Disney Agrees to Sell 60% of India Business to Reliance-backed Viacom18

The Walt Disney Company has agreed to sell 60% of its India business to Viacom18 for $3.9 billion (INR 33,000 crore), according to the Wall Street Journal. The deal is expected to close this month. Viacom18 is owned by Mukesh Ambani, chairman of Reliance Industries (RIL). Walt Disney and Reliance Industries have been in deep discussions to combine their Indian entertainment businesses since December 2023. The businesses, however, were unable to come to a consensus regarding structure or valuations.

Disney agrees to sell 60% India business for INR 33,000 crore

Following rumors of Reliance Industries’ interest, Viacom18, owned by Reliance, the largest tycoon in Asia by Mukesh Ambani, has now finalized the deal and signed a non-binding term sheet to combine their India operations last month. The deal’s value was previously estimated by reports to be $10 billion. The decline in value is partially attributable to a write-off of revenue from Disney’s sale of cricket TV rights to struggling Zee Entertainment Enterprises Ltd., which is currently anticipated to be unable to make the payment. But according to a report this week from Bloomberg, Disney’s business in India are only worth about $4.5 billion, not the $10 billion that the US entertainment giant had previously sought.

Disney facing difficulties in India

Disney’s difficulties with streaming in India were made worse when Viacom18 outbid the American corporation for the IPL rights, paying $2.6 billion to stream the competition through 2017. Disney’s quarterly earnings in August 2023 revealed a 12 million decrease in streaming subscribers in the subcontinent, which was primarily ascribed to Hotstar’s decision to discontinue IPL streaming.

Disney+ Hotstar in India is facing difficulties because of this deal. Subscriptions to the platform have steadily decreased, from 61.3 million in September 2022 to 37.6 million a year later. Contributing factors include the loss of important content like HBO and IPL shows as well as competition from Jio Cinema. Although the sale’s official motivations are still unknown, rumors suggest:

- Priority Shifts: Disney may be refocusing its resources on high-growth sectors like Disney+ and core markets.

- Content Challenges: It may have been challenging to navigate the intricate Indian media environment and obtain well-liked content.

- Financial considerations: Simplifying operations and increasing financial flexibility are two benefits of offloading a part of the company.

Read More: Viacom18 Scores BCCI TV-Media Rights to Broadcast ICT Matches

Increasing Opportunities for Viacom18

The media behemoth is now poised to take a leading role in the streaming wars. This is all thanks to its agreement with Reliance Industries’ Viacom18. Disney, on the other hand, will keep working with other companies. It will create and distribute content while holding a 40% share. Reliance holds a 51% stake, while Bodhi Tree Systems, a venture led by Uday Shankar, the former head of Disney India, and James Murdoch, holds a 9% stake. With this decision, both businesses enter a new chapter in the ever-changing Indian media landscape. The exact course of this strategic change remains to be seen, but the entertainment sector in the area will undoubtedly be greatly impacted.

Other Business Investment Plans

Viacom18 plans to invest approximately $1.5 billion in cash and equity in the stake. Disney owns a portion of the Tata Sky, Hotstar streaming, and Star India networks. The deal, which is expected to close in February, highlights the difficulties in navigating India’s vast 1.4-billion-person market. Disney Star and Viacom18 were reportedly preparing to battle it out for the right to advertise in the upcoming IPL 2024 earlier this month. Disney Star, which will broadcast the IPL matches on its sports channels, is reportedly requesting INR 167 crore and 83 crore for associate and co-presenting sponsorships on standard definition (SD) channels, respectively, according to a report in the Economic Times.

The broadcaster is requesting INR 35 crore for associate sponsorship and INR 71 crore for co-presenting sponsorship for HD channels. In contrast, Viacom18 has maintained its advertising rates at the same level to attract more advertisers. Viacom18 will continue to stream IPL matches for free on JioCinema. For the 2023 Indian Premier League, the company reportedly signed over 500 advertisers.

Hotstar a few years back

For a few quarters, Hotstar ruled the Indian video streaming scene. However, since then, Viacom18, supported by Reliance, has gained traction by paying roughly $3 billion to secure the five-year rights to stream the IPL cricket matches. Disney paid $3 billion to broadcast the content on television for the same five-year rights.

Read More: Walt Disney and Reliance Industries Sign a Non-Binding Agreement

Disney+ Introduces First-Party Audience Targeting, Programmatic Buying Via PMP

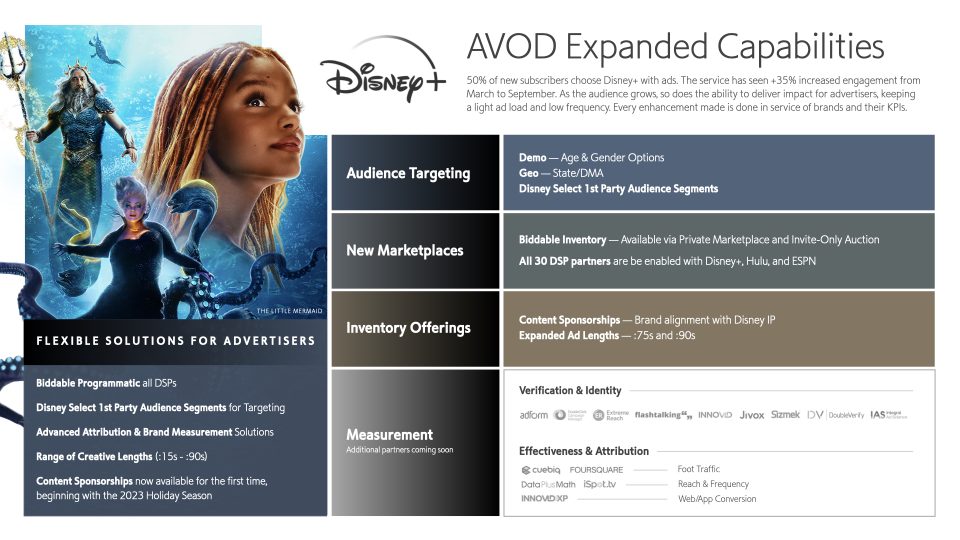

Disney+ has intensified its efforts to provide advertisers with more comprehensive and adaptable ways to reach audiences at scale, as the ad-supported tier nears its one-year anniversary. With its first-party audience graph and programmatic buying via private marketplace (PMP), the Disney+ ad-supported tier has introduced audience targeting. In addition, it now offers measurement services for identity, efficacy, verification, attribution, and approved creative ad formats.

Rising Disney+ ad-supported tier and programmatic capabilities

Of new subscribers, 50% select the ad tier. Furthermore, there was a 35% increase in service engagement from March to September 2023. The capacity to provide impact for advertisers grew along with the size of the Disney+ audience that is ad-supported. In order to provide the best possible customer experience, this was accomplished while maintaining a complementary ad load in line with viewing behavior. Disney’s position as an industry leader has been further cemented by solutions for tracking the effectiveness of campaigns. This is in order to fulfill and optimize advertisers’ performance goals.

Advertising capabilities are available on Disney+

Image credit- The Walt Disney Company

Advanced Audience Targeting

With the help of Disney’s acclaimed, in-house first-party Audience Graph, marketers can now target audiences more precisely for the first time across demo (age and gender); geography (State/Designated Market Area); and Audience Segments. Disney’s audience graph, which features 110 million households, 235 million unique viewers, and more than 2,000 interest- and behavior-based audience segments, will now allow advertisers to use first-party data.

Programmatic expansion

Disney is extending its programmatic offerings to encompass biddable transactions, accessible via exclusive auctions or private marketplaces. Advertisers can unlock Disney’s premium content at scale with greater choice and control than ever before. This is thanks to its availability across 30 DSPs that represent large, midmarket, and local platforms.

Read More: Disney+ Hotstar Amp Brand Outreach With CTV Targeting

Diversified Ad Formats

Disney+ is now accepting a wider range of creative lengths (midrolls and:15s to:90s) in addition to choosing content sponsorships, which are now available for the 2023 holiday season. This builds on its history of creating market-defining, consumer-first formats.

Enhanced Measurement and Attribution

Disney+ has kept developing new tools to help marketers reach a wider audience while guaranteeing efficacy through attribution and measurement. More campaign measurement options than ever before will be available to advertisers through it, all of which will highlight the benefits of running ads on Disney+. InnovidXP provides web and app conversion measurement, Kantar measures brand lift. Furthermore, Data Plus Math and iSpot.tv provide reach and frequency insights, and the platform, which previously offered measurement through Samba TV and VideoAmp, now offers the ability to measure the impact of ads on foot traffic through Cuebiq and Foursquare, and Kantar measures brand lift.

Disney+’s growing audience means more chances for advertisers to enhance their connection with the service as the platform continues to grow in size. Disney Advertising is still dedicated to bringing innovations and solutions to its brand partners to help them achieve their goals.

Here’s what they said

Rita Ferro, president, Global Advertising, Disney said,

Consistent with Disney’s strategic approach, we spent the last 10 months testing, learning and listening to our consumers and clients. That’s how we continue to create viewer-first experiences while simultaneously introducing new capabilities, functionality and formats. We’re seeing increased engagement and time spent, and now providing greater accountability for marketers through robust measurement, proving that premium content matters.

Read More: Reliance Industries to Acquire Disney India in a Cash and Stock Deal

Disney+ Hotstar Amp Brand Outreach With CTV Targeting

For South Asian nations, including India, cricket is a profound enigma. As a result, cricket enthusiasts are in for an adrenaline rush next month as the major tournaments kick off. The ODI World Cup this year will be the ideal venue for companies to partake in both festive ecstasy and cricketing enthusiasm. As the holiday season approaches and these prominent tournaments are taking place, businesses have the perfect opportunity to take advantage. Brands can now leave their imprint by engaging with consumers in creative ways thanks to Connected TV (CTV) targeting.

A CTV Recap

As a part of programmatic advertising, CTV has risen to popularity in recent years. To explain CTV in short, simple terms, it is any device that can be connected to your traditional TV set, like a Smart TV. It offers online viewing and streaming experience via the internet. These ad formats are very cost-effective, easily trackable, and safe for brands. As such, they also offer a broadcast-quality experience. In a report by Exchange4Media, and a survey by Statista, the CTV advertising market is expected to grow by $45 billion by 2025.

CTV expansion is responsible for India’s rising content consumption. As a result, Disney+ Hotstar, the largest OTT platform in the nation, leads the curve. Disney in India has revealed that users can stream the Asia Cup and the Men’s Cricket World Cup on their mobile devices for free. In a statement, the company stated, “The move to lift the paywall for mobile-only viewers is aimed at further democratizing the game of cricket and making it accessible to as many mobile users in India as possible for the duration of the season.”

How will it benefit Advertisers?

CTV offers shared viewing. During peak sports tournaments like the Men’s Cricket World Cup or the FIFA World Cup, spectator emotions are high. This results in heightened emotional responses to the ads they are subjected to at that time. Disney+ Hotstar offers a subscription video-on-demand viewing experience. During live events like these sport world cups, Disney+ Hotstar switches to a hybrid model where, during commercial breaks, they display ad campaigns from brands. Viewers are also shown ads on their screens while live streaming the sports content, however, the ad does not cover the entire screen like traditional TV. They can access the brand’s website without disrupting their streaming experience. Here’s how it will help brands in their outreach strategies with Disney+ Hotstar

Brand Reach

As CTV popularity grows in India, more brands opt for CTV advertising. Disney+ Hotstar has a wide audience base in India. As such, the platform’s track record of offering the highest CTV results, brands are excited to collaborate with them in the upcoming cricket season. By combining their first-party data with the streaming platform, they will receive perceptive insights about their target audiences while controlling ad frequency and reach. This will help them understand how and when their ads are to be displayed so they reach the right cohort.

Audience targeting

Brands will be able to efficiently identify where and how the Disney+ Hotstar audience streams with first-party data. This will help them cater their ads according to not only the audience but the location as well so that they resonate with the population better. Advertisers will also be able to measure the campaign’s efficacy.

User actions

While streaming events like cricket or other sports, audiences are not constantly inundated with commercials. Hence, there is a high chance that viewers will watch the entire ad without skipping it. For the upcoming cricket season, Disney+ Hotstar has introduced video and display billboard ads. This will work in favor of the brands as audiences are more likely to remember the brand resulting in high brand recognition and loyalty. Although viewers might not convert into customers immediately, they will have gained a worthy prospect.

Cost-Friendly

CTV advertising is cost-effective for brands. This is because CTV ad format reaches only a single individual device according to the brand’s targeting campaign. It is unlike traditional TV advertising where viewers are subjected to the same ad around the network. Brands will be able to manage their cost per impression thanks to this ad format. At the same time, advertisers will be able to produce high quality, high performance, and targeted ads. Brands will benefit from this as the audience is more likely to respond positively to better quality ads, increasing loyalty and visibility. Advertisers with niche audiences will also enjoy a better ROI while eliminating any extra costs that might otherwise occur.

Disney+ Hotstar and CTV

Disney+ Hotstar is known for its sophisticated targeting capabilities. Therefore, this cricketing season offers marketers a fantastic chance to succeed with audience involvement. They ran 47 campaigns ICC T20 World Cup in 2022. The results can be used to measure the efficacy of their CTV advertising campaign. The analysis provides insightful information on how sports advertising affects brand visibility. Here are some of the analysis’s major takeaways.

By the numbers

The campaign delivered 25% higher results than the industry benchmark

- Sponsor brands were twice as high as inventory buyers.

- Brands with investments over Rs. 5 crores saw two times more impact on awareness and favorability

- Brands with supplementary campaigns like branded cards, billboards, etc. witnessed 1.5x and 2x higher impact on awareness and favorability respectively.

With Disney+ Hotstar, a number of brands have already found success, and they are grateful for the platform’s assistance in reaching previously untapped audiences.

Read More: PubMatic Takes On DSPs in Video & CTV Deals, Aims for Direct Access

Disney+ Is All Set To Lure Advertisers And Enhance Options For User Targeting.

Disney+ plans to get innovative with its user advertisement policies. Earlier, Disney+ offered the best package for users costing $7.99/ month. In this package, users can enable parental control. Advertisers were not allowed to target specific audiences with Disney+ advertising. However, with new policies framed, advertisers will get the independence of targeting the audience and households according to their choices. Meanwhile, Disney+ will also ensure the privacy of the users.

Users will get a variety of subscription options to choose from. Some of these subscriptions will support advertisers, as the package will enable advertisers to show ads to their audiences. Since Disney+ has always been strict about user privacy, it enables filtering advertisements following the appropriate age groups. The profiles of users under 18 years of age will receive the advertisements according to their age criteria.

“Expanding access to Disney+ to a broader audience at a lower price point is a win for everyone – consumers, advertisers, and our storytellers,” said Kareem Daniel, Chairman. He added, “More consumers will be able to access our amazing content. Advertisers will be able to reach a wider audience, and our storytellers will be able to share their incredible work with more fans and families.”

Disney+ has been one of the premium digital content providers. Streaming services like Hulu is one of the top-notch ad-supporting streaming services, providing on-demand video subscriptions.

Rita Ferro, President of, Advertising, highlighted her statement given to Digiday,

Since its launch, advertisers have been clamoring for the opportunity to be part of Disney+ and not just because there’s a growing demand for more streaming inventory.

She mentioned that,

Disney+ with advertising will offer marketers the most premium environment in streaming with our most beloved brands, Disney, Pixar, Star Wars, Marvel, and National Geographic. I can’t wait to share more with advertisers at the Upfront.

Now, advertisers will get options to target their audiences based on gender, age, and geo-location. Rita also hinted that from July, Disney+ would launch a much more sophisticated suite empowering advertisers to do more.

Disney+ aims to achieve its desired user target of 230-260 million by FY24. It will be a large pool of audiences for the advertisers, resulting in higher conversions. Disney+ builds its user database by collecting helpful information and the behavior of its users from different platforms.

However, advertisers should not worry if they are unable to get the minute details of the users through Disney+. Advertisers can take help from data brokers and sync that data with the Disney+ platform. Advertisers can use the “data clean room” to pipeline their data to target specific audiences.

Since data privacy has proven to be a threat in the past decade, companies are working to eliminate the risk of data theft and misuse of data from outside sources. In accordance brands like Apple, Facebook, and Google have implemented strict policies and introduced new ways to enable data privacy. And discontinuation of third-party cookies is one such major step. Similarly, Disney+ desire to introduce its platform for advertisers is considered to be one such step in the direction of its user’s data privacy.

The plans are yet to be introduced and to be specific with the budget and targeting of their audiences. Hence, advertisers might have to wait till the end of July.

Disney Ad Sales Strongest At Upfront, Records $9 Billion

Disney’s upfront advertising process ended with a record $9 billion in ad sales – 40% of which came from streaming and digital. Disney has become the latest publisher to finish upfront.

This is the first year Disney has offered Disney+ as an advertising option. The forthcoming ad-supported tier of Disney+ was cited by the company as a game-change and particular strength among its platforms, which also include ABC, Disney Channels, ESPN and ESPN+, Freeform, FX, Hulu, and National Geographic.

Interesting Read: Disney Signs A Major Adtech Deal With The Trade Desk

What is an Upfront?

Uninitiated viewers may not know that broadcast and cable networks hold spring events to promote their new programming lineups. As a classic futures market, the idea is to entice media buyers to commit to ad contracts for shows months or even years down the road. To put it another way, they buy inventory in advance.

Disney at the Upfront

The 2022-23 upfront posted the second straight year of double-digital gains in sports volume and pricing.

The CPM(cost per thousand viewers reached) increased in streaming, sports, broadcast, and cable, the company said, with prime seeing double-digit increases and high single-digit increases in addressable ads. In contrast to traditional advertisements, addressable ones can be targeted based on a person’s purchase history or other factors far beyond their age and gender.

The company also said it secured DEI commitments from every top-performing categories included Diversified Consumer Services, financial services, media & entertainment, pharmaceutical, sports gaming, and travel & leisure. The demand for Disney HuluXP, an integrated video ad platform across the Disney portfolio, also increased. Rita Ferro, president of ad sales for Disney Media and Entertainment said in a statement,

“Disney Advertising entered our 2022-2023 upfront committed to executing on our strategic priorities – streaming, multicultural and inclusion, sports and entertainment – and we delivered.

I am proud to partner with all of our clients to reach audiences at scale across all screens, and alongside the most premium content.”

The upfront process has been unlike most previous years for all of the major media companies. Traditionally, the upfront sales should wrap in the spring instead it dragged into summer this year. With streaming the ritual has become more complex and less calendar-based, allowing network parents to weather the ongoing decline in traditional bundles and overall live tv viewing.

Interesting Read: AVOD Surprise: Netflix Advertising Powered By Microsoft

What is important for Disney?

Ferro gave Adweek an overview of Disney’s upfront priorities in May and said,

“The upfront was really about how do we tell a big-picture story of the volume of content coming from the Walt Disney Company because we have a lot of different endpoints, and we’re the home of streaming in a way that no one else has in the marketplace, premium storytelling in the streaming space with Hulu that has been around for 14 years. But since it was integrated and we took operational control a couple of years ago, it has been a driver of the AVOD opportunity in the marketplace.”

The new ad-supported tier would be coming to Disney+ later this year and would be launching internationally next year.He also explained that it will have an average of four minutes of commercials per hour.

“The reason for that is we know most people come to Disney+ for our movies, and movies have a different ad load than a series would. So what drives Hulu is more series. What drives Disney+ is more consumption of movies, and therefore the ad loads will look different. So it’ll be an average of four minutes an hour, but it depends on the types of content you stream.”

Interesting Read: Marriott International : A Hotel or An Ad Tech Company?

Disney Launches Clean Room For Marketers’ First-Party Data Needs

With the help of first-party data service providers Snowflake, Habu, and InfoSum, the Disney Advertising Sales department has officially created its own data clean room. A ‘ clean room’ is usually leveraged to integrate client proprietary consumer information with other industry data to improve performance. Clean rooms are used to safeguard a company’s data as well as the privacy of its customers.

What makes clean room services appealing to broadcasters is that programmers have dependable linkages to viewers who are signed into OTT services or have monthly subscriptions.

Disney’s announcement is interesting in that it does not include large cloud marketing businesses like Google and AWS, instead of focusing on data and identity vendors who operate across channels.

Interesting Read: Group Nine Launches First-Party Product In Wake Of Cookie Apocalypse!

Disney Clean Room: What’s In It For Marketers?

The primary idea behind the ‘clean room’ is to help marketers with their first-party data. Through this move, marketers will be able to collaborate with 1,000 first-party sectors, according to Disney.

Furthermore, marketers can use clean rooms to match their first-party data with other industry data in a secure environment. Marketers may match and instigate their needs when it comes to buyer behavior, household features, and psychographics using its first-party segments.

That’s What They Said!

Lisa Valentino, Disney ad sales EVP gave an official statement saying –

We are building data solutions for our clients and marketers anchored in Disney Select’s unrivaled audience-based capabilities. It was important for our clean room offering to be cloud agnostic to provide brands with scale and variation

Drivetime and Omnicom Media Group (OMG) were the first clients to use Disney’s clean room for beta testing. Habu, InfoSum, and Snowflake are also among the data firms taking part in the test.

OMG chief investment officer Geoff Calabrese, said –

This partnership with Disney is about setting the standard for the future of media accountability, and a more accurate understanding of consumer engagement and outcomes – it’s where we need to go as an industry, and OMG is proud to work with Disney in leading the way forward

Also Read: The Ultimate A-Z Glossary Of Digital Advertising!

TikTok Appoints Former Disney Chairman As New CEO To Capture New Markets.

- Disney veteran Kevin Mayers who oversaw the launches of Disney+ and ESPN+ is leaving the company after 27 years to become the new CEO of TikTok.

- Mayer will take the lead on ByteDance’s music, gaming, and emerging business along with heading TikTok.

- Mayer will start on June 1 and report directly to Bytedance CEO Yiming Zhang.

- TikTok had an immense impact on the music industry and grabbing eyeballs of gaming and esports companies.

TikTok appoints Kevin Mayer as the new CEO after being poached from Disney. Kevin Mayer who was passed over for the Disney CEO role is taking a jump from the entertainment industry’s most esteemed names to one of its most dynamic new arrival.

TikTok’s new CEO plans to explore business opportunities in music and gaming as the company looks to capitalize on a recent increase in app downloads. Mayer, head of The Walt Disney Company’s direct-to-consumer and international business said in a statement,

“I’m thrilled to have the opportunity to join the amazing team at ByteDance. Like everyone else, I’ve been impressed watching the company build something incredibly rare in TikTok – a creative, positive online global community – and I’m excited to help lead the next phase of ByteDance’s journey as the company continues to expand its breadth of products across every region of the world.”

Advertisers and brands taking advantage of music trends

TikTok is a significant player in the music industry for discovering new artists and making songs to hit status. The platform contributed to the grand success of Lil Nas X’s record-breaking “Old Town Road” and more recently with chart-toppers like Doja Cat’s “Say So” and Megan thee Stallion’s “Savage,” which are all featured in the TikTok videos.

Advertisers have found new ways to use TikTok music and dance trends to their advantage in order to drive brand awareness among the Gen Z audience. Brands like e.l.f. Cosmetics and Warner Bros. have used original music and dance challenges to attract the audience and generate billions of views and user engagement on the app. As quoted by Business Insider, Evan Horowitz, CEO of the creative agency Movers+Shakers said,

“I think the nature of TikTok as a platform is that it’s one. It’s only natural that brands that create really good music.that the community on TikTok really resonate with, that music can start to trend and be successful outside of the platform.”

Gaming and esports companies jumping onto the bandwagon

Video games companies and esports brands have shown keen interest in the TikTok app as it continues to be popular among Gen Z users of the app.

Many esports brands like FaZe Clan, Team SoloMid (TSM), and 100 Thieves have officially created verified accounts whereas video game content is slowly taking up TikTok’s content recommendation landing page (ForYou). It’s too early for gaming creators on the platform even though esports companies are slowly and carefully exploring TikTok in recent months. Jason Wilhelm, CEO of TalentX Gaming told Business Insider,

“For TikTok, they haven’t really found what is the best way forward for gaming yet. You need a lot of requirements in order to stream video games. TikTok obviously is not set up for that right now, but that is something that we’re going to be figuring out.”

TikTok has seen a significant surge in users since the pandemic hit U.S – 315 million downloads across the iOS and android app stores in 2020 Q1, that’s the most download for one app in a single quarter as per mobile data analysis group Sensor Tower.

Also read: YouTube Shorts: Will it be Able to Capture Tik Tok’s Audience?