Are Podcasters using Mobile Game Ads Tactic To Buy Listens?

Mobile game ads help podcast makers reach millions of listeners. Wondering, how is this possible.

The idea is a mobile in-game reward ad is served to players who click on it to gain digital loot. In return, the user downloads a podcast episode in the background.

By tapping on the ad, which may be enticingly rewarded with in-game rewards, players automatically download an episode from a podcast they may have never heard before. It allows the podcast company to claim an additional download and a new listener.

A win-win for all! Game developers require advertising revenue, especially from non-gaming apps. Users receive their favorite rewards in-game. Moreover, podcasters win because downloads are their main metric. However, this brings into question who can be recognized as a podcast listener and what time span to be considered as a download. This is debatable and analysts suggest that it could devalue the main metrics -downloads and listens for ad sales.

According to Bloomberg, ads are inserted into episodes as soon as they are downloaded, so whether or not a user listens long enough for the ads to play, another impression is counted by network sales. A person can listen to an episode even without an internet connection if they tap on the in-app play button on their mobile device. A 30-minute episode’s ads are placed at that point of download, so even if a consumer listens to only 10 minutes, the mid-roll ad at the 15-minute mark is already there, ready to be heard, and counted.

The numbers say it all

Jun Group, an intermediary company helps podcast networks that are enjoying downloads in the mobile game space. As Ashley Carman stated in Bloomberg, the price charged to podcast networks for the ads depends on the target criteria- demographics or attracting listeners. The starting rate for a 20-second ad is $27 per 1,000 website page views. Eventually, podcast networks will be able to sell the resulting audience to brand advertisers for a nice profit over what Jun Group is paid.

There is no mention in the podcast industry of embracing the video game strategy. In fact, podcast ad deals are determined by downloads and not the listening behavior or numbers that remain undisclosed. Additionally, podcast ads are not programmatic which means the ads with downloads are not served in real time. In other words, the ad is still counted even if the podcast is deleted without ever being opened. Podcaster Scott Saslov, who uses the in-game reward ads tactic told Bloomberg,

“Don’t rely on exclusively because at some point you’re going to want as much organic and authentic growth as you can get.”

He also pointed out that in-game reward ads aren’t exclusive to podcasters but publishers also use this strategy to increase traffic.

The audio industry is growing

There are heavy investments in the audio industry. Companies are making the best possible move to recover it. They are increasing the reach of podcasts and bringing more ad revenue. The way ads are placed in podcasts has changed significantly over the last couple of years. It is projected that the industry will generate $2 billion in revenue this year and $4 billion by 2024. The growth is not because of a high number of podcasts or listening but advances in ad tech that allows advertisers to better target audiences and encourage them to spend more money.

Interesting Read: Targetspot and Gadsme Unites to Launch In-Game Audio Ads

Targetspot and Gadsme Unites to Launch In-Game Audio Ads

Targetplay, Targetspot’s gaming division, announced a new partnership with Gadsme, a global in-game monetization platform. The latter is adopted by major studios including Voodoo, Ubisoft, Tilting Point, TapNation, and Lion Studios. Gadsme’s supply side network of mobile game studios will be accessible at scale to Targetplay demand partners across the USA, Europe, LATAM, and APAC.

Gadsme specializes in non-intrusive ad formats and works with some of the largest gaming and advertisers worldwide. It includes clickable performance-based In-Game ads, to serve the entire advertising world with measurable KPIs and maximize revenue for game studios. Guillaume Monteaux, CEO of Gadsme, said,

“We are focused on delivering best-in-class non-intrusive monetization solutions to our gaming community and our elegant and unique audio format – jointly developed with Targetplay – is designed to maximise audio KPI’s and minimise user disruption.

Interesting Read: Meta Audience Network Announces Rewarded Interstitial Ads

The most premium inventory in the market

Targetspot, an adtech company and a pioneer in the audio industry has the vision to open a new arena of opportunities in the audio advertising industry. Mario Cabanas, General Manager at Targetspot stated,

“Mobile gaming advertising spending is forecasted to reach 130 billion dollars worldwide in 2025*, a great opportunity for audio ads who are preferred by 75% of mobile users over video ads** because they allow the gamer to keep playing”, stated Mario Cabanas, General Manager at Targetspot.”

Adam Pattison, Global Head of Targetplay, said,

“Our advertising partners have been experimenting with in-game audio, and our partnership with Gadsme gives them access to some of the most premium inventory in the market today.”

Targetspot connects brands to their target audiences via an inventory of leading publishers across all areas of digital audio. The Targetspot platform provides advertisers and publishers with end-to-end integration for contextually targeted, cookie-free campaigns involving direct and programmatic buying.

Interesting Read: Have You Played Netflix Games?

Meta Audience Network Announces Rewarded Interstitial Ads

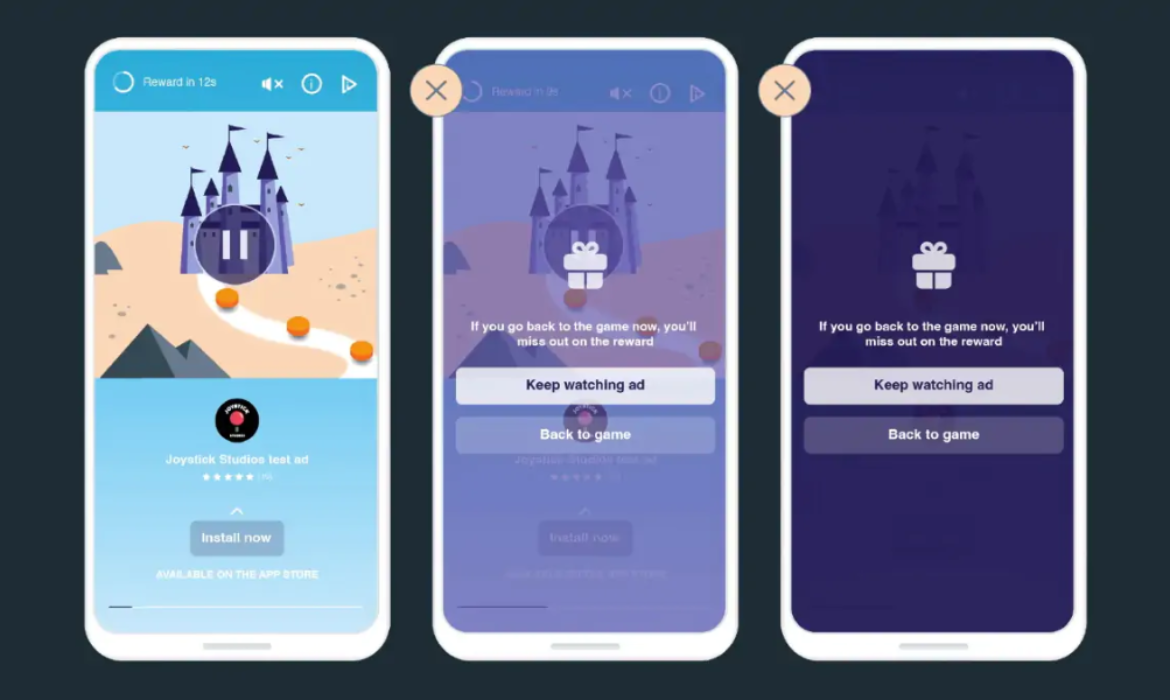

Meta Audience Network announced a new ad format ‘Rewarded Interstitial Ads’ on Wednesday. The rewarded interstitial ads are new, user-friendly, skippable format. It allows game developers to reward players in-game after completing a video view, encouraging longer sessions.

How rewarded interstitial ads work

In the blog, the company said place the ads at gameplay moments when rewarding players is suitable. The players can opt out after 5 seconds of ads played. However, they can also receive an in-game reward, like coins or extra lives for viewing the full video.

In its blog post, the mobile monetization platform explained how rewarded interstitial advertising helps game developers:

Improve user experience: This skippable, non-intrusive ad format doesn’t interrupt players during application events resulting in higher retention.

Increase session length: By offering rewards for watching the ads, gamers are motivated to continue playing, resulting in fewer lapsed players.

Make an impression: These interactive, full-screen ads can grab attention when placed at natural transition points or breaks in the game like in-between activities or game levels.

Monetize more players: Rewarded interstitials can be tested to monetize players who may not engage with rewarded video and in-app purchases.

Interesting Read: Your Ultimate Guide to Understanding Gaming Advertising

Best practices for implementing rewarded interstitial ads

Take a closer look to implement the new ad option including a review of the in-game economy and consider the placement strategically to avoid cannibalizing other ad formats. To test the effectiveness of ads, add a pre-prompt screen at the beginning of the video to inform players what rewards they will receive.

Manish Gajria, Director, Product Management at Meta said,

“Publishers told us they wanted new opportunities to monetize gaming apps, and we listened. We’re proud to launch rewarded interstitial ads: an improved consent-driven interstitial experience aimed at driving higher eCPMs and increased player engagement for Instant Games and native mobile game apps. Next, our teams will look into ways publishers can get the most out of this innovative format by sharing best practices and recommendations.”

Interesting Read: Have You Played Netflix Games?

Have You Played Netflix Games?

Netflix is becoming more aggressive in its push into gaming, but less than half of the streaming giant’s subscribers are playing at the moment. In fact, it plans to double its video game catalog by year’s end. Games have been rolled out since November to keep users engaged between show episodes. The games are accessible to subscribers on the Netflix app.

Isn’t Netflix streaming service, why games?

In a streaming market dominated by Netflix, Amazon Prime Video, Hulu, and Disney Plus are its most obvious competitors. However, Netflix has other plans. Rather than competing for the title of leading streaming service, it vies for users’ attention.

Gaming is therefore an appropriate addition to its entertainment offerings. In between movies and shows, subscribers can play games on Apple iOS and Android devices. Netflix’s subscriber base has also been declining, and it’s not surprising that Netflix is interested in exploring a different demographic.

Over the past year, Netflix has acquired three mobile game studios in order to broaden its entertainment offerings. Recently it acquired Finnish developer Next Games for a total value of $72 million. As per stats obtained by CNBC, Apptopia estimates that Netflix games have been downloaded 23.3 million times, with an average daily user of 1.7 million people.

That may sound impressive on paper, but it represents less than 1% of Netflix’s 221 million subscribers. This data appears to indicate that approximately 200 million people who have access to Netflix’s game library are currently not playing them or are unaware of its existence.

The reason? A big problem with Netflix is that not many of its subscribers care, and it does not spend much on PR campaigns. Despite owning all three game studios, the company spends more on one big-budget movie than it does on all three. However, Netflix is now bringing AVOD to the forefront, hopefully selling more subscriptions while compensating for any revenue losses (and increasing revenue).

The importance of games to Netflix’s overall strategy has arguably grown in recent months, as the company competes for user attention more aggressively. Netflix lost nearly a million subscribers in the Q2, after losing 200,000 in the first — its first major subscriber decline in more than a decade.

Interesting Read: AVOD Surprise: Netflix Advertising Powered By Microsoft

TikTok, a strong competition

Video games are a multi-year endeavor that requires a dedicated and talented team. Even though Netflix produces good games like Stranger Things, Exploding Kittens, or Moonlighter, it takes more than a few titles to entice the gamers away from their Xbox, Playstation, or Apple Arcade and play them. Netflix understands that apps like TikTok are its main competitors for mobile attention.

Netflix named Epic Games and TikTok as two of its main competitors for people’s attention. The company claimed they are in the early stages of expansion into games and view it as another new content category. A key benefit of the strategy for Netflix is that it can drive engagement beyond the show’s initial release and revenue.

A lot of ambiguity

Netflix has been tight-lipped about how it intends to make video gaming a core component of its strategy. According to CNBC, Netflix appears to have taken a risk, as COO Greg Peters stated last year that the company was “many months and really, frankly years” into learning about the gaming industry. In the Q4 earnings call, he also said,

“We’re going to be experimental and try a bunch of things. But I would say the eyes that we have on the long-term prize really center more around our ability to create properties that are connected to the universes, the characters, the stories that we’re building.”

Leanne Loombe, Netflix’s head of external games, said during a panel at the Tribeca Film Festival in June.

“We’re still intentionally keeping things a little bit quiet because we’re still learning and experimenting and trying to figure out what things are going to actually resonate with our members, what games people want to play.”

The streaming service hinted earlier this year that it would license popular intellectual property for its new gaming offerings. However, there are no details on investment in this capital-intensive segment.

As projected by Apptopia, Netflix games have less than a quarter of the downloads of the top mobile games. Examples include Subway Surfers, Roblox, to name a few and each has over 100 million downloads. As quoted by CNBC, Netflix co-CEO and co-founder Reed Hastings said earlier,

“We’ve got to please our members by having the absolute best in the category.“We have to be differentially great at it. There’s no point of just being in it.”

Despite that, Netflix plans to double the number of games in its library from 24 to 50 which will also include Queen’s Gambit Chest based on the show by the end of this year. Netflix’s games aren’t attracting anyone despite a solid list and a small percentage of subscribers playing them. On the other hand, there are hundreds of lousy mobile games that have twice as many downloads.

Evidently, gaming is still in the infant stage for Netflix. Considering the company is looking to reduce expenses, is it worthwhile to invest more money in this gaming experiment?

Interesting Read: The Journey From Deterministic To Probabilistic Marketing

Omnicom Group Launches In-Game Advertising Solution For Brands

The Omnicom Advertising Collective a portfolio of integrated marketing agencies within Omnicom Group announced a dedicated gaming offering called LevelUp OAC. The Marketing Arm and GSD&M will lead the new gaming unit. The responsibilities will be divided between the two agencies where The Marketing Arm has over a decade of experience in gaming brand strategy, content creation, influencer engagement, and experiential activation. GSD&M offers in-game advertising solutions as well as in-house game experience design and augmented and virtual reality capabilities. These agencies are also part of a unit called Omnicom Advertising Collective, which is a collection of creative shops organized by the holding company. The Collective is in charge of launching the gaming practice.

Interesting Read: New Video Game Measurement Allows Brands To Evaluate The Impact Of The In-Game Ads

The offering

With the offering, brands looking to enter the space will have access to creative and media expertise, such as in-game media planning and buying, experiential marketing, and influencer marketing. James Fenton, CEO of the Omnicom Advertising Collective, stated:

“LevelUp OAC brings together our most passionate and seasoned talents in the gaming space and offers a single source solution for brands who want to engage with gamers in an authentic, 360-degree way.”

Along with the expertise of TMA and GSD&M, LevelUp OAC brings together other capabilities to round out its offerings such as earned media, PR, commerce, and others. Additionally, the Advertising Collective will focus on other disciplines and verticals, including B2B, multicultural marketing, retailing, and the metaverse.

As examples of recent gaming-related work from the two agencies- GSD&M helps Pizza Hut deliver pizza boxes with an AR Pac-Man game incorporated into them. On the other hand, The Marketing Arm helps State Farm to incorporate its signature character Jake into NBA 2K22. LevelUp OAC plans to offer an end-to-end solution. As reported by Adage, Marketing Arm’s Andrew Robinson Jr said,

“There are a ton of gaming solutions for brands, specific boutique solutions, larger agency solutions, but I think there are very few that offer a top to bottom comprehensive solution. So everything from strategy, creative, media, experiential, influencer —they are all the things that LevelUp offers.”

LevelUp aims to provide clients with a “general learning experience” about gaming despite its massive popularity. A critical part of that education is helping brands differentiate between gaming and Web 3.

Gaming Market

The new focus on gaming is driven mostly by big growth in gaming numbers. eMarketer research shows that Americans spent $47 billion on gaming services last year. Gaming analytics firm Newzoo also estimates that gamers worldwide will grow to 3 billion, up from 2.03 billion in 2015.

There is no doubt that Omnicom’s move is long overdue. COVID has brought massive growth to this sector, and it’s now reaching a tipping point for brand engagement. The company is working to grow its strengths in these areas as well – e-commerce, retail media, precision marketing, and performance media.

Interesting Read: Your Ultimate Guide to Understanding Gaming Advertising

Marriott Revamps Ad Sales, Ties Bonvoy To Gamers Paradise Series

A Marriott Bonvoy, the hotel chain’s loyalty program, will present a new digital variety show featuring Asian esports and gaming culture. Gamer’s Paradise is a 15-episode variety talk show series produced by ONE Esports, a subsidiary of ONE Championship (ONE).

Why the amalgamation of Travel With Gaming?

The travel market may not be closely associated with a stationary activity like games. However, Marriott clearly plans to grow affinity with gamers, whose popularity has skyrocketed since the pandemic hit. It is backing the digital content series to expose its Bonvoy loyalty program to a broader audience of gamers and esports fans.

“Gamer’s Paradise” episodes highlight regional Marriott hotels centered around specific themes. It will enable viewers to immerse themselves in travel destinations through the lens of gaming culture. It will feature content that celebrates the diverse gaming and esports culture in Asia – Indonesia, Japan, Malaysia, Philippines, South Korea, Singapore, Thailand, and Vietnam.

Interesting Read: New Video Game Measurement Allows Brands To Evaluate The Impact Of The In-Game Ads

The series will feature across One Esports channels including Facebook, Twitch, YouTube, and Afreeca T.V, a Korean peer-to-peer streaming service. Streaming and digital programming sponsorships are common since gamers prefer these platforms to linear TV for entertainment. It is clear from Marriott’s support that it plans to tap the enthusiasts’ group not traditionally targeted by the hospitality sector.

Marriott joins a growing group of non-endemic marketers bolstering their gaming practices as desirable consumer groups like millennials and Gen Z express a clear preference for the sector. Julie Purser, Vice President, Marketing, Loyalty & Partnerships, Marriott International, Asia Pacific said,

“We teamed up with ONE Esports on Gamer’s Paradise to bring Marriott Bonvoy’s expression of good travel in both virtual and physical settings to gamers across the region. This series is rooted in travel, and we hope to showcase how the digital and gaming worlds draw inspiration, energy and community from the transformative power of travel.”

Interesting Read: Your Ultimate Guide to Understanding Gaming Advertising

With the travel industry experiencing a recovery from pandemic lows, advertisers have ramped up their marketing spend is up 43% Y-o-Y. Marriott Bonvoy acting as a sponsor comes from the bounce back.

It is also revamping its ad sales business. The hotel chain recently launched Marriott Media Network which chain is a cross-platform omnichannel advertising platform. It leverages data from Bonvoy, Marriott’s loyalty program with more than 164 million members. And the network intends to initially focus on content and editorial products.

Interesting Read: Marriott International: A Hotel or An Ad Tech Company?

New Video Game Measurement Allows Brands To Evaluate The Impact Of The In-Game Ads

Recent years have seen an upsurge in video game advertising, as unprecedented numbers of consumers have turned to video games to keep entertained during the COVID-19 outbreak. However, advertisement measurement standards haven’t kept pace with this fast growth. The prevalence of in-game advertisements has led brands and marketers to look at different metrics to determine their effectiveness.

So, was Frank Redhot’s recent appearance in a sports video game well-received? McCormick’s Frank’s Redhot brand placed banner ads inside Basketball Battle, a free-to-play mobile 2D basketball game. The banner advertisements were prominently displayed below the scoreboard at the center court.

Frameplay, a global leader in enabling intrinsic in-game advertising tracked the duration of time the player saw the ad. It recently introduced the first-to-market attention metric called Intrinsic Time-in-View. Attention is a key indicator of where advertisers should spend ad dollars, but how can it be measured? An understanding of the research and data can provide valuable insight into the future of advertising.

What is Intrinsic Time-in-View?

The Intrinsic Time-in-View metric from Frameplay measures how long an ad impression is visible during the gameplay. An impression is only considered viewable if it meets Frameplay’s viewability standards.

The in-game advertising platform measures the viewability of in-game ads using computer vision. It evaluates the total amount of time the ads are viewed throughout the campaign and the average amount of time each ad campaign is viewed per player session.

Interesting Read: Your Ultimate Guide to Understanding Gaming Advertising

Game-changing findings

Frameplay has joined forces with Lumen and eye square independently to analyze and compare its Intrinsic Time-in-View calculation with their respective eye-tracking measurement. It will validate whether Frameplay’s Intrinsic Time-in-View measurement is a viable measure of attention or not. Dentsu International, McCormick’s agency, also took part in the research as part of its Attention Economy initiative, which seeks to understand attention in this new format.

In fact, both computer vision and eye-tracking tech yielded similar results, supporting Frameplay’s method of measuring attention in games. The test also studied the effectiveness of in-game ads.

In-game ads captured about 1.4 times more attention of the gamers vs the mobile display attention norm. It performed similarly to social in-feed video norms and outperformed every other social, web, and mobile format, including a social in-feed image. In fact, eye square’s eye-tracking measurement concluded that Intrinsic Time-in-View turned out to be very close to the true real-life value. The ad framework satisfies the changing commercial and cultural needs of advertisers, companies, and gamers.

Image Credit: Advertising Week

Adexchanger reported that In-game ads generated an average of 2.4 attentive seconds per impression, on par with the attention generated from a social media video ad (even though the in-game ad was a static banner).

Joanne Leong, Dentsu’s VP and Director of Global Media Partnerships, stated that having a reliable metric to compare in-game ads vs social ads helps them decide where to spend the dollars.

“The average consumer sees over 4,000 ads in any given day, so it is imperative that advertisers start evaluating channels through the lens of attention metrics, which are more indicative of meaningful exposures. The results from these studies validate proven attention in Frameplay’s gaming inventory, and we will use this data in planning as we evaluate future intrinsic in-game opportunities.”

Interesting Read: InMobi And Anzu Partners To Bring Programmatic In-Game Ads To APAC Region

Setting up in-game advertising standards

Frameplay along with other players took a leadership position to update the guidelines with MRC and IAB so that intrinsic in-game advertising placements properly measure 3-D gaming environments. Ads are more difficult to measure than in other display formats because they are frequently obscured by game elements such as environmental features and player avatars.

Adexchanger quoted Frameplay Chief Strategy and Operations Officer Cary Tilds,

“When you calculate , there’s a lot to consider, like the size of the ad on the screen at any given time, the skew or the angle of the ad at any given time, obstructions between the player perspective and the ad and how lighting affects viewability.”

He also stated that more should be accounted for in any industry-wide in-game measurement standard in addition to all those factors. Frameplay wants advertisers to look at overall attention instead of the only time in view, and change how the ad tech industry thinks about viewability in the gaming sphere.

Considering that in-game advertising is one of the pillars of many companies’ marketing strategies, statistics like these show that it can be a valuable investment for companies looking to reach customers where they prefer. The data gives marketers leverage to understand and compare gaming to other mainstream channels.

Interesting Read: 5 Ad Industry Trends That Are Likely To Unveil in 2022!