Expedia and Netflix Collaborate for First-of-its-kind Global Advertising Campaign

Expedia and Netflix have collaborated on a one-of-a-kind advertising campaign. It is intended for Netflix’s global monthly active users (MAUs) on the ad-supported tier. The goal of the campaign is to seamlessly integrate contextually appropriate ads into the Netflix viewing experience, improving the platform for users and providing partners with a global advertising platform. Furthermore, through this partnership, Netflix will be able to provide marketers and members with better multi-country advertising options while also supporting Expedia Group’s efforts to expand globally.

First-of-its-kind global advertising campaign

For 2024, Expedia will be the first worldwide advertising partner of Netflix to launch a multimarket campaign on the streamer’s ad-supported plan. The collaboration serves as evidence of why companies are placing their bets on Netflix’s emerging ad-supported tier. It offers global reach and the ability to engage specific audiences where they are watching TV when linear TV usage declines. A range of advertisements tailored to language and culture in the United States, Canada, Mexico, the United Kingdom, France, Germany, Australia, Japan, and Brazil will be displayed on the travel booking website. In the United Kingdom and Brazil, Expedia will also serve as an Alpha measurement partner.

Read More: Netflix May Monetize Its Games Platform with In-App Purchases and Ads

Tailored advertising

With campaigns targeted at the more than 23 million global monthly active users of the streamer’s ad-supported tier, Netflix and Expedia are showing their international strength. Netflix will start running localized creative in the respective markets this month as part of the partnership. The content was created by an internal creative team and is part of Expedia’s “Made to Travel” brand platform. Expedia will use the agreement to run a range of nationalized advertisements, including 15-, 30-, and 60-second spots.

The first execution will debut on Netflix in Japan with the 60-second anthem spot “Two Step.” It was directed by Hiro Murai (“Atlanta,” “The Bear”). In the commercial, a group of friends from Japan travel to the United States to follow their love of line dancing.

Netflix to remain the hub for the campaign

In each of the markets, advertisements will also be displayed on platforms other than Netflix. However, the streamer will serve as a hub for the entire campaign. Advertisers have been eager to capitalize on Netflix’s global reach, which sets it apart from other leading streaming services. Since its ad-supported tier’s launch just over a year ago, the streamer claims 23 million users worldwide have used it. U.S. ad subscribers, however, make up a very small portion of that total.

Here’s what they said

Amy Reinhard, President of Advertising at Netflix said,

This first of its kind partnership will offer our engaged ad-supported members contextually relevant ads creatives, making the viewing experience even more enjoyable, while also making Netflix a global destination for our advertising partners.

Jon Gieselman, president of the Expedia Group added,

As global consumer habits rapidly evolve, we are always looking for innovative opportunities to showcase our brands and story-tell locally. Netflix’s sophisticated product allows us to target relevant audiences with impressive reach. We aren’t afraid to be first and I look at this partnership as just the beginning.

Read More: Netflix Agrees to $5 Billion Deal to Stream WWE’s Flagship RAW Show

Amazon Prime Video Estimated to Generate $1B From Ad-Supported Tier in Debut Year

With the introduction of advertisements on its video service, which has over 100 million subscribers, Amazon’s Prime Video has created a significant stir in the streaming market. According to MoffetNathanson Research, Prime Video is expected to generate an estimated $1 billion in revenue during its first operational year and is poised to make a major entry into the ad-supported streaming market with its upcoming service launch on January 29. Analysts view Amazon’s move as a “disruptive force,” even though its active viewership in the United States may be lower than that of some rival services. Furthermore, estimates suggest that in 2025, $1.75 billion, $2.26 billion, and $2.76 billion will be this amount.

Lesser ad content than other streaming platforms

Amazon stated that Prime Video would feature “meaningfully fewer ads than linear TV and other streaming TV providers” when announcing its plans. The Wall Street Journal reported that Prime Video would have an average ad load of two to three and a half minutes, which is expected to be significantly less than traditional TV and most streaming services. The report was based on Amazon’s presentation. Certain advertisements will start playing before the content does, and some will run while the show is being aired. More than 200 million people have signed up for Amazon Prime worldwide. This entitles users to free two-day shipping from the behemoth online retailer as well as other perks like access to Amazon Music.

Read More: GroupM Announces Ad Innovation Accelerator for Future of Advertising

Different strategy

Naturally, Amazon is adopting a different strategy than other streaming services like Netflix and Disney+. These services introduced more affordable options for plans that have ads in addition to their more expensive ad-free tiers. While this is going on, Amazon is automatically displaying advertisements on Prime Video for all subscribers. Users in the United States will need to actively choose to pay an extra $2.99 per month to avoid advertisements. This will result in an additional $400 million. By the end of 2024, the U.S. will have benefited from a total of $1.4 billion from these actions. In its first year of operation, Amazon is expected to earn $300 million from advertising. Moreover, it is expected to earn an additional $100 million from subscribers abroad.

Other ad-supported services

The company estimates that there are 96 million Prime households in the United States. However, only some of them are actively watching Prime Video. Beyond the ad-supported service, it is estimated that in 2025, Amazon will earn $1.7 billion from FreeVee. It is a Free Advertising Supported Television (FAST) channel similar to Tubi and Pluto TV. It is anticipated that the addition of “Thursday Night Football” will boost Amazon’s digital video and streaming businesses by an additional $600 million. When all of these projects are combined, it is anticipated that Amazon’s yearly revenue from streaming and digital video platforms will reach $4 billion. This will exceed that of rivals like Roku ($1.9 billion), Peacock ($2.3 billion), and Hulu ($ $3 billion).

Other options will be made available

Similar commercial-free options will be available in other markets. Early in 2024, ads will be made available to users in the United States, the United Kingdom, Germany, and Canada. Later in the year, France, Italy, Spain, Mexico, and Australia will host the first-ever Prime Video advertisements. According to Amazon, users who pay for a commercial-free experience will still see advertisements where Prime Video already does so. This includes sports content like Thursday Night Football and material from the FAST service FreeVee.

Read More: Netflix May Monetize Its Games Platform with In-App Purchases and Ads

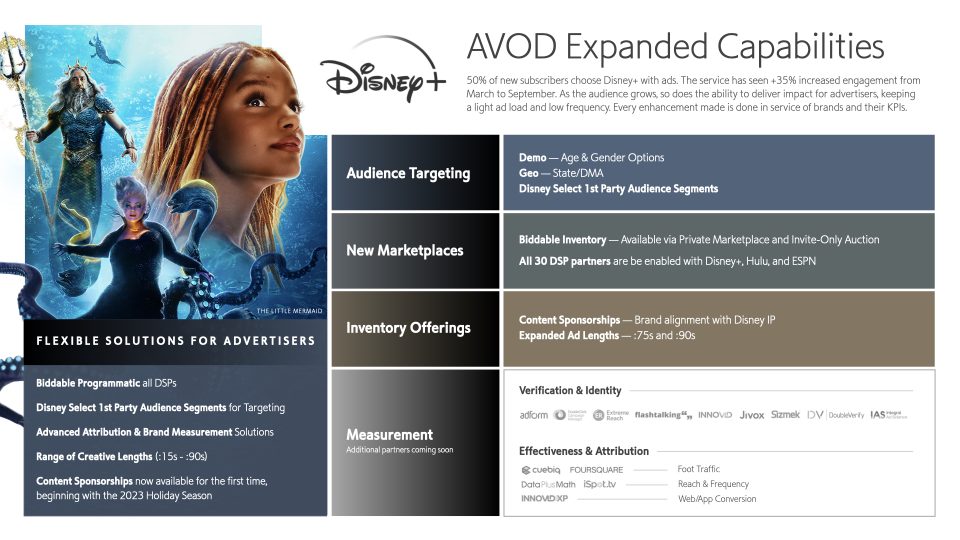

Disney+ Introduces First-Party Audience Targeting, Programmatic Buying Via PMP

Disney+ has intensified its efforts to provide advertisers with more comprehensive and adaptable ways to reach audiences at scale, as the ad-supported tier nears its one-year anniversary. With its first-party audience graph and programmatic buying via private marketplace (PMP), the Disney+ ad-supported tier has introduced audience targeting. In addition, it now offers measurement services for identity, efficacy, verification, attribution, and approved creative ad formats.

Rising Disney+ ad-supported tier and programmatic capabilities

Of new subscribers, 50% select the ad tier. Furthermore, there was a 35% increase in service engagement from March to September 2023. The capacity to provide impact for advertisers grew along with the size of the Disney+ audience that is ad-supported. In order to provide the best possible customer experience, this was accomplished while maintaining a complementary ad load in line with viewing behavior. Disney’s position as an industry leader has been further cemented by solutions for tracking the effectiveness of campaigns. This is in order to fulfill and optimize advertisers’ performance goals.

Advertising capabilities are available on Disney+

Image credit- The Walt Disney Company

Advanced Audience Targeting

With the help of Disney’s acclaimed, in-house first-party Audience Graph, marketers can now target audiences more precisely for the first time across demo (age and gender); geography (State/Designated Market Area); and Audience Segments. Disney’s audience graph, which features 110 million households, 235 million unique viewers, and more than 2,000 interest- and behavior-based audience segments, will now allow advertisers to use first-party data.

Programmatic expansion

Disney is extending its programmatic offerings to encompass biddable transactions, accessible via exclusive auctions or private marketplaces. Advertisers can unlock Disney’s premium content at scale with greater choice and control than ever before. This is thanks to its availability across 30 DSPs that represent large, midmarket, and local platforms.

Read More: Disney+ Hotstar Amp Brand Outreach With CTV Targeting

Diversified Ad Formats

Disney+ is now accepting a wider range of creative lengths (midrolls and:15s to:90s) in addition to choosing content sponsorships, which are now available for the 2023 holiday season. This builds on its history of creating market-defining, consumer-first formats.

Enhanced Measurement and Attribution

Disney+ has kept developing new tools to help marketers reach a wider audience while guaranteeing efficacy through attribution and measurement. More campaign measurement options than ever before will be available to advertisers through it, all of which will highlight the benefits of running ads on Disney+. InnovidXP provides web and app conversion measurement, Kantar measures brand lift. Furthermore, Data Plus Math and iSpot.tv provide reach and frequency insights, and the platform, which previously offered measurement through Samba TV and VideoAmp, now offers the ability to measure the impact of ads on foot traffic through Cuebiq and Foursquare, and Kantar measures brand lift.

Disney+’s growing audience means more chances for advertisers to enhance their connection with the service as the platform continues to grow in size. Disney Advertising is still dedicated to bringing innovations and solutions to its brand partners to help them achieve their goals.

Here’s what they said

Rita Ferro, president, Global Advertising, Disney said,

Consistent with Disney’s strategic approach, we spent the last 10 months testing, learning and listening to our consumers and clients. That’s how we continue to create viewer-first experiences while simultaneously introducing new capabilities, functionality and formats. We’re seeing increased engagement and time spent, and now providing greater accountability for marketers through robust measurement, proving that premium content matters.

Read More: Reliance Industries to Acquire Disney India in a Cash and Stock Deal

Netflix Striving to Expand Ad-Supported Format Reach and Appeal

Netflix is admitting that it still has ways to go in order to scale the necessary advertising reach and subscriber size with its ad-supported model. It claims that by taking a customer-focused approach and providing advanced features to advertisers, they may ultimately surpass competitor streaming services in the advertising market. Netflix suggests that its ad-supported tier serves as a backup plan for users who express dissatisfaction with price increases. It seems that the streaming behemoth believes its competitors are doing advertising incorrectly. Some of its streaming competitors haven’t yet done as well in creating an advertisement-friendly environment.

Netflix wants to educate consumers about the ad-supported tier

According to Netflix, part of its mission is to inform customers about what to expect from their Netflix advertisements. This allows people to consider what, given their unique tastes, would be the best decision for them. The secret is to use the data collected as more people use the ad-supported tier to build models and capabilities that minimize repetition and intrusiveness while delivering relevant ads and a tailored experience.

Insights on new subscribers to ad-supported plans

Some reports state that new customers to the ad-supported plans see four minutes or less of advertising every hour, whilst those who cancel and re-up only view 60 seconds or less. This is before the amount of ad time is progressively increased once more. Resulting in rumors that a sophisticated method of desensitizing ad-verse consumers is part of Netflix’s educational process. However, since last May, six months after the plan’s introduction, when the business claimed to have drawn close to 5 million sign-ups worldwide, Netflix has not made available the precise number of with-ad members. According to reports from July, out of over 75 million Netflix members in the United States, 1.5 million of them were using the advertising plan.

Read More: Meta Contemplates Ad-Free Subscriptions, Targeting Indian Market

Netflix’s Ad Formats Expansion

Netflix announced the start of title sponsorships for seasons, series, and new domestic live sports events in addition to the growth of its ad formats. It includes the addition of a binge format, as part of its effort to realize that potential. Apart from introducing ad buys for its top 10 content selection, Netflix is collaborating with Microsoft, an ad tech partner, to provide other programmatic ways to access its ad inventory. Future expanded targeting capabilities should be available soon, as improving ad relevance is the first stage.

Challenges Netflix Might Face

Customers who use streaming services aren’t used to any kind of advertisement environment. In the past, cord-cutters sought to save money by forgoing the pricey cable bundle. In the process, they improved their viewing experience by being able to watch content whenever they wanted, without interruptions. Priorities are ranked highest for measurement. Therefore, Netflix is working to give comparable measurement capabilities to service a large list of partners across other nations in addition to launching a measurement relationship with Nielsen in the U.S.

A chance for Netflix

Just one year into their agreement, Netflix started a restructuring of its advertising partnership with Microsoft in July. In order to revitalize the developing area of its business, the streaming juggernaut decided to lower its ad pricing. Netflix leaders within the firm voiced their displeasure with Microsoft’s ad inventory and sales performance. Microsoft was forced to make the maximum amount stipulated in the agreement reached more than a year ago. This was a result of weak sales and a smaller-than-expected ad market. Microsoft had been chosen by Netflix as a partner at the beginning of its advertising business.

Read More: Netflix Removes Password Sharing, What’s It Say For Subscribers?