Google’s Third-Party Cookies Deprecation Rolls Out Today

Cookies are the currency of the world of digital advertising. At least that’s how they were once. Now is the time to get ready to phase out third-party cookies and begin using cookie-less strategies. Making the switch to contextual advertising will now require getting ready for a world without cookies.

Beginning today, January 4, Google intends to remove third-party cookies from its Chrome browser by the end of 2024. With 1% of cookies impacted, the tech giant has planned a gradual phase-out that will begin today and give marketers time to adjust before the full removal by the end of the year. Publishers’ and advertisers’ interactions will undoubtedly change significantly as a result of the gradual removal of cookies. It represents a significant policy shift and a move towards privacy-focused transactions.

Google’s third-party cookies phase-out plans

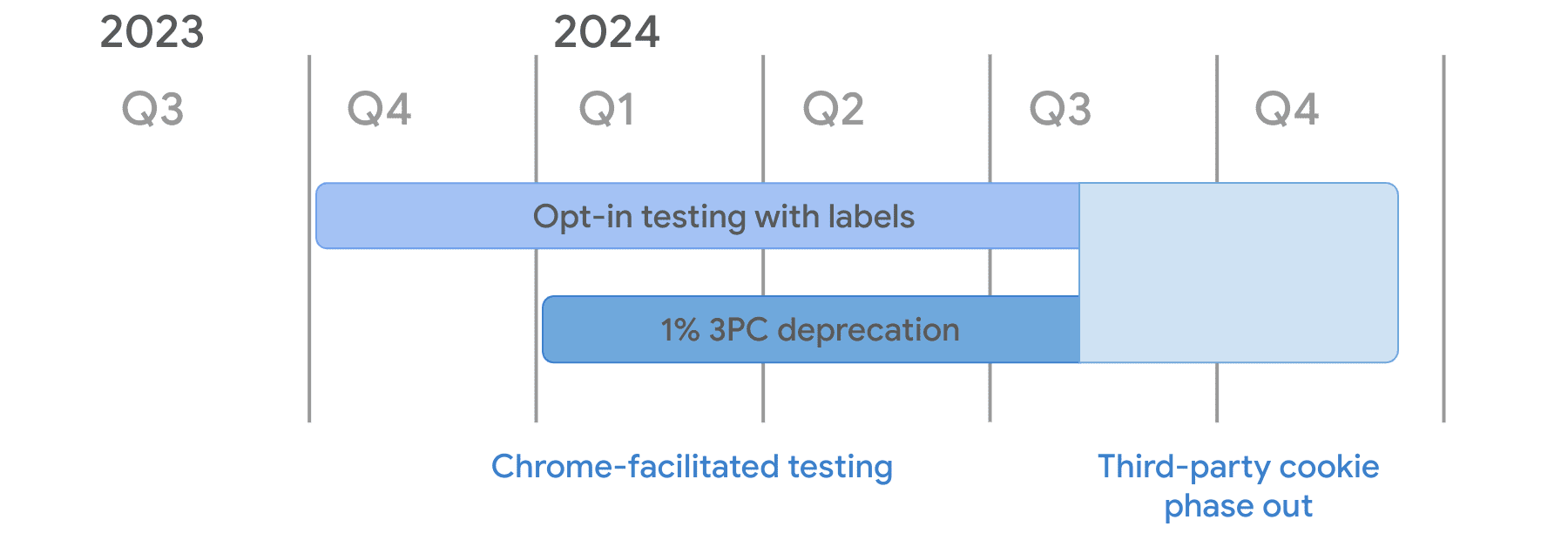

As part of a pilot program, Google will begin gradually phasing out cookies for 1% of Chrome users starting today. To prepare for the big show, Google’s masterminds will observe, evaluate, test, and reorganize. Understanding the nature of the cookie-less environment and its practical implications will be greatly aided by this small-scale deprecation. Although Google did not immediately disclose the precise number of cookies for the impacted internet users, it is possible that up to 30 million cookies are in place. Despite being gradual and phased out, the phaseout would be finished by this year’s second half, most likely in Q3 2024. If regulations allow, Google intends to remove third-party cookies for all Chrome users.

Image credit- Google

A major shift in the advertising world

Google wanted to allow publishers and advertisers ample time to get ready. Thus, the delayed launch. This will compel significant adjustments to the way digital advertising functions. Some worry that it might force websites to use more obscure tracking methods. Given how heavily the digital advertising sector depends on third-party cookie tracking, the news is probably going to cause controversy. Certain ad tech companies may lose their present capacity to gather data. Rather than being genuinely excited, the advertising industry’s anticipation can best be described as cautious skepticism. It is independent of the segment of the advertising business, be it browsers or ad tech providers.

Origin of third-party cookies

Originally, the goal of third-party cookies was to provide website users with more specialized advertisements. Rather, they evolved into something that was frequently centered on obsolete consumer behavior. To generate behavioral profiles, cookies were combined. Because of retargeting and open conversion loops, website users would still see ads for items they had previously browsed six months ago.

Read More: Google’s Phasing Out of Third-Party Cookies: A Paradigm Shift in Digital Advertising

How does the advertising world perceive this?

At the moment, the Privacy Sandbox is not a problem for any ad tech providers. Some vendors may view the partnership with Sandbox as a calculated move to remain relevant and competitive in light of Google’s strong market position. This decision was made easier by the testing grants Google is providing. That being said, some businesses aren’t as welcoming. They are unwilling to support the Sandbox as long as they believe it will further reinforce Google’s supremacy over the advertising industry.

With this first rollout, advertisers, publishers, and creators should take advantage of the chance to test and modify their strategies to effectively adjust to this change. Although the digital advertising industry has had nearly four years to plan, it is now necessary to develop flexible and adaptive approaches to determine what works and what doesn’t.

Important Alternatives to Cookies

It’s safe to say that there are a lot of interesting and complicated third-party cookie alternatives available. Shifts on this scale leave alternative identities in a constant state of change. They face difficulties with privacy compliance, interoperability, and measurement and targeting efficacy. Even the front-runners struggle with personal issues.

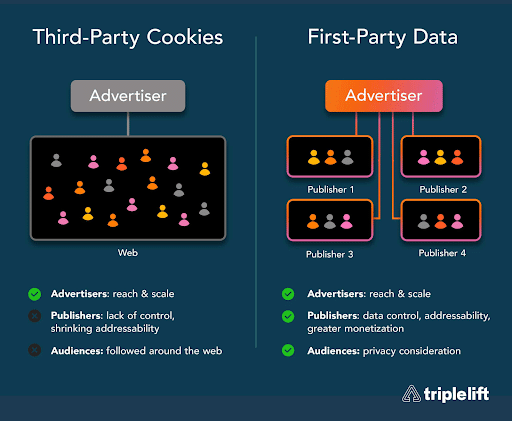

First-party cookies

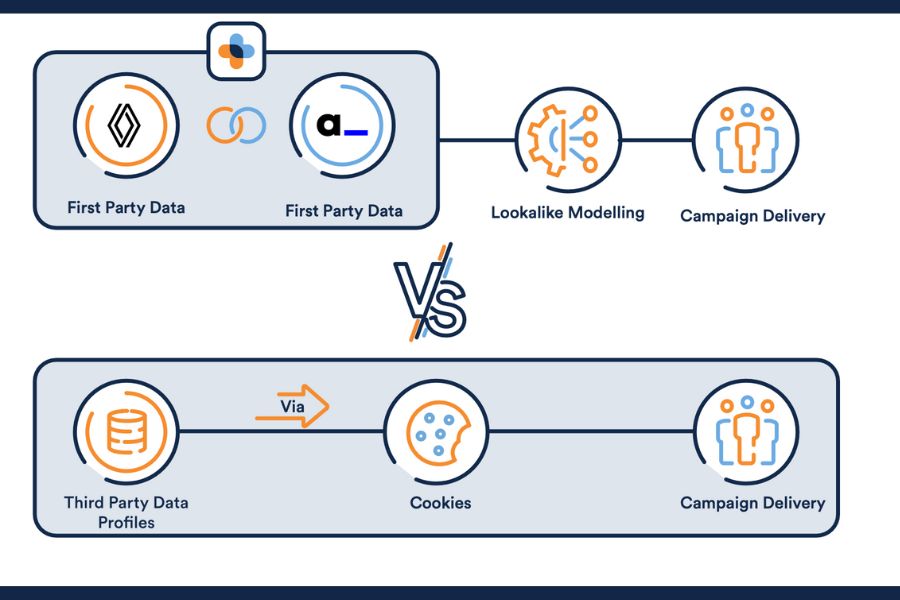

To get ready for a world without cookies, advertisers need to gradually wean themselves off third-party data. To address this, first-party data-based solutions must be adopted, enabling advertisers to use their own, consenting user data for targeting. Instead of cookies, publishers and advertisers are experimenting with several first-party data-based solutions.

In the world of digital advertising, first-party cookies are a tactical turning point. Because they are site-specific, these cookies are ideal for meeting the requirements and preferences of different publishers and websites. Everything is connected to Google’s Privacy Sandbox program. The main focus of this large-scale project is privacy compliance. It seeks to satisfy cross-site use cases without using third-party cookies or other tracking mechanisms while balancing the needs of digital advertising with the privacy of individuals.

Image credit- Campaign Asia

Hashed emails

User email addresses are necessary for a hashed email solution to work. A user provides a wealth of identity and online behavioral data when they log in with their email address. This crucial information, which is now hidden by an encrypted identifier can be shared further up the chain with media buyers for more precise targeting. It can be pushed through a hashed email API and ensures that user data is fully secure. Ad tech companies first proposed hashed emails as a substitute for third-party cookies.

Read More: Yahoo Partners with VIOOH for prDOOH and Twilio for First-Party Ad Reach

Contextual data

One more of these alternative methods for third-party cookies is to use contextual data, which provides perspective about an online user rather than presumptive behavior. Contextual data assists advertisers in making decisions based on the content a user is currently consuming rather than previous behavior in this way. In addition to being frequently more effective, contextual data is also less expensive to obtain than third-party data. Generally speaking, contextual ad impressions are less expensive than behavioral ones. Given that the targeting is based on context and recency rather than legacy behavior, it can also aid in providing a better user experience.

APIs

Google is testing APIs. These include the “first locally executed decisions over groups experiment” (FLEDGE) and the Topics API, which have taken the place of the Privacy Sandbox’s initial federated learning of cohorts (FLoC) proposal. After analyzing a user’s three weeks of content consumption in an anonymous manner, Topics creates five “Topics” every week, one of which is sent in response to an ad request. The FLEDGE API auctions don’t rely on following users around websites because they operate directly within Chrome.

Retail Media Networks

Another cookie-less option that has emerged is retail media networks. Through these platforms, advertisers can reach more niche audiences and gain access to first-party data, including loyalty and point-of-sale data. By expanding the scope of this first-party data outside of the retailer’s owned and operated properties, RMNs assist advertisers in reaching in-market consumers without the need for cookies.

Chartering the course in the future.

The ad tech industry has entered uncharted territory with Google’s third-party deprecation. Everyone is wondering what the world will look like when the last third-party cookie disappears. There’s no denying that this ushers in a new era of digital advertising where privacy is crucial. Publishers will need to adjust to first-party cookies and other practices like hashed emails, and advertisers will move toward more content-based and contextual approaches.

Businesses of all sizes will need to be inventive and flexible to succeed in this new era. This entails making investments in fresh platforms and technologies that can adapt to the change and create new opportunities for efficient audience targeting without compromising user privacy. It’s not all bad news, though. A plethora of prospects lie ahead of us. Recall that in the cookie-less future, flexibility is essential.

Read More: GroupM and Google Announce Post Third-Party Cookie Readiness Program

Yahoo DSP Leverages Both AI and First Party Data For Campaign Advancement

The central AI suite that powers performance-based solutions within the Yahoo DSP, Yahoo Blueprint, was introduced by Yahoo Advertising. Yahoo Blueprint is powered by more than 335 million globally logged-in Yahoo users. It improves decision-making, simplifies AI, and acts as a result-driven guide for advertisers at every stage of the campaign lifecycle. Together with Fortune 500 brand partners and agencies, this new AI suite has launched. With the use of valuable first-party data and state-of-the-art AI technology, Blueprint provides real-time optimization recommendations that enable advertisers to meet their campaign goals and determine the lifetime value and conversion potential of each user.

AI for Yahoo DSP

Yahoo’s demand-side platform (DSP) will benefit from artificial intelligence in order to enhance data visualization, forecasting, optimization, and predictive audiences. Using first-party data, the Blueprint tool can find customers who match the expected value of the brand’s current customer base. Using Yahoo’s algorithmic forecasting tool Omniscope, it allows advertisers to predict the incremental reach of connected television (CTV) advertisers against linear audiences.

Yahoo’s new strategy reflects how the programmatic market is changing. Yahoo left SSP Business because a large number of publishers can now effectively monetize their inventory through programmatic changes to header-bidding wrappers. They therefore depend less on publisher tech platforms. In a similar vein, the introduction of the Blueprint is a reaction to growing buy-side sophistication.

Omniscope – Blueprint’s forecasting tool

One of Yahoo Blueprint’s primary algorithmic forecasting tools, Omniscope, lets advertisers plan and evaluate expected performance and reach across a range of channels, exchanges, formats, and targeting parameters. It assesses how adjustments to targeting parameters can affect scale, projected spending, and winnable impressions, and it facilitates mid-campaign planning and optimization.

Yahoo DSP uses location and purchase data

Yahoo’s solution leverages location and purchase data from users logged in with Yahoo email addresses, as well as first-party behavioral data sourced from their owned-and-operated websites. Yahoo DSP clients can expect better performance with Yahoo Blueprint, leveraging years of AI experience to bid on the right impressions, optimizations through AI co-pilot that suggest campaign enhancements and auto-optimize, and an improved and straightforward user interface (UI) that helps advertisers and increases efficiency. Yahoo’s DSP has long possessed AI capabilities, but Blueprint is able to present algorithmic recommendations for several campaigns on a single dashboard.

Read More: Yahoo Advertising Launches New Suite of Premium Ad Formats Edge-2-Edge

Yahoo Blueprint benefits Yahoo DSP clients

- Better outcomes: Sturdy performance that makes use of years’ worth of AI experience to bid on the appropriate impressions at the appropriate time and cost.

- Self-assurance in optimization: AI copilot that suggests ways to improve campaigns and automatically optimizes to fulfill advertisers’ objectives.

- Efficiency and Simplicity: A more efficient and straightforward user interface that directs advertisers.

Blueprint workflow

In order to improve performance, Blueprint first considers the advertiser’s Key Performance Indicators (KPI) before making suggestions for target audiences or Private Marketplaces (PMPs). These suggestions are accompanied by forecasts of the effects that various audience targeting techniques will have on the designated KPIs. Customers are free to choose whether or not to use these recommended campaign tactics.

First-party data advantage

All Yahoo DSP clients have easy access to the blueprint via the current dashboard. New data visualizations, audience insights, campaign forecasting tool integration, predictive audience modeling, and customer lifetime value features are all introduced during the first phase of implementation. Yahoo intends to release additional information in the upcoming summer. Additionally, when it fits the needs of a particular campaign, Yahoo’s Backstage direct publisher connection is incorporated as a supply source for Blueprint optimization. Yahoo emphasizes how important its first-party data pools are. It is easier to comply with privacy regulations when first-party data that has been collected with user consent is used.

Transparency and accountability

Even though AI-driven optimization tools are very beneficial, there are still transparency issues. This is especially when it comes to competing products like Advantage+ from Meta and Performance Max from Google. Yahoo is dedicated to encouraging candid dialogue with advertisers about the information that goes into its algorithmic recommendations. Notably, when it comes to executing campaign modifications, advertisers have the last word.

Read More: Yahoo and LiveRamp Expand Partnership, Scaling Addressability

Disney+ Introduces First-Party Audience Targeting, Programmatic Buying Via PMP

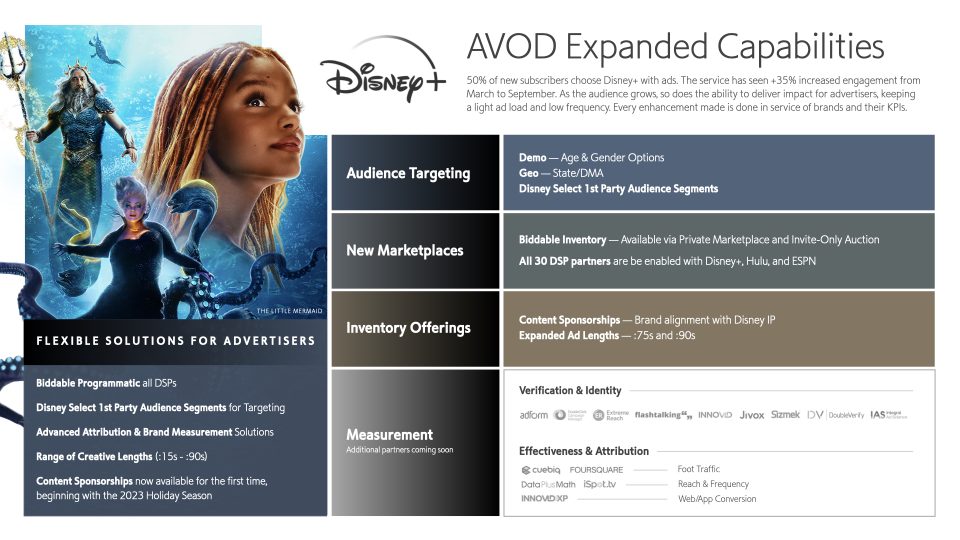

Disney+ has intensified its efforts to provide advertisers with more comprehensive and adaptable ways to reach audiences at scale, as the ad-supported tier nears its one-year anniversary. With its first-party audience graph and programmatic buying via private marketplace (PMP), the Disney+ ad-supported tier has introduced audience targeting. In addition, it now offers measurement services for identity, efficacy, verification, attribution, and approved creative ad formats.

Rising Disney+ ad-supported tier and programmatic capabilities

Of new subscribers, 50% select the ad tier. Furthermore, there was a 35% increase in service engagement from March to September 2023. The capacity to provide impact for advertisers grew along with the size of the Disney+ audience that is ad-supported. In order to provide the best possible customer experience, this was accomplished while maintaining a complementary ad load in line with viewing behavior. Disney’s position as an industry leader has been further cemented by solutions for tracking the effectiveness of campaigns. This is in order to fulfill and optimize advertisers’ performance goals.

Advertising capabilities are available on Disney+

Image credit- The Walt Disney Company

Advanced Audience Targeting

With the help of Disney’s acclaimed, in-house first-party Audience Graph, marketers can now target audiences more precisely for the first time across demo (age and gender); geography (State/Designated Market Area); and Audience Segments. Disney’s audience graph, which features 110 million households, 235 million unique viewers, and more than 2,000 interest- and behavior-based audience segments, will now allow advertisers to use first-party data.

Programmatic expansion

Disney is extending its programmatic offerings to encompass biddable transactions, accessible via exclusive auctions or private marketplaces. Advertisers can unlock Disney’s premium content at scale with greater choice and control than ever before. This is thanks to its availability across 30 DSPs that represent large, midmarket, and local platforms.

Read More: Disney+ Hotstar Amp Brand Outreach With CTV Targeting

Diversified Ad Formats

Disney+ is now accepting a wider range of creative lengths (midrolls and:15s to:90s) in addition to choosing content sponsorships, which are now available for the 2023 holiday season. This builds on its history of creating market-defining, consumer-first formats.

Enhanced Measurement and Attribution

Disney+ has kept developing new tools to help marketers reach a wider audience while guaranteeing efficacy through attribution and measurement. More campaign measurement options than ever before will be available to advertisers through it, all of which will highlight the benefits of running ads on Disney+. InnovidXP provides web and app conversion measurement, Kantar measures brand lift. Furthermore, Data Plus Math and iSpot.tv provide reach and frequency insights, and the platform, which previously offered measurement through Samba TV and VideoAmp, now offers the ability to measure the impact of ads on foot traffic through Cuebiq and Foursquare, and Kantar measures brand lift.

Disney+’s growing audience means more chances for advertisers to enhance their connection with the service as the platform continues to grow in size. Disney Advertising is still dedicated to bringing innovations and solutions to its brand partners to help them achieve their goals.

Here’s what they said

Rita Ferro, president, Global Advertising, Disney said,

Consistent with Disney’s strategic approach, we spent the last 10 months testing, learning and listening to our consumers and clients. That’s how we continue to create viewer-first experiences while simultaneously introducing new capabilities, functionality and formats. We’re seeing increased engagement and time spent, and now providing greater accountability for marketers through robust measurement, proving that premium content matters.

Read More: Reliance Industries to Acquire Disney India in a Cash and Stock Deal

Google Launches Google Ads Data Manager for First-Party Data

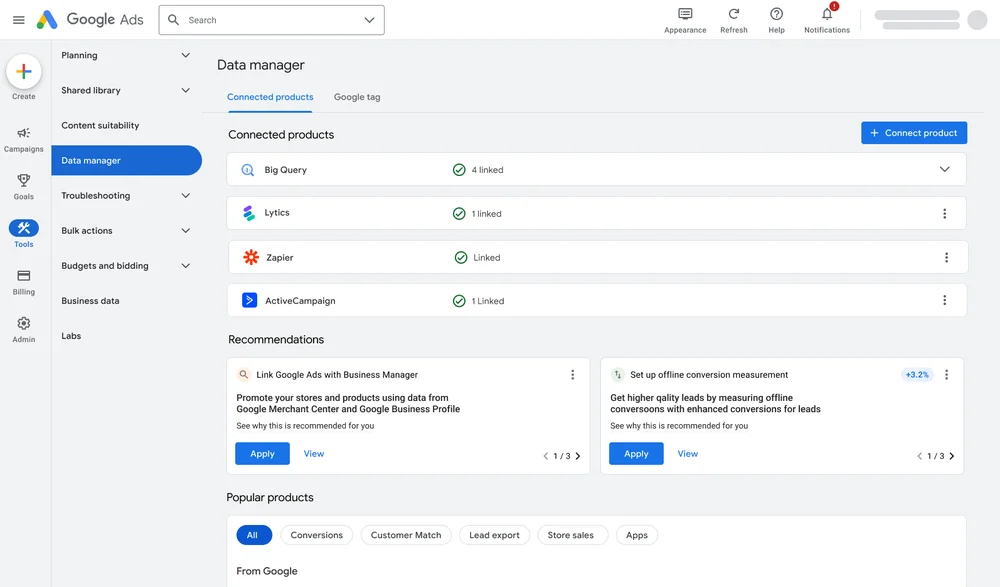

Google has created an advertising measurement tool that integrates with first-party data from marketers. It is made to function without browser cookies and other data tools that use antiquated techniques to measure performance. The measurement tool, Google Ads Data Manager, will be made accessible in Google Ads from the beginning of 2024. As the business continues to simplify the administration and use of first-party data, the product plan calls for expanding it to additional Google platforms. The tool will make it easier to connect to and utilize first-party data. It centralizes all data management controls, allowing for more income and improved business outcomes.

Google Ads Data Manager for Advertisers

Less than one-third of marketers, according to Google, consistently and successfully access and integrate first-party data across channels. This issue is resolved by Google Ads Data Manager, which streamlines the administration of first-party data connections and the procedure for utilizing that data for commercial purposes. As the advertising business enters the new year and Google deprecates third-party cookies, advertisers will gain knowledge about integrating data sources and protecting consumer data privacy. When it launches, it will make it easier to enable improved conversions for leads and Customer Match from many partners while still maintaining the essential functionality of each service.

Image credit- Google

Read More: Google Opens Automatically Created Assets Publicly to Boost Efficiency

A number of data sources, such as customer relationship management (CRM) and customer data platforms (CDPs), will be able to be connected by advertisers. Along with marketing tools like Shopify Audiences, this will also incorporate data sources like ActiveCampaign and Pipedrive. If Google Ads Data Manager is a success, it will be simpler to track client interactions with the Google tag and off-website transactions. Instead of altering how Google’s products function, the platform makes it easier for advertisers to use them. Data utilization in marketing is easier because it requires little to no coding expertise.

Benefits of the first-party data measurement tool

Analysts can build new data links using a single collaborative interface. Additionally, marketers can use discrete data to track conversions to target customers with relevant adverts. Zapier and CDPs, such as Lytics, will also provide data sources through cloud-based data storage solutions. Google wants the platform to give users access to all types of data through a single collaborative interface. This will allow analysts to make new data linkages. Furthermore, it will enable marketers to use discrete data to track conversions or target people with appropriate ads

Read More: Samsung Ads and Epsilon Partner for First-Party Data Advancements

Samsung Ads and Epsilon Partner for First-Party Data Advancements

Samsung Electronics’ advanced advertising division, Samsung Ads, recently announced a partnership with Epsilon, a leading provider of advertising and marketing technology worldwide. The partnership promises to provide brands with cutting-edge TV viewership data, network reach, precise activation, and measurement. Brands can access distinctive audiences produced from transactional and demographic data thanks to the connection. For activation across Samsung’s brand-safe Smart TV, connected TV (CTV), and mobile inventories, it also provides a brand’s own first-party data. Additionally, the collaboration enables businesses to use Epsilon audiences to launch ads across the US Samsung Ads Smart TV Ecosystem.

Samsung Ads and Epsilon’s first-party data integration

As the advertising sector gets ready to function in an age without third-party cookies and identifiers, collaboration will become increasingly crucial. This announcement mostly relies on first-party data. It provides the framework for exact ad targeting and campaign execution. It makes it possible to create unique segments. The relationship with Epsilon is a significant accomplishment for Samsung Ads. To improve precision, the new integration provides a direct one-on-one match. It also does away with the requirement for third-party data or crosswalks utilizing Epsilon segments. It improves productivity, generates cost savings, and streamlines business operations, adding value. With the help of top measurement partners, ads are measured using industry-standard Samsung measurement procedures. They differ according to the goals of the campaign, key performance indicators (KPIs), intended results, and other pertinent variables.

Read More: TripleLift’s First-Party Data Targeting Solutions Shines Sans Cookies

Epsilon database

250 million verified US consumers are included in Epsilon’s consumer database. The volume of consumer data gives businesses the chance to identify and communicate effectively with each customer across channels. Additionally, it gives organizations the ability to monitor the success of their marketing initiatives while ensuring that consumer data is kept safe and secure at all times.

Here’s what they said

Epsilon general manager of data solutions Dennis Self said

Epsilon’s partnership with Samsung Ads provides a seamless experience for marketers who are looking to activate Epsilon’s audiences and their first-party data in CTV environments. Our unique audiences provide marketers with confidence that they’ll reach the right people at the right time with messages that matter, removing barriers to activation while simultaneously creating increased demand for CTV campaigns.

Courtney Howell, head of agency development at Samsung Ads commented,

Samsung Ads’s platform, device ecosystem and media assets, including Samsung TV Plus, are critical to reaching consumers across CTV. Through our direct integration with Epsilon, brands can leverage the Samsung TV universe and engaged audience to make CTV campaigns even more powerful. This partnership represents a milestone for Samsung Ads’ ongoing relationship with Epsilon to give even more brands and agencies the ability to immediately activate against our Smart TV footprint with improved measurement and attribution solutions. Our partnership with Epsilon also means that any brands working with Samsung Ads can expect a faster, more seamless execution, combined with the ability to leverage our leading TV data and scale to power CTV campaigns that drive significant performance.

Read More: Samsung Ads Partners with Brightline To Boost CTV Advertising

TripleLift’s First-Party Data Targeting Solutions Shines Sans Cookies

TripleLift, the ad tech platform boosting digital advertising across all screens made the first-ever large-scale test findings public, demonstrating the effectiveness of its recently announced first-party data targeting solution throughout the web. This includes cookie-restricted settings too. Results reveal that when a third-party cookie was not accessible, the offering significantly improved results for both advertisers and publishers. It also states that first-party data outperforms both cookie and non-cookie buys.

The solution, known as TripleLift Audiences, is especially successful in tackling approximately 50% of the internet that already works without cookies. Furthermore, it forges a new path as the sector gets ready for additional addressability disruptions in 2024. Currently, cookie-free environments account for 47% of all ad requests worldwide. Beginning in January 2024, Google is planning to phase out the use of third-party cookies throughout the whole ecosystem of its Chrome browser. About 90% of the open web will no longer be reachable in this way as a result of this change.

Advertiser Results

The outcome presented in collaboration with a significant international advertiser in consumer electronics demonstrated higher performance for impressions enhanced with publisher first-party data. When compared to impressions without first-party data, but with a combination of third-party cookies and no cross-domain identifiers, the advertiser obtained a 33% reduced cost-per-click. With delivery and analysis of 230 million impressions, the test was carried out on a large scale.

Image credit- TripleLift

How publisher first-party data works

Since TripleLift Audiences’ introduction in June of this year, numerous brands and agencies have conducted sponsored campaigns utilizing its first-party data segments. This method produces curated segments utilizing publishers’ data to identify and reach audiences on their own websites, as opposed to placing cookies on visitors and tracking them throughout the web. With more than 10,000 sites now signed up, this method of quality targeting covers 800 contextual and behavioral audience segments. Furthermore, it also covers 30 billion daily ad impressions without the need for third-party cookies.

Read More: TikTok Expands Measurement Suite with First-Party Solutions

Publisher results

The test showed improvement for publishers as well, with CPMs rising by 26%. Publishers may now re-offer those views through first-party data targeting thanks to TripleLift Audiences. It enables them to monetize content that they were unable to target previously due to third-party cookie deprecation.

Image credit- PRNewswire

Due to two factors, TripleLift has been able to offer this service. First, it used the Zurich-based DMP 1plusX it acquired in 2022. It did so to build the advanced technology, data protection, and privacy requirements needed to develop a workable first-party data segmentation strategy. Second, it used its established, trustworthy connections with publishers to create integrated native ad products. Publishers and advertisers in the U.S. can both use TripleLift Audiences at the moment. In 2024, it will launch in European markets.

Here’s what they said

Ed Dinichert, Chief Revenue Officer at TripleLift said,

We have been discussing the coming cookie-pocalypse as an industry, but often forget that almost half the internet is already unaddressable. This is a boiling the frog moment happening right before our eyes. While many ideas have been proposed, there have never been concrete results showing that any one of them can address deprecation at scale – until now. This solution is effective for advertisers today.

Airey Baringer, VP of Product Management at TripleLift added,

First-party publisher data is underutilized in the programmatic ecosystem. TripleLift Audiences enables easy activation of first-party data to improve targeting on every impression, with or without third-party cookies. The data is superior and outcomes are improved for both publishers and advertisers. This is a win-win for the programmatic ecosystem. Publishers win because they monetize more of their inventory, leading to higher effective CPMs. Advertisers win because they can target more efficiently without third-party cookies, leading to lower CPCs and improved efficiency against all post-click metrics.

Paul Bannister, Chief Strategy Officer at Raptive commented,

TripleLift Audiences has enabled us to drive greater monetization of our inventory, putting more money into the pockets of the 5,000+ creators and publishers we work with – and first-party data is unlocking that opportunity. This presents a big advantage for us and other publishers in the ecosystem, and we’re excited to be at the forefront of testing these new cookie alternatives.

About TripleLift

TripleLift is an advertising platform aiming to elevate digital advertising with gorgeous creative, reliable publishers, useful data, and clever targeting. It assists publishers and platforms in monetizing their operations through more than 1 trillion ad transactions each month. The most popular companies in the world use technology to reach consumers through online video, linked television, display ads, and native advertisements. Because of its cutting-edge solutions, first-rate formats, and helpful professionals committed to enhancing their success, brand and enterprise customers choose TripleLift. The company is NMSDC certified, eligible for different spending targets, and is dedicated to economic inclusion as part of the portfolio of Vista Equity Partners.

Read More: Google’s Phasing Out of Third-Party Cookies: A Paradigm Shift in Digital Advertising

Dynata and Comcast Partner for Accurate Media Measurement

The largest provider of first-party data for insights, activation, and measurement in the world, Dynata, has reached an agreement with Comcast. According to the arrangement, Comcast data will be licensed and involved in Dynata’s offering of advertising solutions. AudienceXpress, one of the companies from Comcast, uses analytics to deliver omnichannel advertising. More than 300 million people have access to it nationwide. The Effectv ad sales division and the FreeWheel platform for ad management solutions are some further brands.

Dynata-Comcast Advertising Join Hands

As a result of the agreement, marketers will be able to evaluate the success of their marketing initiatives across broadcast, cable, streaming, and addressable television for the first time using a combination of the precision and depth of Comcast’s aggregate viewership data and Dynata’s real-time survey data. By combining these solutions, marketers can measure the effectiveness of their TV advertising using a single source, agreed-upon, panel-based approach. This is compared to how well video assets perform on average across all screens and gadgets. The collaboration highlights both businesses’ commitment to advancing and quickening development in audience-based measurement across media channels. Additionally, it will give advertisers the ability to calculate their cross-screen media investment with a lot more assurance.

A compelling narrative can be created by marketers and creative experts to engage their audience and make a lasting impression. The expanded coverage of Dynata by Comcast’s representative footprint improves the stability and dependability of the inputs utilized to report effectiveness as measured by the shift in customer’s perceptions of the advertiser. A more detailed narrative about the best channels to use and how to more effectively tailor messaging deployment for the greatest engagement and lasting impact is also portrayed thanks to the wider reach.

Read More: Bloomberg CPMs Soar 20% With Transition To First-Party Platform

Here’s what they said

Larry Allen, VP & GM, Addressable Enablement, Comcast Advertising said,

We’re very excited to support Dynata in their efforts to enable marketers to better measure the impact of their media investment and understand consumer perceptions, favorability, and intent. Our ecosystem is stronger when marketers and media owners have a clear understanding of how cross-media campaigns perform and how their brand messages impact consumers.

Eric Sandberg, managing director of Dynata’s global advertising solutions business added,

Partnering with Comcast to enhance our advertising solutions product suite is a strategic investment in our commitment to deliver innovative products that help our customers make practical marketing decisions through the highest quality and scalable passive television viewership data sets. This partnership reflects Dynata’s commitment to delivering customer-centric solutions that enable more accurate insights, smarter strategies, and more effective campaigns.

Read More: Basis Tech-FreeWheel Partner for Direct Access to Premium CTV Inventory

The Trade Desk Makes It Easier To Activate First-Party Data, Releases ‘Galileo’ At CES

The Trade Desk announces new all-in-one CRM data solution Galileo at Consumer Electronics Show (CES). It aims to make it easier for marketers to act on first-party data. Galileo helps advertisers match their customer data with the content owners’ audiences in order to target more effectively. The ad tech giant has built integrations across the most sought-after platforms from CDP to cleanrooms to help advertisers match audiences using Unified ID 2.0 and objectively measure performance.

Why Galileo and how does it work?

The internet is changing and the identifiers that will stand that change is deterministic, email, and phone numbers based. Advertisers need a seamless and secure way to activate their CRM data. They also need to accurately match and measure it across publishers, channels, and devices. As part of Galileo, The Trade Desk now has direct integrations with CRM, CDP, and clean room providers, including Adobe, Amazon Web Services, Habu, InfoSum, LiveRamp, Salesforce, and Snowflake.

Galileo can enable advertisers to onboard and activate their first-party data quickly and easily. It incorporates:

- Seamless and direct onboarding of first-party data from anywhere – CRM data, customer data platform (CDP), or cleanrooms. Then match the audiences instantly using Unified Id 2.0.

- Aids to extend reach across the internet, unlike the silo identity solution. The new data solution lets brands match audiences across all publishers, platforms, devices, and channels — including connected TV — which provides a true omnichannel identity environment.

- Objective reporting and measurement of identity matching and advertising performance.

First-Party data is the go-to strategy for the buyers

Using Galileo, which The Trade Desk won’t charge extra for, is the DSP’s main business driver. According to an IAB survey, 53% on the buy-side are planning to pay more attention to placing their ads with publishers with first-party in 2023. The focus is more on first-party data when compared to cleanrooms or retail media networks.

The Trade Desk wants to be the easiest way for buyers newly introduced to first-party data to learn the ropes. Samantha Jacobson, Chief Strategy Officer, The Trade Desk said that we are at the tipping point of the internet. She further added,

“The infrastructure of the internet is embracing new identity solutions built for today’s digital media consumption across different devices and apps, such as Unified ID 2.0. In doing so, they are creating the richest identity ecosystem we’ve ever experienced, and one that aims to put consumer privacy at the forefront. With Galileo, we will help the world’s major advertisers take advantage of this by unleashing the value of their most valuable customer data.”

Galileo works in concert with new cross-channel identity solutions, including Unified ID 2.0 (UID2), which the majority of The Trade Desk’s data and publishing partners have embraced- Paramount is the most recent. It is the latest solution for TTD’s efforts for a post-cookie internet.

Interesting Read: Amazon Web Services Partners With Trade Desk’s UID2 To Integrate First Party Data

Edge over competitors

Trade Desk’s Galileo pitch to marketers goes beyond its now-centralized technology and explains what differentiates it from the competition. Jacobson said in the press release,

“With most walled gardens’ onboarding proposals, advertisers do not get a transparent view of how their data is performing, and therefore how their campaigns are performing. Galileo and Unified ID 2.0 remove this obstacle and allow advertisers to optimize their data across all digital advertising channels with granular reporting on data performance.” ”

Last year, Google released a similar solution called Publisher Advertiser Identity Reconciliation (PAIR). The Trade Desk is touting its own offering to undercut Google’s dominance. With Galileo, advertisers can use the data independently to understand how their campaigns perform.

Google confines the space of data sharing between a particular advertiser and a particular publisher, and not sharing anything out. However, the Trade Desk provides access to opted-in user data across publishers, how and where it is used, and its performance.

As reported by Adweek, Jacobson said, “With the way, Google’s approached it, advertisers can’t control when they’re marketing to me, Samantha, across different sites. They can’t understand the reach. They can’t control frequency capping.”

Furthermore, while acknowledging The Trade Desk supports PAIR’s prioritization of email-based identifiers, she said, “Google made it a black box and removed the understanding from the advertisers.”

The future is going to be first-party data and is a valuable asset where third-party data has a diminishing value. The Trade Desk and Google are both racing to develop tools to support the advertising industry’s needs.

Interesting Read: The Ultimate A-Z Glossary Of Digital Advertising!

Roku Is The New Player: A Look At Its Data Clean Room Strategy

Not to be left out, Roku this week dove into the data clean room. It will offer brands and agencies a way to collaborate with them using encrypted first-party data. The concept — built for streaming television — is intended to make planning and measuring campaigns easier without the use of cookies. With agency partners, Omnicom Media Group, Horizon Media, and Dentsu, the streaming TV platform announced the launch of its proprietary clean room offering. The product is based on Snowflake’s media and ad tech cloud data infrastructure.

A clean room is a place where publishers, platforms, and brands can safely and securely share first-party data in a way that can improve advertising effectiveness while still exerting strict controls over user privacy.

Interesting Read: Clean Rooms Explained: How Marketers Can Prepare For Cookieless World

Purpose-built for TV streaming

Roku’s clean room is purpose-built for TV streaming. The planning and measurement capabilities make it the only clean room to use audience data and linear TV data from direct consumer relationships on Roku, America’s No. 1 TV streaming platform.

The company explained in the press release to start with, an advertiser loads their data into a secure environment. Roku’s data clean room creates a secure connection between Roku data and the advertiser’s data. This enables brands to match their own data to Roku’s without sharing or exposing any personally identifiable information, all while protecting Roku users from direct identification. Advertisers can then query matched data and run their analysis within Roku’s clean room to understand potential campaign reach, current audience delivery, and advertising impact on product sales and sign-ups. OneView is also directly integrated with Roku’s clean room. Roku’s omnichannel demand-side platform (DSP) allows them to reach their audience across CTV, display, and mobile.

A look into Roku’s clean room

For instance, Foursquare, a leading location technology platform is a measurement and data partner for Roku’s clean room. The brands can better personalize and attribute their ad campaigns in OneView across devices and platforms.

The company’s first-party location data could be combined with Roku’s to target households in a certain area watching lifestyle and food programs or have people between the ages of 20 and 40 living there. Foursquare will provide the mobile location, but Roku can give behavioral and basic demographic information.

With a clean room, it is possible to match Roku-to-Foursquare audiences, but complex tracking can be layered into the campaign as well. Advertisers can use Roku data and Foursquare data to hone in on an anonymized audience segment in an area that meets their target requirements, then target that segment on Roku.

However, that is a one-time action item. If the advertiser wants to repeat the same activity a year after then it will have to resync the data as well as create a new list for a similar but distinct segment. On the contrary, in a clean room environment, the same type of audiences can be tracked over the years to understand sales and conversions. They can also determine what kind of streaming content causes transactions. This is advantageous for advertisers because a typical Roku ad purchase cannot be segmented based on the content viewed.

Interesting Read: End Of Third-Party Cookies, What Is There For Marketers: Takeaway!

Roku jumping on the bandwagon

The timing is not by chance. During the TV upfronts next month, Roku plans to test out several new services, including its clean room, with major advertisers. In a soon-to-be cookie-less world, data clean rooms are crucial to measuring advertising effectively. Louqman Parampath, VP of Product Management, Roku which has 60 million active accounts said,

The future of TV advertising won’t rely on fragile cookies or consortiums, but on direct connection with actual consumers. We are thrilled to help marketers accelerate their shift to TV streaming by putting privacy and transparency first.

He also added that cleanrooms are in the early stages, but are actively running campaigns.

We believe over time this will be the way first-party data will be used for connected TV.

Although the clean room isn’t a Nielsen alternative – advertisers and broadcasters are experimenting with alternate currencies and methods for measuring TV campaigns. It is perfectly positioned to fit into the trend of new TV attribution models.

Interesting Read: Disney Launches Clean Room For Marketers’ First-Party Data Needs

Samsung Ads Enables First Party-Data For Smart TV Ad Campaigns

Samsung Ads rolled out the Samsung Onboarding Partner Program with leading data management platforms (DMP) and other onboarding platforms to help advertisers plan and buy TV ads using their first-party data sets.

The program will provide advertisers access to the curated audiences through data management platforms that include Acxiom, Adobe, Experian, LiveRamp,Merkle, and Oracle. More partners are expected to join next year. The program is yet another addition to Samsung Ads’ growing AVOD offering pool. The onboarding partner program offers advertisers to plan and activate TV campaigns leveraging their first-party data, It helps them to gain higher returns (ROI) on their data investments.

Interesting Read: Samsung Ads Introduces Predictive Planner To Improve AVOD Ad Buys

Audience Advisor Accessibility

Advertisers planning to leverage the new program will have access to Samsung’s predictive planning tool -Audience Advisor. This means that the media planning guidance will be based on advertisers’ preferred segments and own audience data as well as Samsung Ads’ proprietary first-party TV data. The Audience Advisor tool produces data-backed predictions of scale, reach, and ad frequency for future campaigns based on budget. These integrations will also be made available through the Samsung Ads DSP in the first half of 2022.

Justin Evans, Global Head of Analytics & Insights, Samsung Ads said,

“Now, marketers can activate their most valuable asset in the Samsung Ads Ecosystem, their curated audiences made up of their own combinations of first-party and third-party data.”

He further added,

“Data and audience-driven TV is the future for advertisers and Samsung Ads is committed to bringing to market new tools and partnerships for advertisers to leverage different datasets in a safe and secure manner across their media buys.”

Interesting Read: Trade Desk Partners With Samsung Ads For Programmatic CTV

Buy Your Own Data

Samsung Audience Advisor -a predictive campaign planning tool was launched in Q2, 2021. It allows advertisers to plug in any combination of first- and third-party data to understand the scale, behaviors, and time spent by their target audience in ad-supported video on demand (AVOD).

AVOD lets brands quantify their reach opportunities and gain an understanding of how much reach and frequency they can achieve at various budget levels. Advertisers can get more reach, scale, and efficiencies when they curate audiences through one of the onboarded DMP partners with Samsung Ads.

By the first half of 2022, Samsung Ads will incorporate Onboarding Partner Program and Audience Advisor into its demand-side platform. Molly Lashner, Media Hub’s associate media director, in a statement,

“We’ve had success activating advertisers’ first-party data on the Samsung Ads platform and rely on partners like Samsung to create turnkey integrations like their Onboarding Partner Program. This allows us to gain greater insights into streaming TV audiences and make our CTV campaigns even more powerful.”

Samsung Ads enables advertisers to leverage their first-party data to deliver stronger campaigns and results while ensuring consumer privacy preferences. In an analysis of hundreds of 2021 ad campaigns, Samsung found promising results. Brands that leveraged their own data generated up to 161% higher conversion rates than campaigns that did not. For entertainment campaigns, the audience advisor identified and targeted audiences who hadn’t been using a client’s product for some time. The tool found that this resulted in a 300% lift in conversion compared with audiences who were not exposed to the ad within the target segment.

Evans said that brands have started choosing partners who bring “substantial proprietary data to the relationship” as AVOD continues its share of total TV viewership.

“We are seeing and expecting more advertisers to lean into the partnership with us because they’re attracted to the differentiated data and insights that we provide.”

Interesting Read: Demand Side Platform(DSP) Launched by Samsung Ads