How Donald Trump’s Executive Order Has Changed the Face of Social Media

Key Points:

- President Trump signed an executive order that aimed to scrap the legal protections conformed for social media.

- He is arguing that if social media companies seek protection from the fact that they cannot control what users post, then they shouldn’t intervene with those posts either.

The battle between Trump and Twitter finally came to a peak. President Trump signed an executive order to narrow legal protection to social media platforms that censors speech for ideological reasons.

Image Credit: Twitter

Strict action will be taken against Facebook, Twitter, Google, Youtube, and other platforms that interfere in direct communication with his followers. The orders give federal regulators the right to take action against online platforms if they are censoring free speech.

What it does

His executive orders call for greater scrutiny of social media platforms by limiting or revoking Section 230 of the Communications Decency Act, a piece of a 1996 law.

Section 230 is essential and made sense when it was first introduced when the internet was new. Section 230 gives protection to the digital world. In simple terms, if users post pictures or comments that are defamatory, the operator is not responsible for it but the user and actions will be taken against the user. Without Section 230, the internet that we know now wouldn’t exist. Twitter, Airbnb, Google, Facebook, Trip advisor all depend on this protection for their business. Every internet third party leverages Section 230 to mitigate risks.

Why it matters: The move comes just days after Twitter fact-checked and labeled two of President Trump’s tweet inaccurate.

Image Credit: Twitter

The tech giants move infuriated Trump and gave him a reason to execute his long time plan of reducing the liability of social media giants for content on their platform. Even though the idea of dismantling Section 230 is a threat to internet companies but many legal experts believe that it’s unlikely that the orders will have a practical impact on tech giants.

What changes with the order

Section 230 is an immunity to social media giants and protects them from being liable for the content billions of people post everyday.

- One of the repercussions of the order on the social media companies is stripping away the protections granted to them.

- It can be the death of an online review system that covers consumer products or services in travel, hotel, airlines, car, or others. For instance, Trip advisor boasts of 860 million reviews and could potentially be sued by U.S Federal courts for statements made by online critics if the protections are diluted.

- Social media platforms may either censor everything in the fear of getting sued that would undermine the freedom of speech as pointed out in the executive order.

- Or they might just not regulate or touch anything under the fear of getting sued, then the free speech problem will be out of control with no moderation.

- A troubling landscape for small and medium-sized media companies as they will not be able to afford staff and lawyer services leading to shut down.

- There will be no moderation over disruptive content like child exploitation over the fear of getting sued.

- Jeff Kosseff, who wrote a book about Section 230, says to Marketplace that we have no idea what the internet might look like without this regulation.

What are they saying

Facebook founder Mark Zuckerberg took a different tack and called out Twitter for its fact-checking and said they are not ‘arbiters of truth.’ the company will not get into any political fray.

Mr.Trump posted the same words on Facebook which has similar rules around voter suppression didn’t do anything to it. He said,

“We’ve been pretty clear on our policy that we think that it wouldn’t be right for us to do fact checks for politicians. I think in general, private companies probably shouldn’t be — or especially these platform companies — shouldn’t be in the position of doing that.”

However, the comments were met with derision from Twitter CEO Jack Dorsey, who replied to Zuckerberg tweet,

“This does not make us an ‘arbiter of truth. Our intention is to connect the dots of conflicting statements and show the information in dispute so people can judge for themselves. More transparency from us is critical so folks can clearly see the why behind our actions.”

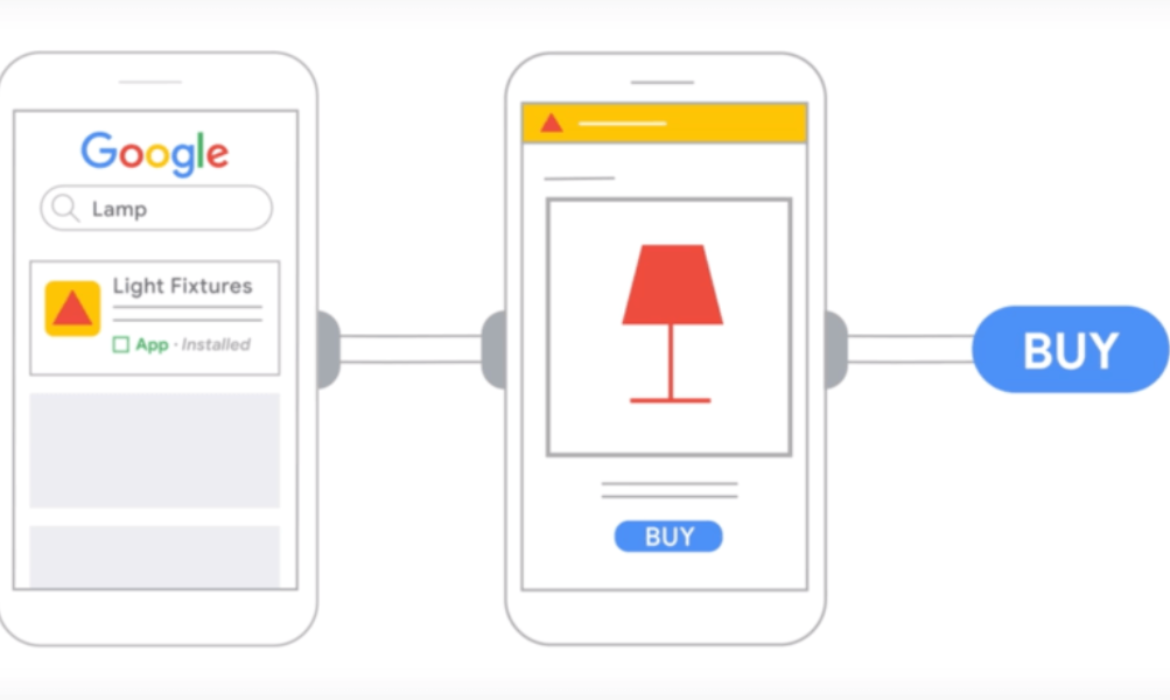

Google’s Native Advertising Solution- Discovery Competes With Facebook

Discovery ads for the UGG brand cover Discovery feed, Gmail, and Youtube.

Image credit: Google

Key Insights:

- Google is positioning Discovery ads as a better way to reach online shoppers.

- 86% of online consumers are on a lookout for shopping ideas as they watch videos or content across the web.

- 90% of users discover new products and brands on YouTube Watch Next.

- Discover reaches hundreds of millions of consumers using the Google Search App.

- One campaign overs three giant Google products- Discovery Feed, Gmail, and Youtube.

Last May, Google announced at Google Marketing Live that ads are coming to discover. As a part of that, the Google Discovery ads were previewed for the Android and iOS feed, as well as Gmail and YouTube, and they are now finally rolled out to all advertisers globally last month.

With a single campaign, advertisers can reach 2.9 billion users across multiple Google surfaces- YouTube Home and Watch Next feeds, Discover feed on the Google Search app, and in Gmail Promotion and Social tabs. This approach to audience totals is similar to Facebook who started reporting usage across its ‘family of apps’ last year. Facebook reported 2.99 billion monthly active people (MAP) as of March 31. In simple words, Google is offering reach on par with Facebook.

All ads feature visual-rich product photography and are labelled.

- YouTube: Ads include an interactive carousel format and appear as users scroll through the Home and Up next feed while looking for new videos.

- Discover: Ads appear along with sports and personalized updates. The feed is available on Android, iOS app, and mobile web at google.com.

- Gmail: As per Google, ‘time offer’ appears as shoppers are checking the latest product deals in the Promotion tab of their inbox and are marked with a green badge that appears on the top of the feed like an email.

Unlike search ads, no need to type the query manually but Google is leveraging its understanding of what customers are interested in.

Thanks to Google’s unique understanding of customer intent, you’ll be able to show more relevant, meaningful ads to people when they’re most interested and ready to learn more about your products and services.

Why should Advertisers use Discovery

Google recommends for advertisers looking for:

- Drive conversions with their media

- Reach new customers with their media.

- Reconnect with their valuable customers.

Early Adopters of Discovery Ads

Early adopters like Deckers, iProspect, and M&M Direct have seen excellent results-driving customer action with Discovery ads alongside their existing media.

Lifestyle apparel brand Deckers worked with digital agency Jellyfish to promote the UGG brand’s 2019 holiday guide using Discovery ads. Deckers used repurposed high-quality images from its social campaigns and saw a revenue return of 10 times of its original ad spend. It plans to implement Discovery ads across the rest of its portfolio including HOKA and Teva.

Michelle Hernandez, senior manager of Omni-digital marketing at Deckers said,

“While Discovery ads don’t appear on social platforms per se, they offer rich, visually engaging experiences filled with meaningful content that excites and inspires consumers as they scroll through new content on YouTube, Discover and Gmail. This is where more and more consumers are engaged and spending time.”

Head of Acquisition, MandM Direct on Discovery Ads

Image Credit: Google

In early 2019, digital marketing agency iProspect tested Discovery ads with several large clients and reported a reduction up to 48% in cost per action compared to social ads.

iProspect senior director of paid search Christina Malcolm said, “We’re finding that Discovery ads are an interesting ad type that blurs the lines between traditional search, display, and social activations, but which can target different audiences and hit conversion performance goals.”

If you have failed to notice the Discovery ads in the feed yet, then that’s because Google is treading lightly. Currently, there is only one ad slot – in position three-on the Discover feed as Google is aiming high-quality bar and only showing the ads with best image assets that are relevant to users. However, the company also confirmed that more ads are likely to be rolled out.

How to get started with Discovery campaigns

Image Credit: Search Engine Land

Discovery ads are set up in Discovery campaigns with two ad formats: Discovery carousel ads with multiple images and Discovery ads with a single image.

Image Assets: Google scans your website for images that meet the size requirement, upload images, or select from the Shuttershock library. The key is to have high-quality images.

Headlines and Description: Discovery ads serve a combination of headlines and descriptions automatically. One can enter up to 5 headlines and 5 descriptions.

Geographical Targeting: Google shows a weekly impression estimate based on geographical targeting.

Call To Action Option: Google can automatically choose the call-to-action text in your ads or there are 10 other options such as ‘Apply Now’, ‘Shop Now’, and more available to choose from.

Finally, Discovery ad campaigns can be targeted by location, audience, or demographics. This is Google’s automated universal campaign and smart bidding is required. In its Discovery ads tips page, Google notes that advertisers should “Choose an average daily budget at least 10 times the value of your target cost-per-action (CPA) bid and wait for at least 40 conversions before making changes to your campaign.”

Read more: Every 2020 Google SERP Feature Explained: A Visual Guide

IPG’s UM Leads The Forrester Media Agency Wave 2020 To Rate Media Agencies

IPG’s UM worldwide is to be named as a leader in The Forrester Wave: Global Media Agencies, Q2 2020 report. The latter gave the highest rating to agencies that used data platforms to improve media execution and ad creatives and created an integrated and centralized experience for the customers.

UM worldwide led 10 media agencies for the evaluation. In order to qualify for the report, each agency requires $10 billion in yearly billing and employ more than 6000 employees.

Forrester principal analyst Jay Pattisall said UM aces the Forrester Media Agency Wave due to its Kinesso offering, its first Axicom based business. It uses data services for typical insights and now applying to develop content for digital ad campaigns, identify audiences, and target content to audiences in a precise way.

Forrester on UM Worldwide :

“Clients like UM for its application of emerging technologies, its partnership with agencies and publishers, and its data technology strategy. We like the agency’s emphasis on business analytics for decisioning and its future-forward approach to crafting data-informed, Hollywood-caliber content that generates new revenue streams for clients.”

Other strong contenders that also scored as leaders are Omnicom’s OMD, Publicis’ Starcom, and Dentsu’s Carat. Meanwhile, WPP agencies MediaCom, Mindshare, and Wavemaker scored well in execution in order to be placed in the next ‘best strong performer’ section but trailed behind Omnicom’s PHD, Publicis’ Zenith and Havas Media Group in the strategy section.

Jay Pattisall did not support the WPP media agencies’ decentralized approach and said,

‘My judgment is that a more centralized structure is more beneficial at this stage.’

Creativity partnership with media

‘Precision creative’ is becoming a core and critical competency among media agencies -where they create multiple versions of an ad to distribute to a highly targeted audience.

For instance, one agency used data to create a feature-length documentary called “5B,” and promoted it with paid promotions to ensure that it reaches the right audience. This shows that creativity lives inside media agencies or are closely partnered. Pattisall commented,

“Because of their ability to work with data platforms, technology, machine learning, and AI, the content create now is heavily data-driven.”

Programmatic is the new way

Forrester combined programmatic into media agencies’ overall buying competency. Today, everything is moving towards programmatic including digital and emerging areas like addressable TV.

One of the criteria for the report was to evaluate how the agencies used private marketplaces(PMP) to curate inventory and target appropriate inventory to the client and see the impact of the tactics on waste and fraud.

Learn more: Programmatic Advertising Platforms in 2020: A Complete Guide

Data and identity

Many agency data platforms are moving towards integration however, few still relied on some form of third party data. Therefore, media agencies are required to work along with the client to build first-party data. Pattisall said,

“It’s a changing world with privacy and tech companies’ approach to cookie deprecation, so they will need to continue to innovate to stay at the forefront of that.”

Having data on identity and audience will be beneficial for the media agencies to bring data-driven creatives to the forefront of their centralized offering. Pattisall added, “Scaling creative content with audience data is something I know desire.”

The way to the future for media agencies is a simplified offering that includes technology, media, and creativity.

Morgan Stanley Forecasts Australian Ad Spend To Fall By 9% In 5 Years

In a recent analysis by investment bank Morgan Stanley on Australian advertising, it forecasted that the domestic media share will shrink if it doesn’t innovate quickly. The domestic media ad spend was $10.4 billion in 2019 and will fall at an annual rate of 9% over the next five years. In a note to clients, analysts wrote,

“We think investors perpetually underestimate the global leakage of ad spend from Australia.”

A section of marketers holds a viewpoint that the ad spend with Google and Facebook has started to plateau and revenue is returning to the domestic traditional media. However, the analysts completely disagree with this market viewpoint and highlighted numbers that suggest that there can be an acceleration post-COVID 19.

The Australian advertising market has shown little growth over the years – around 1.9 % a year. Also, the financial statements filed with corporate regulator ASIC reveals that over the last three years, global media/tech players’ revenues in Australia increased by roughly 20%.

The global ad tech players like Google, Facebook, Snap, and Twitter as well as emerging players like TikTok continue to take an increase in share in the Australian consumer’s time especially the younger demographics. They will have a larger share in digital media spend in Australia post-pandemic as well.

Image Credit: Ad news

Morgan Stanley forecasts 2.1 % revenue to fall of global tech players in Australia in the current downturn but not as severe as that of domestic media- radio, outdoor, print, and TV. On the other side, the revenue of the domestic media players will see a drop of steep 22.1%

However, the analysts believe that global players will lift their market share in advertising in Australia. For instance, Google Australia’s gross revenue was $4.8 billion in 2019. Morgan Stanley estimates a 4% decline this year owing to the ad industry slow down but expects to rise 13% year-on-year growth up to 4 years to reach between $7 billion and $8 billion in ad revenue a year in 2024.

Analysts say,

“Eventually, COVID-19 will be over and there will be a cyclical recovery in the Australian economy, and a bounce-back in the advertising cycle. ”

He further added that the market will be disappointed in expecting a rise in domestic media earnings.

“Even post COVID-19, when the overall advertising market stabilizes and starts to improve, we think the magnitude of the recovery will disappoint investors.”

“Our point of difference is our thesis … that if the global tech players continue to grow revenue double digits in Australia, but the total pool of ad revenues is only increasing 2% to 3% p.a., there is necessarily a ‘crowding out’ of ad spend left for domestic media companies to pursue.”

The markets underestimate the risks to ad revenue, profit margins, and ROCE(Return on equity) from a 5-year long term view. The main reason for the global tech giants growing faster than local media is structural changes. ‘Necessity is the mother of invention’ and businesses that continue with traditional media platforms for advertising need to change and rethink their strategy.

The analysts in the report mentioned that

“The consistent industry feedback we receive is the current challenges facing large, small and medium-sized businesses across Australia is prompting leadership and management teams to think harder and deeper about becoming more digital,”

Many SMEs have tried marketing on digital platforms for the first time during COVID 19 as consumer behavior and time spent has changed and accelerated towards digital/online/mobile media. It is expected that the same pivot will exist with the advertising budgets.

Unfortunately, the crowding of traditional media- radio, outdoor, TV, print – is set to be more intense.

Image Credit: Adnews

Morgan Stanley continues to have an underweight rating for ASX media companies like Seven West Media, WPP AUNZ, oOh! media and Southern Cross but Nine Entertainment.

Nine Entertainment (NEC)is an exception due to its various revenue sources like digital subscription, streaming, and digital advertising assets. Analysts believe that some Australian media companies have the potential to reinvent themselves and develop digital businesses and NEC has demonstrated the ability for such a reinvention.

The global players may face a threat if they fail to innovate themselves and will lose their consumer share and ad share.

Where Do These Global Companies Stand At The End Of Q1: Performance, Insights, And Statistics

We bring you insights and earning calls on various media companies, publishers, agencies, brands, and tech companies performing on a quarterly basis. The iteration focuses on media companies’ financial performance in the 2020 first quarter and taps all the vital data.

Q1 2020 earnings and performance

Though the waters are choppy ahead, we are optimistic that the worst is behind us and have learned to live with the new normal. Consumer habits are changing and the future is more accelerated towards the digital economy. The media landscape has changed especially the TV front and the focus is on opening businesses again with advertising driving the demand.

Q2 Outlook

Q2 advertising for publishers is estimated to be significantly down as much as 25-30% Y-o-Y and for some even 50-55% down. Few companies like Facebook, Snap, Dotdash expects Q2 revenue to be flat or slightly up Y-o-Y. Here are a few key points to consider:

- Google revenue declines by 15% year- over -year, though search activity increased. Advertising spends decreased due to coronavirus recession. However, other advertising mediums are growing like connected TV, ads in video games, or ads in video conferencing.

- International TV ad sales are down by 30-35% Y-o-Y whereas programmatic revenue decreased by 40-45%.

- Performance ads are down year-over-year and demand from industries like restaurants, travel, retail, auto, and luxury has declined.

- Some advertisers seek opportunities and increase spending in financial services, insurance, telecom, technology, streaming services, and app downloads. Gaming and streaming are gaining a strong foothold and permanently taking a share of our time and wallets.

- CPM’s down by almost 50% giving an advantage to advertisers for huge bargains. New and existing advertisers are looking to acquire new customers at a lifetime low value.

- With no new live events expected on TV till September/October, it will boost the growth of CTV.

- Attribution for marketers is easy as most sales are online than in-store. The animation is expected to be robust in Q3 and Q4.

- 90-95% workforce for media companies are operating from home and CMO’s can justify spending using data-driven advertising with trackable ROAS.

Let’s take a look at the financial report card of the global giants.

The Trade Desk

The opening remarks from the trade desks on the present scenario are as follows – Programmatic’s greatest feature is ‘Agility’. One can easily start and stop the programmatic campaigns, unlike linear television. Early April witnesses advertisers stopped/pause ad spend in certain verticals especially travel and remained active in health, technology, games, home, and garden.

However, by mid-April year-over-year spend decline stabilized, and as the month progressed things started improving. Advertisers were trying to adapt to the present environment. For instance, restaurants changed their messaging to “We are open” or “We deliver.” Consumer products focused on pantry loading and travel companies planned to waive off cancellation fees for bookings. Basically, advertisers started to strategize on how to run businesses on the other side of the pandemic. Now, every company is trying to work out an advertising strategy to connect to consumers and gain share once the economy gets going.

CTV is a clear winner as linear TV’s life is shortened. Unlike traditional TV ads investment where brands and agencies commit billions of dollars without knowing the content and audience, they have the freedom to be more deliberate, liberal, and agile on CTV.

Roku:

Roku:

- Pandemic has accelerated the shift to streaming by viewers due to excellent content and value.

- In the short term, the video advertising business has slowed down due to budget cuts and low spending by advertisers.

- In the streaming business, active accounts grew roughly 38% Y-o-Y with an increase in new accounts of more than 70% Y-o-Y.

- Streaming hours grew roughly 80% in April and the increase in streaming hours per account is approximately 30%.

- It is estimated that ad business will grow at a slower pace and gross profit margin will be lower than expected for the year.

- The behavioral changes of TV ad buyers are positive in the long-term and more people are expected to stay home to control spending in the light of economic hardships and the shift to streaming business will grow further.

Google:

Google:

- In March there was a sudden slowdown in ad revenues owing to COVID 19 and lockdown orders. The first two months of Q1 reflected strong growth. Google search and other advertising revenues generated $24.5 billion, up 9% Y-o-Y.

- After the 2008 crisis, the Google search can be adjusted easily-quickly turn-off and back on which is cost-effective and ROI based. At the inception of the coronavirus crisis, users’ interest was more for information on the virus and non-commercial topics providing less opportunity for monetization.

- Q2 looks difficult for the advertising business.

- YouTube advertising revenues were up 33% year-on-year to $4 billion however there were different performance trajectories for direct response and brand advertising.

- Direct response continued to grow throughout the quarter but brand advertising growth grew for the first two months of the quarter and declined in March. This resulted in the slowdown of Youtube ad revenues by the end of March.

- Similarly, networking ad revenue was $5.2 billion, up 4%Y-o-Y for the first 2 months of the quarter, and declined in March in the low-double-digits year-on-year.

Spotify:

- Ads are a small part of the business, nearly 10% of the overall revenues. Therefore it is less impacted compared to other businesses.

- From a long term perspective, it will be an opportunity to move from linear to on-demand due to COVID 19 crisis.

- It is suspected that advertisers will move from pure reach to more measurable ad formats -mostly analog ad formats.

- The conjecture on advertising and consumption front is what is already happening of linear shifting to digital.

Learn more: Spotify Adds $1.7B To Market Cap In 23 Min Post A Deal With Joe Rogan, World’s Leading Podcaster.

![]()

Rubicon:

- The first half of April’s revenue was roughly 30% down until it showed signs of stabilizing in the second half.

- CTV continued to grow at a slower rate in April with a Y-o-Y increase of nearly 10%. Ad slot availability grew by roughly 25% compared to pre-COVID 19.

- Being an omnichannel SSP there has been diversity in ad categories and even more after the merger with Telaria. Certain verticals were highly impacted like travel in entertainment but e-commerce, technology, and direct-to-consumer were benefitted.

- Upfront deals are canceled and focus is shifted to spend from linear to the spot market that programmatic serves.

Microsoft:

Microsoft:

- Reduction in ad spend affected Search and LinkedIn business and assumes that the advertising spend will not improve in Q2 as well.

- Search revenue ex-Tac increased by 1%.

Apple Advertising:

- The economic slowdown and uncertainty on business reopening have impacted the advertising business – which is the sum of App Store search ads, Apple news, and third party agreements on the advertising front.

- This slowdown and uncertain future will have a strong effect on the Service business for the June quarter.

Verizon:

Verizon:

- Owing to the COVID-19 crisis, ad revenue declined by 10% in the second -half of March and the rate of decline only increases in April.

- Industry forecasts a fall of 20-30% in digital media and Verizon media results are likely to be similar.

- It also experienced a decline in advertising and search revenue due to hold back or cancellation of campaigns by advertisers and users searching for fewer commercial terms providing less opportunity for monetization.

- Finally, some staggering numbers were seen- 200% up on gaming, 40% up on video, and 10 times up on the collaboration tools. 800 million calls a day, is double the amount on Mother’s Day, the biggest day of the year.

Netflix:

- Increase in subscriber growth in March and is a pull forward for the rest of the year leading to an assumption that subs will be light in Q3 and Q4.

- Filming is stopped globally except Korea and Iceland.

- Customer services are fully restored with 2000+ agents working remotely.

- With the lockdown orders coming into effect in LA, animation production is up and working from home whereas the post-production of 200+ projects is in pipeline remotely.

- Series writers’ rooms are operating virtually.

- Netflix has invested in Open connect, a pioneering cache system that puts content library as close to members’ homes as possible. This enables ISP’s to run their network efficiently and at a lower cost. However, some countries networks may face issues due to the increasing usage of the internet.

Omnicon

Omnicon

- The company doesn’t collect weekly revenue numbers by the agency and roll them up at the Omnicom group level.

- Q2 downfall is expected in double digits and year-on-year revenues will be down.

- The future is challenging but the company expects to get many of those people back as they move into the year ahead.

Learn more about the quarterly performance of other media companies: Financial Report Card Of The Global Giants And Industries In COVID-19

A One-stop Guide On All You Ever Need To Know About AdTech In 2020

AdTech or Advertising Technology did around $800 Billion Worth Of Business In the US alone in 2019, making it one of the fastest-growing industries in the world.

Are you trying to understand ad tech? Just as advertising is the business of making advertisements, ad tech is the business of using technology to make advertisements faster, quicker, and efficient. The business is driven by powerful algorithms and data points. While it is not rocket science, but for the uninitiated, it can be challenging to understand what is ad tech and how its product and services work.

The ad tech industry fuels the global economy with big investments, employment, and ad spend. Digital advertising has reached new heights of complexity, with the rise of programmatic advertising, AI, and automated interactions between computer systems reducing human intervention. Today’s omnichannel ad campaigns reaching to different platforms all at once from publishers’ websites, mobile apps, social media to search engines. Campaigns using tailor-made and highly targeted ads to reach audiences. This process involves many participants- advertisers, publishers to third-party vendors. The technology used in advertising to store, manage, and deploy data is far more sophisticated.

This guide will give you a sneak-peek into the world of technological advertising and understand the growing ad tech industry. As you read further, you will understand the ever-changing ad tech ecosystem.

What is Ad Tech?

Ad Tech also is known as Advertising Technology covers a range of tools and software that can be helpful for brands and agencies to plan, strategize, and manage all digital advertising activities.

The AdTech ecosystem consists of two major entities – the advertiser (Demand-side) and the publisher(Supply-side).

On one hand, advertisers want to run effective campaigns and optimize their budgets to reach the target audience, gain customer insights, and measure ROI.

Whereas, on the other hand, publishers cater to the need of advertisers and generate revenue through ads by displaying ads on their publications like websites, apps, etc, increase ad impressions, bids for ad slots and visitor insights. These are significant factors that publishers need to consider to maintain the platform User Interface (UI).

Adtech helps advertisers and publishers achieve their goals in harmony by providing solutions that meet the demands of both parties. A few examples of AdTech platforms include Pubmatic, Adroll, MediaMath, SmartyAds, and many more.

Image Credit: MarTech Advisor

Programmatic Advertising Explained

After a brief understanding of ad tech, let’s step into the world of programmatic. You will come across concepts like programmatic advertising, Real-time bidding, and programmatic direct. Let’s discuss it:

Image Credit: Martech Advisor

- Programmatic Advertising Definition:

It is projected to be the game-changer for digital advertising. Programmatic automates the process of buying and selling online advertising space with the help of technology and data. This means, with the introduction of programmatic publishers, advertisers or agencies don’t have to sit across to discuss ad size, rates, et. Ad buying is done through algorithms and data insights.

- Programmatic Direct:

This a type of Programmatic digital advertising, where a publisher bypasses auction and reserves a portion or entire ad inventory for a particular buyer or advertiser at a fixed cost per mile. (CPM). Put simple, here the buyer and seller are known to each other and the ad placement is done programmatically.

- Real-Time Bidding (RTB):

Another type of programmatic digital advertising and also known as an open auction. RTB is when inventory prices are decided through an auction in real-time and open to both advertisers and publishers. This is the most feasible and preferable method of programmatic ad-buying because of scalability and flexibility.

The AdTech EcoSystem

Image Credit: Martech Advisor

The process of digital media buying is similar to the traditional media value chain except AdTech has multiple components in the ecosystem to keep the management of advertising campaigns easy for demand and supply-side platforms. Here are the key components of the AdTech supply chain:

1.Media agency: Responsible to allocate the advertiser’s expenditure budget across the channel. It is not involved in the creative aspect of ad campaigns.

2.Agency Trading Desk (ATD): Plans, buys, and manages ads across different platforms and is a set of services provided by the media agency.

3.Demand-side Platform (DSP): An essential platform for advertisers to buy, search, display video mobile ads. It enables advertisers to buy ad placements in real-time on the publisher websites made available by ad exchange and networks. Some of the DSP players are Simplifi, Smarty Ads, App Nexus, Double Click, and more.

4.Data Management Platform (DMP): DMP’s collect data from sources like websites, apps, social networks, campaigns, CRM’s, and more. Using AI and big data analytics to gather first and third-party data, advertisers, and marketers rely on them. DMP players are Lotame, Oracle Blue Kai, SAS data management and more

5.Ad Networks: The unsold inventory will be bought by ad networks from publishers and try to sell to advertisers using their technology. The popular programmatic advertising platforms for the ad networks are Taboola, Google Double Click Ad Exchange, Rocket Fuel, and more.

6.Ad Exchange: A dynamic platform to buy and sell ad impressions between advertisers and publishers without any intermediaries. Open X, App Nexus, Rubicon Project Exchange are examples of programmatic advertising platforms.

7.Supply Side Platform (SSP): The platform allows publishers to sell display, mobile ad impressions to potential buyers in real-time. Some of the key SSP players are MoPub, AerServ, App Nexus Publisher SSP, and more.

8.Ad Server: This platform is used by advertisers, publishers, ad networks, and ad agencies to run their campaigns. It determines which ad will be displayed on a website and also collect ad performances data such as clicks and impressions Double click for publishers, OPen X Ad server, Ad butler, and more are the examples.

Learn more: Programmatic Advertising Platforms in 2020: A Complete Guide

Is Programmatic advertising worth it?

The programmatic advertising statistics say it all. According to Zenith’s Programmatic Marketing Forecasts 2019, 69% of digital media will be programmatic in 2020.

- The total amount spent programmatically will exceed US$100bn for the first time in 2019, reaching US$106bn by the end of the year, and will rise to US$127bn in 2020 and US$147bn in 2021.

- 72% of digital media will be programmatic in 2021

- Ad spends growth is slowing down to 22% in 2019 due to industry challenges of privacy and supply-chain.

- Brands need to develop new targeting techniques using first-party data and customer data platforms in response to the ongoing death of the cookie.

Programmatic Display Advertising fastest-growing segment.

- The ascent of programmatic display advertising has been rapid. In 2012, only 10.4 % of global digital display spend was programmatic. However, it ballooned to 65.3% in 2019 and it is estimated that the share of programmatic display advertising will grow 69.2 5 and 72% in 2020 and 2021 respectively.

- How does it translate in dollars? In 2012, total digital ad spend was $37.8 billion and the programmatic display market was $3.9 million. Fast forward to today, digital display ad spend is $162.3 billion, out of which $106 billion is invested in programmatic display advertising. In 2021, global digital display ad spend is estimated to reach $204 billion, with $147.1 billion going to be programmatic share.

Image Credit: Marketing Charts

Programmatic marketing by country

One of the benefits of programmatic technology is it shows real-time data that helps companies take swift actions to adjust their strategy as per customer requirements. Digital marketers are considering buying programmatic media in-house due to its transparency. Programmatic has undergone massive growth in the following 6 countries out of which the UK and the US are the most advanced programmatic markets in the share of digital media.

Image Credit: Marketing Profs

As per eMarketer forecast, Programmatic ad spending will reach $59.45 billion in 2019, accounting for 84.9% of the US digital display ad market. It is estimated that 87.5%, or $81 billion, of all US digital display advertisements, will be bought via automated channels in 2021.

Image Credit: eMarketer

The above programmatic advertising statistics prove that the investment has increased Y-o-Y and marketers prefer programmatic advertising to buy digital display ads. Marketers are increasingly allocating their advertising budgets to digital advertising channels as it provides precise data that helps to reach customers effectively.

Learn more: 5 Programmatic Advertising Case Studies That Yielded Exponential Results

Artificial Intelligence can be leveraged in AdTech Industry

Artificial Intelligence(AI) and Machine Learning (ML) are two buzzwords in recent times. And why not, as it brings efficiency in whatever we do.

However, AdTech is a messy market now. Ironically, the good and bad part of AdTech is the abundance of data. True, we certainly have all the information to better understand the customers but most marketers aren’t aware of how to leverage the data and use it forward.

The way you advertise-is going to change extremely right before your eyes- thanks to Artificial Intelligence. Not all in the AdTech world have the analytical skills to evaluate the big data as not many are trained to use it and are misinterpreting them.

Adtech partnering with AI can help lower CPC prices, higher click-through rates (CTR), conversions, and better ROI. Let’s check out how AI can help the Adtech industry find better solutions in the following areas.

- AI in Ads Positioning

Developers don’t need to sit and determine which ad position will drive maximum revenue for the website. With the help of AI, employing machine learning algorithms study historical data to find relevant ads for the targeted user group.

Adtech has not used heatmaps previously but AI algorithms use them to learn where the visitors on the website are going and present them with the relevant ads. AI will help marketers to find the best ad positions by studying the maps in detail.

- AI in Ad Network Selection

There are many Ad Networks that provide different kinds of ads to websites owners and required to sort ads according to the websites. This is called Ad mediation and apt to earn high revenue for the websites.

By employing AI for ad optimization it reduces human effort by using a data-oriented approach that includes data, facts, and intelligence to make sure only relevant ads reach the end-user. Data will be user or website’s past history and facts will be website content, geo, and timing. Machine learning algorithms are employed to enhance the best ad-user match.

- Analytics

In the Adtech world, data analytics is not ‘taken seriously’ and publishers.are not happy about it. The AI-based approach will drive reporting and analytics to new levels.

Analytics will help publishers understand the content that drives the audience, placement of the CTA button to turn one time users into loyal users, and increase traffic. It will be a win-win situation for AdTech and parties- publishers, platforms, and users.

AI is the Future of Advertising

Today, digital advertising cannot exist without AI. Behind most online ads are the sophisticated delivery systems in place powered by AI. These systems place the ads before users, the coordination process happens in real-time and generally is automatic. It’s called programmatic advertising.’

According to eMarketer, 86.2% of all digital display ads will be bought via automated channels and nearly $19 billion in additional spending will enter programmatic display platforms between 2018-2020.

Also, 90% of mobile display ads are bought programmatically. On the other hand, AI also powers advertising products offered by Facebook and Google. In 2017, 90% of the new advertising business was captured by these firms.

In recent times, brands are under more pressure to deliver relevant, personalized, and contextual ads to individual customer preferences.

How AI makes Programmatic Advertising better

More companies are turning to AI for creating advertising relevance at scale.

For instance, if you want to advertise on Facebook,-an AI-powered algorithm determines the relevance of the score of your ad. This means that the score impacts the ad delivery directly and influenced by the experience of the ad delivery to Facebook users. Expect a low score if the ad is not liked or is irrelevant.

This decision is made by machine and is beyond your brand’s control independent of strategic or creative decisions

A marketing company like Phrasee launched an AI tool that writes Facebook and Instagram ads. The AI tool assesses a brand’s voice and copy, then the machine writes the ad that performs better than human-written ads. Recently, it helped reduce one client’s cost per lead by 31%. Another AI-powered tool is Albert that helps automate media buying, testing, and optimization. It enhances ad performance and delivers relevant ads to the right person. This shows that relevance at scale is possible in advertising.

Emerging Programmatic AdTech Trends 2020

Image Credit: MarketingToolbox

1. AI in Programmatic Advertising:

Technologies such as artificial intelligence(AI) and machine learning (ML)have involved programmatic ad buying or bid optimization. Programmatic campaigns are used by companies for more targeted net across platforms. By 2020, it is expected that there will be a shift towards automating technologies like AI and ML to get the most from data.

2. First Part Data Move Made Important by GDPR:

After the announcement of the General Data Protection Regulation (GDPR) in Europe, last year on cookie crumble or removal of third party cookies is gradually turning out to be beneficial. The regulations protecting the privacy of user data initially looked limiting to ad tech experts but is resulting in cleaner and more reliable data over time.

Learn more: Digital Advertising Industry Plans To Replace Cookies With First-Party Data

3. Digital Out Of Home (DOOH) and Mobile Location:

Digital DOOH combined with mobile location data has the potential to help marketers to drive conversions in the offline world. Integrated ‘home-to-out-of-home’ programmatic advertising approach provides a smooth experience to the customers.

4. Voice-activated Ads:

The adoption of voice-based to in-home smart devices has grown rapidly. Gartner predicted by 2020, 30% of web browsing sessions will be done through voice-first browsing. Amazon sold over 100 million Alexa-enabled devices in 2018 compared to 2017. A recent survey by VoiceBot.AI revealed 25% of respondents orders everyday household items through voice assistants followed by apparel and games and entertainment.

Programmatic advertising helps marketers to optimize these ad spaces across in-home smart devices, to on-app audio ad opportunities, and connect to consumers through in-store ads, ads in elevators and taxis, and more.

5. Wearables will enhance programmatic advertising:

Wearables collect data on location, lifestyle, health metrics, and more. The market penetration of smartwatches has grown multifold over the years and programmatic advertising is already making its way into this medium. For instance, it helps advertisers run banner promos to customers on their Samsung or Sony smartwatches. The wearable ecosystem has a huge potential to grow and programmatic adtech can bring greater opportunities.

6. 5G in programmatic advertising:

The high speed and no buffering will encourage the rise of more users to spend time on videos on mobile devices. It will enhance other technologies such as AR-enabled ad displays, VR without headsets, and innovative new digital outdoor mediums.

This will give programmatic advertising new opportunities to run more interactive ads without any lags across mediums. By 2024, the use of 5G in AdTech is predicted to grow to 1.4 billion.

7. Evolution of Personalization:

With Gen Z and Millennials- the biggest demographics -personalization is a priority as they like all things customized. Personalization in advertising is going to be inevitable as the choices of the new generation are different. Therefore, programmatic customization by advertisers is increasing offering personalized, relevant messaging to their target group.

8. Blockchains and Ads.xt:

Ad frauds are increasing over the past few years. A cybersecurity firm Cheq reports that ad fraud damages will touch $26 billion in 2020, $29 billion by 2021, and $32 billion the year after that.

The only way to handle the frauds is by bringing transparency in programmatic advertising. Blockchain and Ads.txt (an Interactive Advertising Bureau initiative – Authorized Digital Sellers) can help to remove unrequired middleman, domain spoofing, and verification of publishers and allow transactions using cryptocurrencies.

Learn More: Advertisers Look For Greater Transparency In Programmatic Ad Buying

9. Programmatic TV, podcasts and audio Ads set to grow:

The content on TV has changed drastically. There is a paradigm shift in TV viewing from cable TV to over-the-top(OTT) like Amazon Prime or Netflix via an internet connection.

Programmatic advertising has a larger role to play to ensure marketers get the best of both worlds. Programmatic TV is also going to get more important with its data-driven approach for buying and delivering ads.

Programmatic in podcasts and audio advertising is also growing. Apps like Spotify and Soundcloud are seeing more user acceptance and a new advertising landscape is being created for companies to monetize on.

10. Omnichannel Programmatic:

Forrester defines omnichannel marketing as ‘the practice of digitally sequencing advertising across channels, which is connected, relevant, and consistent with the customer’s stage in their life cycle.’ This is how programmatic advertising is going to be in 2020 and beyond.

A single marketing resource or an ad can be customized programmatically suiting various platforms through programmatic AdTech.

11. Agencies to work on outcome-based pay:

Discussions are making rounds to switch to an outcome-based remuneration model. With increasing ad frauds and agencies promise programmatic tech, advertisers fear how their budgets were used and where their ads placed. There was a lot of wastage in the space. Media buying companies started giving outcome-based remuneration more prominence. Gradually, advertisers would like to see the full cost chain of their programmatic buys, pushing agencies to outcome-based pay.

12. In House programmatic advertising v/s agency.

An IAB report suggests that nearly 40% executing programmatic trading via in house and 50% publishers also have an in-house model. This means advertisers are looking for more transparency, control of their ad strategies, and outcome.

It makes more sense to have an in-house team for strategizing programmatic ads and an agency partner for implementing parts of it instead of having a full-stack programmatic AdTech in house.

Wrapping up

Yes, Adtech is complicated but the best part is that it allows integrating the whole toolset into a single system. According to Zenith Media, the ad spends on digital media will reach $329 billion in 2021. However, there are major concerns and challenges -Ad Fraud, transparency, and privacy issues need immediate action.

There have been big changes and improvements over what advertisers and publishers used to have earlier but it still needs more work and their expertise to handle the challenges and resolve for good.

5 Programmatic Advertising Case Studies That Yielded Exponential Results

Advertising has come a long way from the early ’70s and with technological shifts, there are incredible options to reach the target customers effectively. We have witnessed the rise of programmatic advertising with the advancement in the digital world.

For the uninitiated, programmatic advertising can be described as automatic buying and optimizing digital campaigns through real-time auctions, where ads are bought at the same time when a visitor loads the website instead of buying directly from the publishers without human interference.

Programmatic advertising is becoming a star strategy and businesses spend almost $60 billion every year. It is forecasted by 2021, 88% of all digital display ad spending will flow via automation.

Image Credit: eMarketer

Explore these five programmatic ad case studies to comprehend how brands are building compelling and successful campaigns.

1. BoxFresh

Challenge:

The men’s footwear brand had lost ground to sports brands like Nike and Adidas over the last couple of years because of its reliance on brick and mortar stores over online sales. The brand aimed to re-establish its brand in the UK and German markets, establish a connection to drive loyalty and repeat business with its target customers.

It concentrated on creating branded casual men’s footwear but reached a point where one in four consumers preferred Boxfresh for their purchase.

Solution:

The brand focused on video-led campaigns advocating their brand ethos- simplicity, value for money, nonconformity and authenticity which are in alignment with target consumers’ own values. Ads on Facebook were segmented based on demographics and interests as well as through first-party based lookalike audiences build. Video campaigns provided tailored messages to the audience’s stage in the buying cycle.

With the newly launched e-commerce website, the brand initially did not retarget cart abandoners and purchasers but model and optimize lookalike audiences prospecting campaigns.

Result:

With a programmatic display campaign, the brand soared above Google benchmarks disrupting the competitive market. The assurance that the brand is connected with the audience own values, display adverts had a click-through rate (CTR) 233%higher than Google’s benchmarks in the UK and 800%higher in Germany. 85% of the users who visited the site through prospecting activities are new users.

The digital agency Europe regional head added,

“The storytelling technique has had incredibly positive effects on the creative performance, which has resulted in great return on spend for Boxfresh. However, it’s important to remember that display is not the final touchpoint in the purchasing journey. Using Cadence, Rakuten Marketing’s data insights and attribution platform, revealed conversion rates for SEO and PPC grew by 169% and 50% in the UK when display campaigns ran alongside other channels. Likewise, the average order value increased by 20%.”

2. ASUS

Challenge:

ASUS has barely 0.3% market share in the Indian Smartphone market. 34% of sales are online and have more than 35+ handsets. With a low market share, it is important to revive the brand and plan a programmatic campaign to attract customers at the buying stage and create brand awareness.

Solution:

The brand integrated real-time data to send feedback on the effectiveness of each audience combination to web ASUS with their OCMPID.

When a user likes something, he adds to the cart. This shows that the user has a higher chance of buying it. On the other hand, there is a chance that he could accept another better deal for a more fitting product. Therefore, the best way was to target the audience through ads based on the cart.

The brand divided the audience into various segments based on – price range, featured buying habits and buying characteristics of the user on Flipkart.

These ads were programmed to reach the consumer on a real-time basis and here it is – when a user adds an ASUS phone in the cart, the brand was informed of the effectiveness of the creative audience combination.

For instance, if a user adds Xiaomi with 3500 mAh battery, ASUS would target them with ads that had 5000 mAh batteries at an even better price.

Results:

Due to a real-time programmatic approach, ASUS met its target to sell more than 1 million units leading to targeting efficiency went up by 3 times. In less than a year, the ASUS market share rose from 0.3 to 3%, a 10x growth.

3. The Economist:

Challenge:

To increase the subscriber base and grab the reader’s attention who are reluctant to try the Economist. Using creative programmatic display, the goal is to reach 650,000 new prospects and stimulate a change in perception.

Solution:

The campaign utilized Economist content and headlines that contained humor, wit, and sparked curiosity. The publication analyzed the extensive audience data which included information on how subscribers responded to the publication’s web and mobile app. Using this data, the Economist determined what content attracted and when. The idea was to link Economist content to the stories ‘the reluctant readers’ were presently reading.

The advertising creative was built in real-time. It matched viewers’ profile and page context to the Economist’s feed before serving an ad to the right people with the right context. For instance, someone could see a featured ad that linked an Economist’s story on US cops using firearms to the story of a police shooting in the Guardian.

Image Credit: Banner flow

Results:

On a £1.2 budget,

- 3.6 million taking actions

- 650,000 new prospects

- ROI of 10.1

The Economists followed up this display campaign with another focus especially on millennials and social networks. It won the 2016 Gold Best use of Programmatic award.

4.Missing People

Challenge:

British charity ‘Missing People’ is an ideal example of how to maximize a small programmatic budget. The charity needs to rescue all the missing children across the UK. With the use of programmatic OOH advertising, it intends to increase reach and impact.

Image Credit: Banner flow

Solution:

Programmatic OOH will help the charity to target those who might miss or disregard print appeal. It also helped to understand that people respond to messages relevant to their area in which they live. And through programmatic it could make a more targeted and location-based appeal.

The move from print to digital was crucial for the charity as it helped to save lives and allowed ads to be adept, creative changing once a child was found.

Result:

Ross Miller, director of fundraising and communication said, “the use of e programmatic use of out-of-home increased the response rate from 50% to 70%.”

5. O2

Challenge:

In 2016, O2 intended to make its “tariff refresh” TV ad more engaging and attractive for a mobile audience. It also wanted to repurpose its TV ads and make them interesting for mobile users.

Solution:

O2 created a system whereby it could take data about mobile usage-device, location, and others to offer personalized messages and video ads based on the user’s profiles.

More than 1000 versions of personalized video ads were made that integrated real-time with the user’s device and location.

Coinciding with the company’s sponsorship of the Rugby World Cup, it launched a website for the users to create rugby-inspired avatars. Using data from the website, O2 launched a campaign targeting those who accessed the website, giving them a personalized video ad and addressed them by their first name and invited to visit the avatar site. It also included a personalized call-to-action button to know whether they have already created the avatar or abandoned the process before finishing.

Result:

Personalized ads had a 128 percent click-through rate and an 11 percent increase in engagement.

Wrapping up

So, are you ready to use programmatic advertising? Well, programmatic adverts have immense potential for all kinds of business in any verticals. Simple but brilliant creative programmatic campaigns can be created to reach the right audience.

Lotame Introduces Cookie Free Data Technology For Publishers and Marketers

Lotame, the world’s leading unstacked data solutions company is looking to help publishers, marketers, media, and agencies to leverage their first-, second-, and third-party data to create and analyze audience segments with a new suite of data enrichment products called ‘Lotame Panorama’.

The suite will help users find customers, increase engagement and growth revenue across the cookie challenged web browsers like Safari, Chrome and Firefox, mobile devices, and OTT environments.

Jason Downie, chief revenue officer, Lotame, said,

“First-party data is a valuable asset, but unfortunately it doesn’t provide the scale marketers need. Bridging together customers’ online and offline lives has been a persistent industry dilemma that was made even more complicated with recent browser changes. To solve for this, we developed Panorama which enables a fuller view of activity that is actionable across a connected ecosystem, even in cookie-challenged or first-party-cookie-only environments.”

Unwrapping data enrichment services

Panorama offers two solutions, one for marketers and agencies, the other for publishers and media companies. Lotame has unveiled three data enrichment services powered by Cartographer, Lotame’s ID graph technology.

- Panorama Insights: It offers a varied set of curated data tools and analysis for better storytelling, prospecting, segmentation, and modeling without cookies needed. It connects users’ first-party data to second and third-party data across the web, mobile, and OTT devices from 250+ online and offline data providers.

- Panorama Buyer: It ensures that media buyers connect customers’ attributes across first-, second- and third-party data to create an addressable audience in the cookie-challenged environment.

- Panorama Seller: This allows publishers to monetize their inventory across the web, mobile, and OTT through direct or programmatic advertising. It also enables publishers to set exact CPM’s in cookie challenged environments.

Also Read: Prebid Server Aims To Ease Header Bidding For Programmatic Advertisers

Panorama launches as publishers and others that rely on extensive data sets may have to struggle to find the scale they need. Lotame has appointed Ruby Brenden as head of data products to drive Panorama Insights forward. Brendan said,

“I have spent the last decade helping innovative marketing companies launch products. I am excited to launch Panorama, a solution that is exactly what the industry needs as third-party cookies start fading out. Insights will give marketers and agencies a single, trusted place to uncover relevant data stories and build smarter, addressable audiences, which means better advertising for consumers.”

Customers Signing for new Lotame Panorama products

Companies like Procter & Gamble and IPG’s Cadreon have already signed up for the new Lotame Panorama products.

Clients agree and testify,

Paras Mehta, Business Head – India, at Cadreon said,

“Understanding customer attributes and behaviors is key to our data-driven strategy when working with advertisers. Data enrichment using high-quality second and third-party data like Lotame’s enables us to draw insights we wouldn’t have access to with first-party data alone. We look forward to leveraging more of Lotame’s data solutions to deliver the exceptional service and results Cadreon is known for.”

Tim Hung, marketing director and lead of media, P&G Hong Kong & Taiwan said,

“Improving the lives of consumers around the world isn’t just our mission, but our daily practice..This requires getting to know those customers through the use of high-quality second and third-party data vetted and verified by Lotame. As cookie blocking becomes more prevalent, data enrichment solutions like Panorama will become even more important for global brands like P&G to understand customers and engage with them in meaningful and respectful ways everywhere they are.”

Partners at launch include Domo amongst others. Jeff Skousen, GM, North American Corp/Ent Sales, at Domo said “We’re excited to partner with Lotame to power Panorama Insights.” He further added,

“By dynamically integrating data and delivering live visualizations, Lotame is providing brands bespoke audience real-time insights in a digestible, actionable format to improve analysis, prospecting, segmentation, and data modeling.”

Spotify Adds $1.7B To Market Cap In 23 Min Post A Deal With Joe Rogan, World’s Leading Podcaster.

The streaming giant Spotify gave 100 million reasons to Joe Rogan to make a move. Though the details of the deals are not disclosed, The Wall Street Journal reported that Spotify is entering in an exclusive licensing deal with Joe Rogan, owner of the world’s leading podcast worth more than $100 million, a move directly aimed at podcast market leader Apple.

Spotify stock shot up on the announcement of the deal and the founder Daniel Ek is now worth $2.8 billion.

Image Credit: Twitter

Why it matters

This is a landmark move for the medium. According to Neilsen, most Americans subscribe to only one audio subscription service but this trend can certainly change if more podcasts prefer to offer exclusively on certain platforms.

- “The Joe Rogan Experience” features long talks between Rogan and celebrities, subject area experts, comedians, and more. It is the second most popular podcast on Apple’s platform.

- Launched in 2009, the podcast was labelled independent and video versions are streamed on Rogan’s YouTube channel which has a loyal fanbase of more than 8.4 million subscribers and witnessed more than 100 million streams in March alone.

- According to MIDiA Research, the difference between Spotify and Apple as the leading podcast platform is so small that it can be considered within margin error.

Details:

The host Joe Rogan announced that the podcast will be available globally on Spotify starting September 1 and will become exclusive by end of the year.

What did he say:

“It will remain FREE, and it will be the exact same show. It’s just a licensing deal, so Spotify won’t have any creative control over the show. They want me to just continue doing it the way I’m doing it right now … I’m excited to have the support of the largest audio platform in the world and I hope you folks are there when we make the switch!” -Rogan on Instagram

- Spotify plans to incorporate video elements of the show that will be available as in-app vodcasts.

- Spotify will start selling ads in September through a partnership with PMM who is representing Rogan’s ad inventory over time.

- The popular comedy talk series will be available for free to all Spotify users like all podcasts on Spotify.

Image Credit: Axios

The bigger picture

Inking exclusive deals with leading podcast players is the latest strategy to woo more listeners. This could compel users to subscribe to multiple audio streaming services to access all favourite content.

- Spotify paid $196 million for Bill Simmons owned sports media company ‘The Ringer’ in February,

- Apple plans to fund and make podcasts for its own platform to promote its TV shows reported by Bloomberg earlier this year.

- Luminary expanded its services globally, bringing many exclusive podcasts to new regions.

Yes, this marks a significant moment for Spotify as it has invested over $500 million on acquiring podcast companies in the past one and a half years and has over one million podcasts on its platform. It also debuted ‘Streaming Ad Insertion’ which provides marketers access to insert host-read ads.

TikTok Appoints Former Disney Chairman As New CEO To Capture New Markets.

- Disney veteran Kevin Mayers who oversaw the launches of Disney+ and ESPN+ is leaving the company after 27 years to become the new CEO of TikTok.

- Mayer will take the lead on ByteDance’s music, gaming, and emerging business along with heading TikTok.

- Mayer will start on June 1 and report directly to Bytedance CEO Yiming Zhang.

- TikTok had an immense impact on the music industry and grabbing eyeballs of gaming and esports companies.

TikTok appoints Kevin Mayer as the new CEO after being poached from Disney. Kevin Mayer who was passed over for the Disney CEO role is taking a jump from the entertainment industry’s most esteemed names to one of its most dynamic new arrival.

TikTok’s new CEO plans to explore business opportunities in music and gaming as the company looks to capitalize on a recent increase in app downloads. Mayer, head of The Walt Disney Company’s direct-to-consumer and international business said in a statement,

“I’m thrilled to have the opportunity to join the amazing team at ByteDance. Like everyone else, I’ve been impressed watching the company build something incredibly rare in TikTok – a creative, positive online global community – and I’m excited to help lead the next phase of ByteDance’s journey as the company continues to expand its breadth of products across every region of the world.”

Advertisers and brands taking advantage of music trends

TikTok is a significant player in the music industry for discovering new artists and making songs to hit status. The platform contributed to the grand success of Lil Nas X’s record-breaking “Old Town Road” and more recently with chart-toppers like Doja Cat’s “Say So” and Megan thee Stallion’s “Savage,” which are all featured in the TikTok videos.

Advertisers have found new ways to use TikTok music and dance trends to their advantage in order to drive brand awareness among the Gen Z audience. Brands like e.l.f. Cosmetics and Warner Bros. have used original music and dance challenges to attract the audience and generate billions of views and user engagement on the app. As quoted by Business Insider, Evan Horowitz, CEO of the creative agency Movers+Shakers said,

“I think the nature of TikTok as a platform is that it’s one. It’s only natural that brands that create really good music.that the community on TikTok really resonate with, that music can start to trend and be successful outside of the platform.”

Gaming and esports companies jumping onto the bandwagon

Video games companies and esports brands have shown keen interest in the TikTok app as it continues to be popular among Gen Z users of the app.

Many esports brands like FaZe Clan, Team SoloMid (TSM), and 100 Thieves have officially created verified accounts whereas video game content is slowly taking up TikTok’s content recommendation landing page (ForYou). It’s too early for gaming creators on the platform even though esports companies are slowly and carefully exploring TikTok in recent months. Jason Wilhelm, CEO of TalentX Gaming told Business Insider,

“For TikTok, they haven’t really found what is the best way forward for gaming yet. You need a lot of requirements in order to stream video games. TikTok obviously is not set up for that right now, but that is something that we’re going to be figuring out.”

TikTok has seen a significant surge in users since the pandemic hit U.S – 315 million downloads across the iOS and android app stores in 2020 Q1, that’s the most download for one app in a single quarter as per mobile data analysis group Sensor Tower.

Also read: YouTube Shorts: Will it be Able to Capture Tik Tok’s Audience?