Best Buy Expands Advertising Business

Owing to the growing demand and eventual spending on technology and consumer electronics, Best Buy’s revenue has seen a substantial soar in the last year. Best Buy Ads is a new iteration of the company’s in-house media business that provides additional services and a greater reach for businesses wishing to interact with customers.

Best Buy CEO Corie Barry, said –

“Best Buy’s relevance, customer relationship, and first-party data have grown along with customers’ technology needs and our ability to meet those needs. These are all great examples of value we can provide to our vendor partners that many other retailers cannot.”

During the pandemic, the rise in eCommerce equipped Best Buy with a wealth of data on buyer preferences and behavior.

Best Buy can run advertising on other publisher sites in addition to its own media holdings, such as its app, website, or a row of television screens in a physical store. Brands who want to work with the store for advertising purposes don’t have to sell their products or services via them.

Best Buy’s chief marketing officer, Frank Crowson, noted that the business’s expertise of shoppers who are drawn to technology helps the company generate audiences of consumers who are interested in things like movies, gaming, and cooking.

AdTech Vs MarTech: Let’s Settle This Once For All!

In the marketing world, adtech and martech may appear similar especially to a novice. Despite their similarities, these two concepts differ quite a bit; a razor-thin line separating AdTech and MarTech. What is the adtech and martech difference? Does one outweigh the other? Let’s find out the nuances of both approaches and dispel the fog around them.

What Is Adtech?

Adtech is the umbrella term for advertising technology. It covers a range of tools and software that can be helpful for advertisers, publishers, and ad agencies to plan, strategize, and manage all digital advertising or monetization activities. Adtech aids companies reduce wasted ad spending as it can target specific audiences.

Studies reveal that total digital ad spending is expected to hit $129 billion by the end of 2021. In short, adtech companies can help businesses maximize the return from their advertising spending by targeting specific audiences.

Image Credit: Smarty Ads

Examples Of Platforms/Tools Of Adtech

Image Credit: Amazon Ads

The two major entities that play a crucial role in adtech are – Demand Side Platform (DSP) and the Supply Side Platform (SSP).

Demand-side Platform (DSP): An essential platform for advertisers to buy, search, display video or mobile ads. It enables advertisers to buy ad placements in real-time on the publisher websites made available by ad exchange and networks. Some of the DSP players are Simplifi, Smarty Ads, App Nexus, Trade Desk, and more.

Supply Side Platform (SSP): The platform allows publishers to sell display, mobile ad impressions to potential buyers in real-time. Some of the key SSP players are MoPub, OpenX, Google, App Nexus, and more.

Broader examples also include:

- Data management platforms

- Ad exchanges/network/servers

- Tag management systems

- Programmatic advertising tools

- SEM (Search Engine Manager)

Interesting Read: A One-stop Guide On All You Ever Need To Know About AdTech In 2020

What Is Martech?

Martech is also known as marketing technology mainly used for digital marketing. John Koetsier, VP of Insights for Singular explains, “Every piece of technology a marketer uses to reach a potential customer is martech.” (via Adage)

Martech refers to the platforms and technologies that you use to create your ad media content, collect and analyze data, and reach your target audience.

MarTech is most commonly known for its automation, which allows you to manage multiple channels simultaneously and save time. Furthermore, it also helps marketers obtain more customer information and resolve tasks efficiently, making digital marketing more cost-effective.

There are more than 8,000 MarTech solutions and it is just expected to grow.

Examples of Platforms/Tools Of Martech

Some of the most common examples of Martech include:

- Customer Relationship Management (CRM) software-Salesforce, Hubspot, and more

- Social media management – Hootsuite and Buffer

- Search engine optimization (SEO) tools– Google Analytics, WooRank, Ahrefs, and more

- Content management platforms– WordPress, Squarespace, and more

- Digital analytics tools-MixPanel, KISSmetrics, and more

- Email marketing tools– MailChimp, Magento, and more

- Marketing automation programs

- Lead Magnets

When people discuss “Martech stack”, it means a collection of marketing technology solutions deployed by an organization to reach and convert potential customers.

Image Credit: Yellow Head Inc

Interesting Read: The Ultimate A-Z Glossary Of Digital Advertising!

Adtech and Martech Difference

Promotional activities like marketing and advertising go hand in hand. However, advertising is largely sponsored content. Advertisers always pay for the placement of their ads on a channel, website, social network, or connected TV.

On the contrary, marketing starts with understanding your product/service’s unique selling proposition, buyer personas, and channel partners. The aim is to understand the audience, deliver the right message, and generate more leads for the sales team. The marketing mix includes a variety of marketing activities, one of which is advertising.

Speaking of adtech vs. martech, let us comprehend the core differences with the help of the illustrating table below.

Adtech And Martech Convergence

Adtech platforms yield huge anonymous customer data and are not as personalized as data obtained from martech platforms. It relies on third-party data which often affects consumer privacy and utilizes the data for targeted online ad campaigns. They are often not in line with consumer interests and behavior.

Hence, adtech and martech convergence is highly essential. And what is this convergence called?

Adtech + Martech = Madtech

A good quality digital strategy requires a comprehensive approach. Therefore, the silos between adtech and martech need to be broken down for seamless data flow and synchronization.

Katie Wheeler in CMSWire wrote,

“The convergence of AdTech and MarTech can redefine the path of your marketing spend across the platforms you invest in, the data you own, the media you choose and the content you develop.”

For instance, a brand can use adtech and martech specific tools for a holistic marketing strategy. It can use an adtech platform to track the users visiting the website for a retargeting campaign. Then utilize the information in combination with the data gathered from blog analytics, email campaigns, or social media platforms (martech) to understand customer needs, optimize landing pages and personalize messaging for a sophisticated campaign.

The union of adtech and martech is every marketer’s dream as it will enhance customer experience which ultimately yields maximum ROI on the campaign and brings value to the business.

Interesting Read: Programmatic Advertising Platforms in 2020: A Complete Guide

Wrapping Up

There is a visible difference in the process of adtech and martech. However, we cannot claim that one is better than the other. The coming age will witness a Madtech revolution that will synergize advertising and marketing. It may cause a paradigm shift among marketers. Advertisers and marketers can benefit by deploying both adtech and martech tools to optimize budgets, increase conversion and achieve the best results.

On that note, ending with a quote of Rob Tarkoff, EVP, Oracle Advertising and Customer Experience from AdExchanger Talks podcast,

“It’s now time for the front office to go the way of the back office, which means we have to automate more of the adtech and martech selling and servicing workflow.”

Interesting Read: Your Ultimate Guide to Understanding the Customer Data Platform

Instacart’s Ad Chief Seth Dallaire Exit To Join Walmart

Instacart’s Ad chief will be moving over to Walmart as the chief revenue officer (CRO). Wal-Mart poaches Instacart’s CRO, Seth Dallaire, to fill the same role in the retail advertising wars. Before Instacart, Dallaire was responsible for turning Amazon into the world’s third-largest digital advertising company. Instacart had recruited him in 2019 to build a sizeable ad business. Business Insider reports, this part of the operation generated $300 million in sales last year. Now, it has lost the key architect who could make it possible.

Walmart intends to build its advertising business by utilizing customer data to drive digital ad revenue. Dallaire, an expert in programmatic automated advertising, will help Walmart scale Connect and Walmart +. Walmart Connect is Wal-Mart’s ad-platform unit, which will release its own DSP in the near future.

Relevant Read: A Panoramic Perspective Of Amazon’s Advertising Business!

As quoted by Adage, Walmart spokesperson confirmed the recruitment and said,

“His remit will include Walmart Connect, membership (Walmart+), data monetization, and business partnerships.”

Dallaire will directly report to John Furner, the CEO, and president of Walmart U.S. Instacart, an online grocery, and delivery service, has enhanced its advertising offerings and personnel. Seth’s exit comes after the company brought former Facebook executives Fidji Simo as CEO and Carolyn Everson as president.

It might look that Instacart is picking up the most talented Facebook execs. However, the reality is different! The Information reports that Instacart had earlier poached key executives that include developers and engineers from Amazon to build a $10billion to $20billion ad business.

Again quoted by Adage, an Instacart spokesperson expressed gratitude for his contributions and wished him for his future endeavors, said,

“Over the last two years, Seth and our broader advertising team have helped build Instacart into one of the largest pure-play grocery ad platforms in the world, supporting more than 2,500 brands.”

Also Read: Here, There, Everywhere, It Is Cross-Screen Advertising!

Google Tax: How The 2% Levy Affects Advertisers And Beyond!

Starting in October, Google is planning to pass on India’s 2% equalization levy, which went into effect in April 2020, to its clients whose ads are viewable in India.

Even if both the buyer and the seller are not based in India, the Google tax applies if the advertisement is visible in the country.

In 2020, the Indian government broadened the scope of the equalization fee, which had been levied on cross-border digital transactions since 2016 in an attempt to tax Google’s digital advertising revenues from India.

This was done to incorporate any acquisition made by an Indian or India-based agency through an overseas eCommerce portal.

A Google spokesperson went on record to say –

From 1st October 2021, we’ll be adding a surcharge to the invoices we send to non-Indian customers whose ads are viewed in India. The surcharge is to cover part of the costs associated with complying with the Indian Equalization Levy, which only impacts non-Indian advertisers. We will continue to pay all the taxes due in India and elsewhere

Here we can also recall how Apple since October 2020, is passing on the 2% equalization charge to Indian customers who buy applications or other products from its iTunes or App store. This excludes the 18 percent goods and services tax (GST).

This was essentially a levy on any programme purchased from Apple’s iTunes store.

Now, Google is taking a step ahead.

It is creating a situation where even though neither the buyer nor the vendor is an Indian if the advertisement is viewable in India, the tech giant’s tax will be charged.

Ajay Rotti, partner, Dhruva Advisors said that there will be a variety of circumstances where the service receiver is not an Indian firm, but the equalization levy will apply if the advertisement is directed at an Indian customer.

He added –

Google’s interpretation is in line with the provisions of the law which covers certain specified circumstances where the levy would apply. This would add to the collections of the revenue department going forward

The new rules identify online selling goods or services as any purchase made online, any payment made online, or even an accepted offer made online, and they apply to all transactions.

Even if only a tiny portion of a transaction was completed online and the remainder was completed offline, the 2% Google tax might be charged.

By the virtue of this Google tax, many businesses are now concerned that the charge will apply to a wide range of transactions, including hotel reservations, software purchases, and even the purchase of specific components from other countries.

According to legal experts, because of the way the law is written, even ERP (enterprise resource planning) systems—internal software systems that many businesses use—could potentially be deemed an internet platform and so be subject to the levy.

A senior lawyer said –

The way the equalization levy law is worded, almost every transaction that happens on the internet could potentially face the tax. Also, many companies are relooking at their existing structures to see if they can park the India specific activity in a separate domestic entity to avoid complications around equalization levy

According to tax specialists, Google‘s interpretation will have an influence on a number of other businesses.

Because tax rates in some countries are near to zero, several firms have formed holding entities in tax havens where most earnings are gathered or where intellectual property is held, saving taxes on overall revenue.

Hitting $61.9B, Google Parent Company Alphabet Revenue Rises By 62%

As of the end of the second quarter, Google’s advertising income was $50.4 billion, accounting for the largest chunk of Alphabet’s $61.9 billion in revenue.

Now, the world’s largest digital marketer has generated more than $560 million in advertising income over the previous three months – every single day!

Alphabet’s earnings are up 62 percent year over year from Q2 last year, when the firm experienced its first-ever sales loss owing to the global pandemic’s effects.

Sundar Pichai, CEO of Alphabet, and Google said in a prepared statement that the figures show a growing surge of online activity.

CFO of the companies, Ruth Porat said –

Revenues of $61.9 billion reflect elevated consumer online activity and broad-based strength in advertiser spend

Alphabet also carefully dissected the results of its many advertising departments. Ad revenue increased to $50.4 billion from $29.9 billion a year ago.

During the reporting period, search advertising brought in $35.8 billion, YouTube brought in $7 billion, and Google’s ad network brought in another $7.6 billion in media expenditure.

Traffic acquisition costs (TAC)–the amount of money Google needs to invest to get the attention needed to attract ad spend–kept rising in the third quarter, approaching $11 billion, up from $6.7 billion a year earlier.

Porat told investors on the company’s earnings call that Google’s search ad sales increased by 68 percent during the quarter, with retailer expenditure being a key contributor.

Additionally, Porat also said that YouTube’s 84 percent rise in advertising income over the period reflected the platform’s rising appeal among brand marketers.

She also stated that Google Ad Manager and AdMob were the two most important drivers of ad network spend.

The second quarter of 2020, which saw revenue decline by 1.5 percent yearly, was described by Alphabet executives as a “tale of two quarters” marked by an abrupt stoppage of advertising expenditure.

Marketers who promptly restarted their campaigns spent a large portion of their budgets online, as shown by Google’s recent revenue increase.

In A Pioneering Move, Starcom Launches Media Booking Bot

Starcom, which is owned by Publicis, has announced the design and delivery of an industry-first automated media booking bot.

This first edition of the media booking bot can book and modify digital and print advertising campaigns on a regular basis thanks to clever automation called – Robotic Process Automation (RPA).

ABACUS (Automated Bot for Amendments to Campaigns and Uploads), which was developed in-house, employs a bespoke technological platform to analyze and verify critical campaign data overnight, ensuring that planned media plans are accurate and efficient.

Campaign

The UK CEO of Starcom, Nadine Young ( above picture) explained how automation is a major component of their new intelligence-driven approach, designed to utilize the best of human capacity and revolutionary technology such as this.

She commented –

ABACUS allows us to liberate our teams from the more repetitive administrative tasks and unleash further opportunity to focus on more strategic and creative growth opportunities for our clients

Young also added –

This is the future, and a brilliant example of automation being used to enhance, rather than dampen, creativity

Authenticating media plan data, publishing to campaign booking platforms, trafficking to ad servers, and sending campaign information to media owners are all part of the media booking bot’s operation.

During testing, it was gathered that the bot increased booking speed and accuracy by up to 50%.

Starcom’s buying teams will be able to focus on higher-value activities, such as generating innovative creative executions with media partners, owing to the bot’s contribution in saving them a great deal of time.

Starcom is the first Publicis Media firm to test this as part of a pilot programme.

Football Stadium Advertising: How Different Channels Show Different Touchdown Ads!

Were you aware that football stadiums actually show different touchline ads for different channels or countries?

Pretty mind-boggling, right?!

So, how do they do it?

They incorporate a technology called virtual replacement perimeter technology. Using this sort of advanced technology, broadcasters can filter regional-specific ads over existing ads in the stadium.

A Twitter user by the name of @UltraLinx observed this recently and explained how it works. He said that the camera is mounted atop a “virtual head” that reads the data for positioning and alignment.

That camera’s lens is aligned with the camera body and sensor, as well as the software, so that the virtual software may be corrected for any offset off “zero” when the camera is installed.

He added-

“Think of a virtual 3D box, and they just tell the computer where to put everything relative to the camera. Data is fed from the camera to a computer running the virtual software. After the calibration, the virtual operator will load in the graphics they have been given, created to whatever specifications. They then use various keys to mask out what they want and don’t want the virtual graphics to appear on.”

http://www.youtube.com/watch?v=EuTVVg0_Si8

The virtual replacement perimeter technology is also used to create virtual billboards, distance lines (for example, in horse racing), stat overlays, on-ground logos that can be seen in cricket matches, and pictures, as well as whole studios.

In fact, this is not the first time this technology is being used. In a 2018 warm-up Football game between England and Costa Rica at Elland Road in Leeds, The Football Association (FA) and ITV tested this new adtech.

The stadium’s peripheral advertisements were limited to the United Kingdom. During the show, however, Virtual Replacement Technology broadcasted newly enhanced and augmented regional advertising to the Americans on one stream and Asia, Australasia, and portions of Europe on another.

Tom Gracey, senior broadcast manager of The FA, said-

“The potential for Virtual Replacement Technology is substantial. Perimeter LED displays have become a fundamental platform for activating brand partnerships in sport.”

Technology has really revolutionized the way we see the world how the content of any form can be tailored to meet the entertainment needs of people across the world.

Revolutionizing Advertising: Australia Invests In Programmatic DOOH

The entire world is undergoing complete digitalization and advertising companies in Australia are no far behind. In Australia, advertising agencies are progressively resorting to programmatic DOOH, with over a quarter of agencies trading DOOH inventory programmatically for the first time in 2020.

This move has a significant hand in revolutionizing the ad tech sector, as it enables programmatic platforms to run ads on outdoor advertising billboards. In an attempt to replace traditional outdoor advertising, such ads will feature videos and images that will be more engaging and easy to track.

As per the IAB Australia’s Attitudes to Programmatic DOOH Report, well over 10% of agencies raised their programmatic spending in an otherwise dismal OOH market.

According to this report, for agencies interested in programmatic DOOH, flexible purchasing options, operational efficiency, and better data targeting possibilities are key.

They also rated the opportunity for self-reported cross-channel planning as pertinent.

The report also says that agencies are still figuring out how programmatic DOOH fits into their internal planning and buying, with only 37% using the same team to place and buy OOH and programmatic DOOH

Nearly half of programmatic DOOH decision marketers planning and buying totally independent of other media, says the report.

Furthermore, the report also adds that agencies and advertisers are requesting education to better grasp the programmatic DOOH offering and mechanisms so that measurement and tracking may be improved.

Gai Le Roy, the Chief Executive of IAB Australia, said that this critical new industry study provides very clear feedback from media buyers and advertisers on areas where they would like more education and support from the industry to aid with their programmatic DOOH investment, measurement, and assessment.

He further added –

I have every confidence that the programmatic DOOH market will boom through 2021 and 2022, embracing the benefits of programmatic while also retaining the long-standing agency approach to developing fit for purpose OOH creative for different environments and placements.

According to the report, in 2022 and beyond, the industry will see more innovative exploration as marketers begin to broaden their creative suite beyond conventional executions, with a number of agencies planning to use alternative formats for the first time (HTML 40 per cent, video 37 per cent, and dynamic creative 36 per cent).

Neeva : An Ad-Free Search Engine Launched By Former Google Ads Head

After a long tenure as Google’s head of search and advertising products, Sridhar Ramaswamy left the business three years ago. His experience of managing the world’s largest ad-supported firm was one of the most powerful in advertising, and it prepared him for virtually any leadership post in data-driven marketing.

This is why, it was quite the shocker when Ramaswamy co-founded Neeva, a search engine with the purpose of never including advertising. After one year of testing with a 10,000-person user base, Neeva has now been launched to the public.

Ramaswamy went to record to say –

“ We started Neeva because we love search, the technical problem. But we thought the long-term consequences of a primarily ad-supported model for the search engine was more and more about the advertiser, rather than the user or the customer.”

In a conversation with AdExchanger, Ramaswamy went on to speak at length about his motivation and ambitions regarding this project.

On being asked why he decided to launch a new search engine, the former Google head said that he considers this market to be incredible and dominated by one single player.

The reasoning behind a new search engine, Ramaswamy says, is to have a fundamentally distinct business model as a strong base of a new product that would allow Neeva to compete more successfully than other search engines that try to replicate Google’s offerings.

When the obvious question of – why is Neeva different – was thrown in the air, Ramaswamy said-

“We describe it as a private and personalized search experience. And it is a subscription search engine.”

He added that as of now, they have 10,000 users. And about the pricing, Sridhar Ramaswamy said that they are still deciding on how much to charge for the subscription, but it will hit the ballpark of $5 per month across the US. Furthermore, he said that his team is still in the process of creating a search stack.

AdExchanger then asked – “Why the commitment to an ad-free search engine?”

Ramaswamy replied that Neeva’s logic is based upon the fact that any ad-supported business model is built on collecting large amounts of data; and over time, the user experience takes a back seat to advertising. This makes it hard to distinguish an ad from organic content.

Moreover, he says that at Neeva, nobody will have to wonder about affiliate links. The aspiration behind this search engine is to create trust and make it user-oriented.

Ramaswamy also said during this conversation, that if publishers provide Neeva with content, then a portion of the revenue will be shared with them.

When asked if there were ways for marketers to reach users apart from advertising, Ramaswamy said that they have worked with SEO players and site owners to keep their content relevant.

They have also created a product known as Spaces, which can be conceived as a user’s thoughts and images related to a specific topic.

He adds further that the aim of Neeva is to bring together customers with content creators on the internet, without taxing anyone for it.

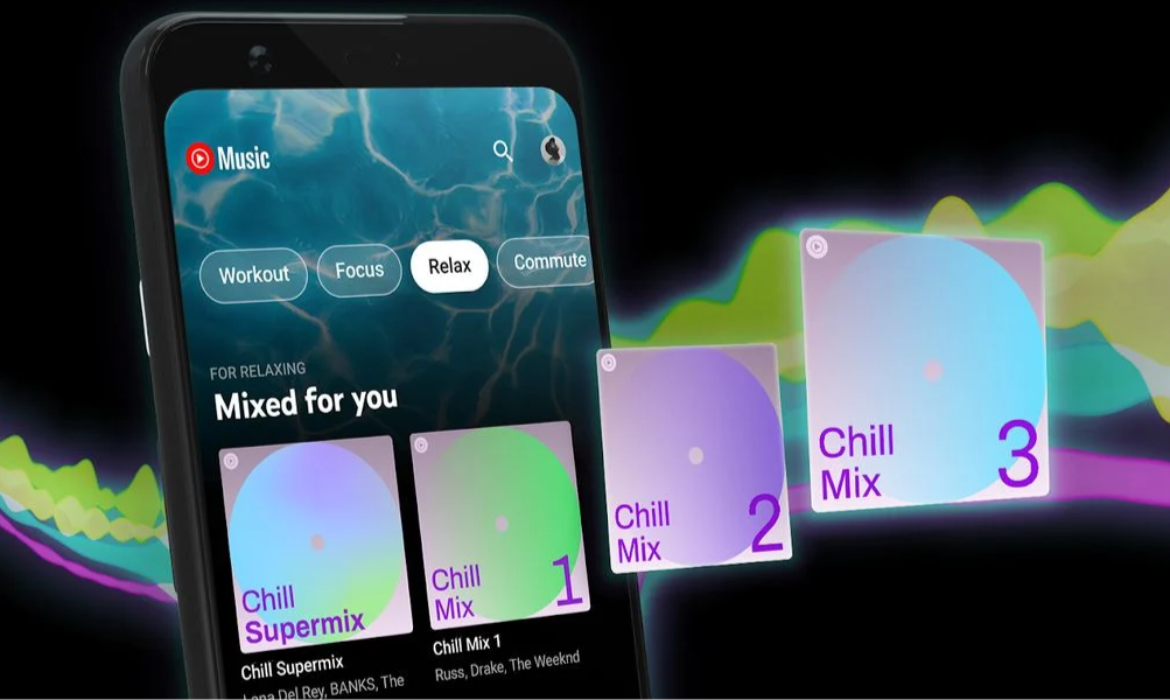

YouTube Introduces New Audio Ads To Target Music Fans

In a bid to help brands grow further and better reach music fans on its platform, YouTube launches new audio ads and music lineups.

With people shelter-in-place due to pandemic and music concerts are closed, users are increasingly turning to YouTube to listen to a podcast while doing regular chores or working out while listening to albums. In an effort to adapt to this consumer behavior and monetize the moments on YouTube, the platform rolled out audio ads in beta.

The 15-second audio ads are now available to all advertisers globally via auction on Google Ads and Display Video 360 on a CPM basis with the same audience targeting options, bidding strategies and Brand Lift measurement capabilities, and brand safety features as YouTube video campaigns.

These ads won’t be audio-only but the audio soundtrack plays the lead role in delivering the brand message. The visual component is mainly a still image or basic animation. In the blog post, YouTube says the key that the audio message should carry is: “Think: If I close my eyes, I can still clearly understand what this ad is about.”

The company claims that in months of alpha testing,

“75% of audio ad campaigns on YouTube resulted in a significant lift in brand awareness.”

For instance, this Shutterfly Audio Ad resulted in a 14 percent lift in ad recall and a 2 percent lift in favorability among their target audience.

YouTube is also introducing dynamic music lineups that allow advertisers to target campaigns at collections of music channels on YouTube in the popular genre such as Latin, K-pop, country, rap, and hip-hop. Marketers can buy ads targeted by moods or interests like fitness or meditation. Let’s say if a brand prefers to run ads at any given moment, they can buy against the Top 100 — powered by YouTube Charts. In head-to-head competition with Spotify that pioneered in selling only audio-ads for years, YouTube expects the move to boost ad revenue that it generates from music on the platform.

In another blog post, Lyor Cohen, global head of music for YouTube, positioned the new ad push as an effort to help artists and record label partners earn more revenue from this new ad format. He further explained, more than 2 billion logged-in viewers are watching at least one music video each month whereas 60% of music consumption on YouTube happens on mobile devices,4 where background play is not available.

“Regardless of when and how people are tuning in, we have ways to help advertisers connect, even when they’re consuming music in the background. Now you can complement the moments your consumers are watching, by engaging them in moments when they’re listening, with newly announced audio ads.”

The blog reveals more than 50% of logged-in viewers consume more than 10 minutes of music content in a day. Though, video is still the main and largest category for YouTube: 85% of music consumption on the platform is in the foreground, Adam Stewart, YouTube’s VP of sales said the remaining 15% is a ripe market to tap for audio ads.

“We know being associated with this content works, and so it’s incumbent on us to create packaged opportunities for advertisers to get close to it in whatever format they want to work in, whether that be audio, video or both.”

The audio ad on YouTube follows another audio announcement from Google earlier this year in August as it launched programmatic audio in Ad manager.