Deciphering Big Tech Giants’ Quarterly Results: Here’s What They Say!

The Big Techs recently disclosed their fourth-quarter results. For those who are interested in the industry, these are a few key findings and insights from the quarterly reports.

![]()

ALPHABET

Alphabet Inc., the parent company of Google, exceeded Wall Street forecasts with its fourth-quarterly earnings report. Ad sales, however, failed to expand quickly enough to keep up with experts’ predictions. YouTube, which has been contributing to increased growth, came up barely short of projections. With over 2 billion monthly users and an average of 70 billion views per day, YouTube Shorts continues to be a top priority for Google.

The cloud division, which was losing money for years while it attempted to compete with Microsoft Azure and Amazon Web Services, is where the company makes its money. Google Cloud continued to be a growth engine in the fourth quarter, expanding by 26%. The primary driver of revenue growth continues to be search. While brand and direct response advertising drove YouTube advertising, growth in retail was the main driver of Google Search and other forms of advertising revenue.

By the numbers

- Revenue reported was $86.31 billion, up 13.5%.

- Google Search and other advertising revenues rose to $48 billion, up 13% Yo-Y.

- Google cloud computing revenue was $9.19 billion up 26% Yo-Y.

- Advertising revenues reported were $65.52.

- YouTube advertising reported $9.2 billion, up 16% Yo-Y.

- Network advertising revenue was $8.3 billion, down 2%.

- Traffic acquisition costs were $13.9 billion.

Google is beginning to provide generative AI to an increasing number of companies to assist them in creating more effective campaigns and advertisements. Google unveiled Gemini, a large language model that it claims to be its most powerful AI model, in December. The business intends to license Gemini to users via Google Cloud so they can utilize it in their apps. Additionally, Google plans to test the usage of Gemini in Search, where it will speed up consumers’ Search Generative Experience (SGE).

Sundar Pichai, CEO, said in the conference call,

We are pleased with the ongoing strength in Search and the growing contribution from YouTube and Cloud. Each of these is already benefiting from our AI investments and innovation. As we enter the Gemini era, the best is yet to come.

Ruth Porat, President and Chief Investment Officer, CFO said,

We ended 2023 with very strong fourth quarter financial results, with Q4 consolidated revenues of $86 billion, up 13% year over year. We remain committed to our work to durably re-engineer our cost base as we invest to support our growth opportunities.

Read More: Google Integrates Gemini AI Into Search Ads Platform

META

Meta exceeded Wall Street expectations and had a positive fourth quarter. The positive outcomes show that digital advertising has recovered well from its 2022 decline. It was a significant year for both the business and the community. According to Meta’s estimation, over 3.1 billion individuals use at least one of the Meta applications daily. The already enormous social media company keeps on adding new users across all platforms.

Overall, Meta’s Q4 revenue increased by 25% over the previous year. Threads, the business’s Twitter-like social app that launched in July 2023, now has over 130 million monthly active users, according to the company. As is usual, almost all of Meta’s revenue came from sales of digital advertising. Chinese retailers have increased their spending to reach customers worldwide, which has contributed to Meta’s financial turnaround during the past year. They have been heavily investing in Facebook and Instagram ads.

By the numbers

- Revenue was $40.11 billion, an increase of 25% Yo-Y, and $134.90 billion, an increase of 16% Yo-Y for the full year.

- Facebook DAUs were 2.11 billion on average, an increase of 6% Yo-Y.

- Facebook MAUs were 3.07 billion, an increase of 3% Yo-Y.

- Family DAPs were 3.19 billion on average, an increase of 8% Yo-Y.

- Family MAPs were 3.98 billion, an increase of 6% Yo-Y.

- Ad Impressions delivered across all Meta apps increased by 21% Y-o-Y and the average price per ad increased by 2% Yo-Y.

Strong sales of the company’s Quest device during the holiday season drove record sales of $1.1 billion for the metaverse-focused Reality Labs division. Additionally, Zuckerberg stated that the ad business, which is expanding more quickly than Google, has benefited from advancements in artificial intelligence. By the end of the year, Meta plans to completely launch Meta AI assistant and further AI chat experiences in the United States using generative AI.

Meta Chief Executive Mark Zuckerberg said in a news release,

We had a good quarter as our community and business continue to grow. We’ve made a lot of progress on our vision for advancing AI and the metaverse.

Susan Li, CFO, stated that Meta’s big areas of focus in 2024 will be working towards the launch of Llama 3, expanding the usefulness of Meta AI assistant, and progressing on our AI studio roadmap to make it easier for anyone to create an AI.

AMAZON

For the fourth quarter of 2023, Amazon reported better-than-expected revenues, exceeding sales forecasts thanks to new generative AI capabilities in its cloud and e-commerce businesses, which drove strong growth throughout the Christmas season. The e-commerce behemoth had a great holiday season. Over 1 billion items were bought on the site in the course of the company’s 11-day Black Friday and Cyber Monday sales. Additionally, the events helped bring in new Prime members and save consumers billions of dollars.

With 26% Yo-Y growth in worldwide advertising, Amazon had a great result. Because machine learning has improved ad relevancy, sponsored products have been the main driver of advertising strength. The shift in customer attention towards encouraging innovation and introducing new workloads to the cloud was attributed to the increase in AWS revenues.

By the numbers

- Revenue was reported at $169.9 billion versus expectations of $166.2 billion, up 13.9% Yo-Y.

- AWS Revenue 13% increase in sales over the prior year to a total of $24.4 billion.

- Advertising sales of $14.7 billion.

- Subscription services were up 13%, reporting $10.4 billion in revenue.

Amazon has launched Rufus, a new AI shopping assistant trained in Amazon’s product catalog and other web-based information. The tool, driven by generative AI, may provide product recommendations and respond to queries from users of the Amazon mobile app. The corporation believes that advancements in AI might bring in tens of billions of dollars for its cloud computing division.

Chief Executive Andy Jassy said in Amazon’s press release

This Q4 was a record-breaking holiday shopping season and closed out a robust 2023 for Amazon. While we made meaningful revenue, operating income, and free cash flow progress, what we’re most pleased with is the continued invention and customer experience improvements across our businesses.

Amazon’s Chief Financial Officer Brian Olsavsky added,

We’re coming off a period where we’ve done a lot of hiring. There’s a general feeling in most teams that we’re trying to hold the line on headcount.

Read More: Amazon and Reach Partner for Targeted Ads Ahead of Third-Party Cookie Phase-Out

MICROSOFT

Microsoft had a record-breaking quarter, mostly due to Microsoft Cloud’s ongoing growth. Strong executions in the commercial areas and device advancements were credited for the anticipated growth in its quarterly results. The robust demand for Microsoft Cloud offerings, particularly AI services, led to enhancements in Azure, which in turn drove revenue growth.

On October 13, 2023, Microsoft completed the acquisition of Activision Blizzard. With the acquisition, the business expanded its player base by hundreds of millions. It broke previous records for MAUs on Xbox, PC, and mobile devices with over 200 million MAUs in a single month. The business has been integrating AI into every aspect of the IT stack, bringing in new clients and fostering increased efficiency. Additionally, the business reported increased revenue from Windows OEM sales and improved performance in consumer markets.

By the numbers

- Revenue recorded was $62.0 billion, an increase of 18%.

- Intelligent Cloud unit $25.9 billion, increasing 20% ahead of expectations.

- Azure revenues increased by 30%.

- LinkedIn’s revenues increased by 9%.

- Microsoft Cloud Revenue was $33 billion, up 24%.

- Search and news advertising revenue excluding traffic acquisition costs increased by 7%

AI is helping to drive revenue in the Azure consumption business. Over the past year, Microsoft, Amazon, and Google have all invested billions of dollars in artificial intelligence (AI) in an attempt to overtake one another as the leading providers of AI software.

Satya Nadella, chairman and chief executive officer of Microsoft said,

We’ve moved from talking about AI to applying AI at scale. By infusing AI across every layer of our tech stack, we’re winning new customers and helping drive new benefits and productivity gains across every sector.

Amy Hood, Chief Financial Officer added,

While it’s early days for Microsoft 365 Copilot, we’re excited about the adoption to date and continue to expect revenue to grow over time.

Read More: Vodafone and Microsoft Sign 10-year Strategic Partnership for IoT, Cloud, AI and More

APPLE

In its first-quarterly report, Apple exceeded analysts’ projections for both revenue and profits, but it revealed a 13% drop in sales in China, one of its most significant regions. The tech giant surpassed 2.2 billion active devices, setting a new milestone for its installed base. Apple attributes this to extremely high levels of customer satisfaction and unmatched customer loyalty.

According to projections, Mac sales increased by less than 1% throughout the quarter. Nonetheless, this is a noteworthy comeback for the product line, which had an annual decline of about 34% in the September quarter. iPad sales are still declining. For the first time in iPad history, Apple did not introduce a new model in 2023.

By the numbers

- Revenue was $119.6 billion, up 2% Yo-Y.

- iPhone Revenue was $69.70 billion 6% up.

- Mac $7.78 billion 1% up Yo-Y.

- iPad $7.02 billion down 25% Yo-Y.

- Wearables, home, and accessories revenue was $11.95 billion, down 11%.

- Service Revenues $23.13 billion up 11% Yo-Y

Additionally, Apple unveiled the Apple Vision Pro, their most sophisticated personal electronics gadget to date. Customers in the United States will be able to purchase it via Apple stores; later in the year, it will also be available in other countries. It is considered a groundbreaking gadget that is years ahead of anything else and is based on decades of Apple ingenuity. Additionally, the company announced that customers may select any Apple Watch model that is carbon neutral for the first time.

Tim Cook, Apple’s CEO said in the conference call,

Today Apple is reporting revenue growth for the December quarter fueled by iPhone sales, and an all-time revenue record in Services. We are pleased to announce that our installed base of active devices has now surpassed 2.2 billion, reaching an all-time high across all products and geographic segments. And as customers begin to experience the incredible Apple Vision Pro tomorrow, we are committed as ever to the pursuit of groundbreaking innovation — in line with our values and on behalf of our customers.

SNAP INC

Snap Inc. released a forecast that was slightly below Wall Street expectations. The company has now recorded six consecutive quarters of single-digit growth or revenue contraction. Snap Inc. struggled to recover from the downturn in the digital ad sector.

Snap Inc. has announced a new publisher partnership with Spotify in the United States, which will bring short-form highlights from Spotify’s podcasts to Spotlight and Stories. Additionally, the social media giant revealed new AI-powered tools for Snapchat+ users, enabling them to edit and share Snaps as well as create and send AI-generated images in response to text prompts.

By the numbers

- Revenue was $1,361 million, an increase of 5% Yo-Y.

- DAUs were 414 million, an increase of 39 million or 10% Yo-Y.

- MAUs increased 8% Yo-Y and surpassed 800 million in Q4.

- Subscriptions for Snapchat+ have reached over 7 million

Snapchat made a large investment in its augmented reality system. On average, almost 300 million Snapchat users use its augmented reality feature every day. Additionally, it has invested in automation and technology, used generative models, and optimized the ML Lens generation workflow.

Evan Spiegel, CEO said in the announcement,

2023 was a pivotal year for Snap, as we transformed our advertising business and continued to expand our global community, reaching 414 million daily active users. Snapchat enhances relationships with friends, family, and the world, and this unique value proposition has provided a strong foundation to build our business for long-term growth.

OMNICOM MEDIA GROUP

Omnicom exceeded analyst forecasts with impressive Q4 and full-year 2023 results. The growth in advertising and media during the quarter was driven once again by the performance of global media, with softer results from Omnicom’s advertising agencies serving as a partial offset.

Additionally, Omnicom completed the acquisition of Flywheel Digital, which will contribute to the introduction of scaled capabilities in the retail, media, and digital commerce sectors—the fastest-growing areas of the business. Furthermore, Omnicom disclosed that it has partnered with Getty Images as a first mover, giving them early access to a new generative artificial intelligence tool.

By the numbers

- Revenue reported increased $192.7 million or 5% organically, to $4,060.9 million.

- Advertising and media were up 9.3%.

- Public Relations was 2.9% down.

- Third-party service costs increased by $97.5 million or 12.4% to $884 million

Omnicom has reportedly spent tens of millions of dollars developing artificial intelligence over the past ten years, according to CEO John Wren. With the recent June 2023 launch of Omni Assist, a generative AI-powered virtual assistant that organizes, carries out, and produces advertising campaigns through cooperation with Microsoft, Omnicom became the first agency holding company to get access to the most recent Open AI GPT models.

John Wren, Chairman and Chief Executive Officer of Omnicom commented,

Omnicom finished 2023 with 4.4% organic revenue growth in the fourth quarter and 4.1% for the year. Looking out to full year 2024, we are set up well with solid fundamentals, tremendous opportunities in digital commerce and retail media from our Flywheel acquisition, and momentum in new business wins. Our accelerated investments in analytics and AI will enhance our ability to drive the best outcomes for our clients, while shareholders remain supported by our profitable operations and balanced deployment of capital through dividends, acquisitions, and share repurchases.

Read More: Decoding Big Tech Giants Quarterly Results: Insights Await!

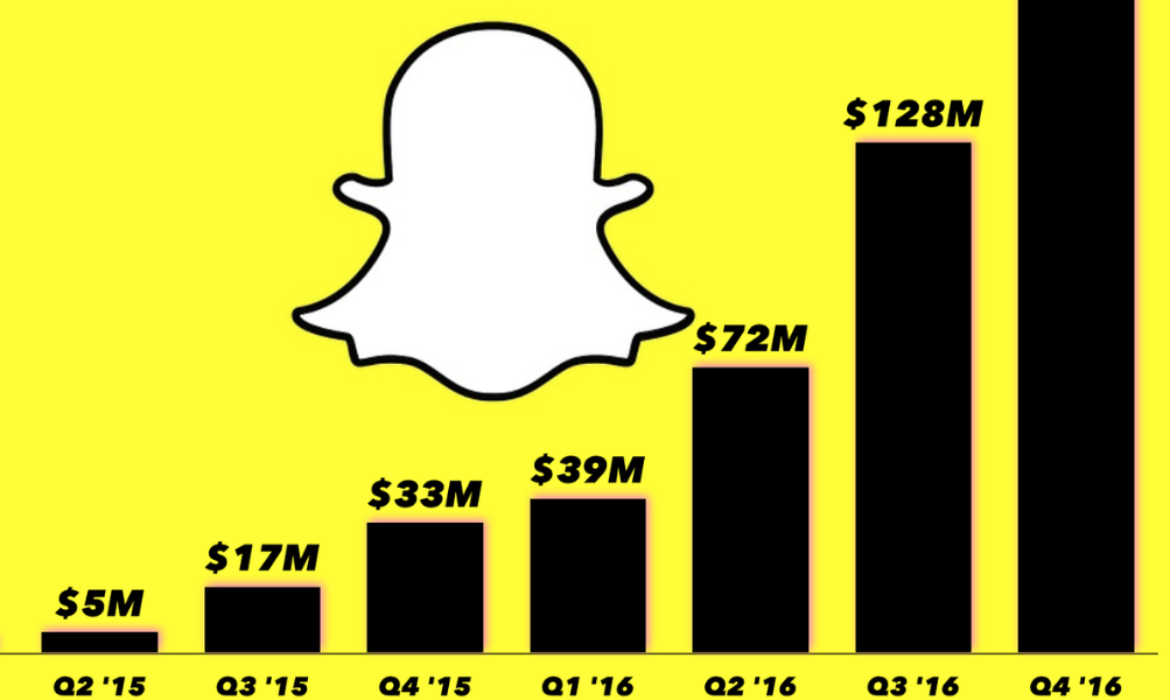

Snap Sees a 64% Increase in Q4, Records Fastest Revenue Growth Yet!

During its Q4 2021 earnings report, Snap Inc. announced excellent revenue and user growth. The company’s total revenue for 2021 was $4.1 billion, representing a 64 percent year-over-year increase, the fastest rate of yearly revenue growth in the company’s history.

While Meta recently experienced its first drop in usage, Snap is still on the rise. In Q4, it increased its daily active user base to 319 million. In the fourth quarter, the firm attracted 13 million daily users, bringing the total number of daily users to 54 million for the year. This is said to be the fifth quarter in a row that the community has grown by at least 20% year over year.

Snap’s Q4 performance was boosted in part by the company’s attempts to recover from the negative effects of Apple’s App Tracking Transparency (ATT) policy on its direct-response (DR) advertising relationships. ATT took away many of Snap’s capabilities for providing advertising partners with accurate conversion numbers, hurting the company’s business with DR clients.

Interesting Read: Snapchat Sees a 20% Plummet In Revenue Due To Apple’s Privacy Changes!

Snap has armed itself with a measurement that focuses on mid-funnel targets such as clicks or installations to combat this. According to Snap, its first-party measurement solution and advanced conversions were essential in the company’s refocus on mid-funnel analytics.

Snap also hailed its new first-party measurement strategy for safeguarding user privacy and providing advertiser partners with a more precise estimate of their ROI.

Snap has outlined three growth goals for its ad business in the future. The first was to keep improving the company’s ad optimization and measurement capabilities. The second was to continue to invest in sales and marketing by continuing to train and expand its sales and marketing personnel. The final task was to create ad products for video and augmented reality.

Interesting Read: Snapchat Spotlight Challenges & Other Monetization Tools For Creators!

Snapchat Sees a 20% Plummet In Revenue Due To Apple’s Privacy Changes!

Snap, the parent company of Snapchat, claimed that recent privacy changes in Apple’s iOS mobile operating system had impacted its company by restricting some advertisers from tracking it. The company stated that while it expected some interruption as a result of the adjustments, the issues for advertising were worse than anticipated.

Snap recorded a stock drop of more than 20% recently, soon after the firm published quarterly results that fell $3 million short of its forecast. Snap’s most recent quarter saw revenue of $1.067 billion, up 57% from the same period the previous year.

According to Snap, advertisers were also hampered in their spending due to the pandemic and supply chain problems.

To accommodate to Apple’s privacy rules, the business said it was developing new technology and measuring solutions for advertising. Snap’s chief executive, Evan Spiegel, gave a statement saying –

“We’re now operating at the scale necessary to navigate significant headwinds, including changes to the iOS platform that impact the way advertising is targeted, measured, and optimized, as well as global supply chain issues and labor shortages impacting our partners.”

Also Read: Power Of Out-Of-Home Advertising In The Middle East And Road Ahead!

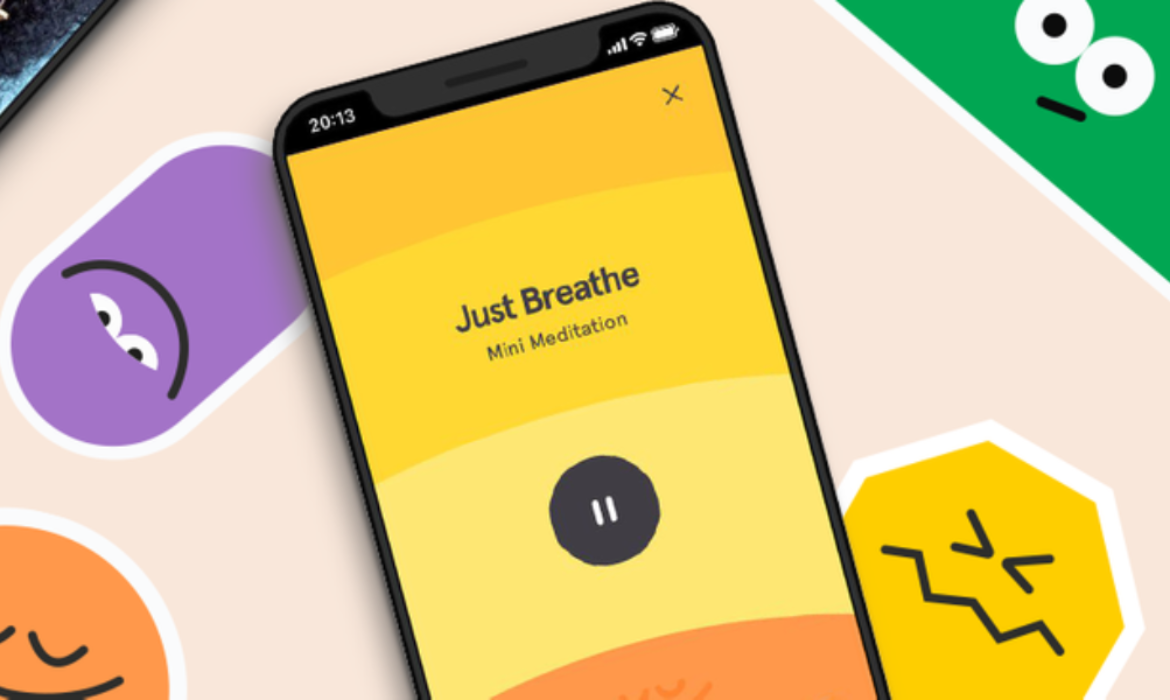

Snapchat’s New Feature ‘Snap Minis’ Will Be the Next Hot Thing in the Market

Snap introduced an array of new products and partnerships for Snapchat including original shows, Minis, new lenses, new navigation bars, and games at the 2020 Snap Partner Summit.

The highlight of the event was Minis – a suite of miniature apps developed by third parties that will run inside Snapchat. This will be integrated into the Snapchat chat window that would allow users to buy movie tickets, shop with friends or meditate.

In an interview with The Verge, Snap CEO Evan Spiegel said,

“Let’s say you’re getting ready with your friends, or your school dance is two weeks from now — you can actually shop together with your friends, which I think could be a really fun experience.”

Image Credit: Snap

What Snap Announced:

-Minis are web-based apps built on HTML-5 for Android and iOS.

-Minis will start rolling out next month on Snapchat with the first seven minis.

-A mini-app by Coachella to coordinate and plan a festival line up with the friends.

-A mini version of Headspace to meditate and send encouraging messages to friends.

-A mini-app by Tembo to create flashcards for studying,

-A mini-app by Atom to buy movie tickets, pick seats, and choose timings.

Why They Matter:

– The inclusion of mini-apps will increase Snapchat’s functionality and potentially making it a one-stop app like WeChat for GenZ.

– The main purpose behind creating minis is creating eCommerce avenues as its main competitor WhatsApp has already ventured into digital payments and shopping.

– The company’s growth is stable in the messaging space but is not big enough to compete with the likes of Facebook and Google for ad revenues in the long term.

– As a result, it plans to build an ecosystem that revolves around its camera technology to unlock new revenue generation options.

What’s New For Brands:

– Brands especially looking to target the younger audience should consider developing a Snap Mini to provide services and ensure easy accessibility to Snapchat users.

– It is easy to maintain a mini-app than a full-size app as brands can leverage the Snapchat’s user base to gain traction.

By The Numbers:

– These miniatures applications are compared to WeChat’s mini-programs that generated $113 billion for Tencent last year, according to The Verge.

– Snap execs revealed that it reached over 229 million daily active users on average in the first quarter of this year, with over 100 million in the U.S. alone. (That’s larger than TikTok or Twitter’s U.S. footprint.)

And, there’s lots more from the 2020 Snap Partner Summit:

1. Camera Kit: It allows developers to bring Snapchat’s AR capabilities and engagement into their own apps that enable apps like Squad to create a co-viewing experience while video chatting with friends.

2. Dynamic Lenses: It allows developers to bring real-time information from their app into Snapchat lenses.

3. Bitmoji For Games: A cross-platform avatar for gaming on mobile, PC, or console. This means it is easier for a user to maintain a uniform gaming identity online by using one avatar across all games.

4. Snap Games: An interactive way for friends to play the game on mobile which includes “Bitmoji Party.”

5. Lens Studio: A free and new desktop feature that allows developers to bring their machine learning models to power lenses. For the first SnapML creations, the company partnered with Prisma, Wannaby, and others.

6. Local Lenses: A new feature that allows users to create 3D worlds on top of their building and or decorate nearby buildings with colorful paints and have a new AR experience.

7. Scans: Snap expanded its scan platform and announced new partners for plants, dogs, and nutrition information. Plant Snap will help the user identify 90% of all known plants and trees. Dog Scanner to identify 400 breeds, Yuka will launch a nutrition scanner to provide ratings on the quality of ingredients in the packaged foods and Louis Vuitton will help users scan the monogram to be transported into the inspiration behind their latest collection.

8. Voice Scan: It allows users to issue voice commands to find lenses.

Snap’s Q1 2020 Report: Users and Revenue Increases, Ad Spend Declines

Snap Inc. the parent company of the popular social media platform Snapchat reported in its Q1 2020 earnings – strong gains in both users and revenues but a dip in advertiser spend despite the growing concerns about the coronavirus pandemic.

No Coronavirus Negative Impact on Earnings-Yet

The stock was up nearly 20 percent after the company reported a 44 percent (Y-o-Y) increase in its first-quarter revenue to $462 million. That was a far better performance than expected. The ad spend growth grew 58% in January and February, and fell to roughly 25% in March (when the pandemic grew rapidly), the gains from the first two months helping to end the quarter positively.

CFO Derek Andersen said during Snap’s earnings call,

“The economic environment has become challenging for many of our advertising partners.”

The company didn’t provide guidance for Q2 citing uncertainty related to the worldwide economic crisis but in an unusual step, provided revenue growth figures for the first week of April. The advertiser mix on Snapchat contributed to the Q1 performance and continues to help in Q2. Snapchat has a few small business advertisers unlike Facebook and Instagram, however many large advertisers are ready to commit on a regular basis.

Snapchat CEO Evan Spiegel said in a statement,

“We are grateful for the opportunity to serve our community and partners during this difficult time.” He added, “Snapchat is helping people stay close to their friends and family while they are separated physically, and I am proud of our team for overcoming the many challenges of working from home during this time while we continue to grow our business and support those who are impacted by COVID-19.”

Strong User Growth and increase in Engagement

Snapchat’s daily active user (DAV) base reached 229 million in the first quarter across all regions and on Android and iOS.This represents a 20 percent increase from last year.

Image Credit: Snapchat Earnings Slides

There is some concern over the divergence of Snapchat’s users’ growth. Snapchat added 2 million more users in North America- the most lucrative market but the majority of the growth was from the ‘Rest of the World’ category. Snapchat has witnessed significant growth in the Indian market since it revamped its Android app, a key contributor to the ‘Rest of the World’ category.

However, the key area of opportunity that Snap would prefer to boost growth in the US as it will get more 3.5x more revenue per user.

Image Credit: Snapchat Sides

Besides, the time spent on Snapchat has increased due to coronavirus. CEO Evan Spiegel reported that the average time spent in the last week of March vs. the last week of January was up more than 20%. On the other hand, markets like the U.K, France saw more than a 30% increase.

Mobile app tracker App Annie’s findings point out 54% growth in average time spent per user on Snapchat in South Korea from March1-14,2020, compared with Q4 2019. Italy marked a 36% increase and Japan was up 23%.

Image Credit: eMarketer

Additionally, this pandemic increased communication with friends and family on Snapchat, up more than 30% in the last week of march compared to the last week of January whereas in some other geographies there was an increase of more than 50%.

Games, TV, Chat, Calling are other highlighting points of group engagement.

Snapchatters watching Snap’s premium content hub ‘ Discover’ grew 35% Y-o-Y in Q1 2020 which represents the total time spent watching shows more than doubling this quarter. The company also mentioned hiring Hulu senior vice president of advertising sales Peter Naylor.

Chief business officer Jeremi Gorman said,

“As TV budgets migrate to digital, they move to places that carry the same advantages of linear, and we’ve been investing in those things for years. Peter is just the most recent investment in the strategy.”

Snap has also launched App Stories -brings its popular stories feature to the app. It also launched five new Snap games globally. With the use of videoconferencing and live streaming to connect with friends and family, Snap has seen more than 30 times increase in the daily download of Snap camera, a desktop app that allows people to add lenses to whichever video service they use. Besides, it added more than 120 partner app integration with its Snap Kit, and the numbers of Snapchatters using on a monthly basis is up 75% from the Q4 of 2019.

Direct-Response advertising budgets make up half of the revenues.

Snap continues to double down on direct response advertisers especially in games, home entertainment, CPG, and eCommerce. Direct response advertising now accounts for more than half of Snap’s revenue.

Speigel noted,

“In the short-term, we’re shifting sales resources and pulling forward some investments in direct response to better serve the advertisers who are trying to reach our audience during this time. For example, we can help movie studios pivot to digital releases by supporting them with a suite of products designed to track titles over a dynamic and flexible release window. We’ve also seen many large brands doing a lot of important things to help their community and the broader world, and we’re helping these brands communicate their efforts to our audience in a thoughtful and approachable way that inspires others to make a positive impact.”

Snapchat recently worked with Universal on the promotion of the animated film ‘Trolls World Tour’ released digitally incorporating Trolls AR masks into Snap Camera add-on a feature that gained significant momentum as more people work from home.

Snap has worked immensely hard over the past few years to build out measurement capabilities and ad products to interest the direct advertisers resulting in nearly double total ad revenues in two years.

So what has Snap done to get this?

Snap introduced conversion-optimized bidding- which allows advertisers to optimize toward their sales or app install gaols, conversion-tracking advertising pixels, and improved ad-targeting capabilities. This has attracted performance advertisers who already buy those types from other platforms.

Snap has focused on offering unique ad products like augmented reality platforms and easy self serve ad platform.

Chief business officer Jeremi Gorman said,

“Advertisers are looking for a way to make a dollar go further. “We have efficient pricing, and we’re a great place to come to get ROAS for the audience they’re looking for.”

There is also something for Snap’s brand advertisers. The company has doubled the amount of money committed via upfronts in 2020 vs. 2019. Snap is using its creative services to help brands distribute their PSAs related to COVID-19, like the filter from Adidas encouraging people across the United Kingdom and Germany to stay at home that was viewed more than 14 million times.

Snap has a lot of potential and capacity to reach a young audience. Although things look gloomy for the remaining year of 2020, Snap appears more stable and an attractive platform for advertisers and partners. If Snap manages to expand its market appeal geographically, it will be well-positioned beyond COVID-19.