Google Introduces New Ways For Publishers To Activate First-Party Data

Google unveils a new way for publishers to utilize first-party data for targeted advertising. Digital advertising is changing rapidly, and user privacy is at the heart of this change. Publishers, advertisers, and technology providers are rethinking and reimagining how they handle and use user activation to better protect people’s privacy online.

Google’s new offering lets publishers share Publisher-provided identifiers (PPIDs) with Google’s programmatic demand to improve their ad campaigns, targeting, and advertising experiences. Steve Swan, Product Manager, Google Ad Manager said in an announcement.

“By helping publishers expand the use of their first-party identifiers to more transaction types, like the Open Auction, our partners will be able to show ads that are more relevant to their audiences, which will increase the value of their programmatic inventory,”

What Is PPID?

As defined by Google in a blog post, Publisher provided identifier (PPID) allows publishers to send Google Ad Manager an identifier for use in frequency capping, audience segmentation, and targeting, sequential ad rotation, and other audience-based ad delivery controls across devices.

Interesting Read: Impact of Delay in Deprecation Of Cookies By Google On Adtech

The New System And Its Functioning

Publishers and advertisers will benefit from the new PPID sharing option because it helps protect their privacy.

- Google Ad Manager turns PPIDs into per-publisher partitioned IDs before sharing them with Google Demand, so users cannot be identified across different publishers’ sites and apps.

- As a result, Google Ads and Display & Video 360 collate anonymized data from publishers as a way to build audience segments.

- Advertisers can programmatically deliver relevant ads to publishers’ sites and apps using these segments based on first-party data.

- Furthermore, Publishers can earn more revenue in the auction while the data allows advertisers to unlock options, such as cross-device reach, frequency management, and creative optimization, without relying on cookies or other identifiers.

Interesting Read: Relief To Advertisers As Google Postpones The Elimination Of Third-Party Cookies Till 2023.

Why Is This New Update From Google Important?

Steve Swan, Product Manager, Google Ad mentioned that Google prioritized this product area based on partner feedback. It will continue to create features that provide publishers with the data and identity tools they require to prepare and grow their businesses.

“Investing in first-party data is a privacy-forward way that publishers can increase the value of their programmatic inventory now and in the future.”

This move could help news outlets recoup some of the lost revenue from Google’s other policies in light of Google’s tumultuous relationship with publishers. This feature enables publishers to control what data is passed and to which bidders they send signals. The Ad Manager only routes signals on behalf of publishers, but it will not be able to read them. Likewise, advertisers who advertise on these publications can show a more targeted and useful inventory to readers while maintaining the privacy of users.

Interesting Read: Google To Demonetize Ads That Spread Climate Change Misinformation

Amazon Ads Unboxes 8 New Advertising And Measurement Tools

Amazon Ads launched eight new marketing solutions at its annual Unboxed event. New features and tools will enhance brands’ ability to tell their stories and build more connections with customers, the eCommerce giant announced.

Amazon prioritized three core elements at UnBoxed- Reach, Relevance, and Results – amid an increasingly fragmented media landscape and rising omnichannel expectations. Amazon will likely capture more media spend if advertisers find the new features appealing, particularly among advertisers who sell products on the platform.

Alan Moss, VP of global ad sales at Amazon Ads that no one except the brand itself can tell a brand story and educate the customers about their products. As quoted by Adweek, further added,

“And we’re striving to help brands accelerate this by creating differentiated interactive experiences that can help them tell their stories and cultivate long-term relationships across video, audio, display and brand shopping experiences both within and beyond our store.”

Interesting Read: A Panoramic Perspective Of Amazon’s Advertising Business!

Take a closer look at the unboxed customer-centric marketing solutions:

Interactive Video Ads

With, Amazon is adding an interactive feature to streaming TV ads on the IMDb TV app on Fire TV using a “Send Me More Info” voice command. This will allow viewers to ask for product details via email or QR code to visit the brand’s landing page on Amazon.

The company debuted other voice call-to-action prompts like “Add to Cart,” “Add to List” and “Buy Now.” in the U.S in May.

In a survey by eMarketer, Amazon’s market share in the US rose to 10.3% in 2020, reaching $15.73 billion, as ad revenues from Amazon Fire TV, Twitch, and IMDb TV surged.

Interactive Audio Ads

Similarly, Amazon Music is giving its listeners a natural feel with the options for Alexa prompts like “Remind me,” “Send me more information” or “Add to cart” after hearing a brand message on Amazon Music’s ad-supported tier. Alexa will recognize the product featured in the ad and add it to the cart or set a reminder for it. The interactive audio ad product is in limited beta testing in the U.S.

Brand Follow

Using the Brand Follow feature, customers can keep track of their favorite brands across Stores, Posts, and Amazon Live, as well as see deals from those brands.

For example, consumers will receive mobile notifications if a brand is streaming live on Amazon Live. Customers simply click the ‘Follow’ button to follow a brand that is included as a part of the shopping experience. Per Amazon figures, there are more than 20 million brand follow connections. This feature will help brands foster longer-term, loyal connections with consumers.

Image Credit : Adweek

As quoted by Adweek, Moss said that consumers will see more content and products of the brands they love across Amazon.

“Our vision for Brand Follow is to help brands create a community of advocates and enable them to reward and grow a loyal shopper base in Amazon’s store and, importantly for customers, Brand Follow offers a way to personalize their shopping experience.”

Interesting Read: The Ultimate A-Z Glossary Of Digital Advertising!

Sponsored Display in live streams on Twitch

Twitch will integrate sponsored display ads in its live stream. Earlier this year, Twitch started running the self-service format, sponsored display ads in its browse tab and directory pages. Nevertheless, it is the first time display placements will appear around its core live streaming offering reaching 30 million visitors each day.

Image Credit: Adweek

Amazon Marketing Cloud(AMC)

For the relevance portion, Amazon Marketing Cloud, a platform launched in January, is now closely integrated with Amazon DSP. Advertisers can upload their own pseudonymized data sets and query to AMC along with data sets from their Amazon Ads campaigns. Moss says,

“We’re continuously enhancing AMC’s capabilities based on user feedback—reducing query times, adding a simple user interface that complements our API, and enabling brands to bring their own data sets into their AMC instance.”

New instructional query library

Instructional query library is a part of AMC expansion that provides templated analytics queries across a range of measurement options.

Interesting Read: Amazon Blocks Google FLoC – Here’s Everything You Need To Know!

Brand Metrics

Amazon announced a new measurement tool Brand Metrics. Reports are updated every week. Data includes information such as how many shoppers have considered a brand based on product detail page views or brand searches, and the value of shopping engagements based on sales generated over a 12-month period. Utilizing predictive consideration and sales models, brands can also see their awareness and consideration indices compared to competitors. This report gives a detailed insight to marketers into brand engagement and what strategies are resulting in sales

Amazon Brand Lift

Amazon Brand Lift helps advertisers to launch surveys and solicit responses from Amazon shopper panel data. Brands can quantify the impact for six different campaign objectives like awareness, preferences, and intent Survey results are available within two weeks of a survey launch. Amazon said to provide insights on the “percentage of respondents who report being aware of a brand or not, or that are likely to purchase from a brand.” It is currently in beta and available in the U.S.

AMC Networks Offers Programmatic Addressable Advertising On Linear TV

An industry first, AMC Networks makes addressable programmatic television advertising a reality. It announced a partnership with two of the biggest names of adtech – Trade Desk and Magnite.

The First Of Its Kind

The cable programmer worked on several campaigns with national advertisers to enable programmatic and addressable buying on linear television. The new capability allows advertisers to buy live TV inventory with the same type of automated technology traditionally reserved for digital.

For more than a year, AMC Networks has been working to make it possible for advertisers to buy linear TV through automated and programmatic platforms. The aim was to enable advanced and automated buying tools, with enhanced targeting around popular and high-quality content.

Evan Adlman, senior vice president of advanced advertising and digital partnerships for AMC Networks pledges to work on 100% linear reach addressability. He also added that providing a full range of advantages on linear television will be the prime focus of the advertising partnerships

“This is a huge development, for us and for the entire industry, unlocking the value of linear inventory by providing advanced programmatic buying, with full addressability, on linear television.”

Interesting Read: All You Need To Know About Connected TV Advertising!

Successful Pilot Experiment With The Advertisers

The cable programmer enabled the addressable TV capabilities in Q3. It teamed up with The Trade Desk and sell-side platform Magnite to implement addressable programmatic buying for major advertisers like Best Western, Smithfield Foods, Securian Financial. In a statement, AMC Networks said all these clients continued to stay live in the fourth quarter. It is also working to expand the current brand partners and add new ones.

In the past, such buys were only available for AMC Network’s web content, which is generally less expensive. Programmatic buys on linear TV involve advertisers cross-referencing their own first-party datasets with those of media owners to improve their audience targeting. This is usually accomplished using an encryption tool such as a data clean room.

Crucial Partnerships

AMC Networks claims the partnerships are crucial in an effort to protect the core linear product. In partnership with Magnite, the cable programmer intends to make linear reach 100% addressable, regardless of where the consumer views the advertising.

Matt McLeggon, senior vice president of advanced solutions, Magnite said,

“The work we’ve done with AMC brings the full power of programmatic execution to linear TV for the first time and gives advertisers the technology they need to holistically manage campaigns across CTV and linear TV.”

AMC claims an ideal partnership with trade Desk, a buy-side tool popularly known as a demand-side platform. Owing to the Trade Desk’s wide base of media buyers., more advertisers can access inventory.

Tim Sims, chief revenue officer, The Trade Desk said that the partnership will bring advertisers all the advantages of programmatic plus the opportunity to buy high-quality content like never before.

“Giving advertisers the access to a new pool of premium inventory and the ability to use their first-party data through this linear addressable capability is a perfect match.”

Interesting Read: Trade Desk Partners With Choueiri Group For Better Programmatic Access In MENA

The Ultimate A-Z Glossary Of Digital Advertising: Part 2

This is Part 2 of the digital advertising glossary series. In Part 1, we decoded many new terms (that people just throw like a football at meetings) which will help you to speed on all things digital advertising.

Continuing Part 2 of the digital advertising glossary series, let’s jump straight back in.

Native Advertising

Native advertising is the practice of using paid advertisements that have the look, feel, and function of the media format in which they appear. In an attempt to improve user experience, it blends seamlessly into the website content. As a result, it appears to be a natural part of the editorial flow of the page.

It is non-disruptive for the reader and catches immediate user attention. Below are native ads placement examples:

Image Credit: NT technology

OTT Advertising

OTT is the advertising jargon for Over-the-top. The OTT advertisements are commercials that can be delivered on OTT platforms via streaming services.

OpenRTB (Real-Time Bidding)

The advertising terminology OpenRTB should not be confused with RTB(real-time bidding).

The OpenRTB protocol is adopted by Indian Advertising Bureau (IAB). It is used for communications between parties involved in media transactions via RTB. Essentially, OpenRTB aims to create a lingua franca for communication between sellers and buyers. It allows all DSPs, SSP’s and ad exchanges to use the same language for all online transactions.

Image Credit: Indian Advertising Bureau.

Programmatic Advertising

A term that needs a special mention in the digital advertising glossary is “Programmatic Advertising.” It is projected to be the game-changer for digital advertising. Programmatic automates the process of buying and selling online advertising space with the help of technology and data. This means, with the introduction of programmatic publishers, advertisers or agencies don’t have to sit across to discuss ad size, rates, et. Ad buying is done through algorithms and data insights.

Programmatic media buying includes Real-time bidding (RTB), Programmatic Direct, and Private Marketplace (PMP).

Interesting Read: Programmatic Advertising Platforms in 2020: A Complete Guide

Prebid.js

Prebid.js refers to a collection of open-source JavaScript libraries offered by Prebid.org, the header bidding platform. It allows publishers to connect to over 150 SSP’s (Supply-side platform) that taps a wide range of advertising demand sources.

Prebid.org was created to help publishers manage their connections with a number of SSPs. Historically, each SSP had its own setup and complicated codes that were time-consuming. Prebid.js launches are simpler and improve the functioning of header bidding and lower page load times.

Interesting Read: Index Exchange Joins Hands with Prebid.Org to Deal with Industry Crisis

Real-time bidding (RTB)

Another term for the act is ‘Open Auction’and has to be a part of this digital advertising glossary. The buy and selling of digital ad inventory via real-time auctions that happen in milliseconds it takes for the web page to load.

Real-time bidding (RTB) auctions occur when advertisers (through Demand-side platforms (DSP)) buy individual impressions from publishers (via Supply-side platforms (SSP)s and Ad exchanges). It takes under 200 milliseconds from the time a bid request is placed until the ad is served in RTB. For perspective, the human eye takes 300 milliseconds to blink.

Remnant Inventory

A publisher who is unable to sell off the ad inventory via a direct or premium deal with advertisers.

Supply-Side Platform (SSP)

A supply-side platform (SSP) is software used by publishers to sell their display, video, and mobile ad inventory in an automated manner via real-time (RTB) auctions. SSP enables publishers to sell their ad inventory to the best network as it aids to improve the yield optimization of the advertising space inventory. It minimizes wasted space and maximizes views.

Image Credit: Publift

SSP plays a key role in the RTB media transactions as it connects to ad exchanges and DSPs to sell publishers (website and app owners) ad inventory.

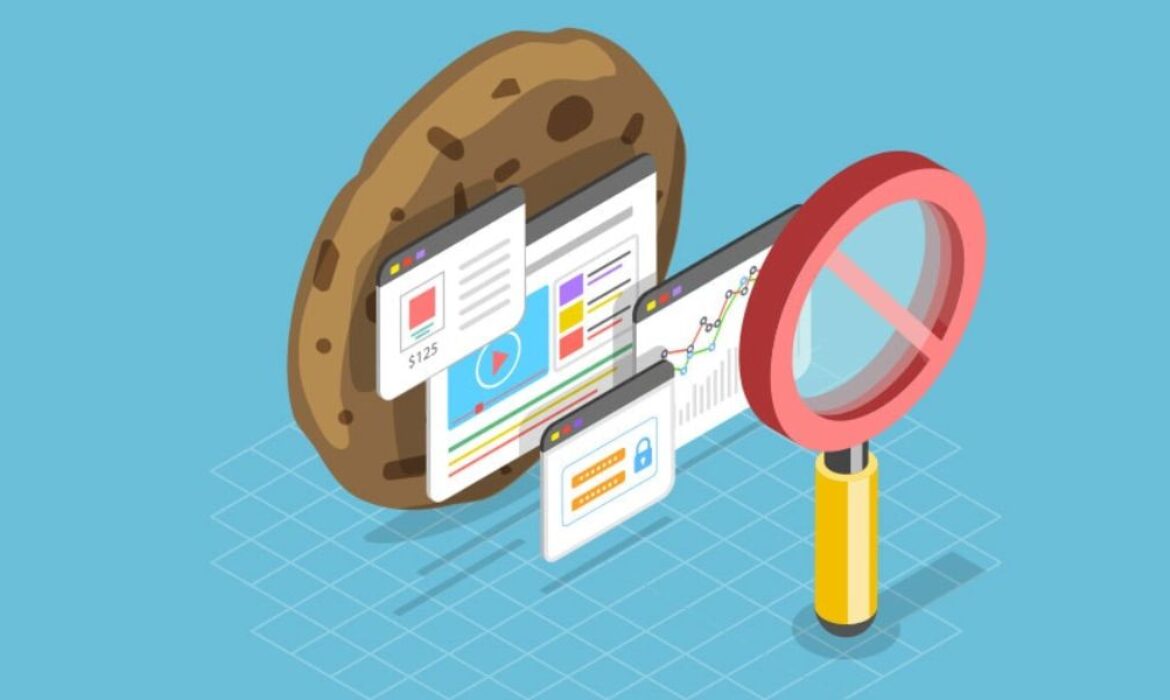

Third-Party Cookies

The third-party cookies are stored in a domain other than the currently opened website(domain). Ad-tech platforms use advertising jargon for online advertising purposes. Advertisers or technology providers use scripts or tags to place on the consumer website by, and not website owners.

Image Credit: Clear code

As an example, news websites create first-party cookies when you visit their website. Like other publisher’s sites, the news outlet uses ads designed by other websites that create a third-party cookie and store it on your computer.

Interesting Read: End Of Third-Party Cookies, What Is There For Marketers: Takeaway!

Unique user identifier (UUID)

Adtech platforms mostly use this advertising jargon. UUID is a set of data stored in a cookie used to identify and track user actions across various platforms. UUID can be used as an alternative method to PII (personally identifiable information) such as email id or contact details to identify users.

Viewable Advertising

The ad lingo ‘Viewability’ simply determines whether the digital advertisement has been viewed by a human being or not. The aim is to know if a user or a bot is viewing the ad. It will help the advertisers to measure the campaigns effectively.

The MRC (Media Rating Council) defines a video ad as “viewable” or “viewed” only if it had at least 50% pixels appear within the browser space for at least 1 second (for display ads), or 2 seconds (for video ads).

Image Credit: Online Advertising Guide

Walled Gardens

A walled garden is a closed ecosystem where the operator does not share information, technology, or data with third parties. The advertisers have limited or less access to customer data and less control over performance measurement. Examples of walled gardens are duopoly Facebook and Google.

Image Credit: Clearcode

Yield Optimization

This advertising terminology simply refers to the efforts taken by publishers and advertisers to maximize the revenue and extract the highest amount of value from ad serving efforts.

Publishers can improve yield rates through price floor adjustments, increasing the inventory value of their ads, and diversifying the advertising demand sources. Advertising yield rates can be improved by defining their target audiences precisely, develop effective bid strategies, and diversifying the supply sources.

Finally, There You Have It!

Digital advertising has plenty of advertising lingos, acronyms, and buzzwords. Our digital advertising glossary has decoded the meaning of the complex advertising jargon that is flying around all over the place. This glossary will simplify your understanding of advertising terminology.

The Ultimate A-Z Glossary Of Digital Advertising!

We all know our ABCs, right?

But when it comes to understanding the complicated advertising jargon used by digital marketers, it is mindboggling. They randomly throw words, assuming we know it all.

The question remains for those who are new to the field or whose specialized roles don’t span the entire spectrum? That’s why we have compiled a digital advertising glossary of the most commonly used terms and definitions.

Digital Advertising Glossary: Beginner’s Alphabetical Guide

Whether you are an amateur or an experienced marketer, this alphabetical digital advertising glossary – will upgrade your digital skills. It will help you to understand advertising terminology that flows so easily off the tongues of our subject matter experts.

AdTech

AdTech is an umbrella term for Advertising technology. It consists of software and tools used by advertisers, ad agencies, publishers, and other industry players to plan and manage their advertising or monetization.

Image Credit: EPOM

Interesting Read: A One-stop Guide On All You Ever Need To Know About AdTech In 2020

Ad Exchange

An ‘ad exchange’ is a stock market for the online ad industry. Publishers and advertisers trade ad inventory. It is an auction-based, automated digital marketplace that allows publishers to offer their ad inventory for sale and advertisers to purchase ad inventory.

Image Credit: AdPushup

Brand Safety

The technology that prevents ads from appearing in inappropriate contexts on publishers’ sites, which could damage the reputation or image of the brand.

Cross-Screen Advertising

Switching between multiple devices is the new way of content consumption. Campaigns that tie digital advertisements and consumers can view one campaign on multiple devices like smartphones, tablets, connected TV, and more.

Read more: Here, There, Everywhere, It Is Cross-Screen Advertising!

Contextual Targeting

The most common question asked, what value is used to determine whether your ad will show on a page and, if so, the ad’s position?

Contextual Targeting matches the ad to the page based on the content. Advertisers can target ads to the relevant groups of consumers based on their interests and has the most impact.

Demand-Side Platform

Demand- Side Platform is an essential platform for advertisers to buy, search, display video mobile ads. It enables advertisers to buy ad placements in real-time on the publisher websites made available by ad exchange and networks. Some of the DSP players are Amazon DSP, AdRoll Trade Desk, Xandr, Google DV360, and more.

Image Credit: ClearCode

DOOH Advertising

An abbreviation for the advertising terminology Digital Out-of-Home Advertising. The concept combines the offline and the digital aspects of OOH advertising. It delivers content via digital screens like billboards, elevator screens, and more.

Image Credit: Admixer

Read more: All You Need To Know About The Rise Of DOOH Advertising

Effective Cost Per Mille (eCPM)

It means an effective cost per thousand impressions. (Mille refers to thousands). In online advertising, the term “impression” refers to the chance to show an advertisement to a consumer on a digital device.

eCPM is a key publisher’s metric to predict revenue for every one thousand impressions. It can be calculated not just for CPM campaigns, but for Cost Per Click(CPC) and Cost Per Lead (CPL) too. On the other hand, CPM is an advertiser metric to estimate the cost of their campaign and reach as per their budget.

eCPM = (Total ad Revenue / Total Impressions) * 1000

First-Party Data

It is an advertising terminology that means information about customers that a company collects from its own sources. Sources for first-party data can be both- online or offline like the company’s website, social media, or surveys.

Interesting Read: Digital Advertising Industry Plans To Replace Cookies With First-Party Data

Full-Funnel Marketing

An ad lingo that has to be a part of the digital advertising glossary. An integrated strategy that addresses the entire consumer journey and incorporates objectives for each step of the funnel: awareness, consideration, and conversion.

Image Credit: Fridge Agency

Guaranteed Deals

A type of programmatic deal where a buyer directly buys inventory from the seller for a guaranteed impression and volume. The publisher agrees to deliver at a guaranteed budget price.

Header Bidding

As defined by Digiday, Header bidding is an advanced programmatic technique wherein publishers offer inventory to multiple ad exchanges simultaneously before making calls to their ad servers. The idea is to let multiple demand sources bid on the same inventory, creating a competitive ecosystem that optimizes a publisher’s revenue. The act is also known as advance bidding or pre-bidding,

For header bidding to work, the header in the publisher’s page used for advertising to its users must contain Javascript.

Image Credit: ClearCode

A study states that in Q2 2021, 66.7% of publishers are using header bidding to monetize their inventories. Furthermore, it reveals that the adoption of this method has generated results. 31% of total publishers witnessed an increase in their yield.

Identity Data & Resolution

The advertising jargon refers to the process of connecting different identifiers like email address, mobile number, customer ID, account username, or more from multiple platforms and devices to a single identity. It helps brands to get a cohesive and omnichannel view of a consumer. It enables brands to deliver people-based targeting, personalization, and measurement.

FoxMetrics

Last Click Attribution

This method identifies the last touchpoint a customer engaged with or clicked before making a purchase, and gives that touchpoint all credit for the conversion.

Long-Tail Ad Inventory

Ad inventory obtained from less popular or lesser-known publishers. It focuses on niche audiences.

Martech

The advertising jargon is also known as Marketing Technology. It is a software or tech tool used to perform marketing activities. Marketers plan and execute the campaigns, analyze the results, and measure the performance of the campaign.

“Every piece of technology a marketer uses to reach a potential customer is martech.”

~ John Koetsier, Journalist (Source)

Image Credit: MarTech Advisor

Mobile Advertising Identifiers(MAIDs)

Unique identifiers provided by mobile device operating system. It is used by marketers to track user activities for advertising purposes. Apple has changed the usage of mobile identifiers (IDFA) on Apple devices where users are asked for permission for ad targeting. Recently, in the new IOS update, users will receive prompts from the Apple App Store asking permission to serve ‘Personalized Ads’ which was earlier enabled by default.

This is Part 1 of the Digital Advertising glossary series. Wait there! There are ample buzzwords and interesting advertising terminologies that will be decoded in the next part.

You can read part 2 – here!

Trade Desk Partners With Choueiri Group For Better Programmatic Access In MENA

The Trade Desk, a global advertising technology leader, enters into a partnership with the Choueiri Group. The latter is a leading media representation group in the Middle East that shares close ties with the region’s largest broadcasters and publishers.

Why this partnership?

The partnership will provide greater access to programmatic ad inventory in the Middle East region. It will allow advertisers to launch and manage their digital campaigns across multiple channels like DOOH, Connected TV (CTV), desktop, and mobile.

Trade Desk and Choueiri Group: An Expertise Exchange

Choueiri’s extensive inventory will offer scale to the brands. Advertisers will also benefit from Trade Desk’s enhanced measurement and data capabilities. It will help them to provide a better customer experience and advanced campaign performance. Choueiri’s newly formed in-house agency, InMotion FZ LCC, will also utilize Trade Desk’s technology to assist local brands to meet their marketing targets.

The partnership will provide global and local brands access to Choueiri Group’s range of inventory across MENA, Europe, and Japan.

Relevant Read: Trade Desk Partners With Samsung Ads For Programmatic CTV

That’s What They Said

Phil Duffield, UK Vice President at The Trade Desk, said,

This partnership combines The Trade Desk’s technical prowess with the Choueiri Group’s unrivalled media connections – a powerful combination for advertisers. Together, we will bring advertisers a media-buying experience that’s independent, objective and helps them reach audiences through data-driven targeting

He also said that the TD was especially enthralled that Choueiri Group will be able to use their platform, which just underwent the most significant update in its history, to push digital advertising ahead in the region. Duffield further added –

The MENA region, with Choueiri Group at the forefront, is on an exciting journey of digital transformation and we’re delighted to be providing them with the tools to make the most of every opportunity

Michel Malkoun, Chief Growth Officer at Choueiri Group added that they are thrilled to work with the top-class platform with advanced expertise, The Trade Desk. He further said,

There has long been a gap between planning and delivery when it comes to programmatic in MENA, but through this partnership, we can join up the process and drive better results, elevating the perception of this type of advertising technology in MENA.

Malkoun said that they are eager to leverage this relationship to combine more thoughtful, data-driven buying methods and fully use The Trade Desk’s platform’s capabilities.

The partnership will be officially live by the end of 2021.

Also Read: All You Need To Know About Connected TV Advertising!

Xandr Launches Monetize Tv To Provide “Granular Targeting” On TV

Monetize TV, an audience-based selling platform developed for the future of advanced TV was launched by Xandr recently.

TV sellers may use Monetize TV’s self-serve platform to get complete monetization capabilities, demand enablement, and, in the future, integrated video solutions. Buyers may also use the platform to make audience-based deals with some of the top premium networks, making it easier to reach particular audiences at scale.

Relevant News: Double Verify Acquires EMEA based Meetrics, Expands Globally

Monetize TV is the outcome of Xandr’s successful acquisition of clypd, a company that provided data-driven linear proposal optimization through deep integrations with top programmers. Monetize TV enhances the clypd platform by allowing Invest TV, Xandr’s simplified advanced TV buying platform, to access automated, cross-seller demand.

Mark Mitchell, Vice-President, Business Development, TV Platform, Xandr, said –

As TV viewership moves to digital channels, buyers want the granular targeting and measurement benefits of digital on TV. As such, sellers need to be able to offer optimized proposals for advanced audience targets for their linear inventory

He further added –

Monetize TV’s effort to standardize audience-based transactions is essential to scaling the TV marketplace

Xandr And Monetize TV: Of Media Owners, Buyers & Sellers

Monetize TV allows rapid and efficient proposal generation with an easy-to-use, automated UI. Media owners may use Nielsen, Xandr, and matching first-party data sources to create sophisticated audiences on the platform.

As a result, sellers may predict viewership in order to create optimal, detailed proposals across networks, dayparts, and selling titles in order to maximize reach or impressions against an advertiser’s target population.

Relevant News: Apple Will Now Ask Permission Before Showing Its Own Targeted Ads

Because of Monetize TV’s direct connection with Invest TV, sellers now have another way to reach premium advanced TV customers. Buyers can deal with sellers in person or through the Invest TV user interface or APIs connected with their agency planning systems.

Programmers that use Monetize TV may sell single-seller or multi-seller agreements to Invest TV customers. Between the two platforms, the same technological backbone allows for uniform audience definitions and universe estimations, as well as prepopulated buyer RFP criteria.

Xandr And Monetize TV: What Does The Future Hold?

Buyers and sellers need unified purchasing and selling methods across inventory types as consumer viewing moves from linear to streaming and across screens. Through expertise in linear optimization technologies and automated demand enablement, Monetize TV allows data-driven, audience-based linear TV sales at scale.

In the future, Xandr plans to work with its partners to solve the challenges of convergence and offer solutions that fit their business demands in an ever-changing media ecosystem.

Also Read: Instagram Rolls Out Ad Feature To The Shops Tab Globally

Taboola Acquires Connexity, A Global Leader In E-Commerce Media

Taboola, the content recommendation company, announced it has completed the acquisition of Connexity. The total consideration of the transaction is $800 million consisting of approximately $590 million in cash and $210 million in Taboola stock.

Connexity is one of the largest independent e-Commerce media platforms in the open web, and the acquisition brings 1,600 direct merchants, and 6,000 publishers including Walmart, Wayfair, Skechers, Macy’s, eBay to Taboola. The acquisition will enable merchants and advertisers to reach new clients through Taboola on the open web and an alternative to the industry’s walled gardens. Adam Singolda, CEO and founder of Taboola, said,

Ecommerce is the future of the open web, consumers will be buying outside of Amazon, on publishers’ sites next to trusted editorial content a lot more than they are today. Amazon has millions of merchants, but merchants mainly have Amazon. That changes today. Combining Taboola and Connexity’s technologies is one step forward in creating an alternative to walled gardens

Similar News: Taboola And Double Verify Partners For Brand Safety

Taboola and Connexity are uniquely positioned to drive growth and diversify their revenue mix as well as helping merchants and advertisers- all capitalizing on the significant growth potential. Adam Singolda explained,

At a time when, according to eMarketer, over 60% of U.S. publishers are turning to e-commerce as a top revenue source, I believe every publisher is going to develop an e-commerce strategy. With Taboola and Connexity, publishers will get instant access to an innovative technology connecting readers with products, which capitalizes on where consumers spend a large part of their day–reading trusted news online

Another benefit to merchants and advertisers would be Taboola offering Connexity e-commerce solutions across the former’s vast network of more than 9,000 digital properties that reach 500 million daily active users. With Connexity’s offering integrated with Taboola’s network, publishers will have a new way to drive revenues, It will scale up customer acquisition by placing products on the stories that consumers are reading.

Similar News: Advertising On Taboola: An Efficient Tool For Advertisers

Connexity Solutions For Publishers And Merchants

Merchant Solution:

–Publisher Network: Connexity core technology powers customer acquisition for merchants like Walmart, Skechers, or Michael Kors on the open web via its extensive publishers’ network and custom-built search platform integrations. Connexity enables more than 750 million product offerings on its shopping intent network, driving more than 1 million monthly transactions for its advertisers.

–Social Influencers: Merchants can reach out to social influencers. Brands like Forever 21, and Wayfair leverage this opportunity to drive customer engagement when social influencers promote their products on their social media post.

Publisher Solution:

– Shopping Section: Connexity allows publishers to build their own shopping section using contextual signals. Brands like CNET and Brand Reviews are using this offering to build their own customized eCommerce section and connect buyers to the products they love.

– Commerce Content Platform: This enables publishers to integrate their products automatically into their editorial content, which will give the readers an opportunity to instantly buy products based on the article they are reading. Publishers including Condé Nast, Hello! Magazine, and News Corp Australia to name a few, are scaling their e-commerce business.

Recent acquisition deals also signal the maturation of ad tech with the rapid public listing of companies and using the resulting funds to grow in an inorganic way.

Impact of Delay in Deprecation Of Cookies By Google On Adtech

Google delays the Cookiepocalypse but should not be taken as a time to pause!

Google announced a nearly two-year delay to Chrome’s deprecation of third-party cookies to increase user privacy in its blog post. As the original 2022 deadline approached, it became clear that more time is needed to thoughtfully design privacy-first solutions without sacrificing ad-funded web. In its updated timeline for Privacy Sandbox milestones, Google announced,

- It plans to develop a more rigorous process including extensive testing and deploy the Privacy Sandbox proposals across key areas, like admeasurement, targeting, and fraud detection. The goal is to deploy these by late 2022, scale adoption, and then phase out third-party cookies Chrome over three months in 2023 only after Privacy Sandbox Google has been fully tested and deployed.

- Google plans to conclude the origin trial of Federated Learning of Cohorts (FLoC) and incorporate feedback received in the first implementation in the future testing.

Is this announcement a relief for the adtech industry? Well, it is a much-needed reprieve for publishers, marketers, and the adtech industry. The adtech industry should not pause the move away from cookies but continue to search for third-party cookies alternatives. Marketers must continue first-party-based targeting, contextual advertising, and a transparent, privacy-friendly future.

In this blog, we take a deep dive to learn about first and third-party cookies and how does the delay affects the adtech industry.

What is a Cookie?

In simple terms, it is a packet of data in a form of a small text file that contains user information and activity stored within the browser or within a subfolder in the user’s device.

First and Third Party Cookies Explained

There are two types of cookies.

- First-party cookies are stored directly on the website like individual information. The information is never shared with other parties outside the website.

- Third-party cookies are set by a third-party server (adtech) using a code placed on the web domain. The data collected on third-party cookies are accessible on any website using the third-party server code. An advertiser can track users across the internet and target advertising wherever the user goes. They are mainly used for remarketing by advertisers.

Google and Third Party Cookies.

Why is Google doing away with third-party cookies?

Safari and Firefox had blocked third-party cookies settings and Apple claimed a competitive advantage by positioning itself as a privacy-first tech company. According to Pew Research Center, 72% of Americans worry that most of what they do online and on their cellphone is being tracked by companies and 81% believe the risks outweigh the benefits when it comes to collecting data. Google in the 2020 blog post wrote,

“Users are demanding greater privacy–including transparency, choice, and control over how their data is used–and it’s clear the web ecosystem needs to evolve to meet these increasing demands.”

Therefore, Google planned to phase out 3P cookies eventually to avoid any negative impact on the online advertising business.

Even though Google isn’t the first web browser to block third-party cookies but the biggest. Techadvisor reports that Google Chrome accounts for more than half of web traffic. As Statista reports in 2019, Google Chrome made up more than 56% of the web browser market.

Credit: HubSpot

How does third-party cookies death affect the ad business?

The death of third-party cookies will have a significant but limited impact on the digital ad business as Google moves a step forward for privacy. Google will collect data and use it to target ads. However, it won’t allow cookies to collect data and sell web ads targeted to individual users browsing activities. This means the raw data like clicks and conversions will be available but specific data points used by advertisers for targeting will be lost. Therefore, ad companies will have to find third-party cookie alternatives to target users.

Options For Ad Companies In The Post-Cookiepocolypse World

There are three major options for the companies to show relevant ads and measure the effectiveness of the campaign in the absence of third-party cookies.

- Google is championing technology developed through Privacy Sandbox-a browser-based tracking model. Federated Learning of Cohorts (FLoC) is an internet-based advertising technology where Chrome will track user’s browsing habits across the web and categorize them in various cohorts alongside audiences with similar interests. Advertisers will show ads to cohorts rather than individual users. The tech giant claims to expect its FLoC technology to be at least 95% as effective as cookie-based advertising — but ad-tech players still have concerns.

- Publishers and Brands are building their own models based on first-party data. Large-scale publishers like the New York Times, Vox Media, and others have already launched their own ad targeting systems based on first-party data.

- Some brands from the ad tech industry are developing identity-based tracking similar to cookies. The leading ad tech company Trade Desk has developed a prominent solution Unified ID 2.0 which has received support from ad tech companies and groups.

Why Has Google Decided To Delay The Deprecation Of Third Party Cookies?

The complexities of removing cookies and delay in implementation of its own Privacy Sandbox system that includes FLoC technology resulted in the delay of deprecation of third-party cookies.

Another reason to phase out by the end of 2023, is the regulatory scrutiny from both sides of the Atlantic. The UK Competitions and Markets Authority (CMA) investigation has raised concerns about whether the new cookie-replacing technology, which categorizes users into ‘cohorts’ is giving an unfair advantage to Google over its competitors. The CMA is investigating if this move by Google can result in advertisers shifting budgets into Google Ads. Vinay Goel, Privacy Engineering Director, Chrome, said:

“We plan to continue to work with the web community to create more private approaches to key areas, including ad measurement, delivering relevant ads and content, and fraud detection. Today, Chrome and others have offered more than 30 proposals, and four of those proposals are available in origin trials. For Chrome, specifically, our goal is to have the key technologies deployed by late 2022 for the developer community to start adopting them. Subject to our engagement with the United Kingdom’s Competition and Markets Authority (CMA) and in line with the commitments we have offered, Chrome could then phase out third-party cookies over a three-month period, starting in mid-2023 and ending in late 2023.”

Should Marketers Change Marketing Strategies Over the Delay?

In response to longer timescales, marketers should not get distracted from the larger context of the moment. The industry is gradually transitioning from opaque consumer data collection to privacy-focused and transparent solutions.

It is essential to understand that there is a delay and not a change in direction, hence stay focused to find authenticated solutions in parallel to cookie strategies through 2022. The next two years are crucial as it gives marketers and the adtech industry time and space to test, and iterate solutions to build consumer trust.

Marketers should continue future-proof targeting and measurement strategies, prepare a sustainable approach for a data deprecated future and invest in first-party data solutions to maximize revenue and personalization.

Expert Chime In On The Recent Change

Some expert opinions from across the adtech ecosystem as quoted by Exchange Wire.

- This news appears to have been met with a huge sigh of relief from the advertising industry, as well as Wall St where the share prices of major DSPs and SSPs saw big spikes. – Rob Hall, CEO, Playground XYZ

The ad tech social sphere was immediately alight with commentary, with a lot of people in the industry proclaiming how nice it was to have more time to work on solutions. But I feel they’re all missing the point: we need to depart from the reliance on third-party cookies as soon as possible because consumers have made their position crystal clear: they don’t want to be tracked around the internet. The fact that Google has delayed these changes due to the ad industry not being ready shouldn’t be met with relief. It should be met with a humble acknowledgment that, if you’re still reliant on third-party cookies, you’re increasingly behind the times. This delay isn’t a lucky break. It’s a stay of execution.

We need to re-shape advertising to not be so reliant on following people around the internet and instead use techniques that reach consumers – on their terms. We think the future of advertising is cookie-less and, largely, identity-free. Consumers have already made it clear that this is what they want, not in two or three years’ time, but today. So, yes, you could keep using third-party cookies for a little while longer. But just because you can, doesn’t mean you should.

- The future is still coming – Kevin Joyner, Director of Data Solutions, Croud

Don’t let Google’s announcement lull you into a false sense of security. Google has not paused the GDPR. Safari and Firefox still exist and have the same significant user base. Mobile and therefore iOS isn’t any less important. Digital attribution is still flawed and unreliable on its own. Automation is still leveling the advertising playing field, and so you still need to activate first-party data to continue to compete. All your “cookieless” plans are still needed, and the future is still coming.

Final Words

Privacy is one of the major concerns on the internet for users. Therefore, the need of the hour is to build an infrastructure based on first-party data. The delay in deprecation of third-party cookies will help to build an advertising ecosystem upon which brands, marketers, and publishers can depend. Now, all eyes are on Google who is working on building a privacy-focused advertising platform. Getting right is crucial as the significance of digital marketing is growing and a longer timeline will help to develop multiple solution approaches.

Trade Desk Doubles The Revenue, CTV Drives Earnings

The digital advertising firm Trade Desk reported revenues of $280 million for Q2, representing a growth rate of 101% Y-O-Y. The growth rate is driven by strong growth in Connected TV (CTV). Its revenues were a major piece of the gain. In an earnings call on Monday, Jeff Green, founder, and CEO of The Trade Desk said:

“We have nearly 10,000 CTV advertisers on our platform, up over 50% compared to last year.”

He further added that through the first half of 2021, brands spending more than $1 million in CTV on their platform have already doubled year-over-year. CTV is the fastest-growing channel and growing as a percentage of overall revenue. It is completely driven by customers in the form of content subscriptions. Its supply hit the roof during the pandemic. Green said,

“One thing we constantly say to advertisers is that whatever you thought you knew about the scale and reach in CTV six months ago has changed dramatically.”

The advertisers growing demand in the Connected TV space especially for premium ad inventory led to the company’s strong revenues. The shift in the behavior of the advertisers is disrupting the traditional TV buying ads- where brands commit in advance to spend on TV ad inventory even before the commercial releases. There is a paradigm shift of advertisers transitioning to digital TV which offers flexibility and data for ad targeting. The ad tech company is acting as a clearinghouse for CTV platforms to funnel ad inventory to digital buyers and is in direct competition with YouTube, Hulu, Roku, and more. Trade Desk is grabbing ad dollars from brands like Mondeléz and Ford. Green also mentioned a food giant brand that shifted a quarter budget of linear TV to CTV.

“We are seeing many brands shift TV budgets to the data-driven precision of CTV.”

On the other hand, Trade Desk is positioning itself as an alternative to the walled gardens and launched the new ad-buying interface Solimar recently. The Trade Desk is trying to develop an open programmatic approach that lets the advertisers access audience ID and export data to their own database. At the same time, walled gardens don’t allow to extract data and restrict data sharing across platforms.

Many broadcast companies are early adopters of the Unified ID 2.0 (UID2) standard, a replacement for third-party cookies. In recent weeks, as reported by Adweek, Interpublic Group joined the list to support UID2 along with Omnicom Media Group and Publicis Groupe. Green is bullish on consumers’ readiness to exchange data for more information from brands.

On the call, Trade Desk emphasized two key drivers that determine future growth – the rise of CTV and its data policies. It is just beginning to witness advertisers moving as much as one-quarter of media budgets to CTV to minimize waste.

Trade Desk expects third-quarter revenues of at least $282 million.