Is Zynn, A Clone Of TikTok, Set To Dominate The Market? Certainly Looks Like So!

From a period, TikTok market is suffering from a lot of negativity. After being criticized for its user data policies in the US, the TikTok market is facing a downfall in its active user database in India. Several of its accounts have been suspended, as complaints have been filed against them for posting unethical content. Now, TikTok is facing a challenge due to the #BycottChineseProduct revolution in the Indian market.

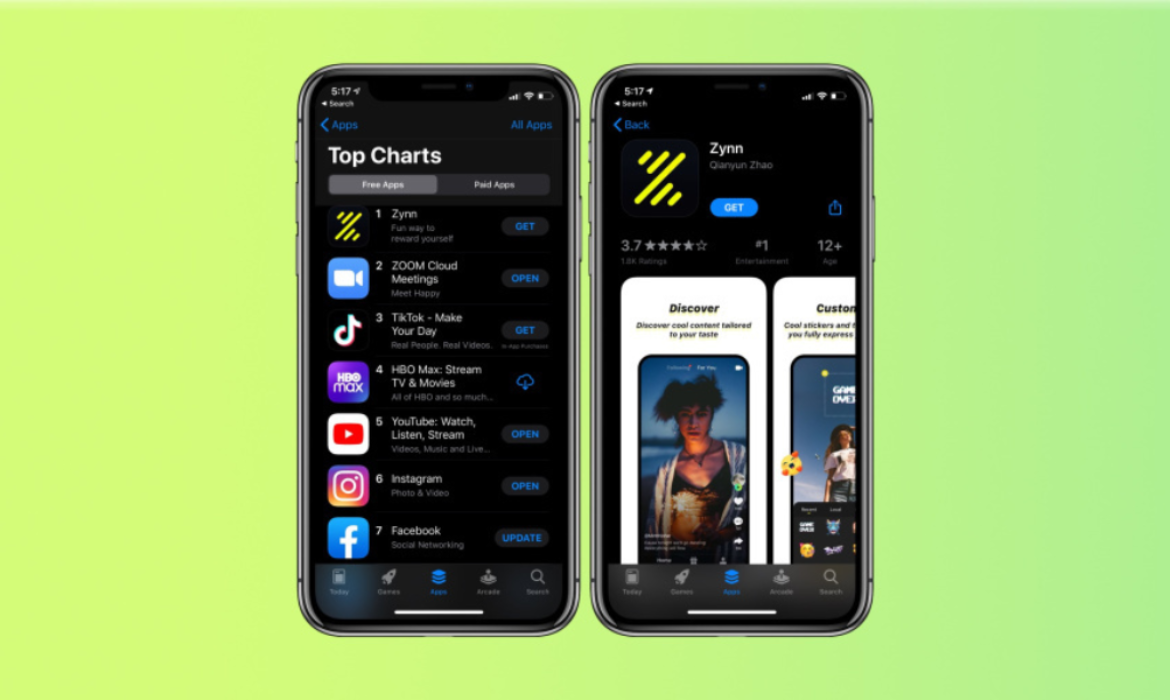

Even in its own country of origin, Its problem doesn’t seem to end. TikTok is facing tough competition within its country bounds. Recently, Zynn, which is a replica of TikTok is making its way on the top charts of Google Playstore and Apple store.

Zynn has been ranked as the number one application in the free app category on Apple store. Whereas, it is among the top 10 applications on Google play store.

Image credit – BusinesBlog

Zynn is a doppelganger of TikTok! Every aspect of Zynn is similar to that of TikTok, even they have a similar user interface. The only difference is, it pays its user to watch a video, refer to friends and even just to sign up.

This is also a USP which keeps Zynn ahead of its competitors.

Image credit – Techio

The only distinct feature of Zynn interface is the dollar sign, appearing on the screen. The “$” sign appears on the left-hand top corner, it also acts as a timer for the video.

The moment a user starts watching a video, the dollar sign gets filled with colour. Once the video is complete, and the sign is filled, it gets added into your credit points. The user can redeem these points, and convert them to gift cards or cash.

There is no personal proof of the redeeming of cash and gift card. Although, there are some YouTube videos which claim to have received the balance in their account. They show their bank statements, confirming the above statement.

Zynn didn’t appear from non-existence. Zynn is a byproduct of the competitive market of China. It is launched and promoted due to an ongoing rivalry of tech companies in China.

Kuaishou, a well-funded start-up running the biggest video apps, created Zynn. To promote Zynn, they used the same payment technique used by Douyin. Douyin is a Chinese version of TikTok.

Zynn supports in-app advertisement purchase. It is its only source of income. Currently, as per the reports they are not selling advertisement in the US.

Recently, Zynn received a hefty investment, amount of $2 billion. Tencent a Chinese tech giant invested this amount in Zynn. Tencent is also a creator of Wechat which is the most popular Instant messenger in China.

The report posted by The Information, in December stated that the investment was made to “contain the threat of ByteDance,” the creator of TikTok and Douyin.

Following are some of the reasons responsible for the quick growth of Zynn in the market:

- It pays its user an approx of ($0.12), to watch a few minutes video.

- Secondly, the application provides you with money for every referral.

- Big brand promotion can provide up to $110. If you make five people sign up, and they keep using the application continuously.

- The brand obtains its data from Kuaishou, hence, the application is pre-loaded with videos.

Image Credit – Three Pixel lab

A report states that most of the video uploaded on Zynn are from Kuaishou database. Zynn is slowly attracting people to leave TikTok and shift to its database.

After downloading, you can directly start watching the videos. Though, If you are willing to earn rewards you must sign up first.

Also, you must know that you can’t create a direct account with Zynn. It has to be either with Facebook, Gmail or Twitter. it will verify your phone number, and in case of failed verification, you won’t be able to sign up.

Image credit – Click Lancashire

It requests access to the device location. However, you can deny it. You also have to attach your Paypal account for the payments you will receive.

Major Brands Condemn George Floyd’s Death | Supports Black Lives Matter

- Major brands released various statements condemning racism and voicing their support for protesters.

- The protests intensified across the U.S after the death of Geroge Floyd, a black man who died in police custody in Minneapolis on 25th May.

Following a long history of Black Americans losing their lives in police custody, the death of George Floyd has sparked nationwide protests and civil unrest.

Why it matters: Even the brands that remained silent against social injustice, such as ad agencies or marketing professionals have raised their voice in the Trump era to fill the void created by the government.

Driving the news: Brands like Twitter changed their official display image as a part of the change. Other brands like Google, YouTube, Disney, Netflix, Amazon followed the suit.

However, the brand’s support has received mixed reactions of praise and criticism. Supports that include tangible steps to action like donation or building up of links and resources with statements are welcome to combat racism. However, generic statements that lacked depth are being accused of commercializing the tragedy.

L’oreal drew criticism from British model and activist Munroe Bergdorf, who claimed that she was previously dropped out from a campaign for speaking on racism.

https://twitter.com/MunroeBergdorf/status/1267460238678069249?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1267460238678069249&ref_url=https%3A%2F%2Fwww.thedrum.com%2Fnews%2F2020%2F06%2F01%2Fbrands-show-solidarity-with-george-floyd-protests-can-they-contribute-real-change

Facebook donated $10 million but received backlash from critics. Social media is still taking heat for not taking a stand against the controversial post of President Trump that promoted violence, unlike the competitor Twitter.

One commenter wrote on the Facebook social media post, “If Facebook was serious then Facebook would censor the president’s inflammatory posts the same way the rest of us are censored. This is just lip service at this point.”

Facebook employees staged a virtual walkout over the issue and one employee, software engineer Timothy Aveni, wrote on LinkedIn about why he’s leaving the company altogether.

How have brands and media companies shown solidarity: They took to social media to support the Black Lives Matter movement using a set of hashtags like #BlackLivesMatter and #JusticeForFloyd.

- Social posts go black for Blackout Tuesday

Scroll through any social feeds on Tuesday, June 2 and there will be a sea of black images on Facebook, Instagram, Twitter, and other platforms with the hashtag #BlackoutTuesday. Brands, celebrities, ad agencies, influencers are participating in support of racial injustice.

Sony postponed a PlayStation 5 event to give fans a sneak peek at the games in a tweet. On the other hand, prominent music labels and musicians participated in Blackout Tuesday with hashtags – #BlackoutTuesday and #TheShowMustBePaused. Others are participating by staying silent on social media.

In solidarity with the Black community, our employees, our friends, our families, and our colleagues across industries we are proud to take part in #BlackoutTuesday.

Savage X Fenty will NOT be conducting any business on Tuesday, June 2 – globally.

— Savage X Fenty by Rihanna (@SavageXFenty) June 2, 2020

Visit this link for a list of actions you can take: https://t.co/tjNjsYlTft #BlackLivesMatter #TheShowMustBePaused #BlackoutTuesday pic.twitter.com/iKvf84Ioav

— Conan O'Brien (@ConanOBrien) June 2, 2020

On Tuesday, June 2nd, Lucky Brand will observe “Black Out Tuesday.” We will be closed for Business. This is not a day off. We have work to do. #BlackOutTuesday #BlackLivesMatter #LuckyTogether pic.twitter.com/CWLCo5SI15

— Lucky Brand (@LuckyBrand) June 2, 2020

Interscope vowed not to release new music for the entire week.

— interscope (@Interscope) May 31, 2020

- Other Brands

Bank of America: It plans to donate $1 billion and four years of support at the local community level to help with economic and racial inequality which has intensified in the pandemic. In a statement, CEO Brian Moynihan, “We all need to do more.”

The financial giant will focus on health, training, small business support, and housing with the help of Bank of America’s 90 local U.S. market presidents.

Verizon: Verizon CEO Hans Vestberg initially fought back tears during a webcast and pledged $10 million to social justice organizations. A full list of those receiving donations can be found here.

"We have the responsibility as a large corporation to do right in these times. We cannot commit to the brand purpose of moving the world forward unless we're committed to helping ensure we move forward for everyone." –@HansVestberghttps://t.co/fHH4TWe52g pic.twitter.com/9wGIjhwBgw

— Verizon (@Verizon) June 1, 2020

Ben and Jerry : This brand has been consistently conscientious. The ice-cream maker has previously also taken a stand in response to Ferguson unrest.

4 years ago, in the wake of Ferguson, we felt compelled to support the #BlackLivesMatter movement. We’re heartbroken those words are just as relevant today. These racist and brutal attacks against our Black brothers and sisters must end. #JusticeForFloyd https://t.co/7ngefmtqnu

— Ben & Jerry's (@benandjerrys) May 27, 2020

Starbucks: In 2018, Starbucks came into limelight after a store manager called the police as two black men were sitting at a table and had yet to order. This incident raised an alarm against racism and the coffee chain conducted training on race, bias, and inclusion and had shut the store one afternoon for discussion.

— Starbucks Coffee (@Starbucks) June 1, 2020

Microsoft: The company shared the black employees’ quotes and feelings in this turbulent time on its social channels.

At this time, we will be using our platform to amplify voices from the Black and African American community at Microsoft.

And we’re starting with Megan Carpenter: https://t.co/cFFHxFQCrQ. pic.twitter.com/nDrMi4MPR2

— Microsoft (@Microsoft) June 1, 2020

Lululemon: The company extended its support not merely by statements but pledged $100,000 donations on Instagram.

https://www.instagram.com/p/CAy3PtKJOdN/?utm_source=ig_embed

- Entertainment:

Netflix – Their move drew accolades online including director Ava DuVernay and “Orange Is the New Black” and “Mrs. America” star Uzo Aduba.

To be silent is to be complicit.

Black lives matter.We have a platform, and we have a duty to our Black members, employees, creators and talent to speak up.

— Netflix (@netflix) May 30, 2020

YouTube: The company pledged $1 million in support of efforts against social injustice whereas Amazon Studios released its own message in support of the Black community and against racism on Twitter and Instagram. Other companies showing their support include HBO, Viacom, Pop TV, Quibi, and more.

HBO changed its name on Twitter to #BlackLivesMatter whereas ViacomCBS President of Entertainment and Youth Brands Chris McCarthy wrote in an internal memo that all entertainment and youth brands and platforms would be going dark on Monday for 8 minutes and 46 seconds, the precise amount of time the police officer knelt on George Floyd’s neck.

A new spot was created that read “I CAN’T BREATHE” on the black background as audio plays the sound of breathing. A Call-to-action was included to support the non-profit Color of Change for civil rights advocacy.

For 8 minutes and 46 seconds, we will go dark in tribute to George Floyd. We dedicate this time to the victims of police brutality and the powerful movement fighting for justice. Join @ColorofChange. Text DEMANDS to 55156. #BlackLivesMatter pic.twitter.com/X6587CxuOw

— VH1 (@VH1) June 1, 2020

- Sportswear

Adidas: Adidas and Nike, the two rivals came together to support the movement and support George Floyd supporters. Adidas shared Nike’s video.

Together is how we move forward.

Together is how we make change. https://t.co/U1nmvMhxB2— adidas (@adidas) May 30, 2020

Business in Minneapolis: Many businesses and stores have been damaged or looted during the unrest but still some of the brands and business owners are voicing their support for protesters

Brand ‘Target’ has seen many of its stores looted in the Twin Cities region, however, the CEO put out a statement sympathizing with the movement.

“We are a community in pain. That pain is not unique to the Twin Cities — it extends across America. The murder of George Floyd has unleashed the pent-up pain of years, as have the killings of Ahmaud Arbery and Breonna Taylor. We say their names and hold a too-long list of others in our hearts.”

“As a Target team, we’ve huddled, we’ve consoled, we’ve witnessed horrific scenes similar to what’s playing out now and wept that not enough is changing. And as a team we’ve vowed to face pain with purpose.”

Can Brands make a real change: It is difficult to gauge how only words of support for the fight against racial injustice is sufficient. Brands voicing their support needs to translate into action for a meaningful impact. Brands should support lobbying and campaigning pressure on the government and institutions to change the structure which few of the organizations are trying within limited means.

What’s next: Even though these protests will eventually cease, brands must ensure they are doing everything to dismantle the pillars of structural racism. Expect brands that have stayed silent until now will feel the pressure to respond quickly to the ongoing crisis with a viewpoint.

How Donald Trump’s Executive Order Has Changed the Face of Social Media

Key Points:

- President Trump signed an executive order that aimed to scrap the legal protections conformed for social media.

- He is arguing that if social media companies seek protection from the fact that they cannot control what users post, then they shouldn’t intervene with those posts either.

The battle between Trump and Twitter finally came to a peak. President Trump signed an executive order to narrow legal protection to social media platforms that censors speech for ideological reasons.

Image Credit: Twitter

Strict action will be taken against Facebook, Twitter, Google, Youtube, and other platforms that interfere in direct communication with his followers. The orders give federal regulators the right to take action against online platforms if they are censoring free speech.

What it does

His executive orders call for greater scrutiny of social media platforms by limiting or revoking Section 230 of the Communications Decency Act, a piece of a 1996 law.

Section 230 is essential and made sense when it was first introduced when the internet was new. Section 230 gives protection to the digital world. In simple terms, if users post pictures or comments that are defamatory, the operator is not responsible for it but the user and actions will be taken against the user. Without Section 230, the internet that we know now wouldn’t exist. Twitter, Airbnb, Google, Facebook, Trip advisor all depend on this protection for their business. Every internet third party leverages Section 230 to mitigate risks.

Why it matters: The move comes just days after Twitter fact-checked and labeled two of President Trump’s tweet inaccurate.

Image Credit: Twitter

The tech giants move infuriated Trump and gave him a reason to execute his long time plan of reducing the liability of social media giants for content on their platform. Even though the idea of dismantling Section 230 is a threat to internet companies but many legal experts believe that it’s unlikely that the orders will have a practical impact on tech giants.

What changes with the order

Section 230 is an immunity to social media giants and protects them from being liable for the content billions of people post everyday.

- One of the repercussions of the order on the social media companies is stripping away the protections granted to them.

- It can be the death of an online review system that covers consumer products or services in travel, hotel, airlines, car, or others. For instance, Trip advisor boasts of 860 million reviews and could potentially be sued by U.S Federal courts for statements made by online critics if the protections are diluted.

- Social media platforms may either censor everything in the fear of getting sued that would undermine the freedom of speech as pointed out in the executive order.

- Or they might just not regulate or touch anything under the fear of getting sued, then the free speech problem will be out of control with no moderation.

- A troubling landscape for small and medium-sized media companies as they will not be able to afford staff and lawyer services leading to shut down.

- There will be no moderation over disruptive content like child exploitation over the fear of getting sued.

- Jeff Kosseff, who wrote a book about Section 230, says to Marketplace that we have no idea what the internet might look like without this regulation.

What are they saying

Facebook founder Mark Zuckerberg took a different tack and called out Twitter for its fact-checking and said they are not ‘arbiters of truth.’ the company will not get into any political fray.

Mr.Trump posted the same words on Facebook which has similar rules around voter suppression didn’t do anything to it. He said,

“We’ve been pretty clear on our policy that we think that it wouldn’t be right for us to do fact checks for politicians. I think in general, private companies probably shouldn’t be — or especially these platform companies — shouldn’t be in the position of doing that.”

However, the comments were met with derision from Twitter CEO Jack Dorsey, who replied to Zuckerberg tweet,

“This does not make us an ‘arbiter of truth. Our intention is to connect the dots of conflicting statements and show the information in dispute so people can judge for themselves. More transparency from us is critical so folks can clearly see the why behind our actions.”

Morgan Stanley Forecasts Australian Ad Spend To Fall By 9% In 5 Years

In a recent analysis by investment bank Morgan Stanley on Australian advertising, it forecasted that the domestic media share will shrink if it doesn’t innovate quickly. The domestic media ad spend was $10.4 billion in 2019 and will fall at an annual rate of 9% over the next five years. In a note to clients, analysts wrote,

“We think investors perpetually underestimate the global leakage of ad spend from Australia.”

A section of marketers holds a viewpoint that the ad spend with Google and Facebook has started to plateau and revenue is returning to the domestic traditional media. However, the analysts completely disagree with this market viewpoint and highlighted numbers that suggest that there can be an acceleration post-COVID 19.

The Australian advertising market has shown little growth over the years – around 1.9 % a year. Also, the financial statements filed with corporate regulator ASIC reveals that over the last three years, global media/tech players’ revenues in Australia increased by roughly 20%.

The global ad tech players like Google, Facebook, Snap, and Twitter as well as emerging players like TikTok continue to take an increase in share in the Australian consumer’s time especially the younger demographics. They will have a larger share in digital media spend in Australia post-pandemic as well.

Image Credit: Ad news

Morgan Stanley forecasts 2.1 % revenue to fall of global tech players in Australia in the current downturn but not as severe as that of domestic media- radio, outdoor, print, and TV. On the other side, the revenue of the domestic media players will see a drop of steep 22.1%

However, the analysts believe that global players will lift their market share in advertising in Australia. For instance, Google Australia’s gross revenue was $4.8 billion in 2019. Morgan Stanley estimates a 4% decline this year owing to the ad industry slow down but expects to rise 13% year-on-year growth up to 4 years to reach between $7 billion and $8 billion in ad revenue a year in 2024.

Analysts say,

“Eventually, COVID-19 will be over and there will be a cyclical recovery in the Australian economy, and a bounce-back in the advertising cycle. ”

He further added that the market will be disappointed in expecting a rise in domestic media earnings.

“Even post COVID-19, when the overall advertising market stabilizes and starts to improve, we think the magnitude of the recovery will disappoint investors.”

“Our point of difference is our thesis … that if the global tech players continue to grow revenue double digits in Australia, but the total pool of ad revenues is only increasing 2% to 3% p.a., there is necessarily a ‘crowding out’ of ad spend left for domestic media companies to pursue.”

The markets underestimate the risks to ad revenue, profit margins, and ROCE(Return on equity) from a 5-year long term view. The main reason for the global tech giants growing faster than local media is structural changes. ‘Necessity is the mother of invention’ and businesses that continue with traditional media platforms for advertising need to change and rethink their strategy.

The analysts in the report mentioned that

“The consistent industry feedback we receive is the current challenges facing large, small and medium-sized businesses across Australia is prompting leadership and management teams to think harder and deeper about becoming more digital,”

Many SMEs have tried marketing on digital platforms for the first time during COVID 19 as consumer behavior and time spent has changed and accelerated towards digital/online/mobile media. It is expected that the same pivot will exist with the advertising budgets.

Unfortunately, the crowding of traditional media- radio, outdoor, TV, print – is set to be more intense.

Image Credit: Adnews

Morgan Stanley continues to have an underweight rating for ASX media companies like Seven West Media, WPP AUNZ, oOh! media and Southern Cross but Nine Entertainment.

Nine Entertainment (NEC)is an exception due to its various revenue sources like digital subscription, streaming, and digital advertising assets. Analysts believe that some Australian media companies have the potential to reinvent themselves and develop digital businesses and NEC has demonstrated the ability for such a reinvention.

The global players may face a threat if they fail to innovate themselves and will lose their consumer share and ad share.

Let’s Understand The Vendor Landscape Of Identity Resolution Platforms.

What is the Identity Resolution Platform?

Present-day, marketers are facing immense challenges to keep a record of their customers. Due to the increase in the number of smart devices per user, it’s getting hard to track users activity. These days each user or consumer is using at least two to three smart devices for their usage. These smart devices include mobile phones, smart television, laptop, desktop, smartwatch etc.

To make sure the user gets the best user experience and user interface, marketers must keep a track of its users’ habits and path on the internet. Marketers and brands use Identity Resolution Platforms to resolve this issue.

These platforms keep a track of user habits with the help of their IP, MAC, phone number, email, cookies etc. Therefore, with the help of these platforms marketers and brands can provide better-personalized services to their customers.

Vendors of Identity Platforms provide services to a wide range of organizations. The consumer of their services can range from a giant(Pvt. Ltd.) company to budding Startups.

Business Identity resolution platform market is filled with large data-firms, credit reporting companies and many pure-play platforms. Identity resolution platform skill in the market community is provided by coincidence, and not by choice or a stand-alone feature.

The biggest boom in the Identity resolution platform came between the years 2017-2018. During these times, four vendors collected an approximate Of $40 million with 6 sponsorships.

However, in 2019 and 2020(first-quarter), vendors were gearing-up, by adding new features and integrating those features to their Identity resolution platform capabilities. Therefore, the financial graph was low as compared to 2017-2018.

Image credit – martechtoday.

However, LiveRamp, an identity resolution platform, in 2019 was growing fast and doing Mergers and acquisitions. It purchased an authorization administration platform “Faktor” in the month of May. However, LiveRamp never disclosed the purchase amount

In the month of June, it acquired another firm “Data Plus Math”. Data Plus Math is a T.V promotion calculation firm. LiveRamp paid $150 million for the purchase of “Data plus Math”.

Dentsu Aegis Network acquired 4Cite Marketing in January 2020. 4Cite Marketing is a technology developer-centric to the identity of people.

Image credit -martechtoday.

Experian, Oracle and LiveRamp, all public-owned companies are giants in the field of Identity resolution. However, Merkle, Valassis, Neustar and Acxiom are either owned by worldwide agencies or by private equity enterprise.

There are private owned start-ups related to pure-play identity resolution which are using venture capital stakes to enhance their marketing platform. These companies include FullContact, SmarterHQ, Signal, Throtle, and Infutor. They are small in staffing and structure. They use this fund to further enhance their staffing and do R&Ds.

Image credit – martechtoday.

CarryMinati Effect Continues To Haunt TikTok Ratings.

Quite recently, the TikTok rating has taken a deep dip on Google play store. This happened after millions of its users starting filing reports and providing poor rating to the application.

Currently, TikTok claims to have around 200 million users in India. TikTok states that around 120 million of the users are active on the application.

A report by SenseTower in September 2019 stated that around 60 million people downloaded TikTok in a single month. This number sets a record of the maximum number of downloads.

Image credit – Sensor report.

Around 40% of this share was contributed by Indians.

So, What exactly went wrong? Why all of a sudden TikTok rating fell on Google Play store?

The rage against TikTok started when a meme started surfacing on the internet. The meme showed a statement released by the owner and CEO of TikTok, Kevin Mayer stated the following:

“I created the TikTok for jobless people, I didn’t know India had so many of them.”

Image credit – Twitter

All social media platforms started flooding with meme templates portraying the statement. Several people across India started requesting people to ban the use of TikTok. #bycottTikTok started trending on Twitter.

Image Credit – Twitter.

Since no authenticity of this news was proved, TikTok had not suffered much damage to its userbase. Still, there was a division in society who wanted this software to banned in India.

However, people soon got the opportunity to express their anger for this platform. A certain Group on TikTok community calling themselves “Nawabs” started a dispute by stating that people on TikTok are more hard-working and efficient than people on YouTube. They also stated that TikTok is a better platform for video upload.

Image Credit – Techbugs

To provoke the debate, TikTok star (Amir Siddiqui) created a YouTube video. He named this video as TikTok vs YouTube and asked YouTubers to step up to this war.

This started a speech war between this group on TikTok and a few people on YouTube.

They started mocking each other in their videos. Elvis Yadav was the first YouTuber to step up to the challenge.

Soon another video surfaced on YouTube made by a YouTuber named CarryMinati(Ajey Nagar). In this video, the YouTube channel host used a lot of creative ways to defame TikTok star Amir Siddique and his fellow group members. The video received a great response from his viewers and people started sharing it across other social networking platforms.

Also, people started creating memes on TikTok star Amir, to show their support for YouTubers and CarryMinati.

Image credit – StrictlyForMen.

In just four to five days this video by CarryMinati gained a lot of popularity on the internet. It became the most viewed video in India. However, YouTube decided to bring down the video as the content of the video was reported to be filled with profanity and hate speeches.

The video was still increasing in its views and likes and sudden removal of it from YouTube started a whole new revolution. People started reporting TikTok on their mobile phones and requested others to do the same.

Many fellow YouTubers and Bollywood celebrities showed their support towards CarryMinati and started uninstalling TikTok from their phone devices.

Image credit – Instagram

Within days, millions of users reported TikTok. They started rating it with 1-star reviews. This resulted in the downfall of TikTok rating from 4.6 to 1.2 on Google play store. Recently Google deleted around 1.5 million reviews and comments from TikTok.

Image credit – Republicworld

While all this was going on, another video surfaced on the TikTok.

This video was made by Faisal Siddiqui brother of Amir Siddiqui. In this video, Faisal can be seen throwing a liquid substance on a girl’s face. Reportedly he was supporting acid attacks on females.

This video was reported to the authorities and the National Commission for Women filed a complaint against the user with TikTok.

After this incident, TikTok banned the accounts of Faisal and Amir Siddiqui. Both are brothers and member of Nawab community on TikTok. Even before these incidents, several complaints were filed against them for spreading hate speech via their videos. Millions of people were following their accounts on this platform.

According to TikTok Asia-Pacific office, they don’t allow any such content which is a threat to the security of an Individual. Their policies are strict against Physical harm of violence against women.

However, so many other cases have been reported earlier well where TikTok has been reported to spread hate speeches in the community or religion.

A One-stop Guide On All You Ever Need To Know About AdTech In 2020

AdTech or Advertising Technology did around $800 Billion Worth Of Business In the US alone in 2019, making it one of the fastest-growing industries in the world.

Are you trying to understand ad tech? Just as advertising is the business of making advertisements, ad tech is the business of using technology to make advertisements faster, quicker, and efficient. The business is driven by powerful algorithms and data points. While it is not rocket science, but for the uninitiated, it can be challenging to understand what is ad tech and how its product and services work.

The ad tech industry fuels the global economy with big investments, employment, and ad spend. Digital advertising has reached new heights of complexity, with the rise of programmatic advertising, AI, and automated interactions between computer systems reducing human intervention. Today’s omnichannel ad campaigns reaching to different platforms all at once from publishers’ websites, mobile apps, social media to search engines. Campaigns using tailor-made and highly targeted ads to reach audiences. This process involves many participants- advertisers, publishers to third-party vendors. The technology used in advertising to store, manage, and deploy data is far more sophisticated.

This guide will give you a sneak-peek into the world of technological advertising and understand the growing ad tech industry. As you read further, you will understand the ever-changing ad tech ecosystem.

What is Ad Tech?

Ad Tech also is known as Advertising Technology covers a range of tools and software that can be helpful for brands and agencies to plan, strategize, and manage all digital advertising activities.

The AdTech ecosystem consists of two major entities – the advertiser (Demand-side) and the publisher(Supply-side).

On one hand, advertisers want to run effective campaigns and optimize their budgets to reach the target audience, gain customer insights, and measure ROI.

Whereas, on the other hand, publishers cater to the need of advertisers and generate revenue through ads by displaying ads on their publications like websites, apps, etc, increase ad impressions, bids for ad slots and visitor insights. These are significant factors that publishers need to consider to maintain the platform User Interface (UI).

Adtech helps advertisers and publishers achieve their goals in harmony by providing solutions that meet the demands of both parties. A few examples of AdTech platforms include Pubmatic, Adroll, MediaMath, SmartyAds, and many more.

Image Credit: MarTech Advisor

Programmatic Advertising Explained

After a brief understanding of ad tech, let’s step into the world of programmatic. You will come across concepts like programmatic advertising, Real-time bidding, and programmatic direct. Let’s discuss it:

Image Credit: Martech Advisor

- Programmatic Advertising Definition:

It is projected to be the game-changer for digital advertising. Programmatic automates the process of buying and selling online advertising space with the help of technology and data. This means, with the introduction of programmatic publishers, advertisers or agencies don’t have to sit across to discuss ad size, rates, et. Ad buying is done through algorithms and data insights.

- Programmatic Direct:

This a type of Programmatic digital advertising, where a publisher bypasses auction and reserves a portion or entire ad inventory for a particular buyer or advertiser at a fixed cost per mile. (CPM). Put simple, here the buyer and seller are known to each other and the ad placement is done programmatically.

- Real-Time Bidding (RTB):

Another type of programmatic digital advertising and also known as an open auction. RTB is when inventory prices are decided through an auction in real-time and open to both advertisers and publishers. This is the most feasible and preferable method of programmatic ad-buying because of scalability and flexibility.

The AdTech EcoSystem

Image Credit: Martech Advisor

The process of digital media buying is similar to the traditional media value chain except AdTech has multiple components in the ecosystem to keep the management of advertising campaigns easy for demand and supply-side platforms. Here are the key components of the AdTech supply chain:

1.Media agency: Responsible to allocate the advertiser’s expenditure budget across the channel. It is not involved in the creative aspect of ad campaigns.

2.Agency Trading Desk (ATD): Plans, buys, and manages ads across different platforms and is a set of services provided by the media agency.

3.Demand-side Platform (DSP): An essential platform for advertisers to buy, search, display video mobile ads. It enables advertisers to buy ad placements in real-time on the publisher websites made available by ad exchange and networks. Some of the DSP players are Simplifi, Smarty Ads, App Nexus, Double Click, and more.

4.Data Management Platform (DMP): DMP’s collect data from sources like websites, apps, social networks, campaigns, CRM’s, and more. Using AI and big data analytics to gather first and third-party data, advertisers, and marketers rely on them. DMP players are Lotame, Oracle Blue Kai, SAS data management and more

5.Ad Networks: The unsold inventory will be bought by ad networks from publishers and try to sell to advertisers using their technology. The popular programmatic advertising platforms for the ad networks are Taboola, Google Double Click Ad Exchange, Rocket Fuel, and more.

6.Ad Exchange: A dynamic platform to buy and sell ad impressions between advertisers and publishers without any intermediaries. Open X, App Nexus, Rubicon Project Exchange are examples of programmatic advertising platforms.

7.Supply Side Platform (SSP): The platform allows publishers to sell display, mobile ad impressions to potential buyers in real-time. Some of the key SSP players are MoPub, AerServ, App Nexus Publisher SSP, and more.

8.Ad Server: This platform is used by advertisers, publishers, ad networks, and ad agencies to run their campaigns. It determines which ad will be displayed on a website and also collect ad performances data such as clicks and impressions Double click for publishers, OPen X Ad server, Ad butler, and more are the examples.

Learn more: Programmatic Advertising Platforms in 2020: A Complete Guide

Is Programmatic advertising worth it?

The programmatic advertising statistics say it all. According to Zenith’s Programmatic Marketing Forecasts 2019, 69% of digital media will be programmatic in 2020.

- The total amount spent programmatically will exceed US$100bn for the first time in 2019, reaching US$106bn by the end of the year, and will rise to US$127bn in 2020 and US$147bn in 2021.

- 72% of digital media will be programmatic in 2021

- Ad spends growth is slowing down to 22% in 2019 due to industry challenges of privacy and supply-chain.

- Brands need to develop new targeting techniques using first-party data and customer data platforms in response to the ongoing death of the cookie.

Programmatic Display Advertising fastest-growing segment.

- The ascent of programmatic display advertising has been rapid. In 2012, only 10.4 % of global digital display spend was programmatic. However, it ballooned to 65.3% in 2019 and it is estimated that the share of programmatic display advertising will grow 69.2 5 and 72% in 2020 and 2021 respectively.

- How does it translate in dollars? In 2012, total digital ad spend was $37.8 billion and the programmatic display market was $3.9 million. Fast forward to today, digital display ad spend is $162.3 billion, out of which $106 billion is invested in programmatic display advertising. In 2021, global digital display ad spend is estimated to reach $204 billion, with $147.1 billion going to be programmatic share.

Image Credit: Marketing Charts

Programmatic marketing by country

One of the benefits of programmatic technology is it shows real-time data that helps companies take swift actions to adjust their strategy as per customer requirements. Digital marketers are considering buying programmatic media in-house due to its transparency. Programmatic has undergone massive growth in the following 6 countries out of which the UK and the US are the most advanced programmatic markets in the share of digital media.

Image Credit: Marketing Profs

As per eMarketer forecast, Programmatic ad spending will reach $59.45 billion in 2019, accounting for 84.9% of the US digital display ad market. It is estimated that 87.5%, or $81 billion, of all US digital display advertisements, will be bought via automated channels in 2021.

Image Credit: eMarketer

The above programmatic advertising statistics prove that the investment has increased Y-o-Y and marketers prefer programmatic advertising to buy digital display ads. Marketers are increasingly allocating their advertising budgets to digital advertising channels as it provides precise data that helps to reach customers effectively.

Learn more: 5 Programmatic Advertising Case Studies That Yielded Exponential Results

Artificial Intelligence can be leveraged in AdTech Industry

Artificial Intelligence(AI) and Machine Learning (ML) are two buzzwords in recent times. And why not, as it brings efficiency in whatever we do.

However, AdTech is a messy market now. Ironically, the good and bad part of AdTech is the abundance of data. True, we certainly have all the information to better understand the customers but most marketers aren’t aware of how to leverage the data and use it forward.

The way you advertise-is going to change extremely right before your eyes- thanks to Artificial Intelligence. Not all in the AdTech world have the analytical skills to evaluate the big data as not many are trained to use it and are misinterpreting them.

Adtech partnering with AI can help lower CPC prices, higher click-through rates (CTR), conversions, and better ROI. Let’s check out how AI can help the Adtech industry find better solutions in the following areas.

- AI in Ads Positioning

Developers don’t need to sit and determine which ad position will drive maximum revenue for the website. With the help of AI, employing machine learning algorithms study historical data to find relevant ads for the targeted user group.

Adtech has not used heatmaps previously but AI algorithms use them to learn where the visitors on the website are going and present them with the relevant ads. AI will help marketers to find the best ad positions by studying the maps in detail.

- AI in Ad Network Selection

There are many Ad Networks that provide different kinds of ads to websites owners and required to sort ads according to the websites. This is called Ad mediation and apt to earn high revenue for the websites.

By employing AI for ad optimization it reduces human effort by using a data-oriented approach that includes data, facts, and intelligence to make sure only relevant ads reach the end-user. Data will be user or website’s past history and facts will be website content, geo, and timing. Machine learning algorithms are employed to enhance the best ad-user match.

- Analytics

In the Adtech world, data analytics is not ‘taken seriously’ and publishers.are not happy about it. The AI-based approach will drive reporting and analytics to new levels.

Analytics will help publishers understand the content that drives the audience, placement of the CTA button to turn one time users into loyal users, and increase traffic. It will be a win-win situation for AdTech and parties- publishers, platforms, and users.

AI is the Future of Advertising

Today, digital advertising cannot exist without AI. Behind most online ads are the sophisticated delivery systems in place powered by AI. These systems place the ads before users, the coordination process happens in real-time and generally is automatic. It’s called programmatic advertising.’

According to eMarketer, 86.2% of all digital display ads will be bought via automated channels and nearly $19 billion in additional spending will enter programmatic display platforms between 2018-2020.

Also, 90% of mobile display ads are bought programmatically. On the other hand, AI also powers advertising products offered by Facebook and Google. In 2017, 90% of the new advertising business was captured by these firms.

In recent times, brands are under more pressure to deliver relevant, personalized, and contextual ads to individual customer preferences.

How AI makes Programmatic Advertising better

More companies are turning to AI for creating advertising relevance at scale.

For instance, if you want to advertise on Facebook,-an AI-powered algorithm determines the relevance of the score of your ad. This means that the score impacts the ad delivery directly and influenced by the experience of the ad delivery to Facebook users. Expect a low score if the ad is not liked or is irrelevant.

This decision is made by machine and is beyond your brand’s control independent of strategic or creative decisions

A marketing company like Phrasee launched an AI tool that writes Facebook and Instagram ads. The AI tool assesses a brand’s voice and copy, then the machine writes the ad that performs better than human-written ads. Recently, it helped reduce one client’s cost per lead by 31%. Another AI-powered tool is Albert that helps automate media buying, testing, and optimization. It enhances ad performance and delivers relevant ads to the right person. This shows that relevance at scale is possible in advertising.

Emerging Programmatic AdTech Trends 2020

Image Credit: MarketingToolbox

1. AI in Programmatic Advertising:

Technologies such as artificial intelligence(AI) and machine learning (ML)have involved programmatic ad buying or bid optimization. Programmatic campaigns are used by companies for more targeted net across platforms. By 2020, it is expected that there will be a shift towards automating technologies like AI and ML to get the most from data.

2. First Part Data Move Made Important by GDPR:

After the announcement of the General Data Protection Regulation (GDPR) in Europe, last year on cookie crumble or removal of third party cookies is gradually turning out to be beneficial. The regulations protecting the privacy of user data initially looked limiting to ad tech experts but is resulting in cleaner and more reliable data over time.

Learn more: Digital Advertising Industry Plans To Replace Cookies With First-Party Data

3. Digital Out Of Home (DOOH) and Mobile Location:

Digital DOOH combined with mobile location data has the potential to help marketers to drive conversions in the offline world. Integrated ‘home-to-out-of-home’ programmatic advertising approach provides a smooth experience to the customers.

4. Voice-activated Ads:

The adoption of voice-based to in-home smart devices has grown rapidly. Gartner predicted by 2020, 30% of web browsing sessions will be done through voice-first browsing. Amazon sold over 100 million Alexa-enabled devices in 2018 compared to 2017. A recent survey by VoiceBot.AI revealed 25% of respondents orders everyday household items through voice assistants followed by apparel and games and entertainment.

Programmatic advertising helps marketers to optimize these ad spaces across in-home smart devices, to on-app audio ad opportunities, and connect to consumers through in-store ads, ads in elevators and taxis, and more.

5. Wearables will enhance programmatic advertising:

Wearables collect data on location, lifestyle, health metrics, and more. The market penetration of smartwatches has grown multifold over the years and programmatic advertising is already making its way into this medium. For instance, it helps advertisers run banner promos to customers on their Samsung or Sony smartwatches. The wearable ecosystem has a huge potential to grow and programmatic adtech can bring greater opportunities.

6. 5G in programmatic advertising:

The high speed and no buffering will encourage the rise of more users to spend time on videos on mobile devices. It will enhance other technologies such as AR-enabled ad displays, VR without headsets, and innovative new digital outdoor mediums.

This will give programmatic advertising new opportunities to run more interactive ads without any lags across mediums. By 2024, the use of 5G in AdTech is predicted to grow to 1.4 billion.

7. Evolution of Personalization:

With Gen Z and Millennials- the biggest demographics -personalization is a priority as they like all things customized. Personalization in advertising is going to be inevitable as the choices of the new generation are different. Therefore, programmatic customization by advertisers is increasing offering personalized, relevant messaging to their target group.

8. Blockchains and Ads.xt:

Ad frauds are increasing over the past few years. A cybersecurity firm Cheq reports that ad fraud damages will touch $26 billion in 2020, $29 billion by 2021, and $32 billion the year after that.

The only way to handle the frauds is by bringing transparency in programmatic advertising. Blockchain and Ads.txt (an Interactive Advertising Bureau initiative – Authorized Digital Sellers) can help to remove unrequired middleman, domain spoofing, and verification of publishers and allow transactions using cryptocurrencies.

Learn More: Advertisers Look For Greater Transparency In Programmatic Ad Buying

9. Programmatic TV, podcasts and audio Ads set to grow:

The content on TV has changed drastically. There is a paradigm shift in TV viewing from cable TV to over-the-top(OTT) like Amazon Prime or Netflix via an internet connection.

Programmatic advertising has a larger role to play to ensure marketers get the best of both worlds. Programmatic TV is also going to get more important with its data-driven approach for buying and delivering ads.

Programmatic in podcasts and audio advertising is also growing. Apps like Spotify and Soundcloud are seeing more user acceptance and a new advertising landscape is being created for companies to monetize on.

10. Omnichannel Programmatic:

Forrester defines omnichannel marketing as ‘the practice of digitally sequencing advertising across channels, which is connected, relevant, and consistent with the customer’s stage in their life cycle.’ This is how programmatic advertising is going to be in 2020 and beyond.

A single marketing resource or an ad can be customized programmatically suiting various platforms through programmatic AdTech.

11. Agencies to work on outcome-based pay:

Discussions are making rounds to switch to an outcome-based remuneration model. With increasing ad frauds and agencies promise programmatic tech, advertisers fear how their budgets were used and where their ads placed. There was a lot of wastage in the space. Media buying companies started giving outcome-based remuneration more prominence. Gradually, advertisers would like to see the full cost chain of their programmatic buys, pushing agencies to outcome-based pay.

12. In House programmatic advertising v/s agency.

An IAB report suggests that nearly 40% executing programmatic trading via in house and 50% publishers also have an in-house model. This means advertisers are looking for more transparency, control of their ad strategies, and outcome.

It makes more sense to have an in-house team for strategizing programmatic ads and an agency partner for implementing parts of it instead of having a full-stack programmatic AdTech in house.

Wrapping up

Yes, Adtech is complicated but the best part is that it allows integrating the whole toolset into a single system. According to Zenith Media, the ad spends on digital media will reach $329 billion in 2021. However, there are major concerns and challenges -Ad Fraud, transparency, and privacy issues need immediate action.

There have been big changes and improvements over what advertisers and publishers used to have earlier but it still needs more work and their expertise to handle the challenges and resolve for good.

Facebook’s “Shop” Feature Breaks The Wall Between Social Media And Ecommerce

Facebook has recently launched an option of “Shops” on its social networking platform. This Will allow its 2.6 billion users an opportunity to shop while browsing through their favorite social networking website.

As the demand for the e-commerce market rises, Facebook sees this as an opportunity and is ready to cash more money. Facebook “Shops” will provide room to merchants, SMB, and product companies to build a virtual store on Facebook. Facebook is calling it “Social commerce”.

“We want to give people a place to experience the joy of shopping versus the chore of buying. And we want to help small businesses adapt and make it easier for people to discover and shop for things they love,” Facebook said in a press release.

To make things easy and secure, the products that will appear on Facebook and Instagram as the ad will not be linked to any third-party website or server. Instead, it will be linked to a zippy on the Facebook portal which will take the user to a catalogue from where the user can choose or purchase the product. It will also show the saved card details if the user has ever purchased from Facebook or any of its applications.

Image credit- Facebook.

Live shopping experience:

Facebook will also provide live shopping features on its platform. According to Facebook, People have always been showcasing their products in live videos. Now, they can link these products with their store. The products will appear on the bottom of their live feed. By tapping on the product on their screen users can get all the details of the product. Live shopping feature will be available worldwide to its users!

Image credit – Facebook.

Image Credit – Facebook

“Shops” will be an integral part of the Facebook family. Users can save products in their cart on Facebook, and complete the checkout process on Instagram, or vice-versa. Facebook aims to target small vendors for his aspirations, and nearly 1 million users have registered to be a part of this experiment.

The other principal dissimilarity from past commerce enterprise is that Facebook “required the small businesses to go all-in on our tools,” Zuckerberg said.

The platform is free for everyone and Facebook is partnering with other tech giants to provide services at the back-end.

Image credit – Facebook.

Zuckerberg further stated, “Rather than charge for Shops, we know if it’s valuable they’ll want to bid more for ads.”

One of the key partnership deals is made with “Shopify”, According to Facebook, in just a few clicks you can operate a Facebook shops account from Shopify.

Shopify founder and CEO Tobi Lutke said, “It’s an incredible new reality in the retail space to have these tools natively in the Facebook platform,” he further mentioned, for small businesses it’s very crucial to find new customers.

CEO Tobi Lutke added, “Communications is incredibly important, for so long that’s been monopolized by large CPG brands on television.”

According to him instead of going to different levels of media and advertisement, sellers will be able to reach directly to the customer. “The DTC industry, as some people call it, really happened on top of Facebook and Shopify.”

With Facebook focusing more on small scale businesses adding Shopify having the strength of entrepreneurs, the model looks like a rival of Etsy and doesn’t seem to target retail chains like Target.

Image credit – Facebook.

According to the Zukerberg and Lutke analysis, this model will help to empower small-scale businesses. Helping those sellers who are genuine, and want to provide efficient services to their customers. The model will help small businesses to highlight their product in the market without expensive advertising. As most of the small scale businesses can’t afford the luxury of advertisement.

Image credit -Facebook

The users will also be able to earn rewards for their purchase. Rewards will be known as loyalty points. Facebook will motivate the sellers to provide these points to the customer on their purchase. This will help them to lure more customers. Users will be able to easily keep track of their loyalty points.

TikTok Appoints Former Disney Chairman As New CEO To Capture New Markets.

- Disney veteran Kevin Mayers who oversaw the launches of Disney+ and ESPN+ is leaving the company after 27 years to become the new CEO of TikTok.

- Mayer will take the lead on ByteDance’s music, gaming, and emerging business along with heading TikTok.

- Mayer will start on June 1 and report directly to Bytedance CEO Yiming Zhang.

- TikTok had an immense impact on the music industry and grabbing eyeballs of gaming and esports companies.

TikTok appoints Kevin Mayer as the new CEO after being poached from Disney. Kevin Mayer who was passed over for the Disney CEO role is taking a jump from the entertainment industry’s most esteemed names to one of its most dynamic new arrival.

TikTok’s new CEO plans to explore business opportunities in music and gaming as the company looks to capitalize on a recent increase in app downloads. Mayer, head of The Walt Disney Company’s direct-to-consumer and international business said in a statement,

“I’m thrilled to have the opportunity to join the amazing team at ByteDance. Like everyone else, I’ve been impressed watching the company build something incredibly rare in TikTok – a creative, positive online global community – and I’m excited to help lead the next phase of ByteDance’s journey as the company continues to expand its breadth of products across every region of the world.”

Advertisers and brands taking advantage of music trends

TikTok is a significant player in the music industry for discovering new artists and making songs to hit status. The platform contributed to the grand success of Lil Nas X’s record-breaking “Old Town Road” and more recently with chart-toppers like Doja Cat’s “Say So” and Megan thee Stallion’s “Savage,” which are all featured in the TikTok videos.

Advertisers have found new ways to use TikTok music and dance trends to their advantage in order to drive brand awareness among the Gen Z audience. Brands like e.l.f. Cosmetics and Warner Bros. have used original music and dance challenges to attract the audience and generate billions of views and user engagement on the app. As quoted by Business Insider, Evan Horowitz, CEO of the creative agency Movers+Shakers said,

“I think the nature of TikTok as a platform is that it’s one. It’s only natural that brands that create really good music.that the community on TikTok really resonate with, that music can start to trend and be successful outside of the platform.”

Gaming and esports companies jumping onto the bandwagon

Video games companies and esports brands have shown keen interest in the TikTok app as it continues to be popular among Gen Z users of the app.

Many esports brands like FaZe Clan, Team SoloMid (TSM), and 100 Thieves have officially created verified accounts whereas video game content is slowly taking up TikTok’s content recommendation landing page (ForYou). It’s too early for gaming creators on the platform even though esports companies are slowly and carefully exploring TikTok in recent months. Jason Wilhelm, CEO of TalentX Gaming told Business Insider,

“For TikTok, they haven’t really found what is the best way forward for gaming yet. You need a lot of requirements in order to stream video games. TikTok obviously is not set up for that right now, but that is something that we’re going to be figuring out.”

TikTok has seen a significant surge in users since the pandemic hit U.S – 315 million downloads across the iOS and android app stores in 2020 Q1, that’s the most download for one app in a single quarter as per mobile data analysis group Sensor Tower.

Also read: YouTube Shorts: Will it be Able to Capture Tik Tok’s Audience?

Financial Report Card Of The Global Giants And Industries In COVID-19

Media companies are facing distress owing to the pandemic crisis, particularly those relying on advertising revenue. The current situation is precarious that compelled companies to roll out furloughs, pay cuts, or layoffs.

Even though publishers are recording high traffic, there is a mismatch in demand and supply in the ad market. Subscriptions are a silver lining for publishers but again sustainability is in question. Many businesses are impacted due to cancelled live events like sports that would bring a vast sum of revenue. Newsstands sales have also witnessed a fall.

Keeping the above factors in mind, below is the analysis of leading media companies’ financial and quarterly reports and their progress in this crisis.

CONGLOMERATES

Bertelsmann: Ad funded businesses were affected while music, services, and education business performed well.

The German media conglomerate Bertelsmann’s revenue declined by 2.7%. The advertising-funded business Q 1 was “highly affected” by the pandemic. Within the digital business RTL Group specifically, the revenue was down 3.4 % owing to the cancellation of ad bookings at the start of March or postponement of productions.

Music business BMG, its Arvato services business and its education business performed well. Subscription to the online streaming services was up 34% Y-o-Y.

Comcast/NBCUniversal: Broadband business upticks whereas rolling out Peacock streaming service.

Comcast is a large company with its broadband business marks an uptick with signups. and revenues up by8.8%. On the other hand, its theme park, TV and film production business is on hold.

NBCUniversal and newly acquired Sky TV cannot broadcast live sports. The company expects the advertising business to be down significantly in Q2

NBCUniversal Q1 revenue was down 7% and it rolled out ad-supported Peacock streaming service to Comcast customers in April.

Disney: Theme Parks and Sports Broadcast Shut, Disney+ subscribers up.

The crisis led to shutting down of theme parks, and productions and theatre movie releases were put to hold. Ad revenue at its TV business was affected as ESPN couldn’t air any live sports.

However, it stepped up the launch of ad-free streaming service in European countries. Disney+ had 33.5 million subscribers by the end of Q1 and an average of $5.63 in monthly revenue per paid user. Disneyland Shanghai did reopen, at 30% capacity on May 11.

WarnerMedia (owned by AT&T): Q1 Revenues severely hit.

Recently, folded its Xandr advanced advertising unit into a bigger WarnerMedia business.

Q1 revenues of WarnerMedia was down 12% on the year-ago quarter to $7.4 billion due to lower ad revenues in March on sports cancellations. Movie productions are also on hold.

PUBLISHERS

News Corp: Circulation and Subscription revenue grows, Ad revenue takes a hit.

Rupert Murdoch’s News Corp includes various leading and established brands like The Wall Street Journal, The Sun, and many more in U.S, U.K, and Australia.

Overall revenue declined 7.8% to $2.27 billion in Q1 due to weak ad business, low ad revenues, and negative currency movements. April ad revenue for Dow Jones declined 20% from the prior year whereas for News Corp Australia and News UK fell by more than 45% which includes negative currency impact.

The Wall Street Journal reported circulation and subscription revenue growth by 1% reaching a record subscriber base of 3 million overall, of which 2.2 million are digital-only.

The New York Times: Focus on Subscription Revenue to thrive in the post coronavirus world.

The NYT is leading more emphasis on subscription revenues to reduce its dependency on ad revenue to be in a better position and thrive post coronavirus world.

NYT recorded the highest quarterly increase in new digital-only subscriptions-up 587,000 in Q1 -leading to a 5.4% increase in subscription revenue to $285.4 million. Ad revenue fell by 15% and likely to fall further in Q2 somewhere between 50% and 55%.

“Other revenues” segment is estimated to fall around 10% as licensing revenue from Facebook News is expected to be “more than offset”- by lower revenue from its live events and its TV series.

TV AND CABLE

Discovery: Their channels are new sports.

Discovery CEO David Zaslav on the Q1 earnings call said, “Our channels are the new sports — the numbers are huge” around its lifestyle channels like HGTV, Food Network, and DIY. The engagement with the characters and talent is enormous. Discovery is also saving money productions through the pandemic as the film shows from home.

Total revenue declined from 1£ in the first quarter to $2.68 billion and expects advertising revenue to fall significantly in 2020. Many sports events are postponed and 90% of the sports deals have force majeure provisions or provisions to not pay for the content that is not received.

Fox: Fox News gains the largest audience.

Revenue for the three months to March 31 rose 25% supported by the forecast of Super Bowl in February, an increase in political advertising, and growth in affiliate revenue. But in March entered coronavirus crisis leading to the postponement of sports events and suspensions of entertainment shows.

80% who signed up for Fox Nation streaming service from Fox news continued to become paying subscribers and advertisers from sectors like technology and communications looked for the transition from sports buy to news buy. Ad revenue within local TV stations to be down 50% from last year.

ViacomCBS: Streaming revenue continues to grow and more on its way441.2 b

Revenue for Q1 fell 6% to $6.67 billion of which advertising revenue marked a 19% drop though a comparison to last year would be unfair when it aired Super bowl and basketball tournament.

Streaming continues to grow- domestic and digital revenue up by 51% to $471 million and had 13.5 million streaming subscribers. It intends to build “a broad pay streaming product in multiple markets” over the next 12 months. It announced a distribution deal with YouTube TV, which will carry 14 ViacomCBS channels

DIGITAL GIANTS

Alphabet or Google: Faring well in this crisis and a better situation.

Q1 revenue stood at $41.2 billion, up 13% Y-o-Y basis(including Google cloud revenue and the ‘other bets’ segment).

According to CFO Ruth Porat, Youtube’s March revenue “decelerated to a year-on-year growth rate in the high single digits” and Google Network March revenue declined “in the low double digits.”

Google Cuts Marketing Budgets by 50%, Freezes Hiring, and launched a “Journalism Emergency Relief Fund”.

Baidu: A closer watch on the signs of recovery in the upcoming result.

Chinese advertising giant Baidu was the first to report the coronavirus crisis set to affect media companies and expect a revenue drop of between 5% and 13% due to advertiser pullback.

In April, it suspended updating content on certain newsfeed channels within its app due to government directives which may impact its marketing services revenue. On May 18, Baidu will give the next quarterly update, and would be worth watching whether there is any recovery in the ad business.

Amazon: The advertising business grew as directly related to eCommerce sales

Amazon’s Q1 revenue soared as consumers quickly shifted to shopping online amidst the coronavirus crisis. Conversely, revenue rose 26%, and profit dropped 29% compared to last year’s quarter. The cost grew to finish the surge in orders

In the financial statement, the ‘other’ category is advertising business- revenue grew by 40% to $3.9 billion in Q1. The growth is consistent with a little downward pressure in March but no major impact as its directly related to eCommerce sales. ‘

Facebook: Post Strong Earnings, Exceeds Projections

Facebook ad revenue grew by 17% Y-o-Y to $17.4 billion despite the instability in the digital ad market due to COVID-19.

Facebook saw strength in the advertiser’s vertical- gaming, technology, and e-commerce whereas travel and automotive were the weakest verticals in the first three weeks of March.

Facebook had Pledged $2M Grant Funding To Support Publishers Financially.

Snapchat: Users and Revenue Increases, ad spend declines

Snapchat reported in its Q1 2020 earnings – strong gains in both users and revenues but a dip in advertiser spend despite the growing concerns about the coronavirus pandemic. the company reported a 44 percent (Y-o-Y) increase in its first-quarter revenue to $462 million. Snap benefited as people used animated lenses to keep in touch with loved ones in this lockdown. Snapchat’s daily active user (DAV) base reached 229 million.

Direct-response advertising accounts for more than half of the company’s revenue and clients in sectors like gaming, e-commerce, and consumer packaged goods continue to spend even during the crisis.

Twitter: Work in progress over AdTech concerns

Twitter’s user growth jumped in March as people rushed to check the latest news updates related to the coronavirus. Despite a 9% growth in daily users, revenue was up only 2.6% to $807.6 million and reported a loss of 8.4 million in Q1 results.

In comparison to its competitors, Twitter doesn’t have a direct-response advertising business. Therefore, the company is improving its mobile application promotion products and rebuilding its ad server which is expected to be up and running by Q2.