Samsung Ads Enables First Party-Data For Smart TV Ad Campaigns

Samsung Ads rolled out the Samsung Onboarding Partner Program with leading data management platforms (DMP) and other onboarding platforms to help advertisers plan and buy TV ads using their first-party data sets.

The program will provide advertisers access to the curated audiences through data management platforms that include Acxiom, Adobe, Experian, LiveRamp,Merkle, and Oracle. More partners are expected to join next year. The program is yet another addition to Samsung Ads’ growing AVOD offering pool. The onboarding partner program offers advertisers to plan and activate TV campaigns leveraging their first-party data, It helps them to gain higher returns (ROI) on their data investments.

Interesting Read: Samsung Ads Introduces Predictive Planner To Improve AVOD Ad Buys

Audience Advisor Accessibility

Advertisers planning to leverage the new program will have access to Samsung’s predictive planning tool -Audience Advisor. This means that the media planning guidance will be based on advertisers’ preferred segments and own audience data as well as Samsung Ads’ proprietary first-party TV data. The Audience Advisor tool produces data-backed predictions of scale, reach, and ad frequency for future campaigns based on budget. These integrations will also be made available through the Samsung Ads DSP in the first half of 2022.

Justin Evans, Global Head of Analytics & Insights, Samsung Ads said,

“Now, marketers can activate their most valuable asset in the Samsung Ads Ecosystem, their curated audiences made up of their own combinations of first-party and third-party data.”

He further added,

“Data and audience-driven TV is the future for advertisers and Samsung Ads is committed to bringing to market new tools and partnerships for advertisers to leverage different datasets in a safe and secure manner across their media buys.”

Interesting Read: Trade Desk Partners With Samsung Ads For Programmatic CTV

Buy Your Own Data

Samsung Audience Advisor -a predictive campaign planning tool was launched in Q2, 2021. It allows advertisers to plug in any combination of first- and third-party data to understand the scale, behaviors, and time spent by their target audience in ad-supported video on demand (AVOD).

AVOD lets brands quantify their reach opportunities and gain an understanding of how much reach and frequency they can achieve at various budget levels. Advertisers can get more reach, scale, and efficiencies when they curate audiences through one of the onboarded DMP partners with Samsung Ads.

By the first half of 2022, Samsung Ads will incorporate Onboarding Partner Program and Audience Advisor into its demand-side platform. Molly Lashner, Media Hub’s associate media director, in a statement,

“We’ve had success activating advertisers’ first-party data on the Samsung Ads platform and rely on partners like Samsung to create turnkey integrations like their Onboarding Partner Program. This allows us to gain greater insights into streaming TV audiences and make our CTV campaigns even more powerful.”

Samsung Ads enables advertisers to leverage their first-party data to deliver stronger campaigns and results while ensuring consumer privacy preferences. In an analysis of hundreds of 2021 ad campaigns, Samsung found promising results. Brands that leveraged their own data generated up to 161% higher conversion rates than campaigns that did not. For entertainment campaigns, the audience advisor identified and targeted audiences who hadn’t been using a client’s product for some time. The tool found that this resulted in a 300% lift in conversion compared with audiences who were not exposed to the ad within the target segment.

Evans said that brands have started choosing partners who bring “substantial proprietary data to the relationship” as AVOD continues its share of total TV viewership.

“We are seeing and expecting more advertisers to lean into the partnership with us because they’re attracted to the differentiated data and insights that we provide.”

Interesting Read: Demand Side Platform(DSP) Launched by Samsung Ads

Digital Powerhouse Deal: Vox Media Announces Merger With Group Nine

Vox Media is set to merge with Group Nine, the parent company of NowThis, PopSugar, and Thrillist brands. Vox Media and Group Nine Media will combine to form “the fastest-growing company of scale in media.”

Why this deal

The merger will create a digital media powerhouse. Before the merger, both companies acquired major digital brands to enhance their scale. This deal will officially take Group Nine out of the start-up mode.

Details

Jim Bankoff, who founded Vox Media, will be the CEO and chairman of the new combined company. CEO Ben Lerer, who built Group Nine Media from a newsletter to a leading digital publisher, will join the Board of Directors and advise on key strategic initiatives

The stock deal will grant Vox 75% of the company’s ownership, while Group Nine will retain 25%. The deal is on pace to close in early 2022, subject to regulatory approvals.

As quoted by Axios, Lerer said,

“I think that doing a stock deal like this signifies that we can be the acquirer of choice. My willingness and our willingness to do a stock deal speaks to a belief that there is real value in this stock.”

In a memo to the staff, CEO Jim Bankoff said,

The business rationale behind this merger is to grow revenue, increase scale, and combine these incredibly powerful and complementary portfolios.

– Together we will be an even stronger, more financially sustainable company that can invest more in our products and our people.

– Our combined company will be the clear leader in modern media, reaching audiences at scale everywhere, from podcasts to streaming services, from YouTube to TikTok, from websites to print.

– Group Nine Media does not have any paywalls and their revenue is largely driven by advertising, a studio operation, affiliate commerce, and licensing agreements.

– A team from both companies will start outlining a considerate plan to integrate functions where it is required. Also, none of the existing editorial offerings or services will change due to the acquisition.

The numbers

As reported by Axios, the companies are expected to bring in combined revenues north of $700 million in 2022. Earlier this year, it was reported Group Nine was expected to make at least $200 million in revenue this year.

The quick catch

Group Nine Media announced last year that it was forming a SPAC that could take another company public.

In his note, Bankoff said,

e have no immediate plans to go public, although we’ll always continue to evaluate opportunities that are in the best interest of all of our stakeholders, including our employees.

The company’s official deal announcement states that the deal is not within the Group Nine SPAC (Group Nine Acquisition Corp.), “which is a completely separate entity”.

The Big picture

The transaction comes during a period of intense consolidation within the digital media sector as digital giants battle it out with internet giants like Google and Facebook.

Some of the recent deals include Dotdash acquiring Meredith Corp, BuzzFeed acquiring Complex, and Axel Springer purchasing Politico.

With third-party cookies deprecated, digital publishers have been rushing to consolidate to reach larger audiences. This will allow them to compete better for advertising budgets against social media platforms and increase the size of their first-party databases.

The Bottom Line

The combined company will include:

- Unrivaled Brand Portfolio- Award-winning, established, and popular brands can appeal to key demographics across all major consumer groups.

- Full suite of advertising solutions– The platform will offer clients comprehensive advertising solutions, including video, audio, branded content, social, events, newsletters, commerce, and programmatic.

- Commerce and licensing– Both companies are recognized for successfully bringing their brands to life through commercial licensing, affiliate partnerships, and collaborations.

- Audio- Vox Media Podcast Network offers the largest and most diverse collection of premium podcasts.

- Studios– Group Nine and Vox Media have established entertainment production studios, leveraging the popular brands of their companies with distribution partners

- Experiential– Crossing together the two companies will create a strong conference and event business known for Code Conference, Vulture Festival, PopSugar Play/Ground, NowThis Next, and Pivot MIA, the first-ever conference in the Midwest.

As Bankoff said in a statement to Axios,

Scale matters. Scale for scale’s sake is not what’s important but quality combined with scale, which is what this story is about, is going to be an advantage in the marketplace.

Instacart President Carolyn Everson Steps Down Only After 3 Months

Carolyn Everson announced that she will step down as Instacart president at the end of the year. The surprise decision comes barely three months after Everson took the helm at the grocery delivery service company.

Instacart’s C-suite recently changed following the departure of its head of advertising, Seth Dallaire. Several big tech executives have been hired, including those from Facebook (now Meta), Amazon, and Google. Instacart’s valuation rose to nearly $40 billion this year, but some of its newcomers, including Everson, have experience managing larger teams.

Over the last decade, Everson has served as Facebook’s ads chief and was Fidji Simo’s most high-profile hire at Instacart. Simo had been at Facebook for ten years, including two years heading the Facebook app, before becoming CEO of the delivery tech company.

Carolyn Everson shared on social media that as she approaches 50 she plans to take a ‘real break’ to consider her next move.

“Fidji and I have been friends for over 10 years and we both agreed that this was the best decision for the company and for me personally. I believe in the company’s mission and the team, and am grateful for the opportunity to have contributed to Instacart’s growth. I intend to take time to dream up what’s next.”

Simo said in a statement that it was a mutual decision and was grateful for her contributions.

“We believe it’s the right decision for both the company and Carolyn based on our priorities and the role she was looking for at this point in her career. She’ll be staying on with us through the end of the year, and leaves as a friend to the company.”

As president of Instacart, Everson manages many divisions, including advertising, partnership services, and legal. As a result of the pandemic, grocery delivery services had flourished and recorded their first profit of $10 million in April 2020, adding 350,000 more customers to their roster.

According to CNBC, Instacart has identified its advertising business as one of its fastest-growing segments, but it is looking to expand into the cash-intensive business of quick commerce, or 15-minute delivery, to compete with the likes of DoorDash and GoPuff. It was widely expected that Instacart would go public this year, but reportedly pushed back plans in order to focus on growth.

Interesting Read: Clean Rooms Explained: How Marketers Can Prepare For Cookieless World

Clean Rooms Explained: How Marketers Can Prepare For Cookieless World

The advertising industry is undergoing a paradigm shift and their favorite buzzword is a clean room. Ad agencies, publishers, and technology providers have long relied on “centralized identification.” They know how to discover, reach, engage, and measure individuals by way of cookies, mobile IDs, and set-top field IDs.

With Google’s decision to end third-party cookie support in Chrome, the data will be lost on which brands once relied upon to gauge advertising returns. Consequently, in a world where user privacy regulations are being strengthened, marketers are heading into a brand new area of marketing analytics where connectivity and addressability are becoming more and more fragmented. Hence, it comes with no surprise that clean room is a hot topic for advertisers.

Interesting Read: Disney Launches Clean Room For Marketers’ First-Party Data Needs

What Does A Clean Room Do?

Data clean rooms are software programs that enable advertisers and brands to match user-level data without sharing any personally identifiable information(PII) or raw data. It was originally arranged by walled gardens such as Google, Facebook, and Amazon to provide advertisers with matched data about how their ads were performing on their platforms.

Image Credit: Search Engine Journal

How Can Advertisers Use The Clean Room?

There are currently two types of clean room: walled gardens, like Google and Amazon, which let brands see inside their own ecosystems. Second, software companies and data managers like Habu or InfoSum act as conduits between parties that wish to share data.

For example, brand partners with a publisher (Google, Amazon, or retailer with a media network). A clean room provides a closer look at campaign performance data like reach, shopper conduct, and engagement for logged-in or registered prospects to both parties. Further, they will relay their first-party data into the clean room and compare it to platform data to enable activation and measurement without revealing user-level details.

Marketers are partnering with expertise suppliers to create their own authentic and privacy-safe clean rooms. The digital sphere is becoming more and more like a federation of private rooms, each with its own distinctive capabilities and information. Also, “Id” is turning more decentralized than before.

Interesting Read: End Of Third-Party Cookies, What Is There For Marketers: Takeaway!

How Should Advertisers Address This?

First, they need to determine which clean room to take advantage of based on their advertising stack and media allocation. Let us understand with an example of Google Ads Data Hub.

Entrepreneurs utilizing Google’s tech stack ought to prioritize Adverts Knowledge Hub for attaining/frequency measurement, marketing campaign supervisor attribution, and DV360 for mapping first-party information. Furthermore, YouTube information is extra efficient when used with the rest of Google’s information, enabling cross-device publicity evaluation.

The next step for advertisers after making the choice is to develop their clean room techniques as follows:

a. Build an audience:

Advertisers will require to build new paths in every clean room for locating and rising audience. They would start with mapping first-party information to every clean room to find present and prospective shoppers. Then analyze and enhance the conduct and efficiency throughout new audiences. This will provide stability as audiences from cookie-based monitoring falls as well as insight into prospects.

b. Brand Engagement

In the absence of cookies, advertisers must shift to a mobile-centric engagement model that allows them to reach shoppers within their in-app experiences and logged-in accounts. Recapturing the information will help device-based remarketing and enable cross-device insights.

c. Measurement and optimization

Deprecating cookies means losing a unified view of the effectiveness of your marketing campaigns throughout the buyer journey. As a result, they have to use cross-device data within every room to find new indicators. Responding to the challenges, advertisers need to provide a framework for the clean room technique.

Furthermore, advertisers would require clean-room measurements and optimization techniques to understand other cell indicators that affect their marketing campaign achievement, frequency goals, and attribution models. Each clean room has its own multi-touch attribution measurement. Afterward, advertisers will want to normalize the load by combining the results across all clean rooms.

Interesting Read: Impact of Delay in Deprecation Of Cookies By Google On Adtech

What Does The Future Hold?

In the wake of third-party cookies being deprecated, marketers and publishers are racing to improve first-party data and the overall way they target, measure, and optimize it. Tracking and reporting no longer function in the background and need explicit user consent. As marketers confront the challenges associated with measurement and optimization, there is a clear need to outline a clean room technique. It may be difficult and time-consuming work, but the rewards are enormous. Rather than relying heavily on small samples to infer buyer journeys, it may make more sense to establish, target, and measure audiences by using de-identified information about writers and platforms. Data clean rooms offer a valuable way to collaborate and analyze data in a privacy-compliant way to better understand how customers interact with the brand.

A Look Ahead: Convergence Of Linear TV And Digital TV Advertising

Digital and Linear TV advertising – two culturally and technologically distinct ecosystems – are merging to increase the effectiveness of marketing to consumers.

The shift from traditional linear television to connected television (CTV) and video-on-demand options has made it difficult for advertisers to reach mass audiences. Intriguingly, some of the same techniques used for converting television viewers to digital audiences can be applied to converting addressable digital inventory into non-addressable inventory.

Interesting Read: Connected TV Explained: The Essential Glossary Of CTV

Machine Learning and Data Automation

Advertising technology(adtech) companies are one of the first to adopt big data, machine learning, and artificial intelligence. One of the reasons is that websites and apps generate enormous data that advertisers can utilize to achieve their quantifiable goals. To leverage this, automation is the key aspect in performance advertising. It is the most feasible economically logical step for marketers. Thus, small and big ad tech companies have embraced machine learning on a large scale successfully to attract customers and increase ROI.

On the other hand, TV advertising continues using conventional methods and relies on billboard data to understand the advertising reach. Even though the data is modeled but it is not as responsive as the techniques used in digital advertising.

As machine learning is not compatible with small and medium-sized data sets, advertisers are using moving to other innovative methods for TV ads. Data-Driven Linear Purchasing(DDL) is gaining momentum as it combines the precision of digital and the reach of TV. It leverages automation and data to target audiences on national linear TV. The method may not be at par with machine learning but optimizing DDL campaigns require accurate prediction and efficient complex procedures.

Interesting Read: AdTech Vs MarTech: Let’s Settle This Once For All!

Performance Measurement

The performance measurement is similar between the two media. In contrast to digital advertising, where convergent events are used to train sophisticated and supervised learning models, TV advertising is more difficult to measure. Nevertheless, Savvy TV buyers have various other ways to improve the buy like web and app analytics, group surveys, and more.

Despite TV advertising embracing the data value, digital advertising has been heavily criticized for using excessive amounts of data. As a result, government and industry privacy regulations have eliminated many of the drivers of machine learning techniques including the individual-level identifiers used during transactional events and advertising exposures.

The Road Ahead For Advertising

What is in store for advertisers after the privacy regulations?

Advertising technology (AdTech) companies can develop technology to learn from data samples, analyze that data based on context, and apply those findings to power buyers and sellers.

There is still enormous digital data despite changes in privacy policies. Advertisers should concentrate on targeting based on context and so machine learning is likely to be part of any solution. However, in television advertising, data scientists will have to prudently balance the statistical outputs of the models. Identifying and targeting audiences will remain a challenge for the advertising industry. In the meantime, data scientists who meld the best technologies from digital and television advertising can deploy powerful and accurate targeting in a more privacy-conscious world.

Interesting Read: The Ultimate A-Z Glossary Of Digital Advertising!

Is Global Ad Revenue Experiencing Fastest Growth In Advertising History?

The GroupM end-of-year advertising review offers marketers a broad view of ad revenues and trends over the past year and what’s anticipated for the coming year. Here are some highlights from the group’s 2021 report:

- In 2021, digital advertising is on track to grow 31%, and it will comprise 64.4% of all advertising, up from 52.1% in 2019. More than 50 percent of total ad revenue this year came from Alphabet, Amazon, and Meta, outside of China.

- Global advertising revenue is expected to grow at 22.5% for the year 2021, totaling approximately $763 billion.

- Next year will witness strong growth and it is estimated to grow at 9.7%.

The stable growth will continue even after 2021. In a briefing, Brian Wieser, GroupM’s global president of business intelligence said,

“It’s possible that this is the fastest growth in the history of advertising, at least in known history.”

Growth projections for 2021 outstripped GroupM’s midyear projections. He further said,

“We do expect some kind of reversion back toward a normal mid-single-digit growth rate over time, but at very elevated levels. In other words, we’re creating a new plateau for future growth to occur.”

Interesting Read: The Ultimate A-Z Glossary Of Digital Advertising!

The Talking TV

The television marketplace is changing rapidly but the growth is generally flat.

There will be an 11.7% growth in global TV ad spending in 2021, but this will not compensate for the 2020 pandemic-induced shortfall. Reports suggest that the industry won’t rebound to its 2019 levels before 2023. TV advertising will make up 21% of total advertising revenue this year.

A contributing factor to slower growth is that smaller companies find it more difficult to buy television advertising. Historically, television has been used for brand-building, using high-quality video messaging to make a lasting impression on the minds of consumers. However, that can be very expensive for small brands that advertise exclusively online.

No Impact Of Apple Change On The Advertisers

The changes in Apple iOS 14 may have impacted marketers but did not have any adverse effect on digital advertising as a whole. Wieser explained,

“The changes in data do not cause a change in budgets allocated to digital media. We saw this with GDPR—no observable impact at an industry level. Even though the data fidelity is lower now than it might have been before, it doesn’t change the budgets, it doesn’t impact the growth rate. But you never know, things could change.”

Interesting Read: Apple Will Now Ask Permission Before Showing Its Own Targeted Ads

What Lies Ahead For Marketers

GroupM forecasts that Connected TV (CTV) is poised to grow “substantially,” – roughly $17 billion in 2022 and $33 billion by 2026. It saw a surge in audience viewership during the 2020 pandemic. Currently, viewers make up 24% of total TV consumption, which is up from 19% a year ago.

Advertisers who buy ads based on user data, including programmatically, may view this additional inventory as an opportunity to increase revenues. But since three of the most popular streamers—Amazon Prime Video, Disney+, and Netflix—are ad-free and may stay the same in the near future. So, marketers need to come up with some alternate strategies to reach viewers.

Even though the scope of advertising would be harder on TV but marketers should not admit defeat. They should look for new ways to collaborate with the streaming partners. They can capitalize on their brand equity by “connecting their service to the brand in the minds of the consumer.”

Interesting Read: Connected TV Explained: The Essential Glossary Of CTV

MMPWW Enters In An Exclusive Tech Partnership With Aqilliz In MENA

Ad-tech solutions provider MMP World Wide (MMPWW) has entered into an exclusive technology partnership agreement with Aqilliz which will cover the Middle East, North Africa (MENA), and North American markets effective January 1, 2022. Aqilliz will authenticate audiences and establish data provenance within campaign environments.

Aqilliz – An Exclusive Technology Partner

The middleware technology provider specializes in providing seamless data collaboration and privacy compliance across the digital marketing ecosystem. Atom, Aqilliz’s proprietary, state-of-the-art data infrastructure, will enable federated learning, a machine-learning technique that allows distributed data sets to be queried and reconciled without the need to leave local storage. This ensures that all deterministic and probabilistic user identification happens within the context of local data protection laws.

Interesting Read: Huawei Ads announces six new additions to Certified Partners Program

How Will The Partnership Contribute?

MMPPWW, an ad tech leader across EMEA and APAC, delivers full-funnel targeting and precision marketing solutions to help brands reach and engage consumers. The company’s in-house expertise paired with strategic industry alliances increases its clients’ ability to effectively monetize digital advertising inventory, which results in better campaign performance and a dynamic and transparent way to communicate through vibrant content.

Automation enables the company to scale the delivery of communications to consumers. The company’s goal is to create the next generation of ad tech solutions through data mining and attribution modeling while also offering cookieless targeting.

Aqilliz’s hybrid blockchain environment will enable MMPWW and its brands to maintain an immutable ledger of transactions that records all activities of audience identification and matching by partnering with Aqilliz. This ensures the highest level of data provenance, which is in line with the requirements stipulated by data privacy laws.

Interesting Read: Trade Desk Partners With Choueiri Group For Better Programmatic Access In MENA

And That’s What They Said

Ayman Hayder, CEO of MMPWW said,

“Compliance isn’t something that is negotiable, and as more legislative reforms come into effect, it’s crucial that we equip our clients with the right tools and technology so they can be fully prepared.”

He further explained that the partnership will have a huge impact on how data is transacted in light of the recent Data Protection Law and the creation of the UAE Data Office.

“We consider this a golden opportunity to ensure privacy-first solutions become more commonplace, and we are very excited to work exclusively with Aqilliz to bring their technology to the MENA market”.

Gowthaman Ragothaman, CEO of Aqilliz is extremely thrilled about this first-of-its-kind partnership and said:

“Legacy technologies in the advertising and marketing technology ecosystem are built for centralized operations. The future of digital advertising is built on managing the value exchanges between brands, platforms, and the consumer, for which we need decentralized solutions in order to be secure and compliant. None of the existing solutions are able to capture and carry consent and provenance across the digital supply chain in order to be compliant.”

Interesting Read: JGroup and Blis To Partner For Exclusive Location-Based Advertising In MENA

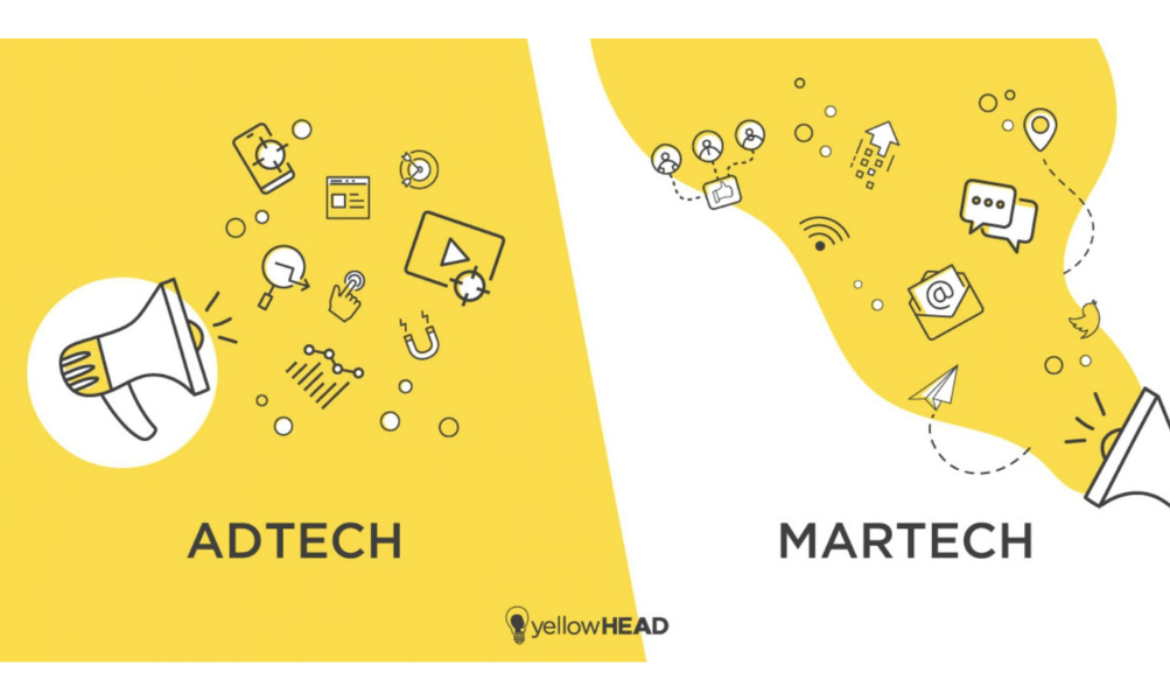

AdTech Vs MarTech: Let’s Settle This Once For All!

In the marketing world, adtech and martech may appear similar especially to a novice. Despite their similarities, these two concepts differ quite a bit; a razor-thin line separating AdTech and MarTech. What is the adtech and martech difference? Does one outweigh the other? Let’s find out the nuances of both approaches and dispel the fog around them.

What Is Adtech?

Adtech is the umbrella term for advertising technology. It covers a range of tools and software that can be helpful for advertisers, publishers, and ad agencies to plan, strategize, and manage all digital advertising or monetization activities. Adtech aids companies reduce wasted ad spending as it can target specific audiences.

Studies reveal that total digital ad spending is expected to hit $129 billion by the end of 2021. In short, adtech companies can help businesses maximize the return from their advertising spending by targeting specific audiences.

Image Credit: Smarty Ads

Examples Of Platforms/Tools Of Adtech

Image Credit: Amazon Ads

The two major entities that play a crucial role in adtech are – Demand Side Platform (DSP) and the Supply Side Platform (SSP).

Demand-side Platform (DSP): An essential platform for advertisers to buy, search, display video or mobile ads. It enables advertisers to buy ad placements in real-time on the publisher websites made available by ad exchange and networks. Some of the DSP players are Simplifi, Smarty Ads, App Nexus, Trade Desk, and more.

Supply Side Platform (SSP): The platform allows publishers to sell display, mobile ad impressions to potential buyers in real-time. Some of the key SSP players are MoPub, OpenX, Google, App Nexus, and more.

Broader examples also include:

- Data management platforms

- Ad exchanges/network/servers

- Tag management systems

- Programmatic advertising tools

- SEM (Search Engine Manager)

Interesting Read: A One-stop Guide On All You Ever Need To Know About AdTech In 2020

What Is Martech?

Martech is also known as marketing technology mainly used for digital marketing. John Koetsier, VP of Insights for Singular explains, “Every piece of technology a marketer uses to reach a potential customer is martech.” (via Adage)

Martech refers to the platforms and technologies that you use to create your ad media content, collect and analyze data, and reach your target audience.

MarTech is most commonly known for its automation, which allows you to manage multiple channels simultaneously and save time. Furthermore, it also helps marketers obtain more customer information and resolve tasks efficiently, making digital marketing more cost-effective.

There are more than 8,000 MarTech solutions and it is just expected to grow.

Examples of Platforms/Tools Of Martech

Some of the most common examples of Martech include:

- Customer Relationship Management (CRM) software-Salesforce, Hubspot, and more

- Social media management – Hootsuite and Buffer

- Search engine optimization (SEO) tools– Google Analytics, WooRank, Ahrefs, and more

- Content management platforms– WordPress, Squarespace, and more

- Digital analytics tools-MixPanel, KISSmetrics, and more

- Email marketing tools– MailChimp, Magento, and more

- Marketing automation programs

- Lead Magnets

When people discuss “Martech stack”, it means a collection of marketing technology solutions deployed by an organization to reach and convert potential customers.

Image Credit: Yellow Head Inc

Interesting Read: The Ultimate A-Z Glossary Of Digital Advertising!

Adtech and Martech Difference

Promotional activities like marketing and advertising go hand in hand. However, advertising is largely sponsored content. Advertisers always pay for the placement of their ads on a channel, website, social network, or connected TV.

On the contrary, marketing starts with understanding your product/service’s unique selling proposition, buyer personas, and channel partners. The aim is to understand the audience, deliver the right message, and generate more leads for the sales team. The marketing mix includes a variety of marketing activities, one of which is advertising.

Speaking of adtech vs. martech, let us comprehend the core differences with the help of the illustrating table below.

Adtech And Martech Convergence

Adtech platforms yield huge anonymous customer data and are not as personalized as data obtained from martech platforms. It relies on third-party data which often affects consumer privacy and utilizes the data for targeted online ad campaigns. They are often not in line with consumer interests and behavior.

Hence, adtech and martech convergence is highly essential. And what is this convergence called?

Adtech + Martech = Madtech

A good quality digital strategy requires a comprehensive approach. Therefore, the silos between adtech and martech need to be broken down for seamless data flow and synchronization.

Katie Wheeler in CMSWire wrote,

“The convergence of AdTech and MarTech can redefine the path of your marketing spend across the platforms you invest in, the data you own, the media you choose and the content you develop.”

For instance, a brand can use adtech and martech specific tools for a holistic marketing strategy. It can use an adtech platform to track the users visiting the website for a retargeting campaign. Then utilize the information in combination with the data gathered from blog analytics, email campaigns, or social media platforms (martech) to understand customer needs, optimize landing pages and personalize messaging for a sophisticated campaign.

The union of adtech and martech is every marketer’s dream as it will enhance customer experience which ultimately yields maximum ROI on the campaign and brings value to the business.

Interesting Read: Programmatic Advertising Platforms in 2020: A Complete Guide

Wrapping Up

There is a visible difference in the process of adtech and martech. However, we cannot claim that one is better than the other. The coming age will witness a Madtech revolution that will synergize advertising and marketing. It may cause a paradigm shift among marketers. Advertisers and marketers can benefit by deploying both adtech and martech tools to optimize budgets, increase conversion and achieve the best results.

On that note, ending with a quote of Rob Tarkoff, EVP, Oracle Advertising and Customer Experience from AdExchanger Talks podcast,

“It’s now time for the front office to go the way of the back office, which means we have to automate more of the adtech and martech selling and servicing workflow.”

Interesting Read: Your Ultimate Guide to Understanding the Customer Data Platform

Marketers Gain Direct Access To NBC Universal’s Peacock Via Yahoo DSP

NBC Universal has teamed up with Yahoo’s demand-side platform to give advertisers direct access to Peacock’s streaming and live content inventory. It is a programmatically guaranteed inventory, thereby facilitating scatter-buying and upfront buying. Programmatic guaranteed means the inventory is reserved for that buyer at a negotiated price.

With a limited number of streaming services, audiences are willing to pay for and many subscription streams stalling advertising-funded platforms become a more appealing option. In general, advertisers are more willing to invest in TV campaigns with larger audiences as long as the complex CTV buying environment does not deter them. This deal will increase the reach of advertisers’ Connected TV (CTV) campaigns. Nearly 70% of the Peacock audience is incremental to other NBCU digital video services.

Marketers can have guaranteed access to Peacock’s complete premium content library including NBC Sports, NBCU Next-Day Prime, Sky News, the Universal Pictures film library, and Peacock Originals.

The DSP will enable advertisers to target users based on location, age/gender, Peacock in-house segments, or contextually pre-defined, dynamic, or seasonal packages. This is Peacock’s first programmatic launch, with Yahoo serving as a pilot partner. Previously, Yahoo delivered programmatic campaigns for leading CPG, automotive, and telecom brands.

Interesting Read: All You Need To Know About Connected TV Advertising!

Pricing and programming Are Important

According to a blog by Yahoo, it said the results are encouraging. A major telecom brand could reach highly engaged audiences with Peacock’s on-demand content.

“For this advertiser, a resounding 92% of viewers reached on Peacock were not reached on linear TV, showcasing the value of Peacock’s digital-first audience.”

It further explained that the client the importance of Peacock in their strategy.

“Using Yahoo’s Unified TV Report, the client was also able to understand how Peacock fit within its overall TV strategy, from incremental reach to cost per incremental household.”

Yahoo points out that audiences are attracted to AVOD services.

Image Credit: Yahoo

Flexibility in pricing and programming is increasingly important to consumers when choosing their streaming service.

“In fact, 83% of viewers say they’re willing to try an ad-supported version of services to save money.”

For Peacock to make the case for advertisers, they require a dependable DSP partner to up the ad revenue and ensure ads are finding the relevant audiences for advertisers.

Interesting Read: Connected TV Explained: The Essential Glossary Of CTV

Outbrain Expands Video Offering With A Swiss Start-Up Acquisition

Open web recommendation platform Outbrain has strengthened its brand and video offering after entering a definitive agreement to acquire a Swiss contextual video start-up VI.

Video intelligence(VI) is a contextual video technology platform for digital and Connected TV media owners. It combines contextually matched content and in-stream video advertising for desktop, mobile, and CTV.

Interesting Read: Connected TV Explained: The Essential Glossary Of CTV

The Deal Makes Absolute Sense

Outbrain works with many publishers who are indexing more towards videos such as Rakuten TV, Pluto TV, and Samsung TV Plus. Media owners and advertisers benefit from Outbrain’s acquisition of the company.

-vi’s contextual and machine learning technologies enable media owners to add relevant video content to their articles to enhance user engagement and monetization.

-vi’s solution is cookieless by design and serves media owners ranging from IDG to Der Spiegel and Funke.

-Advertisers can leverage the high-impact, incredibly viewable, brand-safe video ad inventory that drives awareness and engagement.

Recently, vi partnered with Samsung TV+ to get into the connected TV space.

Outbrain will acquire vi for an aggregate purchase price of approximately $55 million and is expected to close in the first quarter of 2022.

Interesting Read: Why Did The Most Anticipated Taboola-Outbrain Deal Collapse After A Year?

And That’s What They Said

Yaron Galai, Co-Founder and Co-CEO said is excited to have the VI team on board and share significant synergies between both companies.

“The combination with vi will allow us to deepen our partnership with media owners, providing mid- and top-of-article video solutions. It will also expand our addressable market, introducing high-quality in-stream video inventory to support our brand advertisers.“

Kai Henniges, Co-Founder and CEO of VI said that both companies share the same vision of the future media.

“Our years of video expertise and unique offering for publishers and CTV providers are a perfect addition to Outbrain’s leading market position and premium global media owner partnerships. Together we will accelerate our mission to inspire, inform and entertain users by putting video in context.”

Interesting Read: At $1.25B Valuation For News Link Recommendations, Outbrain Raises $160M