Adtech Company TripleLift Acquires 1PlusX For $150 Million

TripleLift, an ad-tech company focused on creative, media, and data acquires Swiss publisher data company 1plusX. The Switzerland-based first-party data platform helps companies use first-party data, which they have collected themselves—an increasingly important strategy amid tightening privacy regulations.

What does this acquisition mean to advertisers and publishers?

As reported by Adexchanger, the acquisition is meant to bolster TripleLift’s two-pronged focus on CTV and identity. It has sponsored content integration and identity solutions for programmatic advertising without the use of third-party cookies. TripleLift is familiar with cookieless solutions. Eric Berry, Co-Founder & CEO, TripleLift said in a statement,

“The combination of TripleLift and 1plusX means publishers and marketers will have a scaled, independent platform that is designed for the privacy-centric future.”

A better way to understand 1plusX, which solves the identity challenge, is to think of it as a revamped version of DMP designed to combat post-cookie advertising. The 1plusX technology is an AI-driven intelligence solution that connects directly into a publisher’s first-party site and app data, which can then be used to build lookalike audiences and match IDs. It provides user-based behavior insights, and publishers can activate them on relevant channels from the web to a connected TV. Since 1plusX is based in Europe, it adheres to a high standard of privacy protection.

Therefore, TripleLift publishers can access 1plusX’s best-in-class technology to leverage first-party data and TripleLift advertisers can apply that same data to targeting capabilities made for the privacy era. No third-party cookies are required.

Interesting Read: 6 Data Privacy Trends To Look Out For In 2022!

Does the deal impacts SSPs or ad tech companies competing with TripleLift or vice versa?

Ari Lewine, Co-Founder and Chief Strategy Officer, TripleLift said that the acquisition would help both companies accelerate their product development and launch new products faster.

“We will grow 1plusX’s thriving business and create net-new products for both publishers and advertisers to leverage moving forward. Our ads will be enriched with first-party data. These new products are the scaled and privacy-friendly solutions our industry has been seeking.”

As quoted by Adexchanger, Lewine said that both companies are from the open programmatic ecosystem. In many instances, TripleLift, 1plusX, and other DMPs will work simultaneously with the same publisher.

It can be a costly affair for TripleLift to license 1plusX since it has hundreds of mid-tail or long-tail publishers in its network. The 1plusX client base is largely international media outlets, and it has worked with Fox, Le Figaro, and Axel Springer, which previously invested in the company.

Nevertheless, TripleLift will level the playing field by making 1plusX’s first-party data cleanroom product more affordable by increasing TripleLift’s features. The TripleLift platform could provide publishers with tools for creating seed audiences using 1plusX data, or provide modeled data when a third-party cookie is not available.

This space is growing and recently one of the 1plusX competitors, Carbon was acquired by Magnite. Paul Bannister, Co-Founder, and Chief Strategy Officer, CafeMedia expressed his thoughts and said,

“Publishers are already sitting on one of the largest potential goldmines of data to fill the cookie void: publisher first-party data, which includes contextual, registration and on-site behavioral data.”

“This acquisition signals to the industry that a much-needed investment in first-party solutions is finally here and it’s being jump-started by TripleLift with this acquisition.”

Interesting Read: Clean Rooms Explained: How Marketers Can Prepare For Cookieless World

Yahoo Expands Partnership With Near Across APAC

Yahoo has extended its partnership with a privacy-let data intelligence provider Near to the APAC region for accurate campaign measurement and attribution, as well as an offline-online view of audiences.

How Is This Alliance Beneficial?

The expansion comes off the back of Yahoo’s partnership with Near in Australia and New Zealand which launched in 2020. It delivered strong results for Yahoo in the region. Yahoo will incorporate Near’s privacy-by-design data set of people’s real-world behavior and artificial intelligence capabilities into its DSP, strengthening Yahoo ConnectID and Next-Gen Solution identity services.

The capabilities of Near’s unique location intelligence data are combined with Yahoo’s omnichannel demand-side platform (DSP) and a suite of identification solutions for cookieless advertising in this partnership. The following are some of the advantages of this partnership:

- Yahoo’s APAC relationship with Near will deliver a unified perspective to advertisers, bridging the gap between online and offline targeting, attribution, and measurement.

- Brands can now track all digital marketing delivered through Yahoo’s ad platforms, regardless of channel or creativity, with online engagement or in-store traffic within the same campaign.

- When connecting the dots in omnichannel audience activation and campaigns, this benefit will be crucial for advertisers to find incremental audiences and create the right channel mix.

Forty advertisers have adopted the integration into their campaigns. One such example is BIG W’s ‘Toy Mania’ Artificial Reality (AR) omnichannel campaign captured a 48% uplift in in-store visits and a 16% lift in add-to-cart conversions from users exposed to the campaign’s ads.

And That’s What They Said

Dan Richardson, head of data ANZ at Yahoo said,

“We’ve seen increased adoption of emerging channels such as digital out-of-home and immersive formats within campaigns because this data intelligence gives marketers the confidence to target effectively, measure accurately and understand attribution across the consumer journey.”

“The benefits of Yahoo’s omnichannel DSP and our direct consumer relationship with nearly 900 million people globally, combined with Near’s rich insights and actionable intelligence, can now empower advertisers across the wider APAC region to steer the success of omnichannel campaigns.”

Shobhit Shukla, the Co-Founder, Near expressed his excitement on the extended partnership to APAC and said,

“Early successes have shown that the combination of Near’s real-world signals, Yahoo’s first-party data and omnichannel DSP give advertisers the leverage and actionable insights they need to make better decisions to drive impactful omnichannel campaigns.”

The Yahoo DSP now supports location-based targeting and measurement solutions, as well as Near’s data set, throughout APAC, which includes Singapore, Hong Kong, Japan, and India, as well as Australia and New Zealand.

Read more: Buzzfeed Integrates Yahoo’s Alternative To Third-Party Cookies

Integral Ad Science Reports Strong Q4 Earnings With CTV Growth

With a focus on measurement and ad verification, Integral Ad Science is pursuing two trends: contextual targeting and connected television (CTV). The company, which reports quarterly earnings, earned $323.5 million last year, an increase of more than a third from 2020. However, Integral’s net loss grew year-over-year as well, from $32 million to $52 million. CEO Lisa Utzschneider told investors that the key focus of the company is ‘growth’.

The recent significant acquisitions have enabled IAS to acquire key technologies, services, and global teams in key growth areas, such as CTV, contextual targeting, social media, and supply chain optimization.

It has now hired over 100 people every quarter, more than any previous quarter. In Q4, IAS’ biggest acquisition, Publica, brought in $7.5 million of total revenue. Publica was acquired for $220 million, the largest of three acquisitions IAS made last year. The Publica business is only 8% of Integral’s total revenue at the moment, but it’s a key component of Integral’s expansion into CTV. Lisa Utzschneider, CEO of IAS joined in late 2018. As stated by AdExchanger that Moat lost shares and customers following its acquisition by Oracle Data Cloud, leaving IAS and DoubleVerify, which also went public last year. To chase the CTV opportunity, however, means competing with other players, such as Nielsen.

Interesting Read: All You Need To Know About Connected TV Advertising!

A CTV ad server, such as Publica, can gather supply-side information, like the app or show in which an ad appeared, or the type of video content, in order to improve ratings for TV campaigns. Many global publishers have chosen Publica to power their ad serving and to accelerate their CTV strategies. These include new integrations with rlaxx TV, VlogBox, and WPSD Local 6 as part of Paxton Media Group.

Utzschneider told AdExchanger, “It’s helping us launch differentiated products that our competitors just can’t build.”

Even though CTV is the biggest growth prospect but counterintuitively programmatic continues to be a tailwind for the business, and it continues to drive accelerated growth. Advertiser-direct, programmatic, and supply-side are the three main revenue areas for IAS. Advertiser direct revenue climbed 7% year over year, including revenue from the open web and social platforms. The fourth quarter’s programmatic revenue increased by 43% year over year. On a combined basis, advertiser revenue accounted for 84 percent of total revenue. The programmatic segment is expected to surpass the advertiser direct segment in the first quarter of 2022 as the largest component of total advertiser revenue.

A key driver for programmatic growth is the company’s contextual advertising product, which directs advertising dollars into brands-safe or brands-appropriate content. It also reconciles campaigns when ads are delivered to inappropriate media for brands. A potential investor asked in the earnings call whether geopolitical tensions (referring to the invasion of Ukraine by Russia) and increased online attention and social media content related to those “events” influence IAS’ interactions with advertisers. Utzschneider said,

“In terms of geopolitical events, our technology and services have never been more relevant. It’s — the relevancy has carried throughout this year, last year, given all of the unprecedented events that we have all experienced. And again, marketers, they continue to lean into our brand safety, brand suitability solutions, especially as we’re seeing that rapid adoption on the social platforms, the dynamic nature of social platforms and also the unpredictability of the content.”

Interesting Read: How Advertisers and Brands Are Responding To The Ukraine Crisis

Magnite Acquires Carbon That Will Allow Publishers Unlock The Value of Audience

Magnite, the world’s largest independent omnichannel sell-side advertising platform announced the acquisition of Carbon. Essentially, Carbon is a one-stop solution for supporting seller-defined audiences, which is one of the hottest trends right now, as inventory sellers have significant bargaining power in CTV. Publishers can create unique audience segments and improve addressability by accessing first-party data from streaming viewers. The acquisition was financed by an asset sale and financial terms were not disclosed.

Interesting Read: GroupM Launches Programmatic Marketplace, Result of Licensing Deals with Magnite and PubMatic

How Will Magnite Benefit From This Deal?

Magnite’s move makes logical because CTV currently accounts for one-third of the SSP’s revenue. The acquisition will benefit Magnite as it expands its audience and identity capabilities and integrates them across its omnichannel offerings.

Adam Soroca, Chief Product Officer at Magnite said,

“CTV sellers have valuable viewer data that makes them well-positioned to create unique first-party data and we expect their demands around addressability to become more pronounced. As it relates to the open web, the likely deprecation of the third-party cookie means publisher-centric identity solutions are foundational to the future of advertising.”

Audience creation is moving from the buy-side to the sell-side, which directly owns the relationship with consumers. Although this shift is new for many publishers, first-party data has been an essential component of CTV/OTT addressability for decades. Magnite supports industry-specific IDs, it adheres to the belief that a variety of identity signals is needed to make the inventory addressable to the greatest extent possible. Carbon enters the picture here.

It will provide sellers with everything they need to maximize their audiences across all channels. In addition, it will provide Magnite with an opportunity to demonstrate its value (aka ROI) as a video ad server and CTV network.

Interesting Read: Unlock The CTV Opportunity: What The Future Looks Like

And That’s What They Said

Advertisers will expect more control and transparency in exchange for the relatively high CPMs they’ll have to pay for CTV now that the honeymoon time for CTV is coming to an end. Publishers and SSPs are beginning to realize that power (and money) will go to those who can show their efforts reached a specific audience or generated business results.

Pete Danks, CEO & Founder at Carbon said,

“Helping publishers be more profitable by providing them with technology to unlock the opportunities within their data has always been core to our mission.”

“We’re excited to further this goal as Magnite and continue to work with publishers to lay the groundwork for a new audience-based advertising paradigm built on sell-side data.”

Interesting Read: Connected TV Ad Fraud: Is It Real And How To Avoid It?

In a First, Walmart Reveals its $2.1B Advertising Revenue!

When Walmart reported profits on Thursday, it went above and beyond in its support for its advertising division.

For the first time, the retail behemoth reported advertising income, which totaled $2.1 billion globally. A total of $500 million was recognized as revenue gained as a result of a reduction in an advertiser’s cost of sales. The remaining $1.6 billion was devoted entirely to the media industry.

Walmart CFO Brett Biggs said –

“We expect Walmart Connect to continue to scale over the next few years with plans to become a top-10 ad business in the midterm. We continue to make strong progress in some of our newer higher-margin initiatives. Walmart Connect advertising experienced robust sales growth this year with a strong pipeline of new advertisers and large growth opportunities ahead.”

Walmart Connect is an element of Walmart’s reciprocating eCommerce and margin expansion strategy. Whereas the high-margin advertising is important for its “growth algorithm” – a plan to invest substantially in brick-and-mortar revamps and fulfillment while preserving or even boosting its total profit margin.

Interesting Read: 6 Data Privacy Trends To Look Out For In 2022!

Roku’s Streaming System is Clearly it’s Bonanza for Q4!

Roku’s Q4 growth in 2021 can be attributed to streaming. Roku had more than 60 million active accounts by the end of 2021, with cumulative streaming hours more than doubling from the year before the pandemic. ‘

According to Anthony Wood, Roku’s CEO and founder, Roku was the biggest streaming platform in the US, Canada, and Mexico in terms of hours streamed in Q4.

The surge in Roku’s Q4 platform growth was driven by “strong demand,” said Roku CFO Steve Louden. Louden also added how in 2021, 40% of the participating advertisers were first-timers.

Interesting Read: Roku And Shopify Collaborate, Create App For SMEs To Launch CTV Ads

As a result of increased competition in the streaming industry, Roku’s monetized video ad impressions rose dramatically (almost double) in 2021. Roku, as the market’s top content aggregator, stands to profit as content providers continue to grow and compete for users.

Roku’s DTC efforts are also proving to be successful. In Q4, its fastest-growing ad product was targeting solutions based on its unique first-party data, which helped some of its DTC clients raise add-to-cart rates.

Also Read: Connected TV Ad Fraud: Is It Real And How To Avoid It?

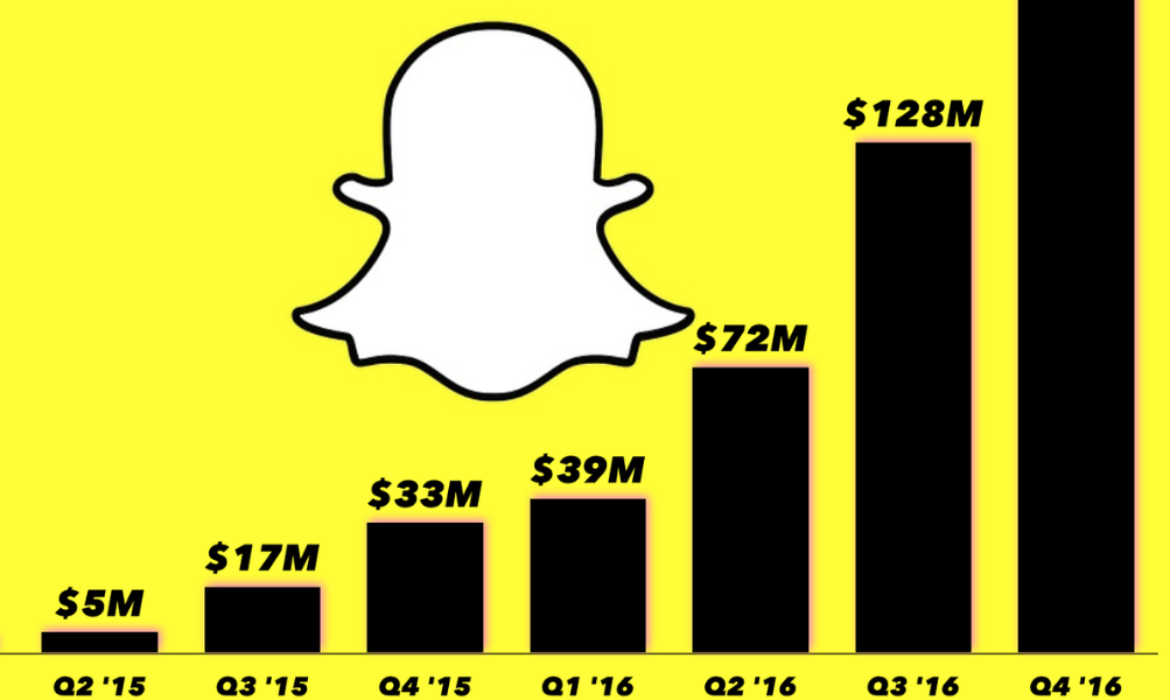

Snap Sees a 64% Increase in Q4, Records Fastest Revenue Growth Yet!

During its Q4 2021 earnings report, Snap Inc. announced excellent revenue and user growth. The company’s total revenue for 2021 was $4.1 billion, representing a 64 percent year-over-year increase, the fastest rate of yearly revenue growth in the company’s history.

While Meta recently experienced its first drop in usage, Snap is still on the rise. In Q4, it increased its daily active user base to 319 million. In the fourth quarter, the firm attracted 13 million daily users, bringing the total number of daily users to 54 million for the year. This is said to be the fifth quarter in a row that the community has grown by at least 20% year over year.

Snap’s Q4 performance was boosted in part by the company’s attempts to recover from the negative effects of Apple’s App Tracking Transparency (ATT) policy on its direct-response (DR) advertising relationships. ATT took away many of Snap’s capabilities for providing advertising partners with accurate conversion numbers, hurting the company’s business with DR clients.

Interesting Read: Snapchat Sees a 20% Plummet In Revenue Due To Apple’s Privacy Changes!

Snap has armed itself with a measurement that focuses on mid-funnel targets such as clicks or installations to combat this. According to Snap, its first-party measurement solution and advanced conversions were essential in the company’s refocus on mid-funnel analytics.

Snap also hailed its new first-party measurement strategy for safeguarding user privacy and providing advertiser partners with a more precise estimate of their ROI.

Snap has outlined three growth goals for its ad business in the future. The first was to keep improving the company’s ad optimization and measurement capabilities. The second was to continue to invest in sales and marketing by continuing to train and expand its sales and marketing personnel. The final task was to create ad products for video and augmented reality.

Interesting Read: Snapchat Spotlight Challenges & Other Monetization Tools For Creators!

IAS Makes Third Acquisition in 12 Months: A French Context Ad Company!

Context, a French contextual advertising business, has been acquired by Integral Ad Science (IAS). Following the acquisitions of programmatic payments auditing business Amino Payments in January 2021 and CTV ad server Publica during the summer, this is IAS’s third acquisition in the last 12 months.

Context is a Paris-based digital content classification organization. Context’s artificial intelligence (AI)-driven technology classifies images and videos across a variety of digital channels, including social media platforms and Connected Television (CTV).

Interesting Read: IAS Acquires Publica For $220M To “Help Advertisers”

IAS and Context: A Golden Integration

IAS’s existing, market-leading media classification and contextual targeting abilities will be enhanced by the acquisition. IAS’ marketing partners will be able to discover brand-appropriate content beyond typical frameworks and contextually target with precision thanks to the integration of Context’s technology.

In addition, the transaction strengthens IAS’s dedication to innovation by adding engineering, data science, and data analyst teams in France and Poland.

Interesting Read: Taboola And IAS Partners To Launch Industry-First New Pre-Bid Brand Safety Solution

Lisa Utzschneider, CEO of IAS said-

“Marketers require sophisticated contextual targeting and avoidance solutions that offer precision and flexibility, especially as the industry moves to a cookie-less world. The acquisition of Context builds on our existing capabilities and accelerates our product roadmap, particularly in video classification for social media and CTV applications. It also furthers our vision of offering tailored solutions to our customers.”

IAS’s Context Control suite of suitability and contextual targeting technologies will use Context’s technologies. Jack Habra, CEO of Context, said –

“We are delighted to join with IAS to advance their market leading contextual targeting and classification capabilities. Our technology is designed to deliver critical insights to help marketers optimize their campaigns, and we look forward to realizing Context’s full potential as part of IAS.”

Also Read: 5 Ad Industry Trends That Are Likely To Unveil in 2022!

NBC Universal and RTL Join Forces for an International Inventory Agreement

NBCUniversal (NBCU) and RTL Group, two media and entertainment businesses, have formed an international agreement to provide access to their TV and digital ad inventory.

The partnership will run via RTL AdConnect, RTL Group’s international sales agency, which aims to reach over 165 million potential customers across Europe each day by providing advertisers with access to video inventory. Over 150 TV networks, including ITV, RTL, Videoland, and 6Play, as well as 300 digital platforms and 40 radio stations, are included in the arrangement, which spans 12 nations.

The agreement will strive to provide advertisers and agencies in the United States, Europe, and Asia with access to RTL’s Total Video European portfolio, while NBCU will represent RTL’s Total Video European portfolio to its Chinese and U.S. clients. RTL AdConnect’s European media partners include France, Germany, the United Kingdom, Belgium, the Netherlands, and Luxembourg.

KC Sullivan, President and Managing Director of NBCUniversal, said –

“We want NBCUniversal to be the number one choice for marketers globally. RTL strengthens our advertising offering in Continental Europe as we strive to deepen our presence across the region.”

NBCU Media’s EVP, Max Raven, and VP of international partnerships, Mark Rogers, will oversee the relationship, reporting to KC Sullivan, president of global advertising and partnerships. As marketers strive for worldwide expansion, it will also try to improve NBCU’s One Platform while expanding its advertising brand’s presence in important areas outside of the United States.

The effort will also strive to strengthen RTL AdConnect’s European offering while also expanding its inventory outside of Europe to assist advertisers looking to expand their brands in the United States and China.

Nazara Acquires 55% Shares in Global Adtech Firm, Datawrkz!

Nazara Technologies, a leading gaming company in India, has agreed to acquire a 55 percent share in Datawrkz, a programmatic advertising and monetization firm, for up to Rs 124 crore, putting the valuation of the company at Rs 225 crore (about $30 million) based on its CY22 EBITDA performance.

Nazara Technologies is a well-known mobile game developer and sports media platform, with offers spanning interactive gaming, eSports, and gamified early learning environments in growing and developed global markets such as Africa and North America.

Datawrkz is a worldwide advertising technology startup focusing on driving user and revenue development for customers through highly optimized digital advertising, launched in 2013 by Senthil Govindan, an IIM Ahmedabad alumnus.

Interesting Read: US and India-Based ZEDO’s Assets Acquired By Discovery

Nazara and Datawrkz: What does this acquisition mean?

Nazara Technologies’ in-house capabilities for optimizing client acquisition expenses as well as increasing ad monetization yields will be enhanced by Datawrkz’s tech solutions. Many of the firms in the ‘Friends of Nazara’ network are anticipated to benefit from this ad-revenue monetization.

Furthermore, there is a growing organic link between gaming firms and ad tech companies throughout the world, since the two may add value to one other’s businesses.

Datawrkz hopes to position itself as a major participant in the gaming industry with this deal, which will cover both demand and supply-side solutions for the gaming ecosystem in the United States and India.

Also Read: Clean Rooms Explained: How Marketers Can Prepare For Cookieless World