Influencers Share Their Secret to Earning Big Bucks on Social Media

Key Insights

- Affiliate marketing and paid advertising are one of the top revenue sources but the real bread and butter of influencer income is brand sponsorships reveals a survey of 69 digital stars by Influencer.co

- The survey results were gathered at the beginning of 2020, before the pandemic that has changed the consumer and digital landscape.

- The result highlighted that influencers have diversified income sources and can help them earn even in an economic downturn.

A goal is a dream with a deadline.

– Napoleon Hill

Making a living out of online business is a dream that is now achievable. For many, it is a dream turned reality but with a fair share of struggles. A survey of 69 influencers conducted earlier this year by influencer platform Influence.co highlighted myriad ways available for creators to make big money in 2020.

The results gathered before the pandemic outbreak reveals Brand sponsorship as the top moneymaker with 78% of creators calling it the main source of income. 58% of creators highlight paid advertising like YouTube AdSense also amongst the top three sources of income. However, this category has been dropped off recently as advertiser demand has run down due to the pandemic.

Image Credit: Influence.co

However, influencers have leaned on alternate revenue streams and moved away from sponsored posts as brands have paused/postponed influencer campaigns in 2020. 41% of survey respondents have named commission-based revenue as a key income driver followed by affiliate marketing (39%). Respondents also pointed to physical merchandise (26%) as one of the top income sources.

These are income sources where influencers are paid a fee for e-commerce sales that they drive from their social accounts.

Below is the breakdown of income sources that is listed by influencers as primary revenue sources in the survey.

1. Brand Sponsorships (78%)

78% of influencers surveyed listed brand sponsorships as a primary source of income.

https://www.instagram.com/p/BYwIRyWgHqY/?utm_source=ig_embed

H&M has the largest followings as women reflect H&M style all by themselves as a part of the influencer campaign. H&M partnered for its fall 2017 collection with two influencers -fashion blogger Julie Sariñana and model Ela Velden. Sariñana promoted the clothes on her own Instagram account as she loved them.

Brand sponsorships are mostly sponsored posts on social platforms like Instagram, YouTube, and TikTok. The most reliable way of making money and the main source of income has taken a hit in the last few months mainly because:

- Advertisers have trimmed their budget to save costs.

- Brands are facing economic headwinds caused by the pandemic.

As reported by Business Insider, the frequency of sponsored posts has dropped down on Instagram and 22% of creators have lowered their rates due to slow demand.

As this category is affected by the economic downturn, brands are partnering with influencers to conduct live streaming as consumers at-home interest in real-time videos have spiked.

2. Paid Ads (58%)

The second-highest source of income listed by influencers in the survey with 58%.

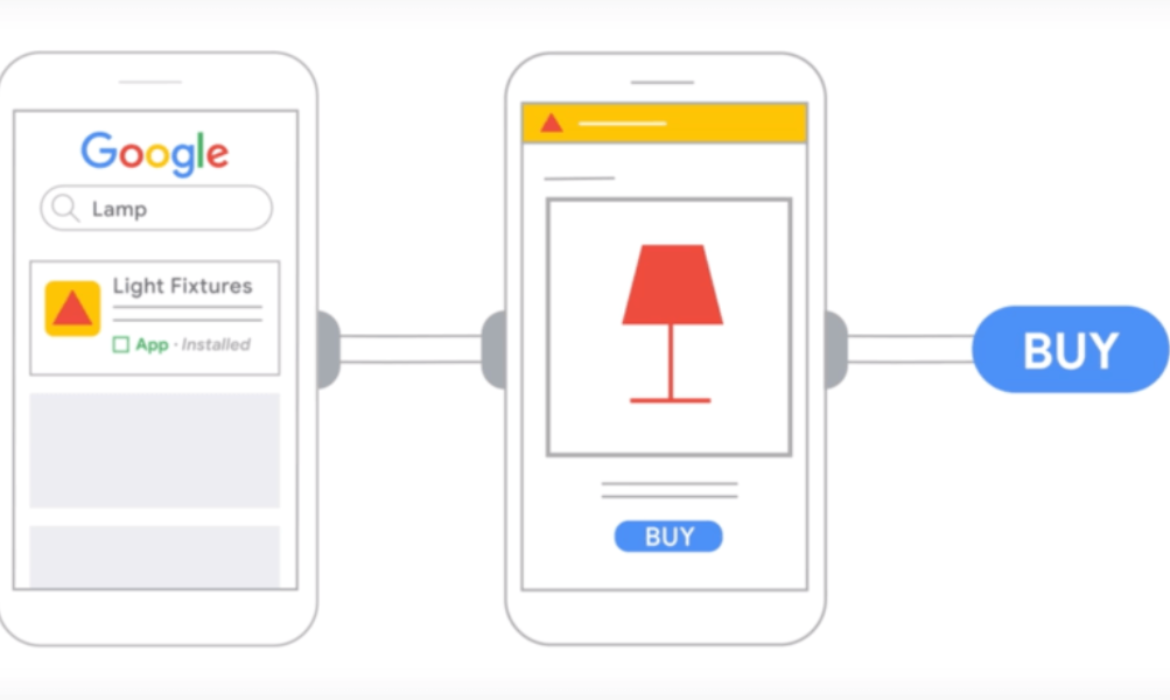

Different Paid Ads Options on YouTube

Image Credit: Marketinghy

Influencers can directly earn through ads that play in their videos across platforms like YouTube, Facebook, and Instagram.

Instagram says that Live creators have seen a 70% increase in video views during the pandemic. It now prepares to launch new tools that enable video creators to earn money that includes badges that viewers can purchase during Live Instagram videos and the introduction of IGTV ads.

YouTube’s Partner Program allows influencers to earn money by placing ad breaks within the content on their channel. Ad revenue earned directly through Google placed ads is the main source of revenue and the rate YouTube pays creators depends on factors like video watch time. And viewer demographics. And if a video climbs millions of views then creators receive a big check from YouTube.

For instance, YouTube creator Groth told Business Insider that normally his channel earns $9 and $12 for every 1,000 views. BI also reported that YouTube creators earned from $3600 to $40,000 off a video with 1 million views.

3. Commissions (41%) and affiliate marketing (39%)

Affiliate marketing has been a popular source of income for influencers and 41% of influencers surveyed pointed out commission on sales as a top source of income.

Image Credit: Influencer Marketing Hub

Another popular revenue source for influencers.- fashion and lifestyle influencers on Instagram, Tech reviewers on YouTube, and media publishers like The New York Times that generates affiliate income on its review site, The Wirecutter.com

In this type of arrangement, creators can earn a commission on sales made through a promotional code and affiliate marketing where they promote products with a trackable link.

Image Credit: Influencer Marketing Hub

https://www.instagram.com/p/BZQolWBB5Eu/?utm_source=ig_embed

In March 2020, the category saw a rise in revenue as many companies shifted their focus to e-commerce sales due to lockdown policies whereas April was a mixed bag as some brands like Walmart, Victoria Secret suspended their services.

4. Event Appearances (29%)

Event Appearances and Speaking engagements are big revenue streams for some YouTube creators who have diversified their businesses.

A recent college grad and YouTube creator Ruby Asabor (170,000 subscribers) have presented for events of universities like NYU and Rutgers in the US. She is a motivational speaker and recently many events and tours have been canceled owing to the pandemic. She explains in her video how the business has changed due to coronavirus and events are postponed.

https://www.youtube.com/watch?v=rlG26M1a2gk

5. Physical- Merchandise sales (26%)

Image Credit: CNN Money

26% of the influencers points out physical merchandise sales as a source of revenue. The ‘merch’ trend has picked up in recent years. While some have built online direct sales to consumers and others have partnered with retailers like Walmart and others.

Stevin John with Blippi dolls

Image Credit: YouTube

Blippi is a popular YouTube star who makes educational videos and has more than 21 million subscribers. The man behind the creation is Stevin John. Recently, Jazwares LLC which makes toys has created a line of items “My Buddy Blippi” which includes figures, plush toys, and toy vehicles. It aims at helping children count or learn colors by putting accessories inside numbered or colored boxes. The products will be released through Walmart and Amazon.

The North Start for the toy industry is Ryan Kaji, an 8-year-old who is the face of YouTube channel ‘Ryan’s World.’ According to Pocket. Watch, retail sales for Ryan-branded products had hit $200 million in 2019.

6. Digital Product Sales (16%):

Fitness influencers on Instagram and YouTube witnessed a spike in engagement and direct-to-consumer sales due to the coronavirus pandemic.

Many fitness influencers sell fitness digital membership programs in the form of app or classes or websites. For instance, Rachel Brathen, aka Yoga Girl, is a Swedish yoga teacher and a New York Times’ best-selling author. She leverages her Instagram account to preach and encourages yoga lifestyle and sell classes from anywhere in the world.

Image Credit: Grin

As reported by Business Insider, a fashion stylist, and influencer, Audree Kate Lopez has nearly 30,000 followers and conducts an online course Fashion Fundamentals for college students.

7. Followers donations(6%)

Image Credit: TikTok

Many influencers receive donations or gifts via live streaming through membership platforms and social media platforms respectively. Take a look:

- Influencers receive donations from followers through Patreon or Buy me Coffee.

- TikTok, Twitch also has features to donate to influencers in real-time.

- In April, Facebook announced the rollout of its star monetization program, where fans can send virtual stars to a live-streaming creator worth $0.01 each.

- YouTube content company launched the “FBE Super” Membership program using Patreon’s Memberful platform. It offers three paid tiers for fans to contribute either $5,$10, or $15 a month to receive exclusive live streams, discounts, or an opportunity to be cast in episodes.

Read more: 26 Stellar Video (YouTube) Advertising Examples To Take Creative Inspiration From!

On His Hustle As An AdTech Entrepreneur, Industry Insights, And More: Interview With Digitalks Founder, Mohit Jain

Mohit Jain has been working in the AdTech space for over a decade in various capacities, the recent being the founder and chief consultant in his own venture- Digitalks in Dubai. He is passionate about data analytics, and particularly enthusiastic about the endless possibilities with the integration of technology and marketing. He has spent the last 15 years working focused on digital advertising & data and has worked with some of the biggest & brightest agency names in the MENA region.

Today he shares with us his thoughts and insights about not just the latest developments in AdTech, but also his hustle as an entrepreneur at Digitalks.

Mohit, firstly, tell us what made you take the leap from your already established career to starting your own venture, Digitalks?

I have just loved working with the agencies throughout my career span and that’s where I learnt the skills which made me whatever I am now but at some point, the work became quite repetitive, dealing with similar challenges over & over again, enormous work pressure and 14 – 16 hours working days was impacting work-life balance. On top of that, I wasn’t able to develop new skills to keep up with the pace of the industry. That’s when I decided to take this leap and take control. I am very glad I took this decision at the right time.

What unseen opportunities do you aim to tap with Digitalks?

I don’t know about unseen but I am trying to position Digitalks in between a world that sits between Marketing & IT i.e. Ad Tech. I think of us as “technical marketers” who understand how marketing communications succeed in the digital world and who can code at the same time and tie both worlds together with the help of data and that is why we call ourselves “Data Whisperers”.

Speaking about AdTech, what recent developments are you most thrilled and concerned about? You can cite one example for each.

Frankly, I am more concerned about how advertisers make use of existing AdTech they have access to.

Agencies are great in promising bells and whistles and sharing incredibly beautiful stories using words such as big data, artificial intelligence, deep learning, machine learning, etc but they fail miserably in fixing the foundations and most basic things in their AdTech. I’ll be very happy if they can simply just use Excel and Google Analytics properly to their full potential, to begin with.

How much importance or budget do today’s Advertisers give to data compared to their marketing budgets? Do they have separate budgets allocated for data alone (similar to marketing budgets)?

The true fact today is that the budgets for projects related to data come out from overall marketing budgets. Unfortunately there are not many advertisers who set budgets aside specifically for data specific work in the region we operate in but the situation is rapidly changing. Businesses seek more accountability and this can be only measured by data so things are already shifting. I believe that Covid-19 pandemic is going to further strengthen the budgets in this direction.

Is DMP mandatory for all the Advertisers who are spending their budgets across multiple platforms. Isn’t that a costly affair for small & mid-sized Advertisers?

DMP is an enterprise technology and definitely not for SMEs. In my opinion, DMP is a dying technology which is severely impacted by walled gardens from Google & Facebook, the war of browsers against cookies, GDPR & similar laws, and most importantly it is dying because DMP ad tech companies oversold & overcharged advertisers to a great extent and then they failed miserably in delivering the business results.

Marketers often get confused between DMP & CDP. Can you please simply state the difference between them both and which one should the Advertisers pick first?

Both of these terms can be confusing for someone who doesn’t work with these platforms closely. The confusion is understandable as both technologies claim to collect, unify, segment and activate customer data across digital channels. In simple words, think of a DMP as a big database that collects addressable “cookies” of your prospects & customers and provides a capability to push this data to outside activation platforms so you can reach them with the right message wherever they are or use this data to personalize their experiences on your website or app. On the other hand, think of CDP as a “data pipe” to pass your own customer data to multiple places depending on the use cases such as when someone fills up a lead form on your website you want to send this data to your CRM, to your email marketing vendor, to your SMS vendor, Google’s & Facebook’s of your world so you can target these users online and then also trigger a workflow to your contact centre partner in India so they can schedule a call with your sales team.

What’s your take on Google disabling the third-party cookies in Chrome? How is it going to affect the data industry of advertising?

It does mean the honeymoon is over for some companies and it is going to impact the audience sizes available in your DSP based on interest and affinity however as the biggest budgets are going to Google, Facebook, Amazon and new social channels such as Snap and TikTok – these guys have built their companies on data they own so I am sure nothing is going to change for them as they will figure out a way however for consumers it does mean more “privacy”. I think it was a very smart move from Google as they prepared themselves clearly to tackle this situation before they announced the change to the world. They gave themselves a 2 years deadline too. Cookies track consumers on the web but things would really change when this rule will be applied on mobile apps as well where cookies are not present and the glue is the device ID of the consumer which is a more powerful piece of data than a cookie. It would be interesting to see how the future will unfold on this front.

Should Advertisers keep buying third-party data from DMPs for their campaigns on programmatic? Is it really worth spending those additional dollars on this data?

It depends on what is your objective. If you are a CPG advertiser looking for mass reach, then these 3rd party datasets can be useful but if you are a performance-driven advertiser then in my experience these 3rd party datasets don’t bring the results they seek. 3P data bought from a DMP or through a DSP is more or less the same but the data volumes of a DMP-based 3rd party data could be higher depending on how that segment was configured.

Coming back to your company Digitalks, how do you plan to increase your verticals and business overall? Is there any expansion plan on cards?

We are a talent-driven business and expansion for us means bigger team sizes. A lot of companies prefer the “hire fast fire fast” approach but that is not my style.

I am not too concerned about the business as there is too much work out there if you know what you are doing. In addition, I don’t want me or my team to end up working 18 hours a day.

What would you suggest to the young Digital Advertising professionals who are looking to build their career around data science? Is there any specific course or education that you would want to recommend to them to enhance their skills?

I think the first piece of advice I give to young professionals entering into the world of data is to understand where they want to start first. I see 3 very broad categories-

- Folks who focus on data collection and who can code, build data pipes, build data lakes, work with APIs, etc

- Folks who can take this data and give it a shape in the form of a report, dashboard, analysis, etc

- Folks who can go beyond and use this data in machine learning, artificial intelligence, statistical modelling and beyond.

At some point when you keep working on multiple projects, the lines become blurry and you start learning skills outside your core focus area naturally. Once you determine where you want to start then choose a course of your choice. There are so many providers out there that the choices have rather too many and confusing to choose. Coursera, Code Academy, EDX, Udacity, Udemy, Data Camp, Pluralsight, etc… the list goes on and on. However, folks who are interested in developing skills more focused on digital advertising & surrounding ecosystems than I highly recommend CXL.com. In all cases, newcomers should first start using the free training courses from Google, IBM, Harvard, Coursera and other technology providers which provide specific pieces of training related to their platforms.

The last question- During this unprecedented Coronavirus phase, brands are becoming conservative about their marketing strategies and spends. How do you think this will affect the overall Digital advertising industry? Does data have a role to play here to help the marketers float through?

The need for measuring every dollar spent is always critical but now due to the CoronaVirus situation, this demand is at its peak. Data has played a great role and will continue to do so in bringing this clarity to advertisers. The advertising budgets were already shifting to online but I think CoronaVirus will work like jet fuel and will speed up the journey of all advertisers who were missing out and will also fuel more money coming to online channels from offline channels.

More and more consumers will go online and as a result demand and supply both will increase however I think brands will be more driven to spend on performance campaigns than just branding campaigns. That right mix between branding & performance will make or break sense from a brand’s advertising budgets. Data will continue to proliferate and how advertisers make use of this data will be the only differentiator left between a successful brand vs average brand.

Google’s Native Advertising Solution- Discovery Competes With Facebook

Discovery ads for the UGG brand cover Discovery feed, Gmail, and Youtube.

Image credit: Google

Key Insights:

- Google is positioning Discovery ads as a better way to reach online shoppers.

- 86% of online consumers are on a lookout for shopping ideas as they watch videos or content across the web.

- 90% of users discover new products and brands on YouTube Watch Next.

- Discover reaches hundreds of millions of consumers using the Google Search App.

- One campaign overs three giant Google products- Discovery Feed, Gmail, and Youtube.

Last May, Google announced at Google Marketing Live that ads are coming to discover. As a part of that, the Google Discovery ads were previewed for the Android and iOS feed, as well as Gmail and YouTube, and they are now finally rolled out to all advertisers globally last month.

With a single campaign, advertisers can reach 2.9 billion users across multiple Google surfaces- YouTube Home and Watch Next feeds, Discover feed on the Google Search app, and in Gmail Promotion and Social tabs. This approach to audience totals is similar to Facebook who started reporting usage across its ‘family of apps’ last year. Facebook reported 2.99 billion monthly active people (MAP) as of March 31. In simple words, Google is offering reach on par with Facebook.

All ads feature visual-rich product photography and are labelled.

- YouTube: Ads include an interactive carousel format and appear as users scroll through the Home and Up next feed while looking for new videos.

- Discover: Ads appear along with sports and personalized updates. The feed is available on Android, iOS app, and mobile web at google.com.

- Gmail: As per Google, ‘time offer’ appears as shoppers are checking the latest product deals in the Promotion tab of their inbox and are marked with a green badge that appears on the top of the feed like an email.

Unlike search ads, no need to type the query manually but Google is leveraging its understanding of what customers are interested in.

Thanks to Google’s unique understanding of customer intent, you’ll be able to show more relevant, meaningful ads to people when they’re most interested and ready to learn more about your products and services.

Why should Advertisers use Discovery

Google recommends for advertisers looking for:

- Drive conversions with their media

- Reach new customers with their media.

- Reconnect with their valuable customers.

Early Adopters of Discovery Ads

Early adopters like Deckers, iProspect, and M&M Direct have seen excellent results-driving customer action with Discovery ads alongside their existing media.

Lifestyle apparel brand Deckers worked with digital agency Jellyfish to promote the UGG brand’s 2019 holiday guide using Discovery ads. Deckers used repurposed high-quality images from its social campaigns and saw a revenue return of 10 times of its original ad spend. It plans to implement Discovery ads across the rest of its portfolio including HOKA and Teva.

Michelle Hernandez, senior manager of Omni-digital marketing at Deckers said,

“While Discovery ads don’t appear on social platforms per se, they offer rich, visually engaging experiences filled with meaningful content that excites and inspires consumers as they scroll through new content on YouTube, Discover and Gmail. This is where more and more consumers are engaged and spending time.”

Head of Acquisition, MandM Direct on Discovery Ads

Image Credit: Google

In early 2019, digital marketing agency iProspect tested Discovery ads with several large clients and reported a reduction up to 48% in cost per action compared to social ads.

iProspect senior director of paid search Christina Malcolm said, “We’re finding that Discovery ads are an interesting ad type that blurs the lines between traditional search, display, and social activations, but which can target different audiences and hit conversion performance goals.”

If you have failed to notice the Discovery ads in the feed yet, then that’s because Google is treading lightly. Currently, there is only one ad slot – in position three-on the Discover feed as Google is aiming high-quality bar and only showing the ads with best image assets that are relevant to users. However, the company also confirmed that more ads are likely to be rolled out.

How to get started with Discovery campaigns

Image Credit: Search Engine Land

Discovery ads are set up in Discovery campaigns with two ad formats: Discovery carousel ads with multiple images and Discovery ads with a single image.

Image Assets: Google scans your website for images that meet the size requirement, upload images, or select from the Shuttershock library. The key is to have high-quality images.

Headlines and Description: Discovery ads serve a combination of headlines and descriptions automatically. One can enter up to 5 headlines and 5 descriptions.

Geographical Targeting: Google shows a weekly impression estimate based on geographical targeting.

Call To Action Option: Google can automatically choose the call-to-action text in your ads or there are 10 other options such as ‘Apply Now’, ‘Shop Now’, and more available to choose from.

Finally, Discovery ad campaigns can be targeted by location, audience, or demographics. This is Google’s automated universal campaign and smart bidding is required. In its Discovery ads tips page, Google notes that advertisers should “Choose an average daily budget at least 10 times the value of your target cost-per-action (CPA) bid and wait for at least 40 conversions before making changes to your campaign.”

Read more: Every 2020 Google SERP Feature Explained: A Visual Guide

IPG’s UM Leads The Forrester Media Agency Wave 2020 To Rate Media Agencies

IPG’s UM worldwide is to be named as a leader in The Forrester Wave: Global Media Agencies, Q2 2020 report. The latter gave the highest rating to agencies that used data platforms to improve media execution and ad creatives and created an integrated and centralized experience for the customers.

UM worldwide led 10 media agencies for the evaluation. In order to qualify for the report, each agency requires $10 billion in yearly billing and employ more than 6000 employees.

Forrester principal analyst Jay Pattisall said UM aces the Forrester Media Agency Wave due to its Kinesso offering, its first Axicom based business. It uses data services for typical insights and now applying to develop content for digital ad campaigns, identify audiences, and target content to audiences in a precise way.

Forrester on UM Worldwide :

“Clients like UM for its application of emerging technologies, its partnership with agencies and publishers, and its data technology strategy. We like the agency’s emphasis on business analytics for decisioning and its future-forward approach to crafting data-informed, Hollywood-caliber content that generates new revenue streams for clients.”

Other strong contenders that also scored as leaders are Omnicom’s OMD, Publicis’ Starcom, and Dentsu’s Carat. Meanwhile, WPP agencies MediaCom, Mindshare, and Wavemaker scored well in execution in order to be placed in the next ‘best strong performer’ section but trailed behind Omnicom’s PHD, Publicis’ Zenith and Havas Media Group in the strategy section.

Jay Pattisall did not support the WPP media agencies’ decentralized approach and said,

‘My judgment is that a more centralized structure is more beneficial at this stage.’

Creativity partnership with media

‘Precision creative’ is becoming a core and critical competency among media agencies -where they create multiple versions of an ad to distribute to a highly targeted audience.

For instance, one agency used data to create a feature-length documentary called “5B,” and promoted it with paid promotions to ensure that it reaches the right audience. This shows that creativity lives inside media agencies or are closely partnered. Pattisall commented,

“Because of their ability to work with data platforms, technology, machine learning, and AI, the content create now is heavily data-driven.”

Programmatic is the new way

Forrester combined programmatic into media agencies’ overall buying competency. Today, everything is moving towards programmatic including digital and emerging areas like addressable TV.

One of the criteria for the report was to evaluate how the agencies used private marketplaces(PMP) to curate inventory and target appropriate inventory to the client and see the impact of the tactics on waste and fraud.

Learn more: Programmatic Advertising Platforms in 2020: A Complete Guide

Data and identity

Many agency data platforms are moving towards integration however, few still relied on some form of third party data. Therefore, media agencies are required to work along with the client to build first-party data. Pattisall said,

“It’s a changing world with privacy and tech companies’ approach to cookie deprecation, so they will need to continue to innovate to stay at the forefront of that.”

Having data on identity and audience will be beneficial for the media agencies to bring data-driven creatives to the forefront of their centralized offering. Pattisall added, “Scaling creative content with audience data is something I know desire.”

The way to the future for media agencies is a simplified offering that includes technology, media, and creativity.

Morgan Stanley Forecasts Australian Ad Spend To Fall By 9% In 5 Years

In a recent analysis by investment bank Morgan Stanley on Australian advertising, it forecasted that the domestic media share will shrink if it doesn’t innovate quickly. The domestic media ad spend was $10.4 billion in 2019 and will fall at an annual rate of 9% over the next five years. In a note to clients, analysts wrote,

“We think investors perpetually underestimate the global leakage of ad spend from Australia.”

A section of marketers holds a viewpoint that the ad spend with Google and Facebook has started to plateau and revenue is returning to the domestic traditional media. However, the analysts completely disagree with this market viewpoint and highlighted numbers that suggest that there can be an acceleration post-COVID 19.

The Australian advertising market has shown little growth over the years – around 1.9 % a year. Also, the financial statements filed with corporate regulator ASIC reveals that over the last three years, global media/tech players’ revenues in Australia increased by roughly 20%.

The global ad tech players like Google, Facebook, Snap, and Twitter as well as emerging players like TikTok continue to take an increase in share in the Australian consumer’s time especially the younger demographics. They will have a larger share in digital media spend in Australia post-pandemic as well.

Image Credit: Ad news

Morgan Stanley forecasts 2.1 % revenue to fall of global tech players in Australia in the current downturn but not as severe as that of domestic media- radio, outdoor, print, and TV. On the other side, the revenue of the domestic media players will see a drop of steep 22.1%

However, the analysts believe that global players will lift their market share in advertising in Australia. For instance, Google Australia’s gross revenue was $4.8 billion in 2019. Morgan Stanley estimates a 4% decline this year owing to the ad industry slow down but expects to rise 13% year-on-year growth up to 4 years to reach between $7 billion and $8 billion in ad revenue a year in 2024.

Analysts say,

“Eventually, COVID-19 will be over and there will be a cyclical recovery in the Australian economy, and a bounce-back in the advertising cycle. ”

He further added that the market will be disappointed in expecting a rise in domestic media earnings.

“Even post COVID-19, when the overall advertising market stabilizes and starts to improve, we think the magnitude of the recovery will disappoint investors.”

“Our point of difference is our thesis … that if the global tech players continue to grow revenue double digits in Australia, but the total pool of ad revenues is only increasing 2% to 3% p.a., there is necessarily a ‘crowding out’ of ad spend left for domestic media companies to pursue.”

The markets underestimate the risks to ad revenue, profit margins, and ROCE(Return on equity) from a 5-year long term view. The main reason for the global tech giants growing faster than local media is structural changes. ‘Necessity is the mother of invention’ and businesses that continue with traditional media platforms for advertising need to change and rethink their strategy.

The analysts in the report mentioned that

“The consistent industry feedback we receive is the current challenges facing large, small and medium-sized businesses across Australia is prompting leadership and management teams to think harder and deeper about becoming more digital,”

Many SMEs have tried marketing on digital platforms for the first time during COVID 19 as consumer behavior and time spent has changed and accelerated towards digital/online/mobile media. It is expected that the same pivot will exist with the advertising budgets.

Unfortunately, the crowding of traditional media- radio, outdoor, TV, print – is set to be more intense.

Image Credit: Adnews

Morgan Stanley continues to have an underweight rating for ASX media companies like Seven West Media, WPP AUNZ, oOh! media and Southern Cross but Nine Entertainment.

Nine Entertainment (NEC)is an exception due to its various revenue sources like digital subscription, streaming, and digital advertising assets. Analysts believe that some Australian media companies have the potential to reinvent themselves and develop digital businesses and NEC has demonstrated the ability for such a reinvention.

The global players may face a threat if they fail to innovate themselves and will lose their consumer share and ad share.

A One-stop Guide On All You Ever Need To Know About AdTech In 2020

AdTech or Advertising Technology did around $800 Billion Worth Of Business In the US alone in 2019, making it one of the fastest-growing industries in the world.

Are you trying to understand ad tech? Just as advertising is the business of making advertisements, ad tech is the business of using technology to make advertisements faster, quicker, and efficient. The business is driven by powerful algorithms and data points. While it is not rocket science, but for the uninitiated, it can be challenging to understand what is ad tech and how its product and services work.

The ad tech industry fuels the global economy with big investments, employment, and ad spend. Digital advertising has reached new heights of complexity, with the rise of programmatic advertising, AI, and automated interactions between computer systems reducing human intervention. Today’s omnichannel ad campaigns reaching to different platforms all at once from publishers’ websites, mobile apps, social media to search engines. Campaigns using tailor-made and highly targeted ads to reach audiences. This process involves many participants- advertisers, publishers to third-party vendors. The technology used in advertising to store, manage, and deploy data is far more sophisticated.

This guide will give you a sneak-peek into the world of technological advertising and understand the growing ad tech industry. As you read further, you will understand the ever-changing ad tech ecosystem.

What is Ad Tech?

Ad Tech also is known as Advertising Technology covers a range of tools and software that can be helpful for brands and agencies to plan, strategize, and manage all digital advertising activities.

The AdTech ecosystem consists of two major entities – the advertiser (Demand-side) and the publisher(Supply-side).

On one hand, advertisers want to run effective campaigns and optimize their budgets to reach the target audience, gain customer insights, and measure ROI.

Whereas, on the other hand, publishers cater to the need of advertisers and generate revenue through ads by displaying ads on their publications like websites, apps, etc, increase ad impressions, bids for ad slots and visitor insights. These are significant factors that publishers need to consider to maintain the platform User Interface (UI).

Adtech helps advertisers and publishers achieve their goals in harmony by providing solutions that meet the demands of both parties. A few examples of AdTech platforms include Pubmatic, Adroll, MediaMath, SmartyAds, and many more.

Image Credit: MarTech Advisor

Programmatic Advertising Explained

After a brief understanding of ad tech, let’s step into the world of programmatic. You will come across concepts like programmatic advertising, Real-time bidding, and programmatic direct. Let’s discuss it:

Image Credit: Martech Advisor

- Programmatic Advertising Definition:

It is projected to be the game-changer for digital advertising. Programmatic automates the process of buying and selling online advertising space with the help of technology and data. This means, with the introduction of programmatic publishers, advertisers or agencies don’t have to sit across to discuss ad size, rates, et. Ad buying is done through algorithms and data insights.

- Programmatic Direct:

This a type of Programmatic digital advertising, where a publisher bypasses auction and reserves a portion or entire ad inventory for a particular buyer or advertiser at a fixed cost per mile. (CPM). Put simple, here the buyer and seller are known to each other and the ad placement is done programmatically.

- Real-Time Bidding (RTB):

Another type of programmatic digital advertising and also known as an open auction. RTB is when inventory prices are decided through an auction in real-time and open to both advertisers and publishers. This is the most feasible and preferable method of programmatic ad-buying because of scalability and flexibility.

The AdTech EcoSystem

Image Credit: Martech Advisor

The process of digital media buying is similar to the traditional media value chain except AdTech has multiple components in the ecosystem to keep the management of advertising campaigns easy for demand and supply-side platforms. Here are the key components of the AdTech supply chain:

1.Media agency: Responsible to allocate the advertiser’s expenditure budget across the channel. It is not involved in the creative aspect of ad campaigns.

2.Agency Trading Desk (ATD): Plans, buys, and manages ads across different platforms and is a set of services provided by the media agency.

3.Demand-side Platform (DSP): An essential platform for advertisers to buy, search, display video mobile ads. It enables advertisers to buy ad placements in real-time on the publisher websites made available by ad exchange and networks. Some of the DSP players are Simplifi, Smarty Ads, App Nexus, Double Click, and more.

4.Data Management Platform (DMP): DMP’s collect data from sources like websites, apps, social networks, campaigns, CRM’s, and more. Using AI and big data analytics to gather first and third-party data, advertisers, and marketers rely on them. DMP players are Lotame, Oracle Blue Kai, SAS data management and more

5.Ad Networks: The unsold inventory will be bought by ad networks from publishers and try to sell to advertisers using their technology. The popular programmatic advertising platforms for the ad networks are Taboola, Google Double Click Ad Exchange, Rocket Fuel, and more.

6.Ad Exchange: A dynamic platform to buy and sell ad impressions between advertisers and publishers without any intermediaries. Open X, App Nexus, Rubicon Project Exchange are examples of programmatic advertising platforms.

7.Supply Side Platform (SSP): The platform allows publishers to sell display, mobile ad impressions to potential buyers in real-time. Some of the key SSP players are MoPub, AerServ, App Nexus Publisher SSP, and more.

8.Ad Server: This platform is used by advertisers, publishers, ad networks, and ad agencies to run their campaigns. It determines which ad will be displayed on a website and also collect ad performances data such as clicks and impressions Double click for publishers, OPen X Ad server, Ad butler, and more are the examples.

Learn more: Programmatic Advertising Platforms in 2020: A Complete Guide

Is Programmatic advertising worth it?

The programmatic advertising statistics say it all. According to Zenith’s Programmatic Marketing Forecasts 2019, 69% of digital media will be programmatic in 2020.

- The total amount spent programmatically will exceed US$100bn for the first time in 2019, reaching US$106bn by the end of the year, and will rise to US$127bn in 2020 and US$147bn in 2021.

- 72% of digital media will be programmatic in 2021

- Ad spends growth is slowing down to 22% in 2019 due to industry challenges of privacy and supply-chain.

- Brands need to develop new targeting techniques using first-party data and customer data platforms in response to the ongoing death of the cookie.

Programmatic Display Advertising fastest-growing segment.

- The ascent of programmatic display advertising has been rapid. In 2012, only 10.4 % of global digital display spend was programmatic. However, it ballooned to 65.3% in 2019 and it is estimated that the share of programmatic display advertising will grow 69.2 5 and 72% in 2020 and 2021 respectively.

- How does it translate in dollars? In 2012, total digital ad spend was $37.8 billion and the programmatic display market was $3.9 million. Fast forward to today, digital display ad spend is $162.3 billion, out of which $106 billion is invested in programmatic display advertising. In 2021, global digital display ad spend is estimated to reach $204 billion, with $147.1 billion going to be programmatic share.

Image Credit: Marketing Charts

Programmatic marketing by country

One of the benefits of programmatic technology is it shows real-time data that helps companies take swift actions to adjust their strategy as per customer requirements. Digital marketers are considering buying programmatic media in-house due to its transparency. Programmatic has undergone massive growth in the following 6 countries out of which the UK and the US are the most advanced programmatic markets in the share of digital media.

Image Credit: Marketing Profs

As per eMarketer forecast, Programmatic ad spending will reach $59.45 billion in 2019, accounting for 84.9% of the US digital display ad market. It is estimated that 87.5%, or $81 billion, of all US digital display advertisements, will be bought via automated channels in 2021.

Image Credit: eMarketer

The above programmatic advertising statistics prove that the investment has increased Y-o-Y and marketers prefer programmatic advertising to buy digital display ads. Marketers are increasingly allocating their advertising budgets to digital advertising channels as it provides precise data that helps to reach customers effectively.

Learn more: 5 Programmatic Advertising Case Studies That Yielded Exponential Results

Artificial Intelligence can be leveraged in AdTech Industry

Artificial Intelligence(AI) and Machine Learning (ML) are two buzzwords in recent times. And why not, as it brings efficiency in whatever we do.

However, AdTech is a messy market now. Ironically, the good and bad part of AdTech is the abundance of data. True, we certainly have all the information to better understand the customers but most marketers aren’t aware of how to leverage the data and use it forward.

The way you advertise-is going to change extremely right before your eyes- thanks to Artificial Intelligence. Not all in the AdTech world have the analytical skills to evaluate the big data as not many are trained to use it and are misinterpreting them.

Adtech partnering with AI can help lower CPC prices, higher click-through rates (CTR), conversions, and better ROI. Let’s check out how AI can help the Adtech industry find better solutions in the following areas.

- AI in Ads Positioning

Developers don’t need to sit and determine which ad position will drive maximum revenue for the website. With the help of AI, employing machine learning algorithms study historical data to find relevant ads for the targeted user group.

Adtech has not used heatmaps previously but AI algorithms use them to learn where the visitors on the website are going and present them with the relevant ads. AI will help marketers to find the best ad positions by studying the maps in detail.

- AI in Ad Network Selection

There are many Ad Networks that provide different kinds of ads to websites owners and required to sort ads according to the websites. This is called Ad mediation and apt to earn high revenue for the websites.

By employing AI for ad optimization it reduces human effort by using a data-oriented approach that includes data, facts, and intelligence to make sure only relevant ads reach the end-user. Data will be user or website’s past history and facts will be website content, geo, and timing. Machine learning algorithms are employed to enhance the best ad-user match.

- Analytics

In the Adtech world, data analytics is not ‘taken seriously’ and publishers.are not happy about it. The AI-based approach will drive reporting and analytics to new levels.

Analytics will help publishers understand the content that drives the audience, placement of the CTA button to turn one time users into loyal users, and increase traffic. It will be a win-win situation for AdTech and parties- publishers, platforms, and users.

AI is the Future of Advertising

Today, digital advertising cannot exist without AI. Behind most online ads are the sophisticated delivery systems in place powered by AI. These systems place the ads before users, the coordination process happens in real-time and generally is automatic. It’s called programmatic advertising.’

According to eMarketer, 86.2% of all digital display ads will be bought via automated channels and nearly $19 billion in additional spending will enter programmatic display platforms between 2018-2020.

Also, 90% of mobile display ads are bought programmatically. On the other hand, AI also powers advertising products offered by Facebook and Google. In 2017, 90% of the new advertising business was captured by these firms.

In recent times, brands are under more pressure to deliver relevant, personalized, and contextual ads to individual customer preferences.

How AI makes Programmatic Advertising better

More companies are turning to AI for creating advertising relevance at scale.

For instance, if you want to advertise on Facebook,-an AI-powered algorithm determines the relevance of the score of your ad. This means that the score impacts the ad delivery directly and influenced by the experience of the ad delivery to Facebook users. Expect a low score if the ad is not liked or is irrelevant.

This decision is made by machine and is beyond your brand’s control independent of strategic or creative decisions

A marketing company like Phrasee launched an AI tool that writes Facebook and Instagram ads. The AI tool assesses a brand’s voice and copy, then the machine writes the ad that performs better than human-written ads. Recently, it helped reduce one client’s cost per lead by 31%. Another AI-powered tool is Albert that helps automate media buying, testing, and optimization. It enhances ad performance and delivers relevant ads to the right person. This shows that relevance at scale is possible in advertising.

Emerging Programmatic AdTech Trends 2020

Image Credit: MarketingToolbox

1. AI in Programmatic Advertising:

Technologies such as artificial intelligence(AI) and machine learning (ML)have involved programmatic ad buying or bid optimization. Programmatic campaigns are used by companies for more targeted net across platforms. By 2020, it is expected that there will be a shift towards automating technologies like AI and ML to get the most from data.

2. First Part Data Move Made Important by GDPR:

After the announcement of the General Data Protection Regulation (GDPR) in Europe, last year on cookie crumble or removal of third party cookies is gradually turning out to be beneficial. The regulations protecting the privacy of user data initially looked limiting to ad tech experts but is resulting in cleaner and more reliable data over time.

Learn more: Digital Advertising Industry Plans To Replace Cookies With First-Party Data

3. Digital Out Of Home (DOOH) and Mobile Location:

Digital DOOH combined with mobile location data has the potential to help marketers to drive conversions in the offline world. Integrated ‘home-to-out-of-home’ programmatic advertising approach provides a smooth experience to the customers.

4. Voice-activated Ads:

The adoption of voice-based to in-home smart devices has grown rapidly. Gartner predicted by 2020, 30% of web browsing sessions will be done through voice-first browsing. Amazon sold over 100 million Alexa-enabled devices in 2018 compared to 2017. A recent survey by VoiceBot.AI revealed 25% of respondents orders everyday household items through voice assistants followed by apparel and games and entertainment.

Programmatic advertising helps marketers to optimize these ad spaces across in-home smart devices, to on-app audio ad opportunities, and connect to consumers through in-store ads, ads in elevators and taxis, and more.

5. Wearables will enhance programmatic advertising:

Wearables collect data on location, lifestyle, health metrics, and more. The market penetration of smartwatches has grown multifold over the years and programmatic advertising is already making its way into this medium. For instance, it helps advertisers run banner promos to customers on their Samsung or Sony smartwatches. The wearable ecosystem has a huge potential to grow and programmatic adtech can bring greater opportunities.

6. 5G in programmatic advertising:

The high speed and no buffering will encourage the rise of more users to spend time on videos on mobile devices. It will enhance other technologies such as AR-enabled ad displays, VR without headsets, and innovative new digital outdoor mediums.

This will give programmatic advertising new opportunities to run more interactive ads without any lags across mediums. By 2024, the use of 5G in AdTech is predicted to grow to 1.4 billion.

7. Evolution of Personalization:

With Gen Z and Millennials- the biggest demographics -personalization is a priority as they like all things customized. Personalization in advertising is going to be inevitable as the choices of the new generation are different. Therefore, programmatic customization by advertisers is increasing offering personalized, relevant messaging to their target group.

8. Blockchains and Ads.xt:

Ad frauds are increasing over the past few years. A cybersecurity firm Cheq reports that ad fraud damages will touch $26 billion in 2020, $29 billion by 2021, and $32 billion the year after that.

The only way to handle the frauds is by bringing transparency in programmatic advertising. Blockchain and Ads.txt (an Interactive Advertising Bureau initiative – Authorized Digital Sellers) can help to remove unrequired middleman, domain spoofing, and verification of publishers and allow transactions using cryptocurrencies.

Learn More: Advertisers Look For Greater Transparency In Programmatic Ad Buying

9. Programmatic TV, podcasts and audio Ads set to grow:

The content on TV has changed drastically. There is a paradigm shift in TV viewing from cable TV to over-the-top(OTT) like Amazon Prime or Netflix via an internet connection.

Programmatic advertising has a larger role to play to ensure marketers get the best of both worlds. Programmatic TV is also going to get more important with its data-driven approach for buying and delivering ads.

Programmatic in podcasts and audio advertising is also growing. Apps like Spotify and Soundcloud are seeing more user acceptance and a new advertising landscape is being created for companies to monetize on.

10. Omnichannel Programmatic:

Forrester defines omnichannel marketing as ‘the practice of digitally sequencing advertising across channels, which is connected, relevant, and consistent with the customer’s stage in their life cycle.’ This is how programmatic advertising is going to be in 2020 and beyond.

A single marketing resource or an ad can be customized programmatically suiting various platforms through programmatic AdTech.

11. Agencies to work on outcome-based pay:

Discussions are making rounds to switch to an outcome-based remuneration model. With increasing ad frauds and agencies promise programmatic tech, advertisers fear how their budgets were used and where their ads placed. There was a lot of wastage in the space. Media buying companies started giving outcome-based remuneration more prominence. Gradually, advertisers would like to see the full cost chain of their programmatic buys, pushing agencies to outcome-based pay.

12. In House programmatic advertising v/s agency.

An IAB report suggests that nearly 40% executing programmatic trading via in house and 50% publishers also have an in-house model. This means advertisers are looking for more transparency, control of their ad strategies, and outcome.

It makes more sense to have an in-house team for strategizing programmatic ads and an agency partner for implementing parts of it instead of having a full-stack programmatic AdTech in house.

Wrapping up

Yes, Adtech is complicated but the best part is that it allows integrating the whole toolset into a single system. According to Zenith Media, the ad spends on digital media will reach $329 billion in 2021. However, there are major concerns and challenges -Ad Fraud, transparency, and privacy issues need immediate action.

There have been big changes and improvements over what advertisers and publishers used to have earlier but it still needs more work and their expertise to handle the challenges and resolve for good.

Financial Report Card Of The Global Giants And Industries In COVID-19

Media companies are facing distress owing to the pandemic crisis, particularly those relying on advertising revenue. The current situation is precarious that compelled companies to roll out furloughs, pay cuts, or layoffs.

Even though publishers are recording high traffic, there is a mismatch in demand and supply in the ad market. Subscriptions are a silver lining for publishers but again sustainability is in question. Many businesses are impacted due to cancelled live events like sports that would bring a vast sum of revenue. Newsstands sales have also witnessed a fall.

Keeping the above factors in mind, below is the analysis of leading media companies’ financial and quarterly reports and their progress in this crisis.

CONGLOMERATES

Bertelsmann: Ad funded businesses were affected while music, services, and education business performed well.

The German media conglomerate Bertelsmann’s revenue declined by 2.7%. The advertising-funded business Q 1 was “highly affected” by the pandemic. Within the digital business RTL Group specifically, the revenue was down 3.4 % owing to the cancellation of ad bookings at the start of March or postponement of productions.

Music business BMG, its Arvato services business and its education business performed well. Subscription to the online streaming services was up 34% Y-o-Y.

Comcast/NBCUniversal: Broadband business upticks whereas rolling out Peacock streaming service.

Comcast is a large company with its broadband business marks an uptick with signups. and revenues up by8.8%. On the other hand, its theme park, TV and film production business is on hold.

NBCUniversal and newly acquired Sky TV cannot broadcast live sports. The company expects the advertising business to be down significantly in Q2

NBCUniversal Q1 revenue was down 7% and it rolled out ad-supported Peacock streaming service to Comcast customers in April.

Disney: Theme Parks and Sports Broadcast Shut, Disney+ subscribers up.

The crisis led to shutting down of theme parks, and productions and theatre movie releases were put to hold. Ad revenue at its TV business was affected as ESPN couldn’t air any live sports.

However, it stepped up the launch of ad-free streaming service in European countries. Disney+ had 33.5 million subscribers by the end of Q1 and an average of $5.63 in monthly revenue per paid user. Disneyland Shanghai did reopen, at 30% capacity on May 11.

WarnerMedia (owned by AT&T): Q1 Revenues severely hit.

Recently, folded its Xandr advanced advertising unit into a bigger WarnerMedia business.

Q1 revenues of WarnerMedia was down 12% on the year-ago quarter to $7.4 billion due to lower ad revenues in March on sports cancellations. Movie productions are also on hold.

PUBLISHERS

News Corp: Circulation and Subscription revenue grows, Ad revenue takes a hit.

Rupert Murdoch’s News Corp includes various leading and established brands like The Wall Street Journal, The Sun, and many more in U.S, U.K, and Australia.

Overall revenue declined 7.8% to $2.27 billion in Q1 due to weak ad business, low ad revenues, and negative currency movements. April ad revenue for Dow Jones declined 20% from the prior year whereas for News Corp Australia and News UK fell by more than 45% which includes negative currency impact.

The Wall Street Journal reported circulation and subscription revenue growth by 1% reaching a record subscriber base of 3 million overall, of which 2.2 million are digital-only.

The New York Times: Focus on Subscription Revenue to thrive in the post coronavirus world.

The NYT is leading more emphasis on subscription revenues to reduce its dependency on ad revenue to be in a better position and thrive post coronavirus world.

NYT recorded the highest quarterly increase in new digital-only subscriptions-up 587,000 in Q1 -leading to a 5.4% increase in subscription revenue to $285.4 million. Ad revenue fell by 15% and likely to fall further in Q2 somewhere between 50% and 55%.

“Other revenues” segment is estimated to fall around 10% as licensing revenue from Facebook News is expected to be “more than offset”- by lower revenue from its live events and its TV series.

TV AND CABLE

Discovery: Their channels are new sports.

Discovery CEO David Zaslav on the Q1 earnings call said, “Our channels are the new sports — the numbers are huge” around its lifestyle channels like HGTV, Food Network, and DIY. The engagement with the characters and talent is enormous. Discovery is also saving money productions through the pandemic as the film shows from home.

Total revenue declined from 1£ in the first quarter to $2.68 billion and expects advertising revenue to fall significantly in 2020. Many sports events are postponed and 90% of the sports deals have force majeure provisions or provisions to not pay for the content that is not received.

Fox: Fox News gains the largest audience.

Revenue for the three months to March 31 rose 25% supported by the forecast of Super Bowl in February, an increase in political advertising, and growth in affiliate revenue. But in March entered coronavirus crisis leading to the postponement of sports events and suspensions of entertainment shows.

80% who signed up for Fox Nation streaming service from Fox news continued to become paying subscribers and advertisers from sectors like technology and communications looked for the transition from sports buy to news buy. Ad revenue within local TV stations to be down 50% from last year.

ViacomCBS: Streaming revenue continues to grow and more on its way441.2 b

Revenue for Q1 fell 6% to $6.67 billion of which advertising revenue marked a 19% drop though a comparison to last year would be unfair when it aired Super bowl and basketball tournament.

Streaming continues to grow- domestic and digital revenue up by 51% to $471 million and had 13.5 million streaming subscribers. It intends to build “a broad pay streaming product in multiple markets” over the next 12 months. It announced a distribution deal with YouTube TV, which will carry 14 ViacomCBS channels

DIGITAL GIANTS

Alphabet or Google: Faring well in this crisis and a better situation.

Q1 revenue stood at $41.2 billion, up 13% Y-o-Y basis(including Google cloud revenue and the ‘other bets’ segment).

According to CFO Ruth Porat, Youtube’s March revenue “decelerated to a year-on-year growth rate in the high single digits” and Google Network March revenue declined “in the low double digits.”

Google Cuts Marketing Budgets by 50%, Freezes Hiring, and launched a “Journalism Emergency Relief Fund”.

Baidu: A closer watch on the signs of recovery in the upcoming result.

Chinese advertising giant Baidu was the first to report the coronavirus crisis set to affect media companies and expect a revenue drop of between 5% and 13% due to advertiser pullback.

In April, it suspended updating content on certain newsfeed channels within its app due to government directives which may impact its marketing services revenue. On May 18, Baidu will give the next quarterly update, and would be worth watching whether there is any recovery in the ad business.

Amazon: The advertising business grew as directly related to eCommerce sales

Amazon’s Q1 revenue soared as consumers quickly shifted to shopping online amidst the coronavirus crisis. Conversely, revenue rose 26%, and profit dropped 29% compared to last year’s quarter. The cost grew to finish the surge in orders

In the financial statement, the ‘other’ category is advertising business- revenue grew by 40% to $3.9 billion in Q1. The growth is consistent with a little downward pressure in March but no major impact as its directly related to eCommerce sales. ‘

Facebook: Post Strong Earnings, Exceeds Projections

Facebook ad revenue grew by 17% Y-o-Y to $17.4 billion despite the instability in the digital ad market due to COVID-19.

Facebook saw strength in the advertiser’s vertical- gaming, technology, and e-commerce whereas travel and automotive were the weakest verticals in the first three weeks of March.

Facebook had Pledged $2M Grant Funding To Support Publishers Financially.

Snapchat: Users and Revenue Increases, ad spend declines

Snapchat reported in its Q1 2020 earnings – strong gains in both users and revenues but a dip in advertiser spend despite the growing concerns about the coronavirus pandemic. the company reported a 44 percent (Y-o-Y) increase in its first-quarter revenue to $462 million. Snap benefited as people used animated lenses to keep in touch with loved ones in this lockdown. Snapchat’s daily active user (DAV) base reached 229 million.

Direct-response advertising accounts for more than half of the company’s revenue and clients in sectors like gaming, e-commerce, and consumer packaged goods continue to spend even during the crisis.

Twitter: Work in progress over AdTech concerns

Twitter’s user growth jumped in March as people rushed to check the latest news updates related to the coronavirus. Despite a 9% growth in daily users, revenue was up only 2.6% to $807.6 million and reported a loss of 8.4 million in Q1 results.

In comparison to its competitors, Twitter doesn’t have a direct-response advertising business. Therefore, the company is improving its mobile application promotion products and rebuilding its ad server which is expected to be up and running by Q2.

Publishers Withdraw Ad Inventory From The Market To Protect Ad Prices

Generally, conventional wisdom says a publisher would sell more ad units at a lower price in a weak market. However, publishers are doing the opposite and pulling their inventory to take a short-term revenue hit and protect their inventory price from falling further. This will help their business in the long run by not falling into the trap of price cuts which would be difficult to win back.

Programmatic advertising market operates under an auction system, lower advertiser demand, and higher web traffic to publishers site has pushed programmatic ad CPM’s down by 10%-20%. Since buyers are now more loyal to price than brands, publishers are preventing prices to tank further to a point of devaluing their inventory over the long term. While some publishers are reducing their inventory in the open market to keep the prices from falling further, others are using ad slots to push internal subscriptions or eliminating ad slots from the pages. For instance, Buzzfeed is getting rid of display ads that receive lower viewability scores.

Unfortunately, the publishers are acting independently and not considering the impact on the broader market. They aim to protect their own inventory prices from falling low as they fear it will take a longer time to return to the previous levels especially if advertisers are buying at a bargain now and unwilling to pay more later when things are back to normal.

As quoted by Digiday, Andy Ellenthal, CEO of the ad sales reporting platform STAQ shares a similar opinion and said, When advertisers return to their normal spending amounts, “they’re going to absolutely remember that a publisher was 25 cents in April of 2020.”

Image Credit: Digi Day

As per the above STAQ graph, the average U.S. display ad CPM in the open auction has fallen from a high of $1.34 on March 1 to $0.91 on May 3.

Even though average CPM has bottomed out on April 8 at $0.83, Andy Ellenthal believes CPM’s will not experience a U-shaped recovery but more of an L-shaped recovery, a slow and steady upward trend. This means publishers whose CPM has fallen least will have to cover the shorter route to return to previous prices.

DigiDay interviewed a few publishing executives and one publishing executive said,

“I’ve got to manage my supply to keep it in balance with demand, and demand has fallen so fast that now we’re trying to get ahead of the game. How much supply can we take off the table to control the CPM without actually truly hurting our business more than it’s hurt now?”

A second publisher executive said that the removal of one ad unit across their sites is equivalent to more than 1 billion monthly impressions. It is a generous number but not significant enough to move the market. Media Math’s DSP sees more than 180 billion impressions each day.

On this Ethenall said,

“These publishers always have to strike a balance between fill and yield. Chances are they are not going to fill 100% of their ad slots right now. If you have a billion impressions that go unsold anyway, what’s the value of them if they’re only pulling down pricing for your better impressions?”

Many publishers have adjusted their floor price to a minimum level at which the inventory can be sold. However, the lower ad demand has made the publishers pull inventory and protect prices as inside programmatic advertising, everything revolves around “Price.”

One of the publishers used to increase floor price by 15% every two weeks since the beginning of Q1. However, in the second half of March, a significant number of impressions went unsold. The publisher could have reduced the price to sell his inventory but he didn’t and said, “in no way do I want to drop my floors to 25 cents because I don’t want crappy ads coming in.”

Lower the ad prices, the higher the chances of giving in to undesirable advertisers who can jeopardize the ability to attract genuine advertisers. Publishers use this opportunity of lower demand to seek out prospective advertisers, but they are wary that lower CPM can alleviate advertiser’s interest in doing programmatic direct or private marketplace deals.

Publishers are also looking at this opportunity to experiment repurposing of impressions that can boost their other businesses and become less reliant on advertisers. For instance, if a publisher can see that house ad proclaiming its subscription product can attract more subscribers and yield than those impressions to advertisers, they would monetize on house campaigns and not take revenue from programmatic advertising.

Shopify Revenue Surges As Pandemic Brings More Business Online

E-commerce platform and payment provider Shopify reported its first-quarter revenue that surpassed analysts’ estimates as more businesses moved online to survive coronavirus pandemic.

The Ottawa-based company Shopify said in a statement that sales grew by 47% to $470 million from the same quarter a year ago. However, analysts expected revenues to come to around $443 million

The key metric of gross merchandise volume which represents all goods sold on the platform 46% to 17.42 billion compared to the previous year. Again, beating analysts expected volume to $16.68 billion.

While sales were booming, the company still posted a net loss of $31.4 million or 27 cents a share. However, on an adjusted basis, the company posted a profit of $22.3 million or 19 cents per share for the first quarter of 2020 compared with an adjusted profit of $7.1 million or six cents per share for the same period last year.

CEO Tobi Lutke said in the quarterly release,

We are working as fast as we can to support our merchants by re-tooling our products to help them adapt to this new reality. Our goal is that, because Shopify exists, more entrepreneurs and small businesses will get through this.

Moving Online

Shopify reported a fall of 71% in gross merchandise volume through its store point-of-sale as stores shut down due to pandemic between March 31 and April 24. Companies also downgraded from Shopify Plus to lower-priced plans.

Also, it throws light on the drop in point-of-sale purchases from the brick and mortar stores questions the sustainability of online switch. It provides store based point-of-sale systems to merchants to operate from a single platform in order to maintain online store and sales.

It is closely observing consumer spending habits online and the ability of brick-and-mortar retail merchants to shift sales online. According to the company statement, Shopify retailers managed to replace 94% of their store volume with online sales.

Retail merchants are adapting quickly to social-distance selling, as 26% of our brick-and-mortar merchants in our English-speaking geographies are now using some form of local in-store/curbside pickup and delivery solution, compared to 2% at the end of February.

Chief technology officer Jean-Michel Lemieux noted the surging demand and had U.S. Black Friday-type of traffic as businesses have used Shopify to stay afloat as nationwide lockdown forces retail store closure across the world.

Impact of COVID-19

This pandemic has strained small and medium-sized businesses and accelerated the shift of buying habits to eCommerce. Shopify introduced many initiatives to support merchants and help entrepreneurs start a business online during the ongoing COVID-19 pandemic, including, offering tools to businesses to open their own digital store online across channels including social media.

An extended 90 day free trial for new sign-ups, gift card capabilities to merchants, and introduction to in-store or curbside pickup and delivery options for greater flexibility in the movement of inventory between different locations.

The company stated that the new stores created on the platform grew 62% between March 13 and April 24 versus the prior six weeks, driven by both first times and established sellers. But is also added,

It is unclear how many in this cohort will sustainably generate sales, which is the primary determinant of merchant longevity on our platform.

What analysts have to say

Few analysts still don’t see Shopify profitable enough in the future to justify the current stock price. They believe the rally is overdone.

Barry Schwartz, chief investment officer at Baskin Wealth in Toronto notes that as they grow, the company will face fierce competition from rival Amazon. He added,

They’re up against some very heavy hitters and I don’t think those guys are going to let Shopify win everything.

Buying it here at that valuation, you’re essentially saying, ‘I don’t care.’

Canaccord Genuity downgraded the stock, with a warning “we’re not entirely convinced” that gross merchandise volume “is as bulletproof as perceived.”

Every 2020 Google SERP Feature Explained: A Visual Guide

How many searches would happen to Google every minute, month, or year? Have you wondered? Finally, the company has released updated data.

Every second, Google processes 63,000 search queries.

Every year, Google has 2 trillion searches.

A caveat, Keep ‘at least’ in mind while reading the figures.

This shows we are so obligated to the power of Google search behemoth and its mystical computing. Google holds nearly 72% market share of search engines.

Why it matters

Companies spend time and effort to develop fantastic content, great titles, meta descriptions, and permalink to rank high on the search and drive conversions. However, a key strategy is often missed- to capitalize and enhance their entry on Google SERP (Search Engine Result Page).

Incorporate the rich snippets into your online stores, websites, blogs, and more

SERP is the way

Google Search engine pages are now accurate, personalized, relevant, dynamic, and helpful. Using structured data, there are many visual enhancements made to the search engine result page which helps you to find the required information. It is essential to know the enhancements as indexability and site optimization has an impact on organic rankings.

Take a look at the enhancements and characteristics of each one:

- Direct Answer Box with short, rapid answers, lists, tables, or carousels may have an image to enhance it.

- Rich Snippet is the additional line of context below traditional SERP and is provided by the websites with price, ratings, etc to enhance the search engine result page.

- Rich Cards for mobile users.

- Knowledge Graphs shows up on the right of a SERP displaying curated images and information about the search.

- Knowledge Panels shows up to on the right of a SERP displaying curated images, information, directions specific to a brand or business.

- Local Pack is an integral part of the local search results with business information, reviews, and location and plays a key role in customer’s decision making.

- People also ask provides related questions and answers to the original query.

- Image Pack is a horizontal carousel of queries related to images or photos.

- Site Links is an expanded pack of links within popular sites. It may also include a site search field that is particular to the internal search mechanism.

- Twitter displays a carousel of tweets with clickable images and links.

- Newsbox: is a carousel of trending, top stories, or breaking news related to the query.

Why Use Rich snippets

By structuring the data and following Schema standards, you can utilize rich snippets and improve your overall visibility on the search engine as it educates the algorithms on the information within the page.

If your company or marketing team is not taking advantage of rich snippets then time to change strategy and develop a new solution. Rich snippets help you enhance your search, increase click-through rates, and engagement. If your company or marketing team is not taking advantage of rich snippets then time to change strategy and develop a new solution. Rich snippets help you enhance your search, increase click-through rates, and engagement.

The Big Picture

This infographic from Brafton, A Visual Guide to Every Google SERP Feature: Snippets, Panels, Paid Ads and More, provides insight on how rich snippets and structured data look like on a search engine results page and why it appears.