time revenue record in Services during the June quarter, driven by over 1 billion paid subscriptions, and we saw continued strength in emerging markets thanks to robust sales of iPhone. From education to the environment, we are continuing to advance our values, while championing innovation that enriches the lives of our customers and leaves the world better than we found it.

Luca Maestri, Apple’s CFO, further remarked,

Our June quarter year-over-year business performance improved from the March quarter, and our installed base of active devices reached an all-time high in every geographic segment.

Snapchat.INC

Snapchat reported its quarterly results and they were mixed. Although revenue was up Q/Q, it still saw a Yo-Y dip. Just like its competitors, Snapchat is grappling with a slump in advertising revenues. Snapchat also introduced an exciting and innovative AI feature a few months back to keep the platform happening and engaged. My AI, Snapchat’s AI chatbot is now integrated into group chats, recommendations, and ‘Lens’ suggestions.

By the numbers:

- Revenue was $1,068 million compared to $1,111 million the previous year

- DAUs 397 million, an increase of 50 million or 14% Yo-Y

- 4 million global users for paid subscriptions introduced in the previous year

This quarter, the social media company pledged to improve advertisers’ expectations through machine learning technology. It will do so to upgrade its framework, find creative approaches to measuring and optimizing ad spending, and encourage new leadership. Its continuous investment in ML infrastructure has improved company ranking and content personalization.

Snapchat believes that it will face healthy community growth in the next quarter with expected DAU increases of 405 to 406 million.

Evan Spiegel, Snapchat’s CEO said,

We are excited by the progress we have made delivering increased return on investment for our advertising partners, growing our community to 397 million daily active users, and reaching more than 4 million Snapchat+ subscribers.

Omnicom Media Group

Omnicom Media Group ended its second quarter of 2023 on a high note. The organic growth rate was up 3.4% compared to the previous quarter’s results, placing it within its projected range. Omnicom spearheads generative AI developments in the media business. Their ongoing strategic alliances with companies like Adobe, AWS (Amazon Web Services), and Microsoft help them do this.

The business has also promised to invest in media sales capabilities, environmentally friendly technology, and data from first parties. They are currently realigning their staff to match strategy choices and outlook.

By the numbers:

- 3.4% organic revenue growth in Q2 23, with $3,609.9 million revenue

- Advertising Media revenue growth was 4.2%, while organic growth grew by 5.1%

- Third-party costs which include supplier costs the company incurs when providing services to clients increased to $86.8 million

- Organic growth rate for Public Relations was up 0.1%, while execution & support decreased by 3.8%

John Wren, Chairman and CEO of Omnicom said in the announcement,

While the balance of the year will continue to see economic uncertainty, we are entering a dynamic and exciting new era for our company. Omnicom has secure leading positions in generative AI technologies and partnerships to deliver on our promise to achieve the best outcome for our clients and increase the operational efficiency of our company.

eBay

EBay has exceeded Wall Street’s expectations in all key metrics and delivered positive results. However, the marketplace’s weakened momentum among active buyers was worrying. Gross merchandise sales decreased also recorded.

In spite of this, the e-commerce marketplace believes that its increasing focus on AI integration into its platform will drive further user momentum. The company currently prioritizes laying a strong foundation for generative AI tools across the website to aid marketers and product listers.

By the numbers:

- Revenue was up to $2.51 billion, an increase of 5% from the previous year

- Advertising revenues were $367 million, up 33.5% Yo-Y.

- Promoted Listings revenue was up 47%, reporting $341 million

- The active buyer base declined by 4%

In the next five years, eBay plans to implement AI enhancements in every part of its organization. They are constantly integrating generative AI features into their site. They are also working towards reinventing the e-commerce landscape. Its work has already produced stellar results and hopes to deliver long-term results.

Jamie Iannone, CEO said,

The foundational work we’ve accomplished over the past 3 years has set us up for a new phase of innovation. Our teams are focused on thinking bigger and moving faster as we build game-changing features and functionality for customers to keep eBay at the forefront of eCommerce.

Read More: Advertise Your Brand in the Metaverse: The Future of Digital Advertising

Dentsu-Microsoft Forge AI Powered Alliance for Agency Brands

Artificial intelligence is overtaking the world. Every industry is rushing to incorporate AI powered tools into its business models, especially the global advertising industry. A collaborative agreement between Dentsu and Microsoft has been announced in yet another case. By creating consumer-ready solutions, Dentsu’s staff will be able to increase client productivity and expansion by utilizing Azure OpenAI technology.

What’s in it for Dentsu?

The agreement will also be guarantee employee access to a secure, enterprise-level development ecosystem , which is an expansion of the already-existing relationship. The partnership between Dentsu and Microsoft aims to give staff access to cutting-edge tools so they can create prototypes more rapidly and effectively. The centralized organizational structure of Azure OpenAI eases the workload on the business and product groups while fostering rapid client development.

AI Connective is diversified online network dedicated to knowledge exchange among all agency brands. Azure OpenAI technologies are accessible globally via this tool. Dentsu’s current systems and databases incorporate the artificial intelligence frameworks as a crucial part of its overall strategy. Additionally, it reduces security concerns while promoting client-centered growth. The fruits of the result have already been borne with the development of two upcoming CXM solutions- Merkle GenCX and AI-playground LATAM

Merkle GenCX uses the potential of generative AI to provide an unforgettable client experience. Regarding LATAM, it offers tailored solutions that integrate audience databases with cutting-edge technologies. Customers benefit from the tool’s increased daily effectiveness and operational dexterity.

Here’s what they said!

According to Simon Crawshaw, Worldwide Lead for Media and Entertainment, Microsoft, both Microsoft and Dentsu share the vision to work towards a responsible AI. This is followed by Azure AI and Co-Pilot’s ability to drive creativity and productivity. He stated,

We are working closely with dentsu to enable AI to drive business and technological outcomes that will fuel a symphony of ideas, orchestrate captivating narratives, elevating brands and campaigns, and provide a powerful platform for their clients.

Dominic Shine, Group Chief Information Officer for Dentsu commented,

By extending our deep partnership with Microsoft and rolling out Azure OpenAI infrastructure, we’re making AI resources accessible to all dentsu employees within a framework defined on ethical and responsible AI principles.

The Dentsu-Microsoft partnership reflects the former’s dedication to employees’ access to the latest AI platforms. Their main goal is to give their staff the tools they need to take advantage of evolving technologies. AI-powered innovation and brand success have never been greater owing to this collaboration between Dentsu and Microsoft. This collaboration should produce outstanding brand experiences and enable the digital workforce.

Read More: Google and Omnicom Collaborate to Enhance Advertising with Generative AI

Microsoft and Meta Deepen Partnership to Boost AI Capabilities with New Gen Llama

Microsoft and Meta, formerly Facebook Inc., have announced the launch of their next generation of large language models (LLMs). Llama 2 will be the latest addition to their growing family of LLMs on Azure and Windows. The collaboration will deepen Microsoft and Meta’s existing alliance. Meta identified Microsoft as their preferred partner with Llama 2. Currently, Llama 2 is accessible to businesses and researchers. They intend to allow access to a large cohort of businesses. Customers will also include academics, tech industry experts, and anyone else who recognizes the value of accelerating AI technology advancements. It is currently under public review.

Llama 2’s capabilities will offer developers flexibility in the type of model they wish to create and support open and experimental models. The approach aims to make it possible for organizations and developers to create generative AI tools and experiences. Meta and Microsoft are dedicated to liberalizing AI and its benefits.

John Montgomery, Corporate Vice President, Azure AI at Microsoft, in the announcement stated,

The announcement builds on our partnership to accelerate innovation in the era of AI and further extends Microsoft’s open model ecosystem and position as the world’s supercomputing platform for AI.

Democratizing AI through the power of partnership.🎉 We're excited to welcome Llama 2 from @Meta to @Azure and @Windows: https://t.co/OJyYP9sVBA

— Microsoft (@Microsoft) July 18, 2023

Customers will now be able to modify and implement Llama 2’s 7B, 13B, and 70B parameters in a more direct and safe manner on Azure. The model will also support Windows PCs. Developers can use Llama by focusing on DirectML execution source through ONNX Runtime. In addition to integrating AI into their apps, it will produce a seamless workflow.

Meta and Microsoft’s evolving relationship

For AI development, Meta and Microsoft have a longstanding relationship. The collaboration first began with the integration of ONNX Runtime with PyTorch to refine the developer experience and Azure as Meta’s choice for a strategic cloud provider.

Azure’s specially designed AI supercomputing platform is created to assist the world’s top AI organizations in developing, honing, and utilizing some of the most resilient AI capabilities. The Llama 2 model equips programmers with tools to use Azure AI’s robust modeling, training, modifying, interpreting, and supporting abilities. It will be the latest addition to Microsoft’s Azure AI model catalog. This catalog will act as a central point for foundation models. This will enable developers and machine learning (ML) experts to find, examine, customize, and distribute huge pre-built AI models widely.

A Vow to Responsibility

Both companies pledge to build AI that is centered around transparency and access. They know the risks that accompany AI. Meta and Microsoft are committed to building responsible AI models and provide a number of resources to help those who use Llama 2

- Safety testing: Several internal and external efforts have red-teamed or safely tested the finely refined models. To help improve the model, their teams created an aggressive prompt. They also commissioned third parties to conduct external combat testing to find gaps in performance.

- Transparency: Both companies promise to outline the model’s tuning and evaluation procedures as well as point out any areas of improvement. Their transparency plan reveals known difficulties and problems they have encountered, offering suggestions to resolve them.

- Responsible resource for developers: In order to help developers with responsible development and safety assessments, they have also created a user guide. These procedures discuss the best practices for the best research underway right now on ethical generative AI.