Place Exchange Allows Audio Advertising In Grocery And Pharma Stores!

Through its collaboration with Quotient, a digital ad services platform for retailers, Place Exchange, an SSP for OOH inventory, said recently that it would begin allowing programmatic audio-based ad buys in grocery and pharmaceutical stores.

InStore Audio Network, which collects digital in-store audio messaging options among retailers in the United States, will provide the audio inventory. On a weekly basis, the network connects over 100 million customers through over 16,000 locations, including Albertsons, Safeway, Southeastern Grocers, CVS, and Rite Aid.

Interesting Read: AMC Networks Offers Programmatic Addressable Advertising On Linear TV

Norm Chait, director for out-of-home product and sales at Quotient, said-

“Unlike a lot of other formats, you wind up having a full-store experience regardless of the aisle you’re in, and you can reach people with some degree of frequency to drive home a purchase,”

Quotient’s DSP, which offers both self-serve and managed solutions, allows buyers to access the in-store audio material, which is offered on a CPM basis.

The advertisements may be targeted using segments obtained from Quotient’s proprietary data, which is collected from aggregated opted-in mobile device IDs that show where individuals are, what stores they visit, and what screens they pass.

Also Read: Connected TV Explained: The Essential Glossary Of CTV

The Impact of M&A deals in AdTech Amidst COVID-19 Pandemic

The year 2020 is facing global problems like pandemic, race riots, or recession. In the early days, many advertisers have pulled back in many areas because of the fear and uncertainty but surprisingly the projected slowdown on the ad spend is minimal, pointing towards a stable and steady growth in the future. The stock performance of adtech and mar-tech companies have performed well despite the crisis. Adtech is witnessing a consolidation phase but how effective will be dealmaking in this pandemic is the next obvious question. Read here to know more.

Image Credit: Adweek

Dealmaking In Pandemic

Luma Partners’ Terrence Kawaja, ad tech’s top investment banker pointed at Adweek’s NexTech 2020 Virtual Summit that dealmaking dropped to almost half in the pandemic where many of them were legacy deals which were already in pipeline pre-COVID. The dealmaking was substantially down in Q1 and Q2 and is expected to further reduce in the third quarter due to short-term lack of confidence owing to the current crisis. However, dealmaking activities have picked up again and will see more toward the end of 2020. Kawaja also said,

“Based on our pipeline and what we’re seeing in the marketplace, buyers are back in and looking for deals.”

Image Credit: Adweek

Where are we seeing these new activities coming from?

Kawaja provides key insights on a potential impending wave of industry consolidation and 5 market segments that are driving M&A deals – Connected TV, Identity, Mobile App, Audio, and what he termed ‘Programmatic End Game Consolidation’ and further elaborated on it.

1. Connected TVs: CTV is over a USD 100 billion market that is growing rapidly and by next year it will be 50% addressable. CTV viewing was up in the pandemic and there is a shift in consumer viewing from linear to streaming mainly due to the loss of live sports. USD 70 billion ad spend from linear is shifting towards OTT channels. Major companies are keen to take advantage of the changing scenario with the right technology. With an accelerated shift to streaming, CTV deal activities are picking up.

Image Credit: Adweek

2. Identity: The core to 360-degree marketing witnessed many privacy regulations and data restrictions from big tech like Google Chrome turning off cookie to Apple’s IDFA deprecation, presenting challenges like limiting targeting in the open-web and measurement. At the same time, there are opportunities like first-party data and resurgence of contextual targeting. Large companies position for privacy-centric data capabilities and predict strategic opportunities in consumer data deal activities.

3.Mobile App: Mobile advertising continues to take share with substantial gains over the last 5 years. A lot of in-app is driven by gaming. A spike in gaming will be witnessed during COVID with 1.2 billion weekly mobile game downloads with people having more time in hand in the lockdown. The latest challenge that companies are trying to sort out is the IDFA deprecation in the iOS 14 update. Deal activities will continue in mobile apps provided there are new opportunities.

Image Credit: Adweek

4. Audio: Podcast has undergone tremendous popularity in the last 5 years with 104 million monthly podcast listeners. The monetization has grown even faster and is still in the early years that has the potential to grow further. The rise in podcasting is driving many more audio deals. Many substantial deals have already happened mainly by Spotify and are expected to continue.

Image Credit: Adweek

5. Programmatic End Game Consolidation: Every industry goes through three generic phases: new company formation, maturity, plus rationalization and consolidation. However, in the adtech industry, the process is “on steroids”. Thousands of companies initially flood the adtech market with an abundance of venture capital and easy market entry, and with early successes follows a rush of IPO’s. Large consumer data companies take advantage of the large, matured, and growing market for scale and profitability. Kawaja says the net consolidation in ad tech started in 2015 and further adds,

“We’ve been on that rationalization push for the last five years.”

He sees this is the final phase -the end-game-of consolidation soon which will be accelerated by the pandemic which will get to fewer players with larger spend and lower-tech rates.

“This will clean the ecosystem with fewer players that are more sustainable with a better market cap. Consolidation on DSP side – Trade desk with 20 billion market cap is the evidence for the final phase.”

If his projection comes true then there will be some activities after a long pause in the deals. Following that, the M&A sprint is likely to exit the industry.

Read more: A One-stop Guide On All You Ever Need To Know About AdTech In 2020

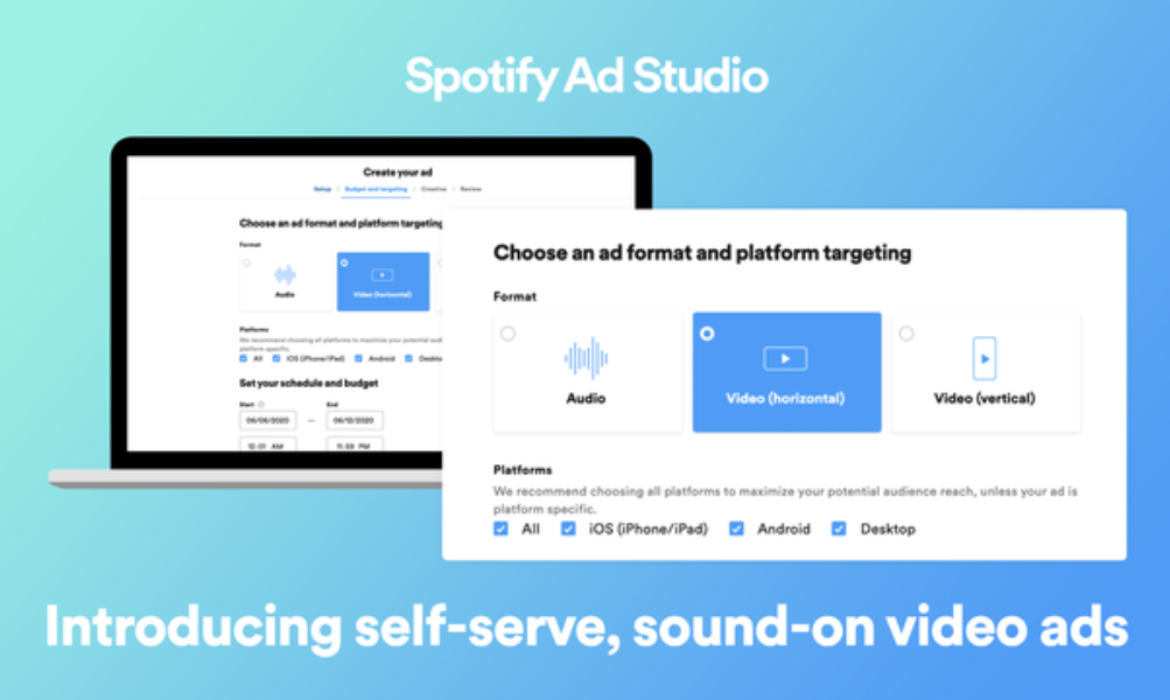

Making Video Campaigns on Spotify Is Now Easy with Sound-On Video Ads!

Key Insights:

- The Ad studio debuted in 2017 and thereafter Spotify has nearly doubled its user base.

- Spotify witnessed an 11% rise globally in mobile downloads.

- Spotify reports an average of 25% of overall ad revenue from video accounts.

- In the past one year, Spotify has witnessed a 68% increase of active advertisers, with double the ads running.

Spotify has announced video advertising on Ad studio, its self-serve platform, in Canada, the U.K, and the U.S. This update is available to select advertisers in the recently added test markets to Ad Studio in April.

The Ad Studio was created initially for small and medium-sized advertisers to connect with Spotify listeners and create budget-friendly, customized audio ads for the platform. In April, it had expanded to 18 more markets and exited the beta version.

Spotify Push into Video Ads can increase brand awareness and brand recall.

Spotify said that often users on other platforms prefer viewing video ads muted, however, Spotify listeners are’ engaging with their sounds on.’ Complimenting their audio ad offering, video ads will give brands a visual storytelling opportunity for the in-focus moments.

The streaming giant further notes that running video ads with audio produces higher brand results than going solely for video ads. Video ads with sound-on lead to 1.9x ad recall and 2.2x increase in brand awareness, according to the company data.

The company said in a statement,

“Unlike many other platforms, on Spotify, listeners are already engaging with their sound on, offering a valuable opportunity for a brand’s message to be seen and heard. This multisensory experience can extend a brand’s audio ad strategy, providing another touchpoint to capture listeners’ attention and share messages across all relevant moments.”

Rise in advertisers using Spotify Ad Studio’s creative perk

Ad studio that is available in 22 countries globally has leveled up the playing field in creative production by offering a free service to generate a brand’s ad spot. Advertiser on Spotify’s Ad Studio can upload a script and in as little as one hour (48 hours in some cases) they will deliver a fully produced ad that includes music and voice over.

The company said that 37% of Ad Studio customers rely on their free voiceover tool for ad creation. Additionally, 50% of its advertisers used this tool in May, which is an 11% rise from March.

Ad Studio offers two options of ad format for video ads- horizontal video and vertical video. Horizontal video can run across all platforms and vertical video is optimized for iOS and Android.

Image Credit: Adweek

Image Credit: Adweek

Why should brands advertise on Spotify?

The company reported recently that it has 286 million active users and 130 million paid subscribers. Spotify is the third-largest advertiser in the world after Facebook and Google.

Spotify Ad Studio enables brands to reach targeted and relevant customers. Their programmatic audio advertising is the best way to reach Gen X and beyond.

If you think ads may annoy the listeners of Spotify, think again. Statistics by Acquisio states, 75% of digital audio listeners think commercials are totally fine on a free streaming service. 47% think ads are even less intrusive on Spotify than traditional radio.

For instance, brands targeting the hip audience that are interested in current trends can consider advertising on Spotify. Advertisers can take advantage of the Spotify data of logged users like moods, preferences, listening habits, interests, and activities. This will help brands to create customized ads.

Learn more: Spotify Adds $1.7B To Market Cap In 23 Min Post A Deal With Joe Rogan, World’s Leading Podcaster.