Omnicom Signs Generative AI Licensing Agreement with Getty Images

Omnicom has signed a groundbreaking generative AI licensing agreement with Getty Images, giving it access to one of the largest global providers of stock photos, videos, and other creative assets. This first-mover partnership will give Omnicom early access to Getty Images’ generative AI. The new tool creates a commercially safe and legally indemnified generative AI tool by combining the best creative content produced by Getty Images with the newest AI technology.

Omnicom Alpha Testing Program

Omnicom integrated the tool into Omni, its open operating system, as part of its Alpha testing program. Agency teams will be able to securely produce on-brand content that aids marketers in orchestrating better results by integrating the tool with Omni’s data. Additionally, they will be able to integrate the tool into client ecosystems and modify it using proprietary client data to create commercially successful images that reflect the client’s distinct visual identity.

Generative AI by Getty Images

Launched in September 2023, Getty Images’ generative AI is built on the cutting-edge Edify model architecture foundry, which is a component of NVIDIA Picasso, a generative AI model-building platform for visual design. The tool has unlimited indemnity for commercial use and is exclusively trained on content from Getty Images. Users can download and license any visual they create, giving Omnicom teams greater protection and usage rights and accelerating the time from idea to completion.

Read More: Omnicom Centralizes Leadership for Three Creative Powerhouses

Ethical AI practices

Both businesses have adopted a resolute position on ethical AI procedures. Omnicom is a member of the Coalition for Content Provenance and Authenticity (C2PA). It works to safeguard the legitimacy of AI assets for creators, brands, and customers. This is by developing and standardizing a future framework for content verification. Furthermore, Omnicom was the first holding company for advertising to sign up for Adobe’s Content Authenticity Initiative (CAI). The initiative aims to improve transparency and confidence in digital content. The C2PA standard is being promoted by means of this initiative.

Maintaining editorial integrity in Generative AI

Additionally, Getty Images has taken significant action to safeguard editorial integrity and public confidence in the media in the face of the proliferation of AI tools and platforms. It has done so by co-signing an open letter with a number of media companies and organizations that outlines suggested guidelines for industry and regulatory action. These guidelines include efforts to remove bias from generated content, transparency of training sets, and clear identification of AI-generated content. With the newest tool from Getty Images, users can be sure that it’s safe for use in commercial settings. Furthermore, they can ensure that the material they create won’t contain any identifiable persons or trademarked goods or brands.

Here’s what they said

Omnicom’s EVP, Chief Technology Officer, Paolo Yuvienco said,

We are honored to be a part of Getty Image’s new Generative AI tool, one that will significantly help our people move from ideation to execution in a seamless manner. Getty Images shares our commitment to the responsible use of AI, and that makes their new tool all the more enticing to us, especially given it is built with high quality authentic content. Providing our people and our clients a commercially safe option is a true game changer, and we’re eager to harness the tool’s capabilities alongside them.

Grant Farhall, Chief Product Officer at Getty Images added,

We are giving brands the freedom to explore Generative AI for internal ideation, alongside the confidence and trust to use content in commercial settings with the same protections as our world-class pre-shot libraries. We’re honored to have worked with Omnicom in our initial testing to refine in ways that meet the ongoing needs of marketers and advertisers.

Read More: Omnicom Acquires Flywheel, the Pioneering Digital Commerce Company

Omnicom, NBCUniversal Pioneer Program-Level At-Scale Reporting

The media services branch of Omnicom Group INC, Omnicom Media Group (OMG), and NBCUniversal have partnered to provide program-level at-scale reporting for the network’s streaming platforms. This first-to-market capability makes use of NBCUniversal’s privacy-conscious clean room technology, NBCUnified Access (formerly known as Audience Insights Hub). It gives five advertisers visibility into where their ads are delivered and whether the content is consistent with their brand. Media buys for CTV do not yet have access to this information, which is crucial for spending decisions.

Omnicom Media Group’s call for new standards

OMG has made a request for additional guidelines pertaining to social, retail, programmatic, and CTV media. By using this capacity, NBCUniversal is meeting important objectives outlined in the CTV guidelines that OMG’s Council of Accountability and Standards in Advertising (CASA) released in 2021. The informal cooperation between OMG agencies, media partners, and clients proposed these new guidelines. It is dedicated to improving transparency and quality control for advertisers across social, SSP, retail, and CTV platforms. By partnering with top streaming companies like NBCUniversal, CASA is enabling capabilities that will increase category growth by improving the ROI and security of CTV as an investment for marketers.

What is CASA?

The goal of CASA is to empower buyers through the definition of key advertising rights and the advancement of the capabilities of corresponding media owners. This will improve buyer control, seller transparency, and brand safety for advertisers across expanding media channels. It also holds partners responsible, and this week’s release is the outcome of talks with CASA participants that lasted three years.

New proposed rubrics for at-scale reporting

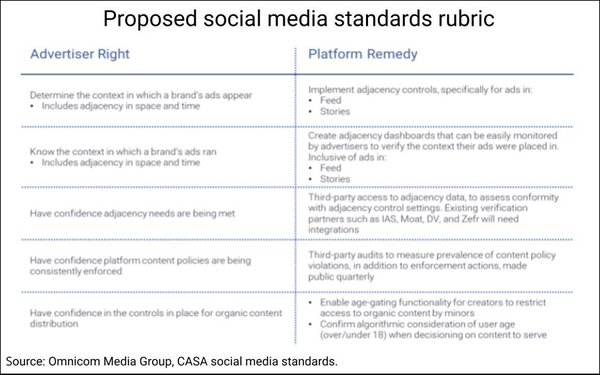

CASA is driving breakthroughs in seller transparency and advertiser control across social, SSP, retail, and CTV channels, as highlighted in several OMG reports published during Advertising Week. A first set of rubrics covering the rights of advertisers and the remedies of social media companies covers social media advertising. According to OMG, the CASA program has collaborated with eight social media networks.

Image credit- Media Post

Read More: Omnicom and Criteo Unveil First-Of-Its-Kind Retail Insights Alliance

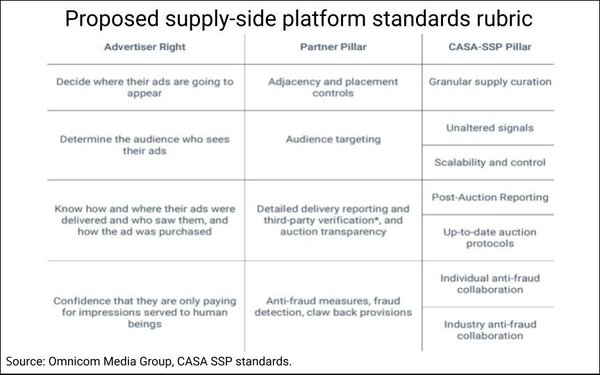

Additionally, OMG announced a proposed set of guidelines for supply side platforms (SSP) in programmatic advertising buys. OMG developed these guidelines in response to a recent analysis from the Association of National Advertisers. It detailed the $13 billion worth of “Made-for-Advertising” or MFA websites

Image credit- Media Post

For retail media, OMG released a third set of suggested guidelines. They created it for addressing the meaningful ways that upper funnel channels like CTV can boost sales.

Image credit- Media Post

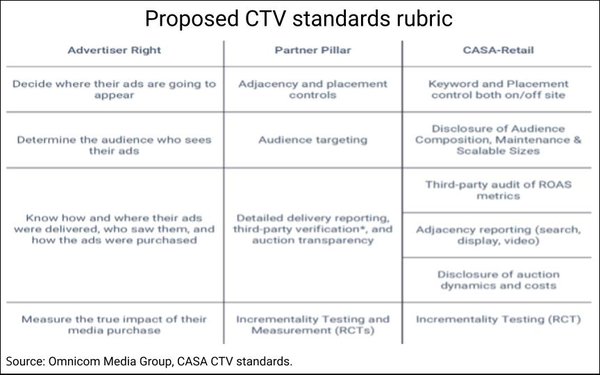

The CTV industry has received a fourth set of guidelines, and the council is now interacting with seven streaming networks and six OEMs/devices. 90% of all CTV is purchased programmatically through them. One or more pillars are fully activated at this point, and two or more pillars will activate soon.

Here’s what they said

Kelly Metz, OMG Managing Director for Advanced TV said,

Connected Television is rapidly becoming the primary channel for consuming long-form video, surpassing time spent watching traditional broadcast and cable television – yet its growth as an advertising medium has been hampered by its inability to provide the same level of control, transparency and safety for brands as its traditional counterparts. For that reason, NBCUniversal’s program level reporting capability is a game changer. Not only will it have transformative impact on planning and buying across NBCUniversal’s streaming properties – it also marks a watershed moment for the category by changing the CTV investment conversation from buying the audience for the platform to buying the audience for the content.

Dominick Vangeli, NBCUniversal SVP/General Manager for Advanced Advertising & Partnerships stated,

The future of streaming depends on media owners standing behind the value of their content. And at NBCUniversal we fully stand behind our content and believe that brand safety and quality are inextricably linked, which is why we are creating this new capability in partnership with OMG.

Read More: Paramount to Utilize iSpot As Currency Measurements for TV Ads

Delve In What the Quarterly Results For Big Tech Titans Are Saying

The quarterly results for big tech companies are out. Here are some key takeaways for advertisers and marketers.

Microsoft

Microsoft’s fiscal year has been challenging on many fronts. The acquisition of Xandr, the ad-buying platform, and the increase in search volume revenues failed to produce satisfactory results, making Microsoft miss the mark in Q4. With continuous commitments to investing in artificial intelligence technologies, analysts predicted the quarter to be successful for Microsoft. The company attributed stagnant growth to a decline in advertising spending, which was lower than a quarter on quarter.

Its Talent Solutions contributed to the company’s revenue growth exceeding expectations. Despite the increased revenue, Microsoft reported a reduction in numbers due to low ad spending. The tech giant concluded it was due to marketing solutions decline. LinkedIn’s revenue increased due to growth in Talent solutions. Microsoft Cloud showed promising growth in all of its businesses with improvements in its verticals. Search and news advertising went up with the Xandr acquisition.

By the numbers:

- Revenue was up by 8% increasing to $56.2 billion.

- Advertising and news search revenues up to $86 million, a 3% increase including traffic acquisition cost, 8% increase excluding traffic acquisition cost.

- Azure Cloud revenue growth slowed from 27% to 26%.

- LinkedIn revenue increased by 5%.

- Microsoft Cloud’s quarterly revenue was 21% or $30.3 billion YoY.

Currently, the company is prioritizing developing and spearheading safe generative AI models and practices. Their aim is to help customers use Microsoft Cloud to make the most of their digital resources and drive operations control.

Satya Nadella, Chairman and Chief Executive Officer, Microsoft stated in the Q4 results announcement,

We remain focused on leading the new AI platform shift, helping customers use the Microsoft Cloud to get the most value out of their digital spend, and driving operating leverage.

Amy Hood, Executive Vice President and Chief Financial Officer at Microsoft cited,

Advertising spend was slightly lower than anticipated which impacted Search and News advertising and LinkedIn Marketing Solutions. For LinkedIn, we expect revenue growth in the low to mid-single digits.

She further added,

Even with share gains in our hiring business, growth will continue to be impacted by the overall markets for recruiting and advertising, especially in the technology industry where we have significant exposure.

Meta

Meta produced results in Q2 that exceeded analysts’ expectations. Revenues from advertising rose robustly. The revenue uptick signaled the social giant’s ad business recovery after previous years of gloom and cross-border concerns. Meta cited the increase in DAUs for Reels, the company’s short-form video content app. This attracts 200 billion people to Facebook and Instagram. The app also generated $10 billion annually, which is a $3 billion increase Q/Q.

The company credits the increase in ad revenues to Threads, the text-based app, and continued investment in artificial intelligence. The company ascribed the increase in ad impressions to a heightened focus on TikTok’s rival Reels and AI-driven products as the key factors in the positive outcome. Meta commits to AI advancements and data centers. The CEO has also highlighted AI as the focal point of Meta’s growth strategy. He predicts revenue from AI-powered structures for marketers, AI chat agents, and productivity tools for employees.

By the numbers:

- Revenue up to $32 billion, up 11%.

- Facebook DAUs are 2.06 billion on average, an increase of 5% year over year.

- Facebook’s MAUs of 3.03 billion increased by 3% year-over-year.

- Family daily active people (DAP) 3.07 billion on average, 7% up Yo-Y.

- Family monthly active people (MAP) 3.88 billion and 6% higher Yo-Y.

- Ad impressions in Q2 2023 increased 34% year-over-year and the average price per ad decreased 16% Yo-Y.

Susan Li, Meta’s Chief Financial Officer however stated that their ongoing commitment to invest in Reality Labs, Meta’s unit for metaverse-related initiatives negatively impacted their results. However, it will not hamper their ambition to spearhead metaverse developments.

Mark Zuckerberg, CEO of Meta added,

We had a good quarter. We continue to see strong engagement across our apps and we have the most exciting roadmap I’ve seen in a while with Llama 2, Threads, Reels, new AI products in pipeline, and the launch of Quest 3 this fall.

Alphabet

Alphabet, Google’s parent company overcame its advertising slump in the Q/Q, signaling a return to momentum with favorable results. The revival of their revenue graph was needed to reshape the competitive AI technology landscape. The Q2 results erased concerns about Google losing digital ad prowess to AI advancements on the financial forefront.

The company attributed the overall growth to increasing Google Cloud Services demand, which is anticipated to adopt AI as it advances. The rise in revenues can be traced to costs from YouTube subscriptions and the Pixel family’s content acquisition. YouTube witnessed a surge in stabilized ad spending despite competition from TikTok. Google Cloud revenues were up due to its AI-optimized structure which piqued consumer interest.

By the numbers:

- Revenue was $74.6 billion, up 7%.

- Ad sales rose 3% to $58.1 billion.

- YouTube revenues increased by 4% to $77 billion driven by brand advertising.

- Network advertising revenues were down 5% at $7.9 billion.

- Google Search and other advertising revenues were up 5%, to $42.6 billion.

- Google Cloud revenues are up 28%, at $23.5 billion.

Alphabet is certain that the money needed to finance AI advancements will come from Google’s advertising engine. As such, Google has predicted that it will face more difficulties not only from rivals like ChatGPT, Microsoft, and Bing but also from Amazon’s shopping unit and TikTok and Reddit in trending topics. As part of its efforts to strengthen cybersecurity capabilities, search, and advertising capabilities, the CEO mentioned that AI would be integrated across its product groups.

Sundar Pichai, CEO, said in the announcement,

There’s exciting momentum across our products and the company, which drove strong results this quarter. Our continued leadership in AI and our excellence in engineering and innovation are driving the next evolution of Search and improving all our services.

CFO Ruth Porat commented,

We expect elevated levels of investment in our technical infrastructure, increasing through 2023 and continuing in 2024. The primary driver is to support AI opportunities across Alphabet, including investments in GPUs and proprietary TPUs, as well as data center capacity. With all that said, we remain committed to durably re-engineering our cost base to help create capacity for these investments in support of long-term, sustainable financial value.

Amazon

Amazon released its second-quarter earnings, and the numbers were impressive. According to CEO Andy Jassy, Amazon saw developments in areas they had been steadily advancing in for the past quarters. The e-commerce giant attributes its revenue growth to the rise in price points, selections, and convenience available to its consumers. Amazon continues to see strong demand for everyday essentials, positive feedback from customers, and updates to its website, mobile apps, and customizations.

AWS growth stabilized in Q2. Moreover, it continues to grow with customers, partner networks, functionality, and operational presentation. AWS revenues were twice as high as any other provider. Amazon is constantly working to further AWS technologies and features to aid customers in leveraging generative AI, productivity, and security. Ad revenue increased due to performance-based advertising efforts, improved customer relevance of ads, and ML benefits to understand ROI and ad spending for brands.

By the numbers:

- $134.4 billion revenue, an increase of 11% Y-o-Y vs estimates of $131.5 billion by Refinitiv analysts.

- Advertising revenue is up 22% Yo-o-Y, to $10.68 billion.

- AWS sales revenue growth of 12% Yo-Y to $22.1 billion.

- Subscription service revenues including Prime memberships were up 14%, at $9.8 billion.

Amazon is currently working on enhancing Machine Learning models to help marketers access audiences that were difficult to reach with Amazon ads. During an AWS event in New York, Amazon also committed to enhancing generative AI-powered applications with the latest and improved pre-trained large language models (LLMs).

CEO Andy Jassy mentioned in the earnings call,

As the economy has been uncertain over the last year, AWS customers have needed assistance cost optimizing to withstand this challenging time. They have also needed assistance reallocating spending to new initiatives that better drive growth. We’ve proactively helped customers do this.

Apple

Apple reported their results for the third quarter that were better than their expectations, however, revenue was down Yo-Y. The company attributed the growth in its revenue to healthy iPhone sales across the world. Apple set an all-time high record for services revenues, including advertising, the app store, and music, exceeding its predictions. The slump in iPad sales revenue was accredited to the iPad Air launch in the prior year. They continue to invest in product enhancements to encourage customer satisfaction which was reported to be 98% across the U.S.

By the numbers:

- Revenue was $81.8 billion, down 1% Yo-Y.

- iPhone revenues are $39.7 down 2% Y-o-Y.

- $6.8 billion, down 7%, for Mac.

- iPad $5.6 billion, down 20%.

- Wearables home, and accessories revenues were $8.3 billion up 2% with expectations.

- Services revenue $21.2 acceleration of 8%.

Apple is releasing its most ambitious and advanced personal electronic device, the Apple Vision Pro early next year for ordinary consumers. It is currently only available to advertisers, content creators, etc for demo purposes and has received stellar reviews.

AI and machine learning will continue to be an integral part of product design. Apple is planning to introduce AI and ML-powered live voicemail in iOS 17. They have also invested in research into generative AI and continue to responsibly enhance their products with these technologies. This is with the goal of enriching people’s lives.

Tim Cook, Apple’s CEO said,

We are happy to report that we had an all-time revenue record in Services during the June quarter, driven by over 1 billion paid subscriptions, and we saw continued strength in emerging markets thanks to robust sales of iPhone. From education to the environment, we are continuing to advance our values, while championing innovation that enriches the lives of our customers and leaves the world better than we found it.

Luca Maestri, Apple’s CFO, further remarked,

Our June quarter year-over-year business performance improved from the March quarter, and our installed base of active devices reached an all-time high in every geographic segment.

Snapchat.INC

Snapchat reported its quarterly results and they were mixed. Although revenue was up Q/Q, it still saw a Yo-Y dip. Just like its competitors, Snapchat is grappling with a slump in advertising revenues. Snapchat also introduced an exciting and innovative AI feature a few months back to keep the platform happening and engaged. My AI, Snapchat’s AI chatbot is now integrated into group chats, recommendations, and ‘Lens’ suggestions.

By the numbers:

- Revenue was $1,068 million compared to $1,111 million the previous year

- DAUs 397 million, an increase of 50 million or 14% Yo-Y

- 4 million global users for paid subscriptions introduced in the previous year

This quarter, the social media company pledged to improve advertisers’ expectations through machine learning technology. It will do so to upgrade its framework, find creative approaches to measuring and optimizing ad spending, and encourage new leadership. Its continuous investment in ML infrastructure has improved company ranking and content personalization.

Snapchat believes that it will face healthy community growth in the next quarter with expected DAU increases of 405 to 406 million.

Evan Spiegel, Snapchat’s CEO said,

We are excited by the progress we have made delivering increased return on investment for our advertising partners, growing our community to 397 million daily active users, and reaching more than 4 million Snapchat+ subscribers.

Omnicom Media Group

Omnicom Media Group ended its second quarter of 2023 on a high note. The organic growth rate was up 3.4% compared to the previous quarter’s results, placing it within its projected range. Omnicom spearheads generative AI developments in the media business. Their ongoing strategic alliances with companies like Adobe, AWS (Amazon Web Services), and Microsoft help them do this.

The business has also promised to invest in media sales capabilities, environmentally friendly technology, and data from first parties. They are currently realigning their staff to match strategy choices and outlook.

By the numbers:

- 3.4% organic revenue growth in Q2 23, with $3,609.9 million revenue

- Advertising Media revenue growth was 4.2%, while organic growth grew by 5.1%

- Third-party costs which include supplier costs the company incurs when providing services to clients increased to $86.8 million

- Organic growth rate for Public Relations was up 0.1%, while execution & support decreased by 3.8%

John Wren, Chairman and CEO of Omnicom said in the announcement,

While the balance of the year will continue to see economic uncertainty, we are entering a dynamic and exciting new era for our company. Omnicom has secure leading positions in generative AI technologies and partnerships to deliver on our promise to achieve the best outcome for our clients and increase the operational efficiency of our company.

eBay

EBay has exceeded Wall Street’s expectations in all key metrics and delivered positive results. However, the marketplace’s weakened momentum among active buyers was worrying. Gross merchandise sales decreased also recorded.

In spite of this, the e-commerce marketplace believes that its increasing focus on AI integration into its platform will drive further user momentum. The company currently prioritizes laying a strong foundation for generative AI tools across the website to aid marketers and product listers.

By the numbers:

- Revenue was up to $2.51 billion, an increase of 5% from the previous year

- Advertising revenues were $367 million, up 33.5% Yo-Y.

- Promoted Listings revenue was up 47%, reporting $341 million

- The active buyer base declined by 4%

In the next five years, eBay plans to implement AI enhancements in every part of its organization. They are constantly integrating generative AI features into their site. They are also working towards reinventing the e-commerce landscape. Its work has already produced stellar results and hopes to deliver long-term results.

Jamie Iannone, CEO said,

The foundational work we’ve accomplished over the past 3 years has set us up for a new phase of innovation. Our teams are focused on thinking bigger and moving faster as we build game-changing features and functionality for customers to keep eBay at the forefront of eCommerce.

Read More: Advertise Your Brand in the Metaverse: The Future of Digital Advertising

Where Do These Global Companies Stand At The End Of Q1: Performance, Insights, And Statistics

We bring you insights and earning calls on various media companies, publishers, agencies, brands, and tech companies performing on a quarterly basis. The iteration focuses on media companies’ financial performance in the 2020 first quarter and taps all the vital data.

Q1 2020 earnings and performance

Though the waters are choppy ahead, we are optimistic that the worst is behind us and have learned to live with the new normal. Consumer habits are changing and the future is more accelerated towards the digital economy. The media landscape has changed especially the TV front and the focus is on opening businesses again with advertising driving the demand.

Q2 Outlook

Q2 advertising for publishers is estimated to be significantly down as much as 25-30% Y-o-Y and for some even 50-55% down. Few companies like Facebook, Snap, Dotdash expects Q2 revenue to be flat or slightly up Y-o-Y. Here are a few key points to consider:

- Google revenue declines by 15% year- over -year, though search activity increased. Advertising spends decreased due to coronavirus recession. However, other advertising mediums are growing like connected TV, ads in video games, or ads in video conferencing.

- International TV ad sales are down by 30-35% Y-o-Y whereas programmatic revenue decreased by 40-45%.

- Performance ads are down year-over-year and demand from industries like restaurants, travel, retail, auto, and luxury has declined.

- Some advertisers seek opportunities and increase spending in financial services, insurance, telecom, technology, streaming services, and app downloads. Gaming and streaming are gaining a strong foothold and permanently taking a share of our time and wallets.

- CPM’s down by almost 50% giving an advantage to advertisers for huge bargains. New and existing advertisers are looking to acquire new customers at a lifetime low value.

- With no new live events expected on TV till September/October, it will boost the growth of CTV.

- Attribution for marketers is easy as most sales are online than in-store. The animation is expected to be robust in Q3 and Q4.

- 90-95% workforce for media companies are operating from home and CMO’s can justify spending using data-driven advertising with trackable ROAS.

Let’s take a look at the financial report card of the global giants.

The Trade Desk

The opening remarks from the trade desks on the present scenario are as follows – Programmatic’s greatest feature is ‘Agility’. One can easily start and stop the programmatic campaigns, unlike linear television. Early April witnesses advertisers stopped/pause ad spend in certain verticals especially travel and remained active in health, technology, games, home, and garden.

However, by mid-April year-over-year spend decline stabilized, and as the month progressed things started improving. Advertisers were trying to adapt to the present environment. For instance, restaurants changed their messaging to “We are open” or “We deliver.” Consumer products focused on pantry loading and travel companies planned to waive off cancellation fees for bookings. Basically, advertisers started to strategize on how to run businesses on the other side of the pandemic. Now, every company is trying to work out an advertising strategy to connect to consumers and gain share once the economy gets going.

CTV is a clear winner as linear TV’s life is shortened. Unlike traditional TV ads investment where brands and agencies commit billions of dollars without knowing the content and audience, they have the freedom to be more deliberate, liberal, and agile on CTV.

Roku:

Roku:

- Pandemic has accelerated the shift to streaming by viewers due to excellent content and value.

- In the short term, the video advertising business has slowed down due to budget cuts and low spending by advertisers.

- In the streaming business, active accounts grew roughly 38% Y-o-Y with an increase in new accounts of more than 70% Y-o-Y.

- Streaming hours grew roughly 80% in April and the increase in streaming hours per account is approximately 30%.

- It is estimated that ad business will grow at a slower pace and gross profit margin will be lower than expected for the year.

- The behavioral changes of TV ad buyers are positive in the long-term and more people are expected to stay home to control spending in the light of economic hardships and the shift to streaming business will grow further.

Google:

Google:

- In March there was a sudden slowdown in ad revenues owing to COVID 19 and lockdown orders. The first two months of Q1 reflected strong growth. Google search and other advertising revenues generated $24.5 billion, up 9% Y-o-Y.

- After the 2008 crisis, the Google search can be adjusted easily-quickly turn-off and back on which is cost-effective and ROI based. At the inception of the coronavirus crisis, users’ interest was more for information on the virus and non-commercial topics providing less opportunity for monetization.

- Q2 looks difficult for the advertising business.

- YouTube advertising revenues were up 33% year-on-year to $4 billion however there were different performance trajectories for direct response and brand advertising.

- Direct response continued to grow throughout the quarter but brand advertising growth grew for the first two months of the quarter and declined in March. This resulted in the slowdown of Youtube ad revenues by the end of March.

- Similarly, networking ad revenue was $5.2 billion, up 4%Y-o-Y for the first 2 months of the quarter, and declined in March in the low-double-digits year-on-year.

Spotify:

- Ads are a small part of the business, nearly 10% of the overall revenues. Therefore it is less impacted compared to other businesses.

- From a long term perspective, it will be an opportunity to move from linear to on-demand due to COVID 19 crisis.

- It is suspected that advertisers will move from pure reach to more measurable ad formats -mostly analog ad formats.

- The conjecture on advertising and consumption front is what is already happening of linear shifting to digital.

Learn more: Spotify Adds $1.7B To Market Cap In 23 Min Post A Deal With Joe Rogan, World’s Leading Podcaster.

![]()

Rubicon:

- The first half of April’s revenue was roughly 30% down until it showed signs of stabilizing in the second half.

- CTV continued to grow at a slower rate in April with a Y-o-Y increase of nearly 10%. Ad slot availability grew by roughly 25% compared to pre-COVID 19.

- Being an omnichannel SSP there has been diversity in ad categories and even more after the merger with Telaria. Certain verticals were highly impacted like travel in entertainment but e-commerce, technology, and direct-to-consumer were benefitted.

- Upfront deals are canceled and focus is shifted to spend from linear to the spot market that programmatic serves.

Microsoft:

Microsoft:

- Reduction in ad spend affected Search and LinkedIn business and assumes that the advertising spend will not improve in Q2 as well.

- Search revenue ex-Tac increased by 1%.

Apple Advertising:

- The economic slowdown and uncertainty on business reopening have impacted the advertising business – which is the sum of App Store search ads, Apple news, and third party agreements on the advertising front.

- This slowdown and uncertain future will have a strong effect on the Service business for the June quarter.

Verizon:

Verizon:

- Owing to the COVID-19 crisis, ad revenue declined by 10% in the second -half of March and the rate of decline only increases in April.

- Industry forecasts a fall of 20-30% in digital media and Verizon media results are likely to be similar.

- It also experienced a decline in advertising and search revenue due to hold back or cancellation of campaigns by advertisers and users searching for fewer commercial terms providing less opportunity for monetization.

- Finally, some staggering numbers were seen- 200% up on gaming, 40% up on video, and 10 times up on the collaboration tools. 800 million calls a day, is double the amount on Mother’s Day, the biggest day of the year.

Netflix:

- Increase in subscriber growth in March and is a pull forward for the rest of the year leading to an assumption that subs will be light in Q3 and Q4.

- Filming is stopped globally except Korea and Iceland.

- Customer services are fully restored with 2000+ agents working remotely.

- With the lockdown orders coming into effect in LA, animation production is up and working from home whereas the post-production of 200+ projects is in pipeline remotely.

- Series writers’ rooms are operating virtually.

- Netflix has invested in Open connect, a pioneering cache system that puts content library as close to members’ homes as possible. This enables ISP’s to run their network efficiently and at a lower cost. However, some countries networks may face issues due to the increasing usage of the internet.

Omnicon

Omnicon

- The company doesn’t collect weekly revenue numbers by the agency and roll them up at the Omnicom group level.

- Q2 downfall is expected in double digits and year-on-year revenues will be down.

- The future is challenging but the company expects to get many of those people back as they move into the year ahead.

Learn more about the quarterly performance of other media companies: Financial Report Card Of The Global Giants And Industries In COVID-19

Google:

Google:  Microsoft:

Microsoft:  Verizon:

Verizon: Omnicon

Omnicon